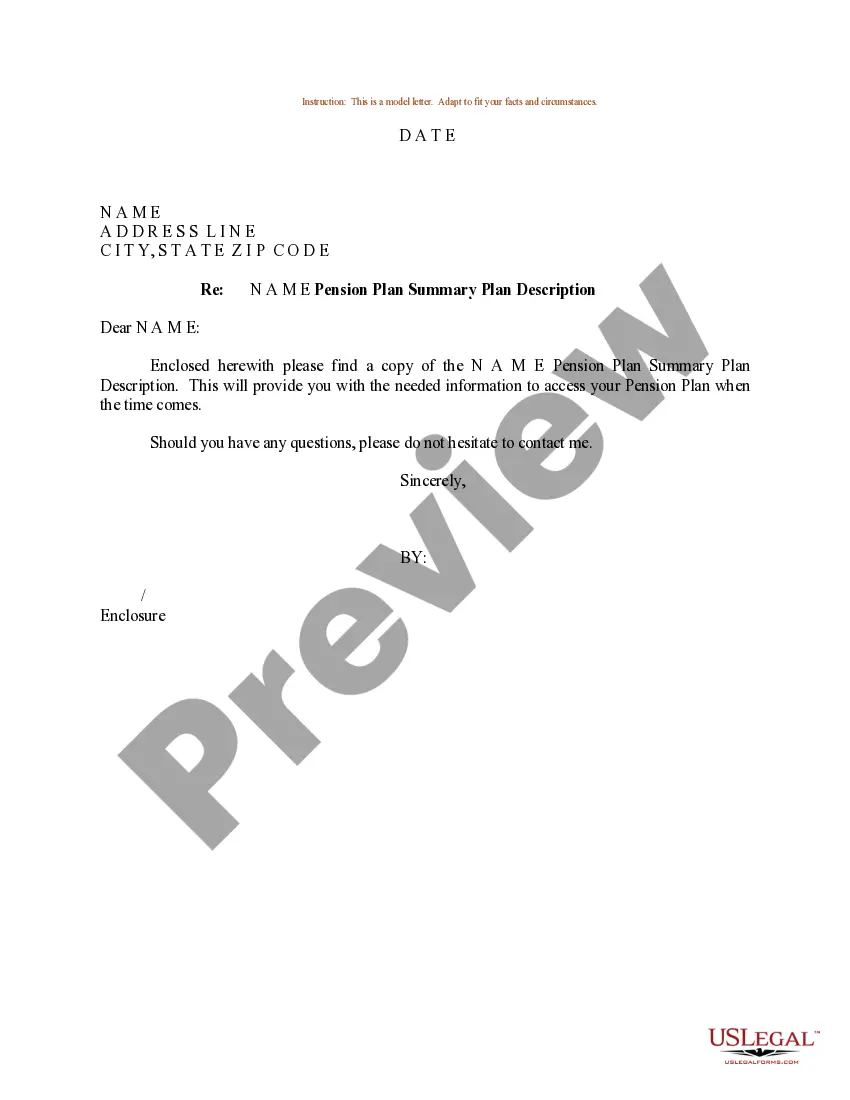

Utah Sample Letter for Pension Plan Summary Plan Description

Description

How to fill out Sample Letter For Pension Plan Summary Plan Description?

It is possible to devote time on the web searching for the authorized papers web template that meets the state and federal requirements you want. US Legal Forms gives a huge number of authorized kinds which can be evaluated by specialists. It is possible to download or printing the Utah Sample Letter for Pension Plan Summary Plan Description from the services.

If you currently have a US Legal Forms profile, you can log in and then click the Obtain button. Following that, you can complete, modify, printing, or signal the Utah Sample Letter for Pension Plan Summary Plan Description. Every single authorized papers web template you get is your own property forever. To get one more copy of the acquired develop, go to the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms web site for the first time, stick to the easy instructions listed below:

- First, make certain you have chosen the best papers web template for that area/city that you pick. Look at the develop information to ensure you have selected the correct develop. If accessible, use the Preview button to check through the papers web template too.

