Utah Customer Order Form

Description

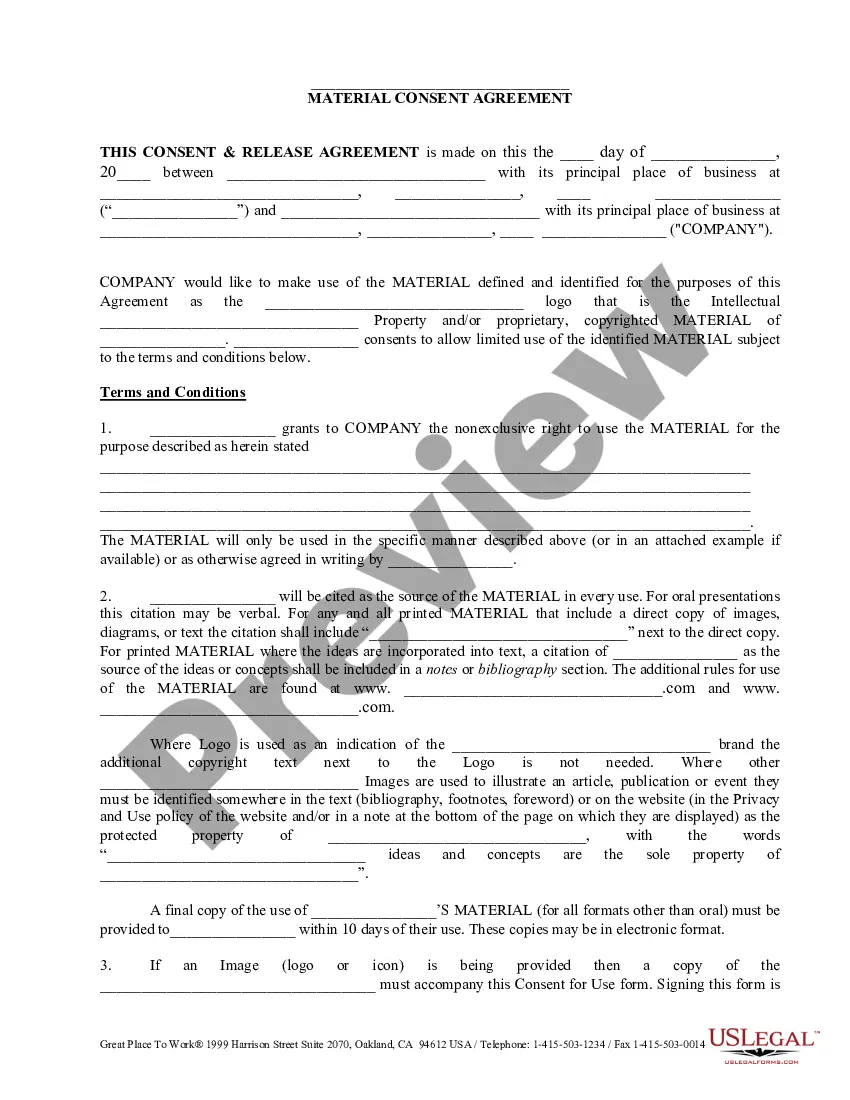

How to fill out Customer Order Form?

If you require to aggregate, download, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site's simple and user-friendly search to find the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Utah Customer Order Form. Every legal document template you purchase is yours permanently. You can access every form you acquired in your account. Select the My documents section and choose a form to print or download again.

- Utilize US Legal Forms to acquire the Utah Customer Order Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to retrieve the Utah Customer Order Form.

- You can also access forms you have previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Review option to examine the contents of the form. Remember to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose your desired pricing plan and submit your details to register for an account.

Form popularity

FAQ

Whether you need to file a Utah state tax return depends on your income level and filing status. Generally, if you earn income in Utah, filing a state tax return is necessary. The Utah Customer Order Form can help guide you through the required forms and calculations. To ensure compliance and avoid penalties, it's wise to consult with a tax professional or use resources available on the US Legal Forms platform.

TC40 is the name of the report that issuing banks send to Visa to report fraudulent transactions as part of its Risk Identification Service, and SAFE (System to Avoid Fraud Effectively) is Mastercard's analogous fraud monitoring program.

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc. with your return.

25b6 TC-40W, Part 1Report Utah withholding tax from the following forms: 2022 Federal form W-2, Wage and Tax Statement. 2022 Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc. with your return. Keep all these forms with your tax records we may ask you to provide the documents at a later time.

TC-62M, Utah Sales and Use Tax Return for Multiple Places of Business.

Find Your Utah Tax ID Numbers and Rates You can find your Withholding Account ID on any mail you have received from the State Tax Commission, or or any previously filed tax forms. If you're unsure, contact the agency at (801) 297-2200.

What does Form TC-40w: payer ID must be 14 characters long without hyphens, you must go back to federal w-2 or 1099 to update the Employer/payer state withholding id mean. The TurboTax program is having difficulty reading a State ID Number. Please go back to your income reporting form, be that a W2 or 1099.

Form TC-941E is an Annual Employer Reconciliation report used to report wages and withholding tax returns for employees.

Use form TC-69 to register with the Utah State Tax Commission for the taxes listed below. Read the instructions on the last page carefully before filling it out. You can register your business online!