Utah Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

Description

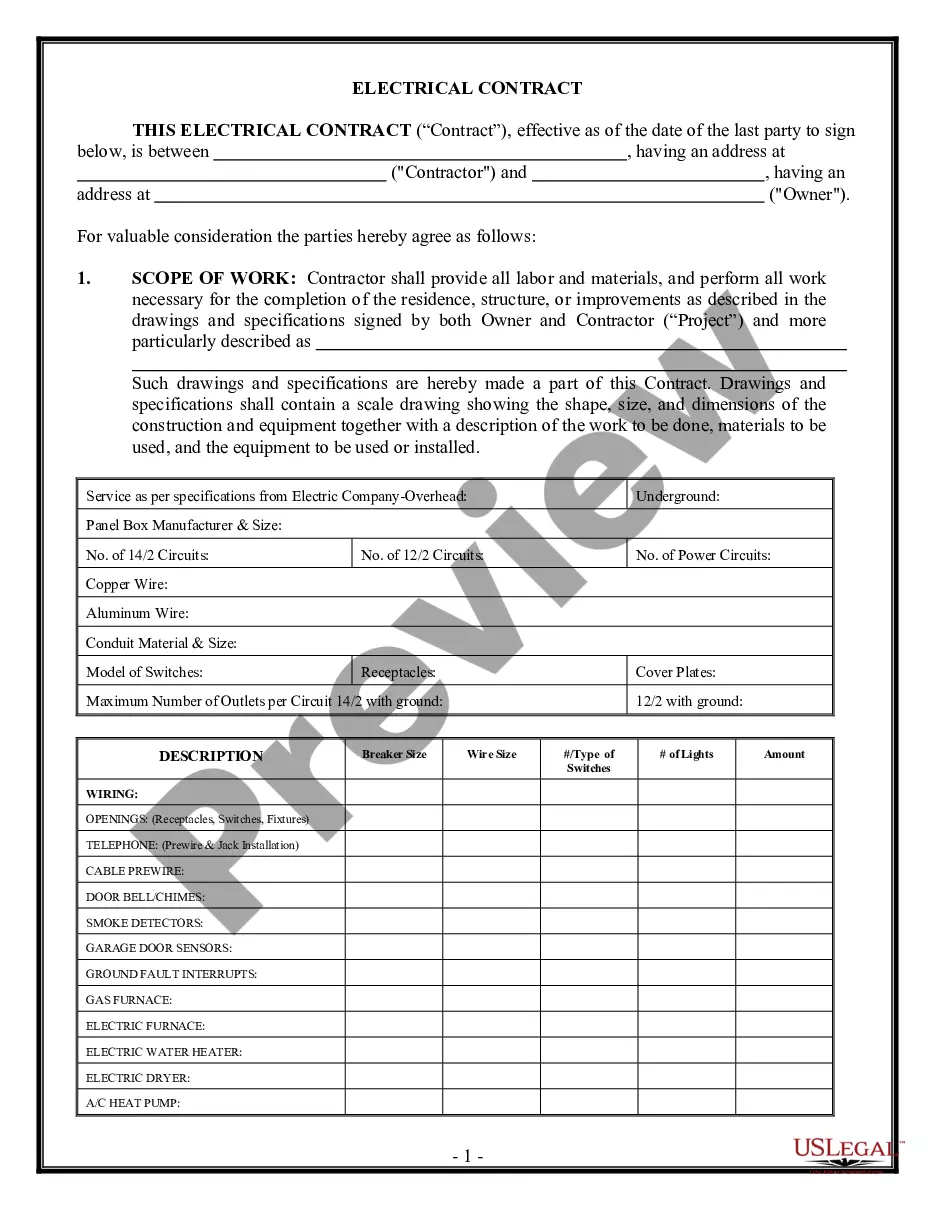

How to fill out Agreement To Dissolve And Wind Up Partnership Between Surviving Partners And Estate Of Deceased Partner?

Selecting the optimal legal document design can be a challenge.

Of course, there are numerous templates accessible online, but how can you locate the legal form you desire.

Visit the US Legal Forms website. The service provides countless templates, such as the Utah Agreement to Terminate and Liquidate Partnership among Surviving Partners and Estate of Deceased Partner, which you can use for business and personal purposes.

You may review the form using the Review button and read the form description to confirm it is the right one for you.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Utah Agreement to Terminate and Liquidate Partnership among Surviving Partners and Estate of Deceased Partner.

- Use your account to browse the legal forms you have previously obtained.

- Proceed to the My documents section of your account and download an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions you should follow.

- First, ensure you have selected the correct form for your location/region.

Form popularity

FAQ

Most legislation states that the partnership will end upon the death or bankruptcy of any partner. If your partner dies, you will then owe your partner's estate their share of the partnership that accrues at the date of their death.

The death of a partner or the unauthorized transfer of ownership of his share in the partnership in case there is a limitation to this effect results in the dissolution thereof. In other words, any change in the composition of the partnership, unless so allowed, will result in the dissolution thereof.

Continuing after Dissociation In an at-will partnership, the death (including termination of an entity partner), bankruptcy, incapacity, or expulsion of a partner will not cause dissolution.

When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death2026 of any partner.

The retiring partner is given his share of capital, revaluation profit or loss and goodwill. Death or insolvency of a partner is the outcome in the reconstitution of an enterprise when the remaining partners desire to continue the enterprise.

Keeping it successful is even harder, and coping with the death of a partner may be the hardest situation of all. When that happens, your deceased partner's share in the business usually passes to a surviving spouse, either by terms of a will or simply by default as the primary heir.

When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death2026 of any partner.

In a landmark judgment, in Mohd Laiquiddin v Kamala Devi Misra (deceased) by LRs,(1) the Supreme Court has ruled that on the death of a partner of a firm comprised of only two partners, the firm is dissolved automatically; this is notwithstanding any clause to the contrary in the partnership deed.

If it was death that had caused the end of the partnership, then the monies are paid out in equal shares to the surviving ex-partners and the deceased's estate. When all the partners are living there may be room to negotiate, but when one of them dies, the options disappear, especially if the beneficiaries are minors.

On the retirement or death of a partner, the existing partnership deed comes to an end, and in its place, a new partnership deed needs to be framed whereby, the remaining partners continue to do their business on changed terms and conditions.