Utah Agreement not to Compete during Continuation of Partnership and After Dissolution

Description

How to fill out Agreement Not To Compete During Continuation Of Partnership And After Dissolution?

If you need to compile, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly and efficient search feature to find the documents you require.

Numerous templates for business and personal purposes are categorized by regions and states, or keywords. Use US Legal Forms to access the Utah Agreement not to Compete during Continuation of Partnership and After Dissolution with just a few clicks.

Every legal document template you buy is yours indefinitely. You have access to every form you downloaded within your account. Go to the My documents section and select a form to print or download again.

Stay competitive and download, and print the Utah Agreement not to Compete during Continuation of Partnership and After Dissolution with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to download the Utah Agreement not to Compete during Continuation of Partnership and After Dissolution.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

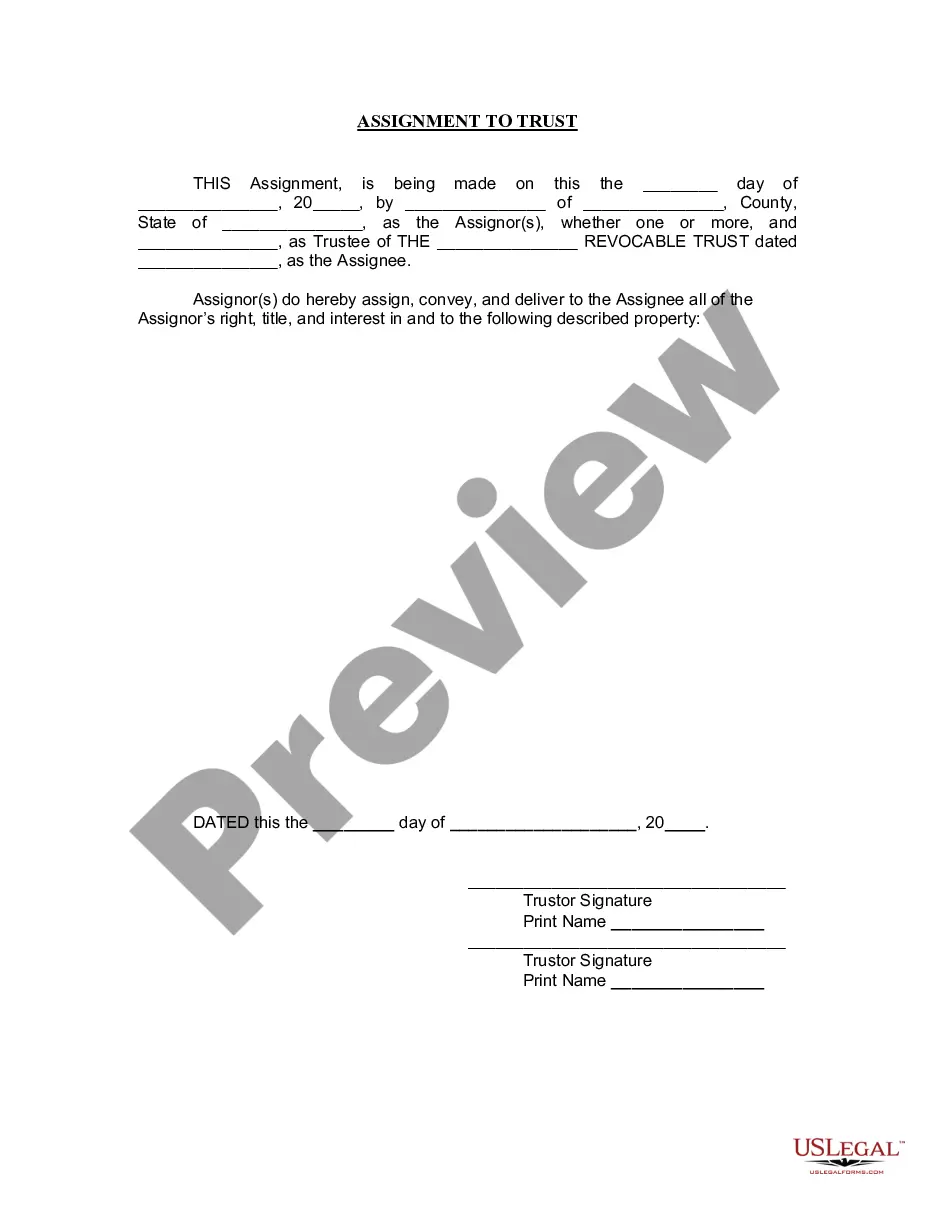

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other types of legal form templates.

- Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred payment plan and enter your details to create an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Utah Agreement not to Compete during Continuation of Partnership and After Dissolution.

Form popularity

FAQ

A contract may be deemed void if the agreement is not enforceable as it was originally written. In such instances, void contracts (also referred to as "void agreements"), involve agreements that are either illegal in nature or in violation of fairness or public policy.

Effect of DissolutionA partnership continues after dissolution only for the purpose of winding up its business. The partnership is terminated when the winding up of its business is completed.

Start now and decide later.Review and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets. Note that only those assets your company owns can be liquidated. Thus, you can't liquidate assets that are used as collateral for loans.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Partnership Agreements and the Exit of One Partner A partnership does not necessarily end when a partner exits. The remaining partners may continue with the partnership. Therefore, your partnership agreement covers what happens when a partner wants to leave, becomes incapacitated, or dies.

53.79 Dissolution - general The dissolution of a partnership is the process during which the affairs of the partnership are wound up (where the ongoing nature of the partnership relation terminates).

On dissolution of the firm, the business of the firm ceases to exist since its affairs are would up by selling the assets and by paying the liabilities and discharging the claims of the partners. The dissolution of partnership among all partners of a firm is called dissolution of the firm.

After the dissolution of the partnership, the partner is liable to pay his debt and to wind up the affairs regarding the partnership. After the dissolution, partners are liable to share the profit which they have decided in agreement or accordingly.