- In order to get one more edition of the develop, use the Look for area to discover the web template that meets your requirements and requirements.

- When you have discovered the web template you want, just click Acquire now to carry on.

- Choose the prices program you want, type your accreditations, and register for your account on US Legal Forms.

- Comprehensive the purchase. You should use your Visa or Mastercard or PayPal profile to cover the authorized develop.

- Choose the structure of the papers and download it to the device.

- Make modifications to the papers if needed. It is possible to complete, modify and signal and printing Utah Sample Letter for Pension Plan Summary Plan Description.

Obtain and printing a huge number of papers web templates using the US Legal Forms web site, which offers the greatest selection of authorized kinds. Use specialist and condition-particular web templates to handle your company or person requirements.

Form popularity

FAQ

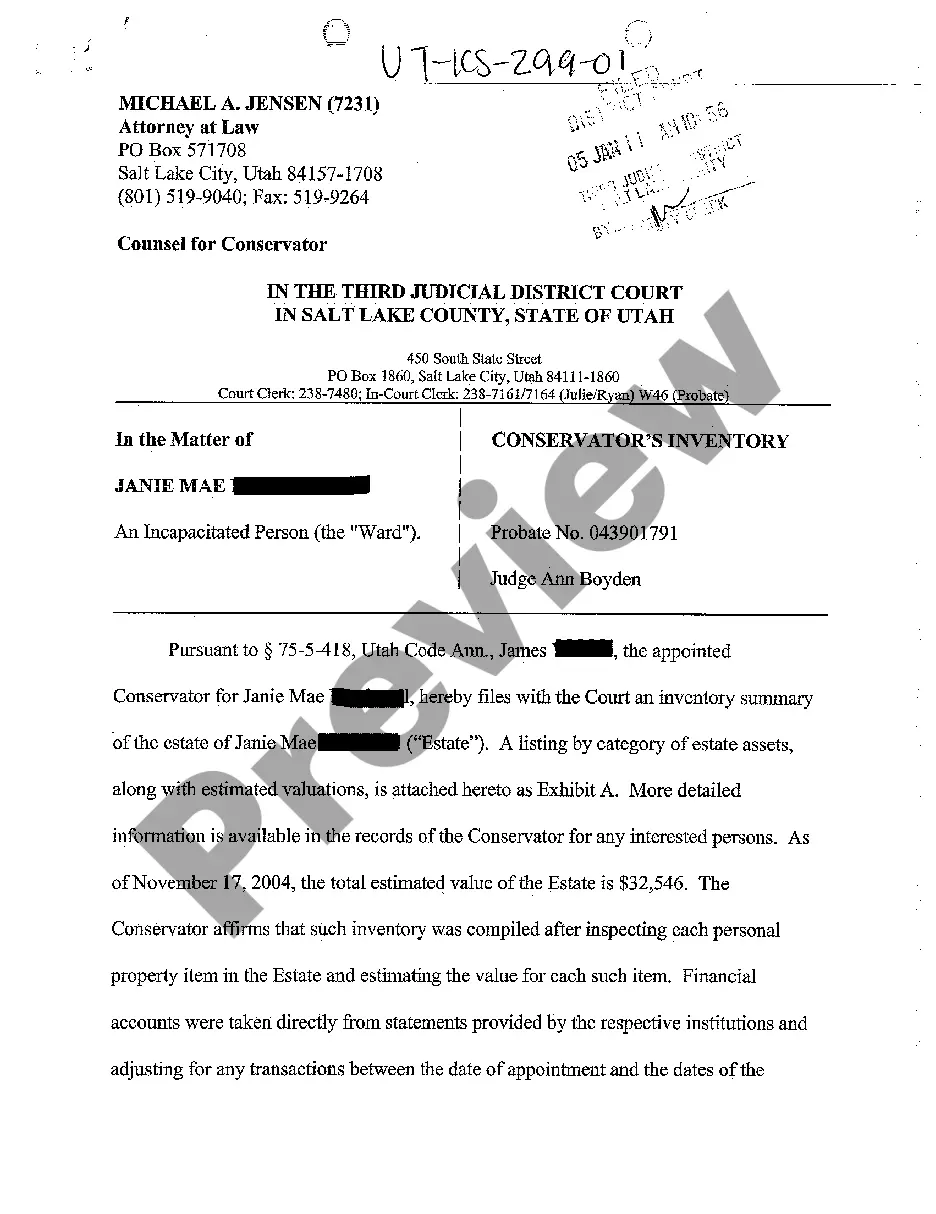

65 with four years of service. 62 with 10 years of service. 60 with 20 years of service. Any age with 35 years of service.

The average annual benefit is $17,894 per year, or $1,491 per month. Employers contribute between 14.33% - 18.76% to the fund. Each dollar invested by Utah taxpayers in the pension supported $4.72 in total economic activity in the state. an employee's years of service and average salary at the end of one's career.

This Plan is intended to meet the requirements of section 403(b) of the Internal Revenue Code. The purpose of the plan is to enable eligible Employees to save for retirement. As well as retirement benefits, the plan provides certain benefits in the event of death or other termination of employment.

For specific information about purchases, contact our Defined Benefit Retirement Department at 801-366-7770 or 800-695-4877. You qualify for a monthly retirement benefit if you are: ?65 with 4 years of service. ?62 with 10 years of service. ?60 with 20 years of service.

A 401(k) Plan is a defined contribution plan that is a cash or deferred arrangement. Employees can elect to defer receiving a portion of their salary which is instead contributed on their behalf, before taxes, to the 401(k) plan.

