Utah Hardware Purchase and Software License Agreement

Description

How to fill out Hardware Purchase And Software License Agreement?

Are you presently in a role where you require paperwork for both business or personal purposes almost all the time.

There are numerous legal document templates available online, but finding versions you can trust is not simple.

US Legal Forms offers a vast selection of form templates, such as the Utah Hardware Purchase and Software License Agreement, which are designed to comply with state and federal regulations.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- After that, you can download the Utah Hardware Purchase and Software License Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

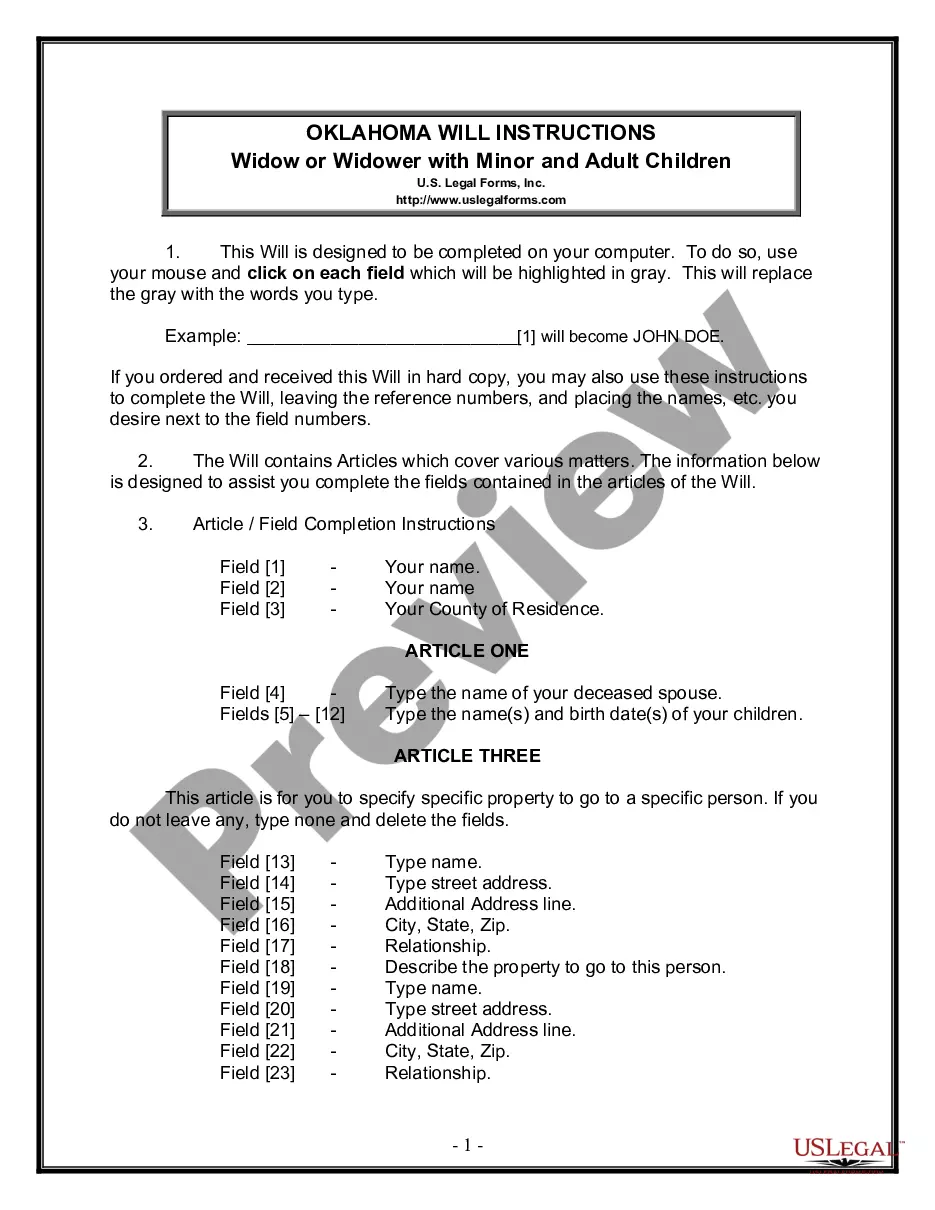

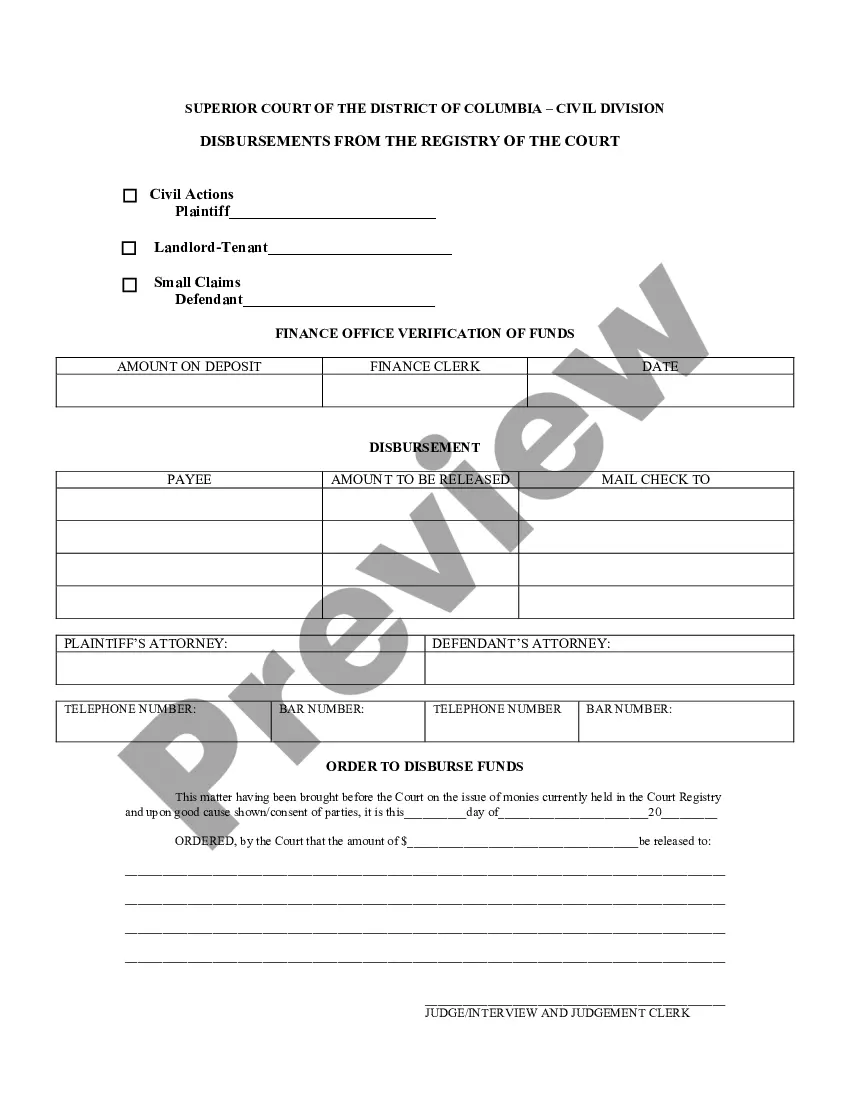

- Find the form you require and ensure it is for the correct city/state.

- Utilize the Review button to inspect the form.

- Read the description to make sure you have selected the correct document.

- If the form is not what you are looking for, use the Search field to locate a document that suits your needs and specifications.

- Once you find the correct form, click Acquire now.

- Choose the pricing plan you prefer, fill in the necessary details to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can download a new version of the Utah Hardware Purchase and Software License Agreement at any time, if needed. Just select the appropriate form to download or print the document template.

- Use US Legal Forms, one of the largest collections of legal forms, to save time and avoid mistakes. This service provides professionally crafted legal document templates that you can utilize for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

In Utah, Software as a Service (SaaS) is typically exempt from sales tax as long as it is accessed via the cloud. However, if a business enters a Utah Hardware Purchase and Software License Agreement that includes a software license with tangible components, it may incur tax. It's always wise to verify current tax laws to remain compliant and informed.

In California, software license fees may be subject to sales tax based on the type of software and how it is delivered. If you are entering into a Utah Hardware Purchase and Software License Agreement that involves California residents, make sure to comply with applicable taxes. Consulting a legal expert can provide clarity regarding your obligations.

In Texas, software licenses are also subject to sales tax, similar to Utah. If you engage in a transaction that includes a Utah Hardware Purchase and Software License Agreement but operate in Texas, be aware of the state's tax rules. Understanding local tax implications can assist you in budgeting accurately.

