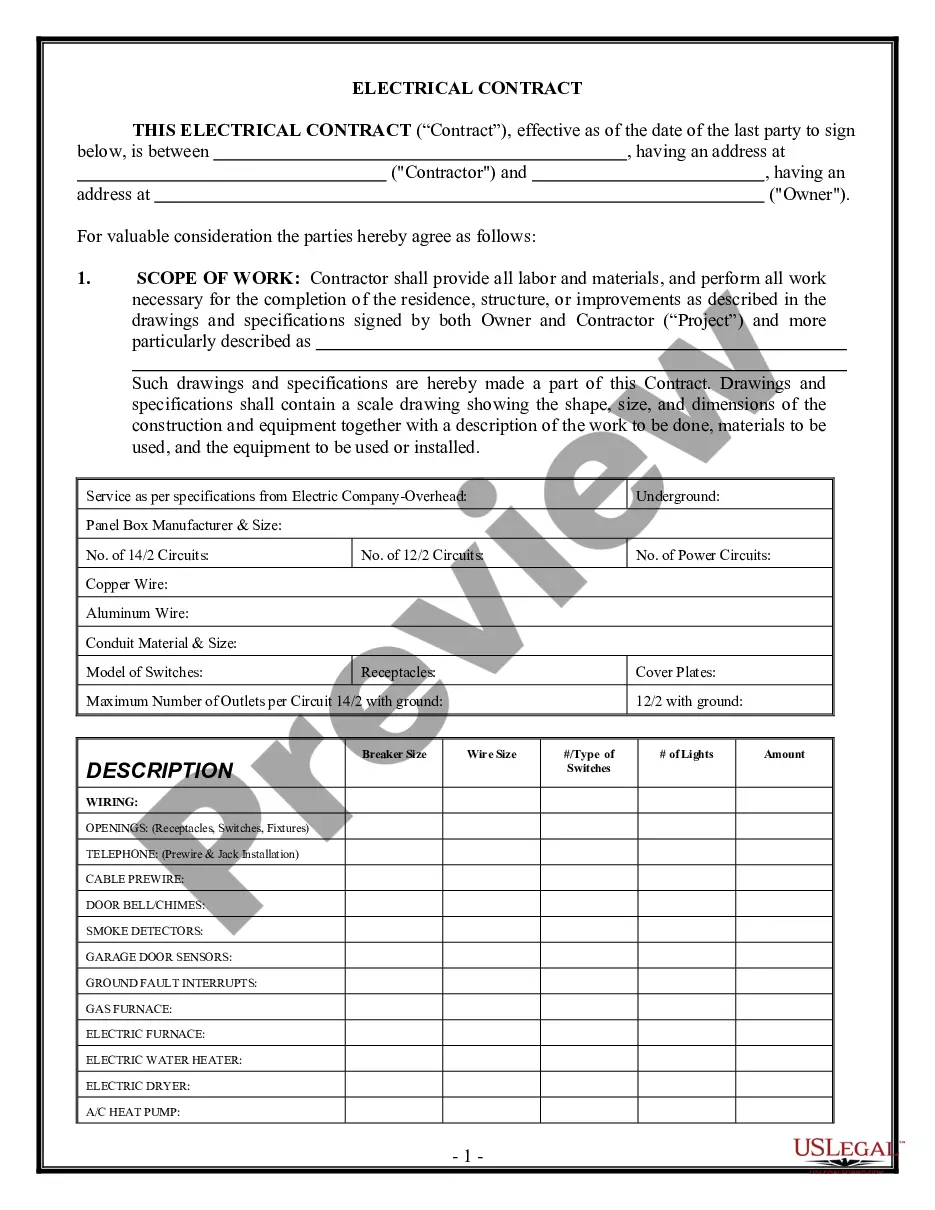

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Utah Check Disbursements Journal

Description

How to fill out Check Disbursements Journal?

It is feasible to allocate time on the internet looking for the valid document template that fulfills the state and federal requirements you will require.

US Legal Forms offers thousands of valid documents that are verified by experts.

It is easy to download or print the Utah Check Disbursements Journal from my service.

If available, use the Review option to go through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then hit the Download button.

- Next, you can complete, modify, print, or sign the Utah Check Disbursements Journal.

- Every valid document template you obtain is yours permanently.

- To acquire another copy of a purchased document, visit the My documents section and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/city of preference. Read the document description to verify that you have chosen the right form.

Form popularity

FAQ

Yes, you can request copies of your tax returns online through the Utah State Tax Commission's website. After logging into your account, you will find options to view and print your returns. To help streamline this process, utilizing the Utah Check Disbursements Journal may simplify your record-keeping efficiently.

You can download Utah tax forms directly from the Utah State Tax Commission's official website. They provide a wide range of forms necessary for filing your state return. To manage your documentation effectively, consider using the Utah Check Disbursements Journal to keep track of which forms you have filed.

Yes, Utah requires residents to file a state tax return if they meet certain income thresholds. This form helps determine your state tax liability or refund status. For clarity on the process, the Utah Check Disbursements Journal can help you understand your financial standing and track your taxes effectively.

To obtain a copy of your Utah state tax return, access your online account with the Utah State Tax Commission. You can request copies of past returns through their system. If you require organized tracking of your past filings, the Utah Check Disbursements Journal can be a helpful tool.

Typically, Utah processes tax refunds within two to four weeks after your return is submitted. However, factors such as the method of filing can influence this timeframe. To stay informed, you may want to check the status through the Utah Check Disbursements Journal, which allows you to track disbursements efficiently.

For comprehensive information regarding income taxes in Utah, the Utah State Tax Commission's website serves as a valuable resource. They provide updates, regulations, and information about tax rates. You may also consider exploring the Utah Check Disbursements Journal for insights into tax disbursements and other relevant records.

You can access your state tax refund information from the previous year by checking your account on the Utah State Tax Commission's website. By entering your details, you should easily retrieve your refund status. If you need further assistance, consider using the Utah Check Disbursements Journal to keep records organized for future reference.

To obtain your Utah state tax return, you can visit the Utah State Tax Commission website. They offer resources to access your return through their online services. Additionally, if you prefer a printed version, you can request it by mail or in person. Utilizing the Utah Check Disbursements Journal can assist you in tracking your refunds effectively.

The timeline for receiving Utah state tax refunds can vary, typically ranging from two to six weeks, depending on various factors such as the method of filing. Busy periods may lead to longer waits, so patience is key. The Utah Check Disbursements Journal allows you to stay updated on your refund process and manage your finances more effectively.

Yes, you can track your tax refund directly through the Utah State Tax Commission's official website. They provide real-time updates on your refund status, helping you stay informed throughout the process. For a comprehensive view, utilize the Utah Check Disbursements Journal to monitor all your disbursements and account activities.