Utah Customer Invoice

Description

How to fill out Customer Invoice?

If you need to aggregate, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

Numerous templates for commercial and individual purposes are organized by categories and states, or keywords.

Each legal document template you obtain is yours to keep for years.

You have access to every form you have downloaded in your account. Click the My documents section and select a form to print or download again.

- Use US Legal Forms to get the Utah Customer Invoice in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Utah Customer Invoice.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific area/state.

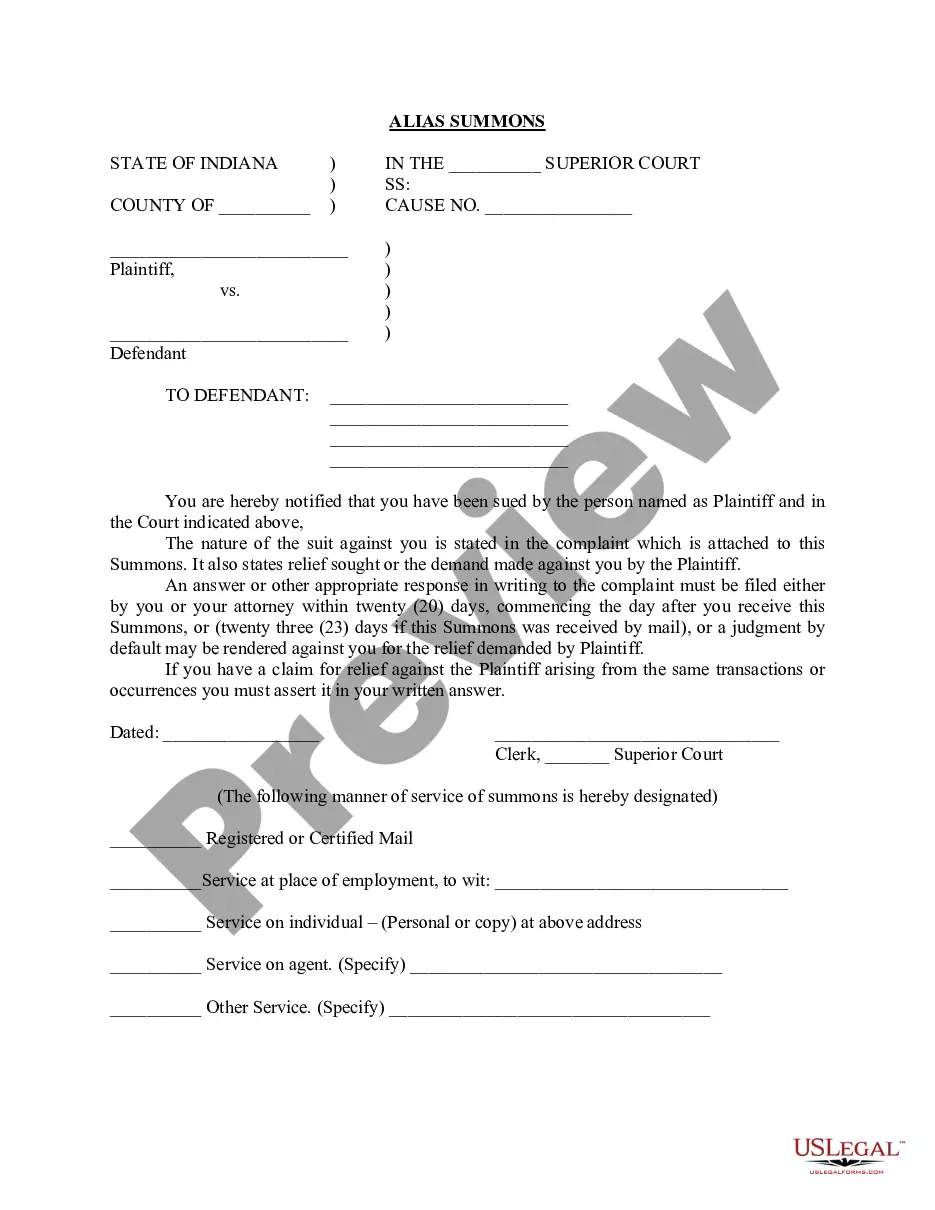

- Step 2. Use the Preview option to review the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you find the form you need, click the Get now button. Choose the pricing plan you prefer and provide your details to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Utah Customer Invoice.

Form popularity

FAQ

To file Utah sales tax online, visit the Utah State Tax Commission's website and navigate to their e-filing section. After creating an account, input the relevant sales data from your Utah Customer Invoice, submit your tax return, and make any required payments. This streamlined process saves you time and ensures your compliance.

Utah uses a destination-based sales tax system. This means that the sales tax rate depends on the location where the buyer receives the items, not where the seller is based. When creating your Utah Customer Invoice, using the destination address will help in applying the correct sales tax rate.

Filling out a Utah bill of sale requires you to include key information, such as the seller's and buyer's names, the item description, and the sale amount. Using a structured format can help ensure you don’t miss any necessary details. USLegalForms offers templates to help you create a compliant and accurate customer invoice or bill of sale.

In Utah, the frequency of filing your sales tax can vary based on your total sales volume. Most businesses file quarterly, but if your sales exceed a set threshold, you may need to file monthly. Understanding your obligations is simple with a tool like USLegalForms, which allows you to create a Utah Customer Invoice that tracks your sales.

Yes, you can file your Utah state taxes online. The Utah State Tax Commission provides an online portal for tax filing, making the process easier and more convenient. By using tools like USLegalForms to manage your invoices, you can ensure all necessary details are ready for an efficient filing experience.

Filing your Utah sales tax online is a straightforward process. You begin by visiting the Utah State Tax Commission’s website, where you can create an account. After logging in, you can enter your sales details from your Utah Customer Invoice, submit your return, and make your payment—all from the comfort of your home.

To set up sales tax for online sales, start by determining the applicable rates for your products in Utah. You can use a reliable invoicing platform, like USLegalForms, to generate a Utah Customer Invoice that automatically calculates the sales tax based on your sales location. Ensure you register with the Utah State Tax Commission to stay compliant with state laws.

To look up a business license in Utah, simply visit the online portal provided by the Utah Department of Commerce. You can search for the business using different identifiers, including the name and license number. This tool is useful for verifying business legitimacy before entering into transactions. Always consider documenting these interactions with a Utah Customer Invoice for better record-keeping.

You can look up a business license in Utah through the state’s official business registry. The database allows you to search by the business name or license number. This lookup can help you confirm the legitimacy of a business. Additionally, when issuing a Utah Customer Invoice, it's beneficial to ensure that your clients are interacting with registered entities.

Yes, in Utah, a business license number is considered a public record. This means that anyone can request access to this information. It is important to note that while the license number is public, other sensitive business details may not be available. Utilizing a Utah Customer Invoice can further enhance your business's public image by maintaining transparency in transactions.