Utah Specific Guaranty

Description

How to fill out Specific Guaranty?

You can spend hours online attempting to locate the legal document template that meets the state and federal standards you need.

US Legal Forms offers thousands of legal forms that can be reviewed by experts.

It is easy to access or print the Utah Specific Guaranty from the service.

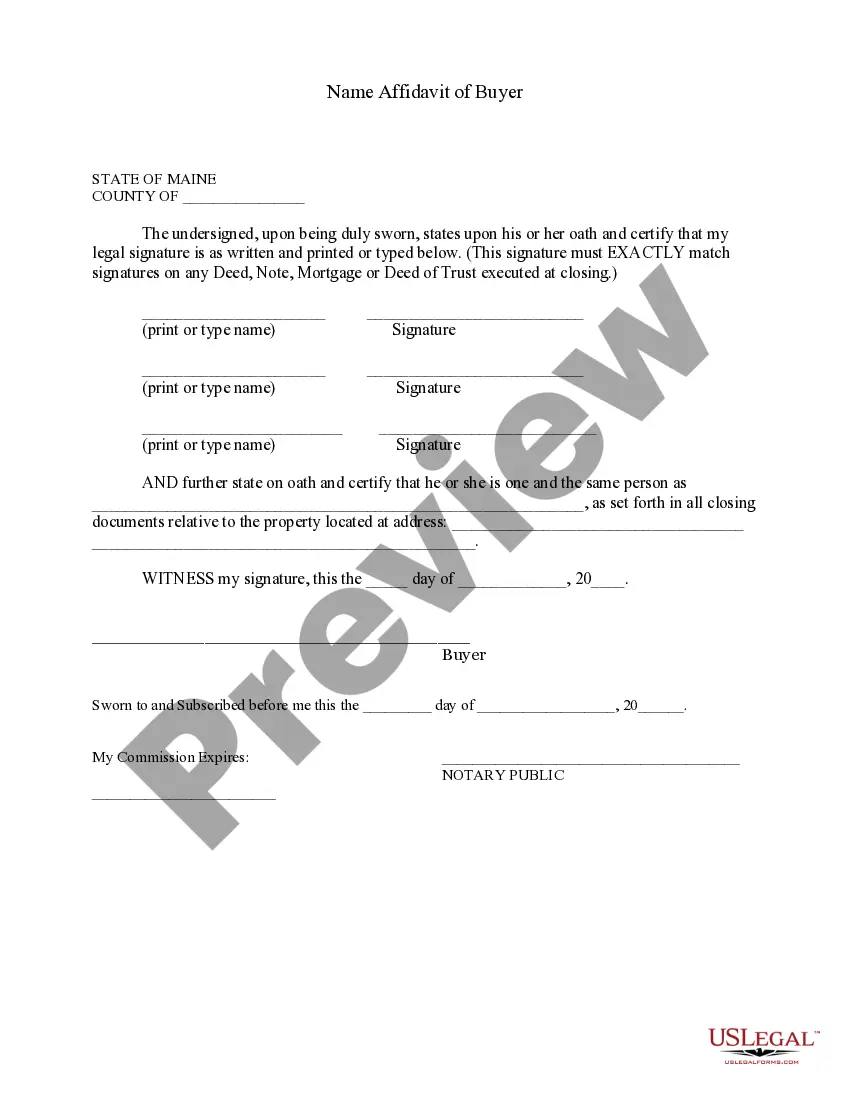

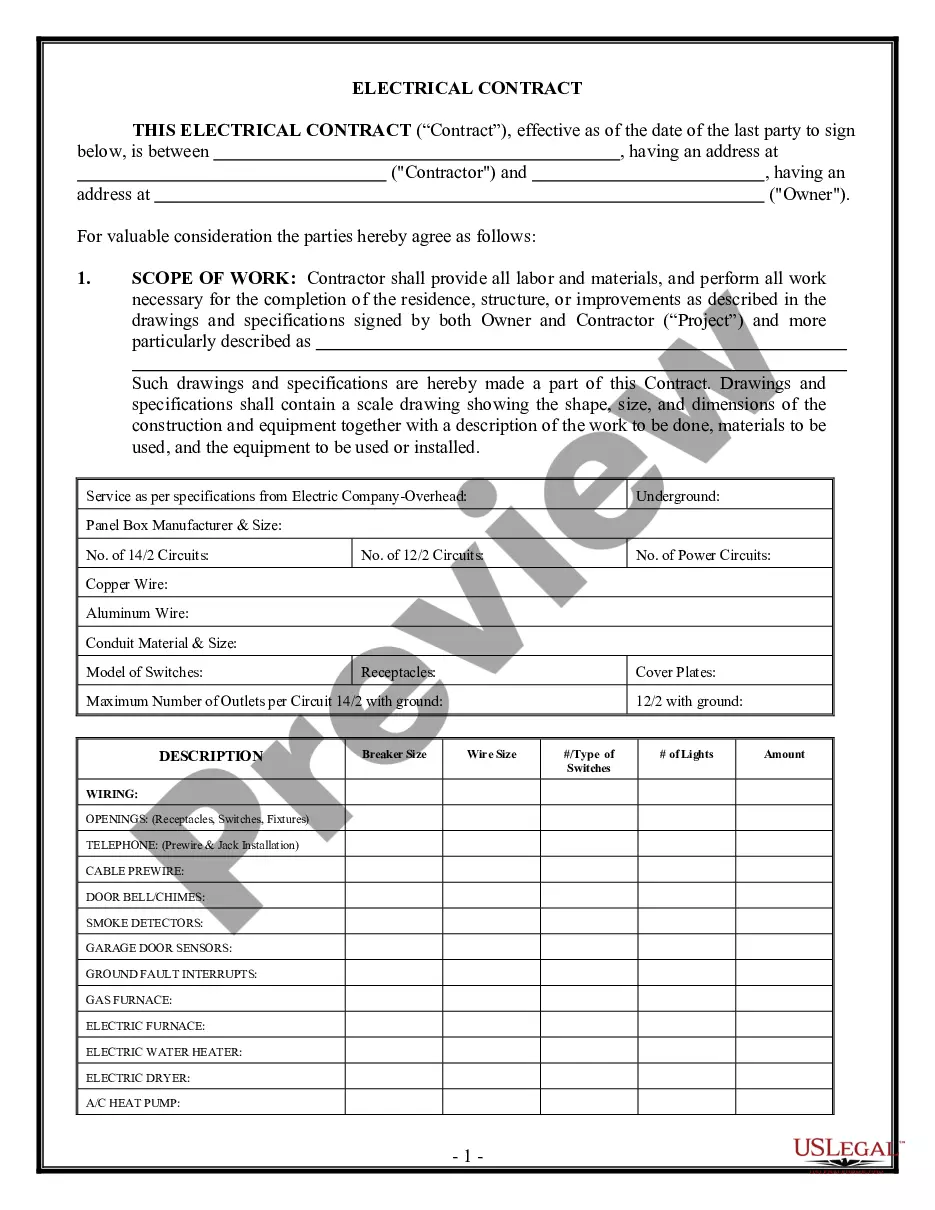

If available, use the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, edit, print, or sign the Utah Specific Guaranty.

- Every legal document template you acquire is your own possession indefinitely.

- To obtain another copy of the acquired form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions below.

- First, make sure you have selected the appropriate document template for the state/city you choose.

- Check the form outline to ensure you have selected the correct one.

Form popularity

FAQ

Utah Form TC 40W is specifically for individuals to report withholding on individual income tax. Employers use this form to share information regarding income tax withheld from employees. The uslegalforms platform provides additional resources to help you understand and properly manage your obligations related to Utah Specific Guaranty.

Tax form 40 is the standard form used for filing individual income tax returns in Utah. It captures all relevant income and deductions applicable to residents. To assist in this process, uslegalforms offers tools that enhance your filing experience related to the Utah Specific Guaranty.

Form TC 40A is the Utah Individual Income Tax Return for part-year residents. It is designed for those who have lived in Utah for part of the year and need to report their income accordingly. Using uslegalforms can simplify this process, ensuring that you meet your Utah Specific Guaranty responsibilities accurately.

The TC 75 form is known as the Utah Corporate Franchise Tax Return. This form is filed by corporation entities to report their income tax. If you are managing such obligations, you can rely on uslegalforms to efficiently handle your submission regarding the Utah Specific Guaranty.

