Utah Angel Investor Agreement

Description

How to fill out Angel Investor Agreement?

Are you in a role where you require documents for occasional business or specific needs nearly every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms offers thousands of document templates, such as the Utah Angel Investor Agreement, created to comply with federal and state regulations.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete the payment using your PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Utah Angel Investor Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the document you need and ensure it is for your correct city/region.

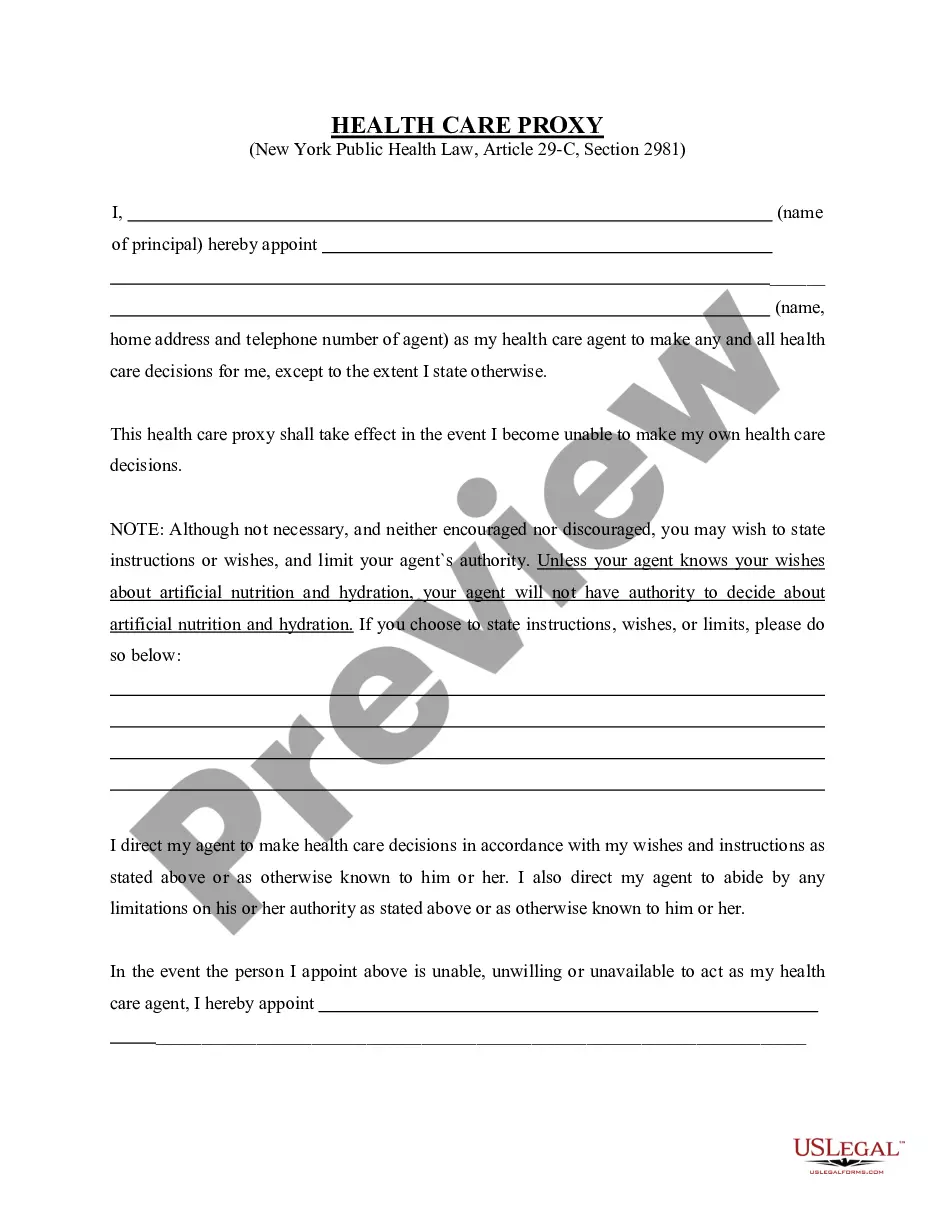

- Utilize the Review button to examine the form.

- Read the description to confirm you have chosen the correct document.

- If the document is not what you are looking for, use the Search feature to find the document that meets your needs and requirements.

- Once you find the right document, click Buy now.

Form popularity

FAQ

To become an angel investor in Canada, one must typically meet specific financial thresholds set by the Canadian Securities Administrators. Engaging with investment groups or networks can provide insights and opportunities. Although this question pertains to Canada, understanding the principles of a Utah Angel Investor Agreement can still offer valuable guidance in structuring your investments internationally.

While it is possible to invest as a non-accredited investor, opportunities may be limited. Many investment deals are restricted to accredited investors for legal reasons. By utilizing a Utah Angel Investor Agreement, non-accredited individuals can explore alternative investment strategies under state regulations.

The amount of capital required varies, but many angel investors typically invest between $25,000 to $100,000 in startups. It's vital to assess your financial situation before making commitments. A well-crafted Utah Angel Investor Agreement will help you manage your investments and expectations effectively.

While anyone can aspire to be an angel investor, certain financial criteria apply. Most angel investors are accredited, meaning they meet specific income or wealth thresholds. Engaging with a Utah Angel Investor Agreement can help clarify your eligibility and provide the tools necessary for responsible investing.

Typically, you do not need a specific license to operate as an angel investor. However, it is crucial to comply with federal and state regulations regarding investments. Utilizing a Utah Angel Investor Agreement can guide you in adhering to these legal requirements without the hassle of navigating these regulations alone.

To become an angel investor, you generally need to have a high net worth and experience in investing. You should understand the market and have the ability to analyze business plans. In Utah, following the guidelines for a Utah Angel Investor Agreement will help you navigate this process, ensuring you meet the necessary criteria.

To write off an angel investment, first document the loss by gathering relevant financial records and any agreements tied to the investment. You can then claim the loss on your tax returns, provided you meet IRS regulations. For assistance in crafting proper documentation, including a Utah Angel Investor Agreement, consider exploring templates available on uslegalforms.

Angel investors usually acquire an equity stake ranging from 10% to 30% in the startup, influenced by various factors such as the business's valuation and perceived potential. This stake reflects their commitment and risk taken. Having this percentage clearly outlined in the Utah Angel Investor Agreement can save future disputes.

The percentage an angel investor receives can vary, commonly falling between 10% and 30%, based on negotiations and the funding round. This equity stake compensates for their investment and risk. To avoid confusion, documenting the agreed-upon percentage in your Utah Angel Investor Agreement is essential.

A fair percentage for an angel investor typically ranges from 10% to 30% equity in the startup, depending on the investment's size, the startup's stage, and the industry. This percentage reflects the investor's risk level and contribution to the business. Clearly stating this percentage in the Utah Angel Investor Agreement helps promote transparency.