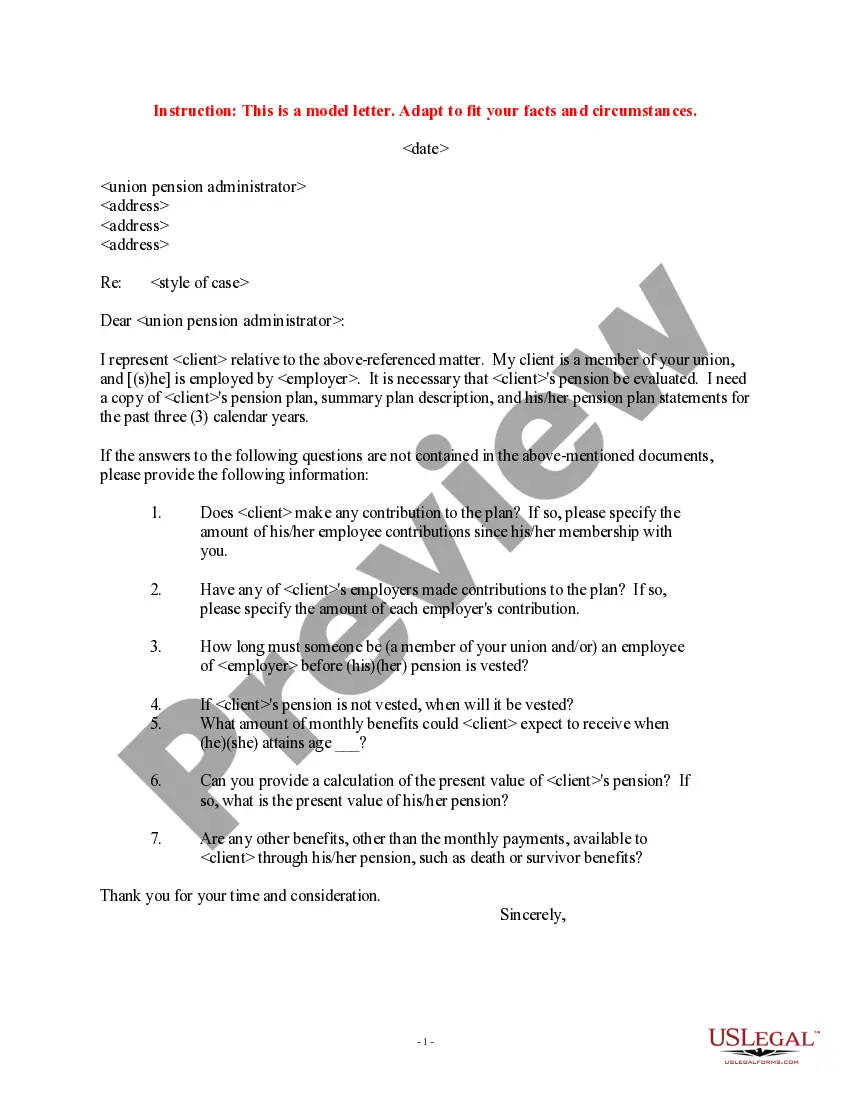

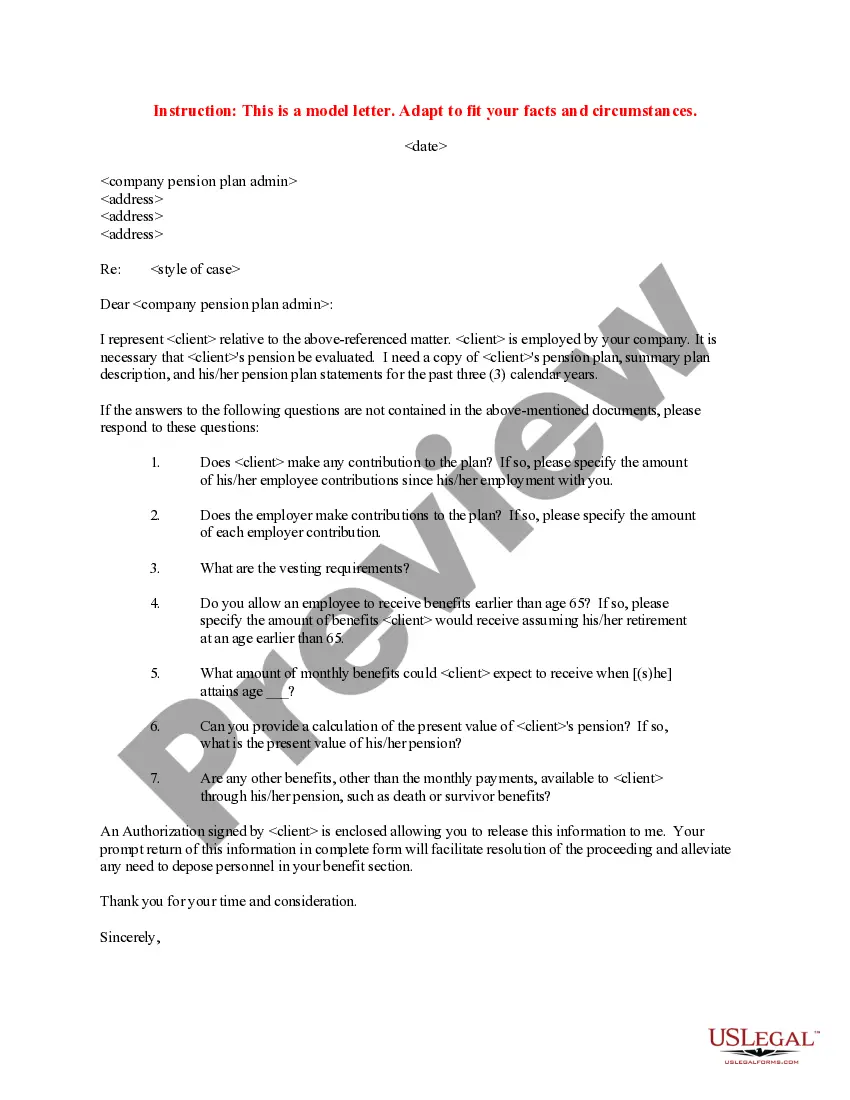

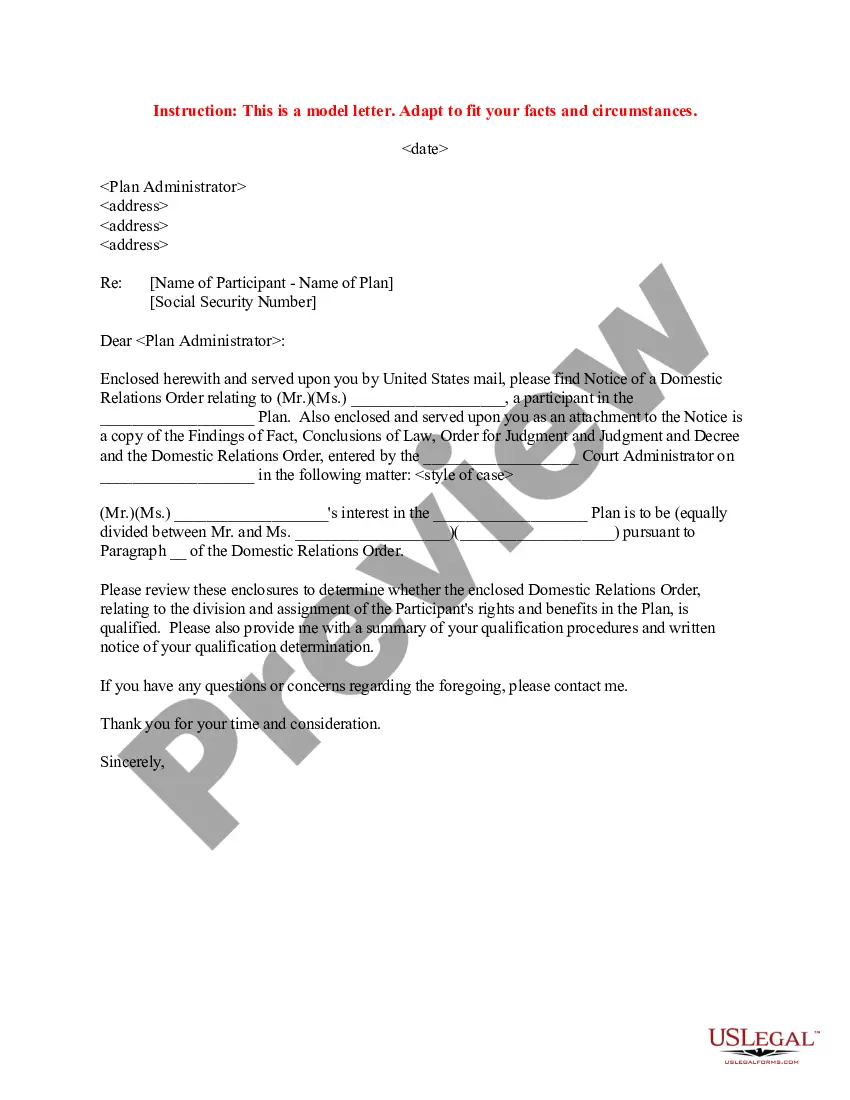

The Summary Plan Description (SPD) is one of the important 401(k) plan documents that provides plan participants (and their beneficiaries) with the most important details of their benefit plan, like eligibility requirements or participation dates, benefit calculations, plan management instructions, and general member ...

With a traditional 401(k), employee contributions are pre-tax, meaning they reduce taxable income, but withdrawals are taxed. Employee contributions to Roth 401(k)s are made with after-tax income: There's no tax deduction in the contribution year, but withdrawals are tax-free.

A 401(k) is a retirement plan offered by your employer that gives you the option to contribute a percentage of your salary on a tax-deferred basis.