Utah Returned Items Report

Description

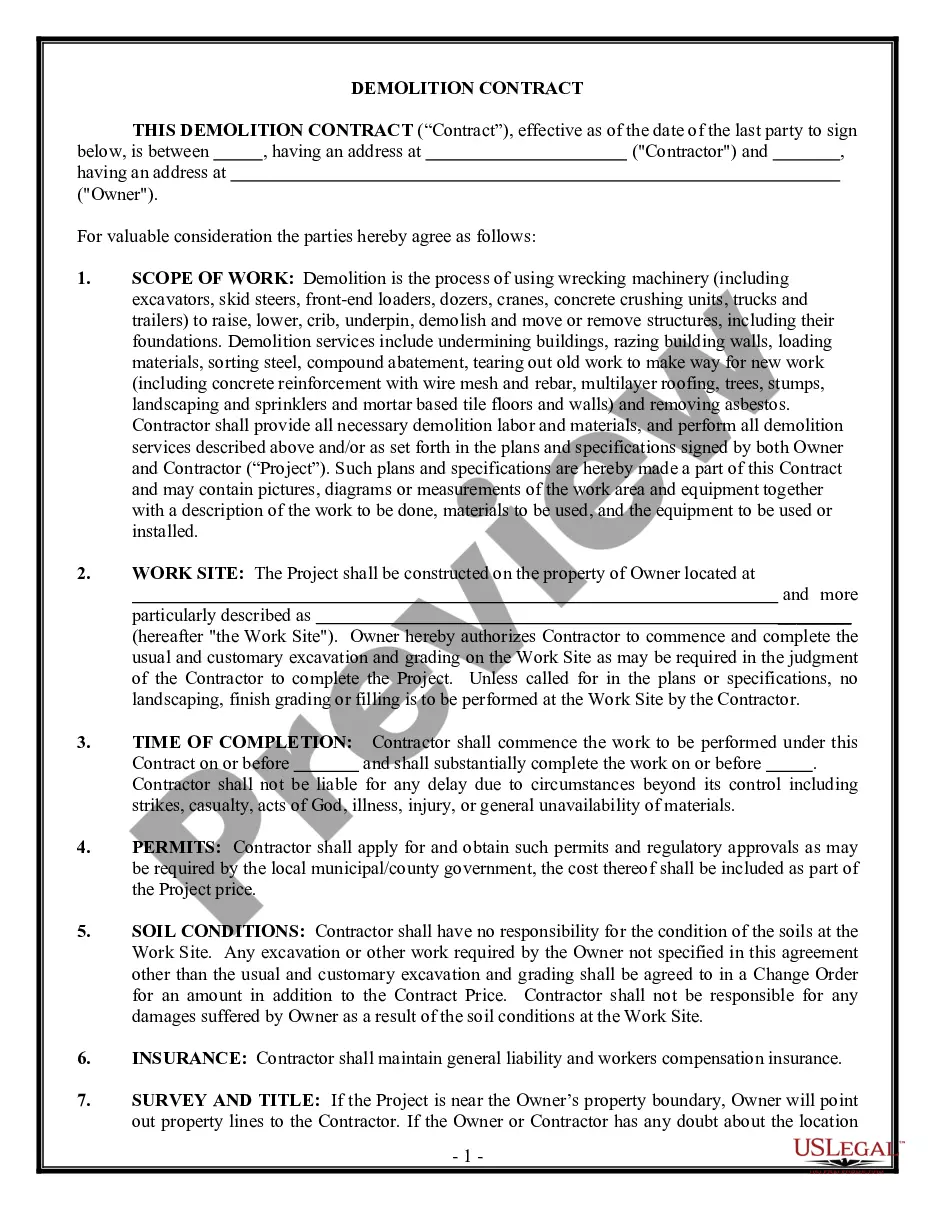

How to fill out Returned Items Report?

If you require to complete, obtain, or print legal document templates, utilize US Legal Forms, the most significant collection of legal forms, accessible online.

Employ the site’s simple and user-friendly search feature to find the documents you need.

A range of templates for business and personal needs are categorized by types and states, or keywords.

- Use US Legal Forms to find the Utah Returned Items Report in just a few clicks.

- If you are a current US Legal Forms user, Log In to your account and click the Download button to locate the Utah Returned Items Report.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Don't forget to read the summary.

Form popularity

FAQ

To verify a Utah resale certificate, you can contact the Utah State Tax Commission or utilize their online resources. They maintain a database that allows businesses to confirm the validity of resale certificates. This process ensures that your transactions are compliant with state regulations. By keeping track of your records, like those found in the Utah Returned Items Report, you can streamline verification efforts.

Unemployment benefits are taxable income and your 1099-G form shows you how much you were paid in benefits and how much you paid in federal and state taxes. If you didn't withhold any taxes and you're looking at zeros in the withheld boxes, you could owe the government money.

TC-62M, Utah Sales and Use Tax Return for Multiple Places of Business.

Do not send a copy of your federal return, credit schedules (other than Utah schedules TC-40A, TC-40B, TC-40S and/or TC-40W), worksheets, or other documentation with your Utah return.

Yes. Wisconsin requires a complete copy of your federal return. Payment If you owe an amount with your return, paper clip your payment to the front of Form 1, unless you are paying by credit card or online.

Utah Form TC-40 Personal Income Tax Return for Residents.

When mailing your return: You must include a copy of your federal income tax return (including schedules) and any income tax returns you filed with other states. Be sure to include enough postage to avoid having your mail carrier return your forms.

Form 1099G is a record of the total taxable income the California Employment Development Department (EDD) issued you in a calendar year, and is reported to the IRS. You will receive a Form 1099G if you collected unemployment compensation from us and must report it on your federal tax return as income.

You should include the 2nd federal return copy with your state return to mail in. Most states require you to mail in a copy of your Federal Return with your state return.

Form 1099G is a record of the total taxable income the California Employment Development Department (EDD) issued you in a calendar year, and is reported to the IRS. You will receive a Form 1099G if you collected unemployment compensation from us and must report it on your federal tax return as income.