Utah Assignment of Interest in Joint Venture with Consent

Description

How to fill out Assignment Of Interest In Joint Venture With Consent?

It is feasible to spend hours online trying to locate the legal document template that fulfills both state and federal requirements you require.

US Legal Forms offers numerous legal templates that are reviewed by professionals.

You can easily download or print the Utah Assignment of Interest in Joint Venture with Consent from the services.

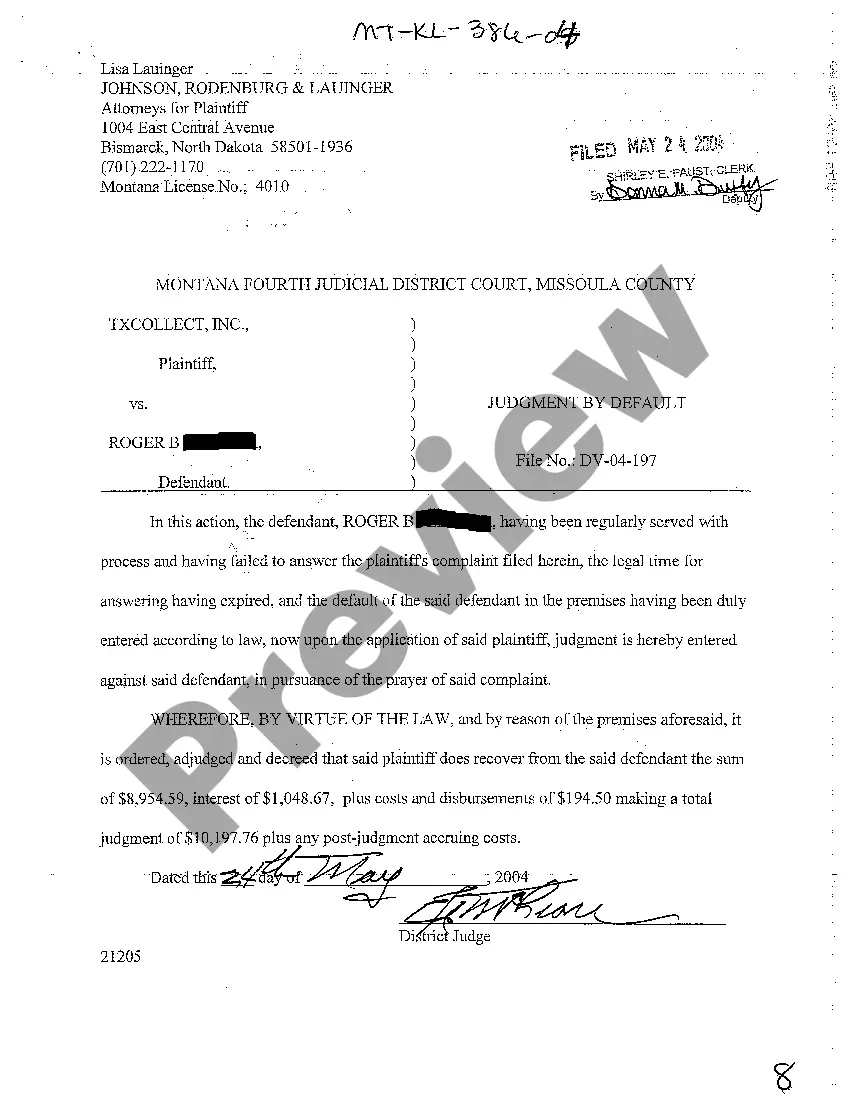

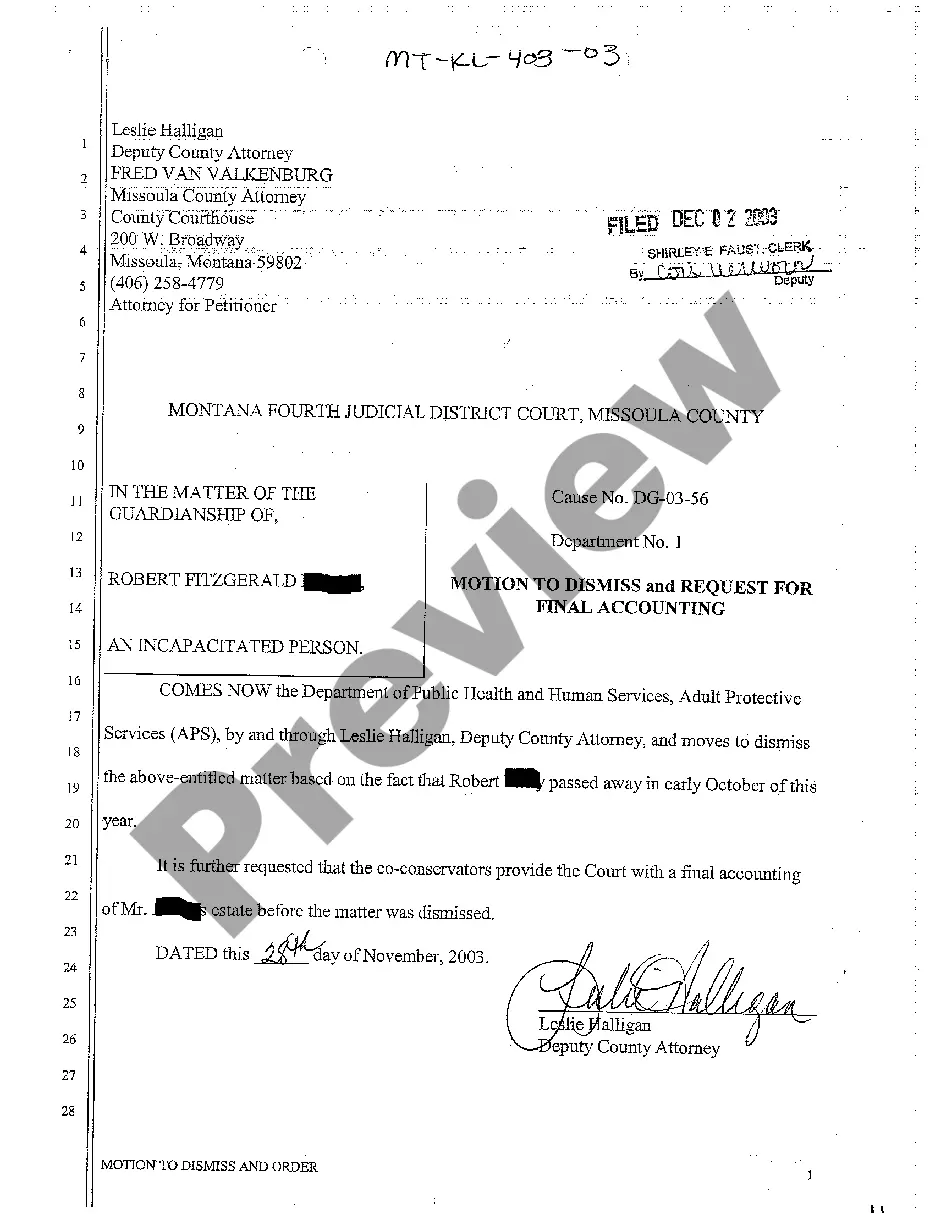

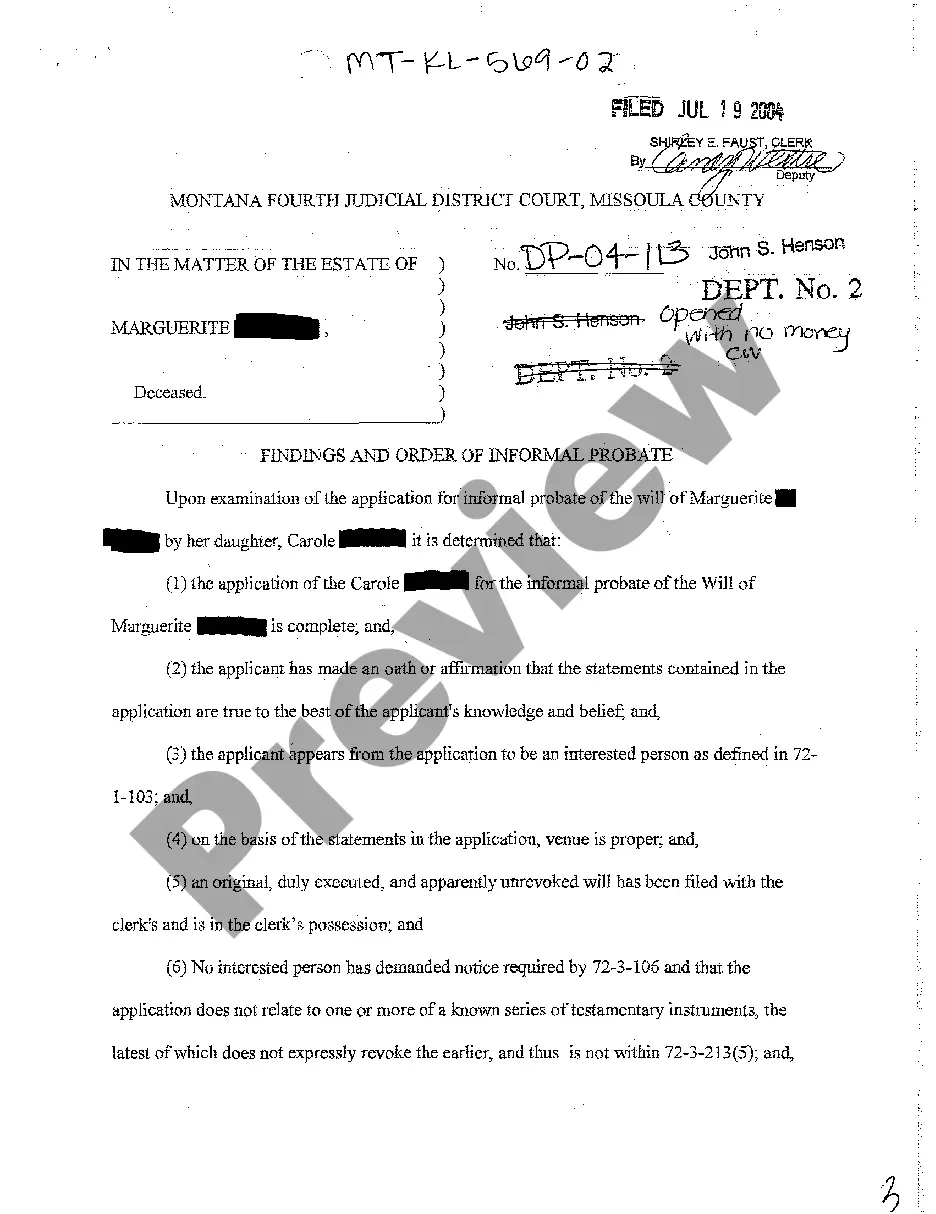

If available, use the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, edit, print, or sign the Utah Assignment of Interest in Joint Venture with Consent.

- Every legal document template you acquire is yours for an extended period.

- To obtain another version of the purchased document, go to the My documents section and click the associated button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have chosen the correct document template for the area/city of your preference.

- Review the form details to confirm that you have selected the appropriate document.

Form popularity

FAQ

If your business operates as a partnership in Utah, you are generally required to file a partnership return. This applies to partnerships engaging in various business activities, including those related to a Utah Assignment of Interest in Joint Venture with Consent. Make sure to adhere to state regulations to avoid unnecessary complications.

