Utah Assignment of Partnership Interest with Consent of Remaining Partners

Description

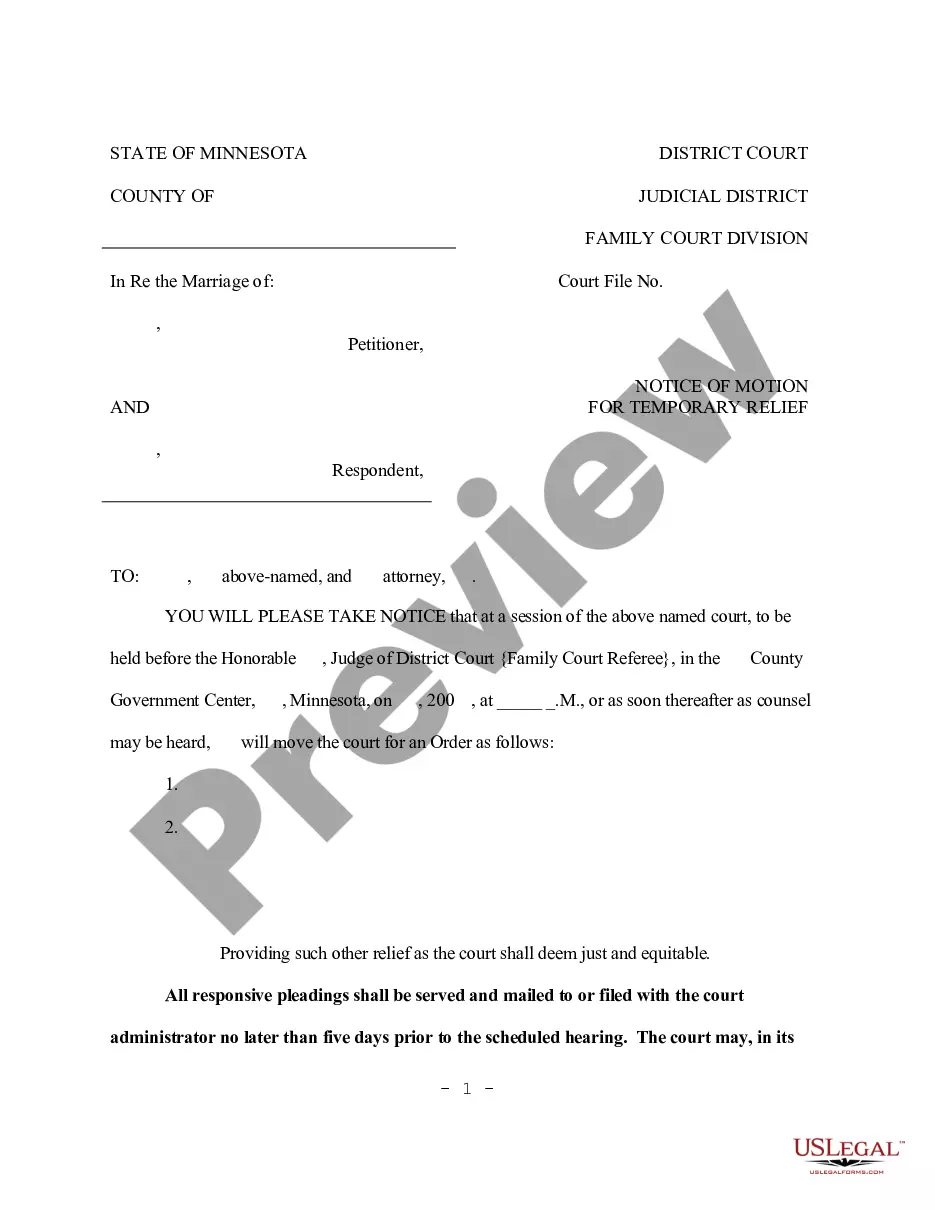

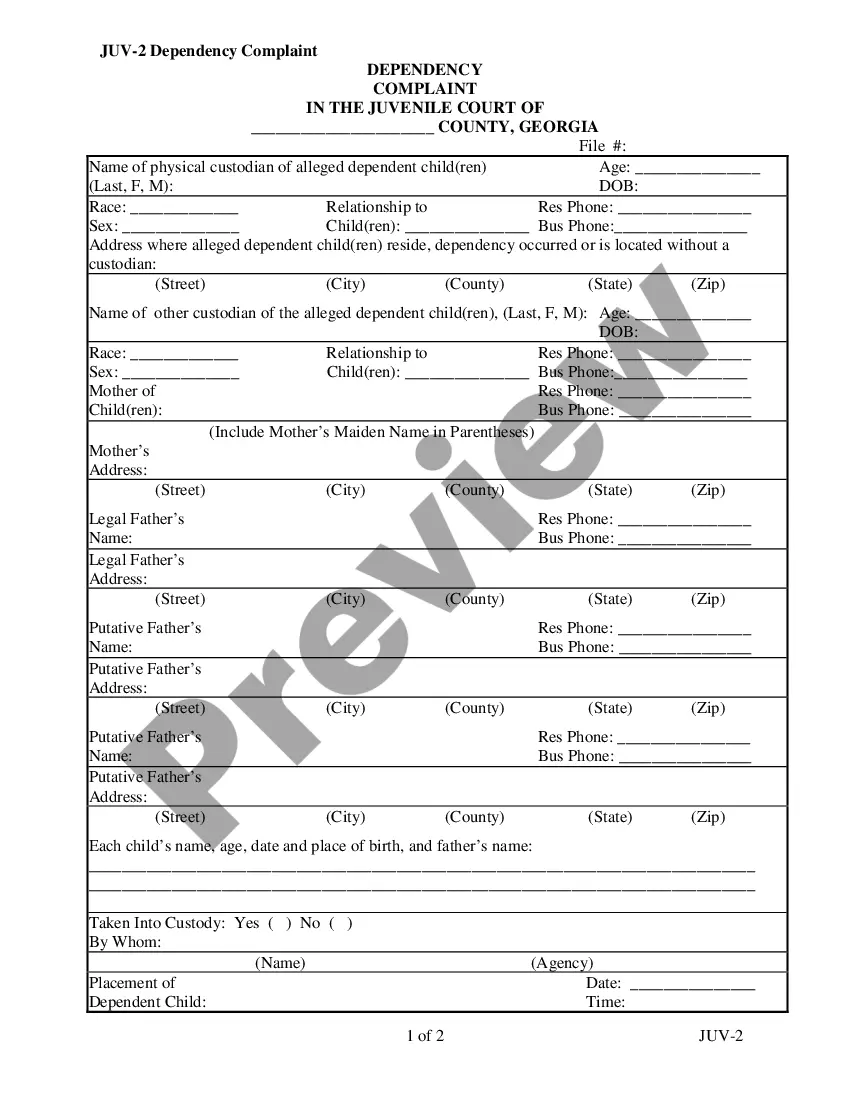

How to fill out Assignment Of Partnership Interest With Consent Of Remaining Partners?

You might spend numerous hours online attempting to locate the certified document template that fulfills the federal and state requirements you desire.

US Legal Forms offers a vast array of legal forms that can be evaluated by specialists.

It is easy to download or print the Utah Assignment of Partnership Interest with Consent of Remaining Partners from the platform.

To discover another version of the form, utilize the Lookup field to find the template that suits your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Utah Assignment of Partnership Interest with Consent of Remaining Partners.

- Every legal document template you purchase is yours forever.

- To obtain another copy of the acquired form, go to the My documents tab and click on the respective button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the appropriate document template for your region/city of choice.

- Review the form details to confirm you have chosen the correct document.

Form popularity

FAQ

A partner typically assigns their interests in a partnership when they decide to withdraw, retire, or transition their business involvement to another party. This can also happen for financial reasons, or when a partner wants to bring in new members to the partnership. Proper documentation, like a Utah Assignment of Partnership Interest with Consent of Remaining Partners, is essential in these cases.

Section 29 outlines that the transferee of a partner's interest gains certain rights, but not all rights inherent to a partner. Usually, the transferee has the right to receive distributions, but they may not have voting rights unless the remaining partners agree. Understanding these rights is crucial when creating a Utah Assignment of Partnership Interest with Consent of Remaining Partners.

