Utah Purchase Invoice

Description

How to fill out Purchase Invoice?

Have you ever been in a situation where you require documents for either business or personal purposes almost constantly.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Utah Purchase Invoice, designed to comply with federal and state regulations.

When you locate the appropriate form, click Get now.

Choose a payment plan you prefer, complete the necessary information to create your account, and process your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Utah Purchase Invoice template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your specific city/region.

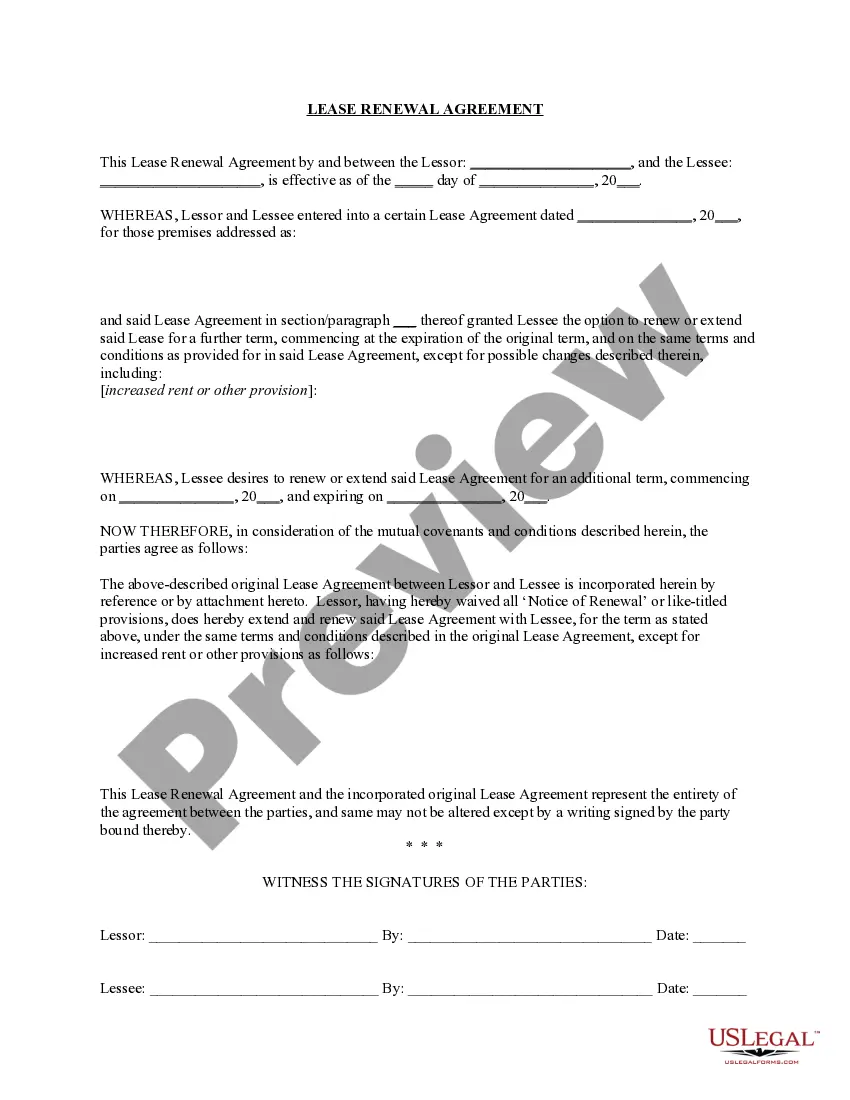

- Utilize the Preview option to review the document.

- Check the details to confirm that you have chosen the correct form.

- If the form does not match your needs, use the Search field to find the one that suits your requirements.

Form popularity

FAQ

Yes, in Utah, you can create a bill of sale without a notary. However, having it notarized can provide additional protection and validity to the transaction. If you choose to forgo this step, ensure both parties sign the document and keep copies for their records. A Utah Purchase Invoice template can help you create a solid document that serves your needs without requiring notarization.

Creating your own bill of sale in Utah is straightforward. Begin by gathering essential information such as the names and addresses of the seller and buyer, item details, and the sale amount. Utilizing a professional template for a Utah Purchase Invoice can make this task easier, as it guides you through necessary components. After filling in the details, both parties should sign the document for it to be binding.

The TC-40 form is Utah's Individual Income Tax Return, which residents use to report their annual income and tax obligations. If you develop a Utah Purchase Invoice for business transactions, be aware that your income may need to be reported on this form. Accurately tracking your invoices can simplify this process at tax time.

A Utah bill of sale does not typically require notarization to be valid. However, having it notarized can enhance its credibility, especially in disputes. When you create a Utah Purchase Invoice, you can include any notarized documents to strengthen your agreement.

In Utah, the seller is primarily responsible for collecting and remitting sales tax on taxable sales. However, as a buyer, you may be liable for the sales tax if the seller does not collect it. Utilizing a Utah Purchase Invoice helps clarify the responsibilities of both parties, ensuring proper tax handling.

Yes, if you make payments to independent contractors or certain vendors, Utah requires you to file a 1099 form. This is particularly important for tracking income reporting and ensuring compliance with state tax laws. When you handle payments with a Utah Purchase Invoice, remember to document all necessary information to make filing easier.

To acquire a Utah sales tax number, you must register your business with the Utah State Tax Commission. You can complete this process online by filling out the necessary forms and providing required information about your business activities. Once registered, you will receive your sales tax number which allows you to collect sales tax from your customers. For assistance with forms related to your Utah Purchase Invoice, USLegalForms offers easy-to-use templates to help you navigate this process smoothly.

To obtain a copy of your Utah business license, you should contact the county clerk's office in the county where your business is located. You may need to provide personal identification and details about your business. Additionally, online resources may allow you to access or request a copy conveniently. For all your documentation needs, consider visiting USLegalForms, where you can find relevant forms to streamline the process of managing your Utah Purchase Invoice.

Yes, you can write your own bill of sale in Utah. A bill of sale serves as a legal document that records the transfer of ownership of personal property. It is essential to include details such as the date of sale, description of the item, and the signatures of both parties. Using a professional template from a reliable platform like USLegalForms can ensure that your Utah Purchase Invoice meets all legal requirements.

Filing invoices involves a few simple steps to ensure your records are accurate and accessible. Organize your Utah Purchase Invoices by date or vendor, scan them for digital storage, and maintain a backup system. Using software provided by platforms like US Legal Forms can simplify this task, allowing you to store and retrieve your invoices quickly whenever needed. Consistent filing practices will enhance your efficiency and accountability in financial management.