Certain entities are exempt from paying state income tax in Utah, such as state and local governments, and specific nonprofit organizations. Additionally, some individuals may qualify for exemptions based on certain income levels. It is essential to check your eligibility, particularly if your business involves a Utah Assignment of Interest in Joint Venture with Consent.

Anyone who earns income in Utah must file a Utah tax return according to state regulations. This includes individuals, corporations, and partnerships. If you engage in a Utah Assignment of Interest in Joint Venture with Consent, your tax obligations may differ, so be proactive in keeping informed.

A partnership is generally required to file its return by the 15th day of the fourth month following the end of its tax year. If your partnership has a tax year ending December 31, for example, this means the return is due by April 15. Having clarity on deadlines is crucial, especially when dealing with a Utah Assignment of Interest in Joint Venture with Consent.

You can file the Utah TC 65 form at the Utah State Tax Commission's office. For convenience, electronic filing options are also available through the tax commission's website. If your partnership involves a Utah Assignment of Interest in Joint Venture with Consent, be sure to select the correct filing method to ensure compliance.

Any corporation doing business in Utah must file a corporate tax return. This applies whether the corporation is based locally or is a foreign entity conducting business in the state. If your business engages in a Utah Assignment of Interest in Joint Venture with Consent, ensure that you meet these filing requirements to avoid penalties.

Best Practices for Documenting Your Joint VenturePick the right time to form the joint venture.Pay attention to the description of the joint venture's purposes.Provide a means to raise future capital.If you can name entities as managers, rather than individuals, do it.More items...

Key Elements of a Joint Venture AgreementBusiness address.Joint venture types.Purpose of the agreement.Names and addresses of members.Duties and obligations.Voting and formal meeting requirements.Assignment of percentage ownership.Profit or loss allocation.More items...

A joint venture is a common form of foreign investment in Nigeria. Parties to a joint venture agreement in Nigeria can be individuals or incorporated bodies. It is very important that the various aspects listed above are carefully documented. A Joint venture agreement is entered into before the company is incorporated.

Joint Venture Interest means an acquisition of or Investment in Equity Interests in another Person, held directly or indirectly by the MLP, that will not be a Subsidiary after giving effect to such acquisition or Investment.