A partner may assign his or her interest in the partnership but is not allowed to assign rights in specific partnership property. A partner's individual creditors may not attach partnership property but may charge a partner's interest in the partnership.

Partners are required to mandatorily obtain the consent of all the partners in case the partner is willing to transfer his/her rights and interest to another person. The partners have to work within his/her assigned authority.

Transfer of limited partnership interest is allowed as long as the general partner consents to the arrangement and it is done in concert with the established partnership agreement. A common example of a limited partnership is the family limited partnership, which is often created to administer a family business.

When one owner sells their stake in the partnership to a third party, an assignment of partnership interest records the transaction to the new partner. The assignment of partnership interest involves two parties: the assignor or the partner transferring their stake and the assignee, the new partner.

An Assignment of Partnership Interest is a legal document establishing the terms under which stake in a partnership is transferred from an assignor to an assignee. In other words, the new partner (assignee) acquires the right to receive benefits from the partnership per the stake granted.

Changes to the PartnersThe individual partners pay, with their own cash and not the partnership cash, the leaving partner for a share of the leaving partner's capital account.The partnership pays the leaving partner for the value of his or her capital account + a cash bonus.More items...

An Assignment of Partnership Interest is a legal document establishing the terms under which stake in a partnership is transferred from an assignor to an assignee. In other words, the new partner (assignee) acquires the right to receive benefits from the partnership per the stake granted.

However, the assignee does not become a partner without the consent of the other partners. Without this consent, the assignee is only entitled to receive the assignor's share of the profits of the partnership and the assignor's interest when the partnership dissolves.