In Utah, the state generally considers software licenses to be taxable, especially for pre-written software. This means that when you establish a Utah Hardware Purchase and Software License Agreement, you should anticipate including sales tax in your financial calculations. Staying informed about tax obligations helps you manage costs effectively.

In Colorado, the taxability of software licenses depends on the type of software and usage. Generally, pre-written software is taxable, while customized software may be exempt under certain conditions. If you are considering a Utah Hardware Purchase and Software License Agreement that involves out-of-state usage, consulting a tax expert on Colorado regulations is beneficial.

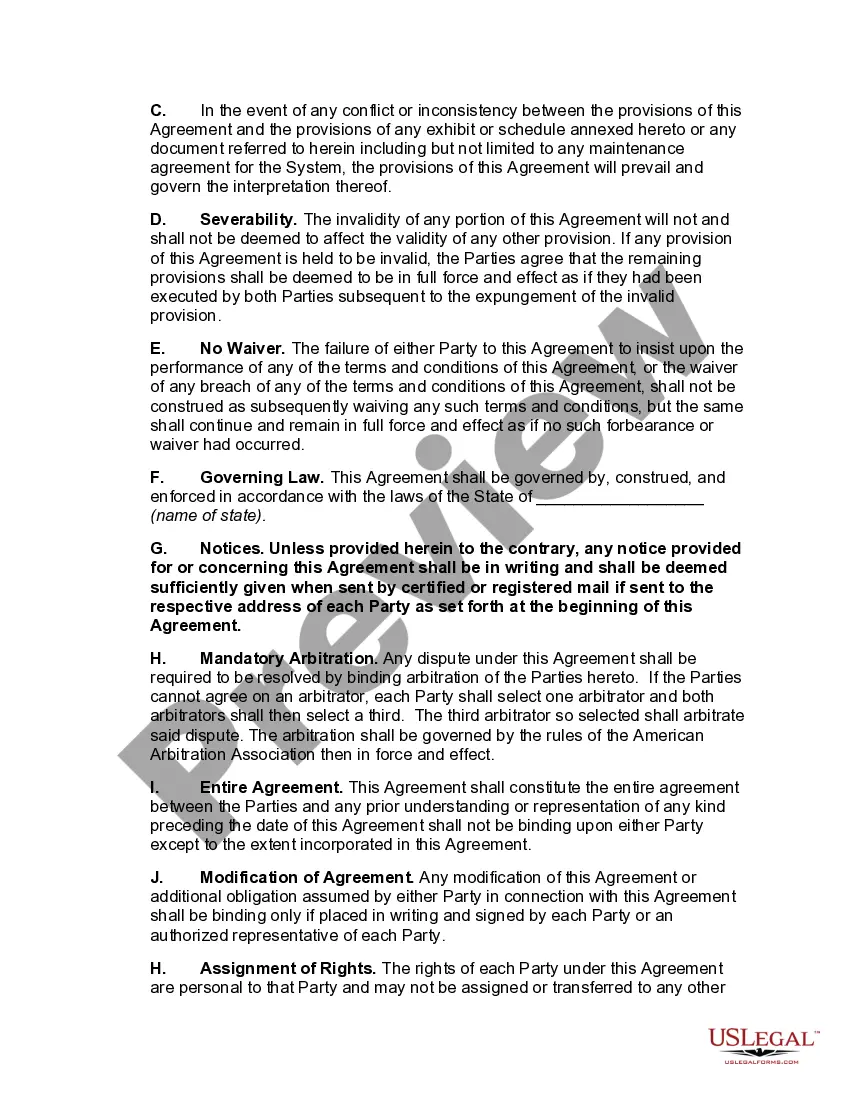

A software license agreement is a legal document that outlines the permissions and restrictions regarding the use of software. This agreement is vital when entering a Utah Hardware Purchase and Software License Agreement, as it specifies what you can and cannot do with the software. Understanding this document helps protect your rights and ensures proper use.

Yes, if you sell tangible personal property or services in Utah, you are required to obtain a sales and use tax license. This requirement also applies if you are involved in a Utah Hardware Purchase and Software License Agreement, as it involves taxable software or equipment. Acquiring the necessary license allows you to collect and remit sales tax correctly.

In Utah, the sale of software is generally taxable, including both pre-written and customized software. When you enter into a Utah Hardware Purchase and Software License Agreement, it is crucial to account for sales tax on the total amount of the software license. Always consult the latest regulations or a tax professional to ensure compliance with local tax laws.