A nonemployee compensation tax form is used to report payments made to independent contractors in Utah. This form helps track compensations and ensures proper tax compliance. To assist you with these filings, the uslegalforms platform provides templates and guidance tailored to your Utah Specific Guaranty needs.

The TC 40W form is a withholding tax form for Utah. It is used by employers to calculate and report the state income tax withheld from employees' wages. To ensure compliance with your Utah Specific Guaranty obligations, you can use resources available on uslegalforms that simplify the process and offer guidance on completing this form.

The Utah TC-40 should be filed with the Utah State Tax Commission as well. This form allows individual taxpayers to report their income and calculate their tax liability. For those seeking an efficient way to manage their filings, uslegalforms provides user-friendly options to streamline the submission of your Utah Specific Guaranty documentation.

You can file the Utah TC 65 with the Utah State Tax Commission. This form is necessary for specific transactions and must be submitted accurately. Moreover, you can conveniently file online through the uslegalforms platform, ensuring a swift and efficient process that covers your Utah Specific Guaranty needs.

You can file your Utah TC 40 with the Utah State Tax Commission. This form is essential for claiming the Utah Specific Guaranty when reporting your taxes. Filing accurately and timely can help you avoid potential penalties and ensure that you benefit fully from any available exemptions. If you're unsure about the filing process, exploring options on platforms like uslegalforms can guide you through the necessary steps.

The TC 75 is a critical tax form in Utah, specifically used for reporting the sale of certain assets or transactions related to real estate. Understanding how this form interrelates with the Utah Specific Guaranty can help you ensure compliance while maximizing your financial benefits. Properly filling out the TC 75 can assist you in keeping your records updated and accurate. For anyone involved with real estate in Utah, getting acquainted with this form is essential.