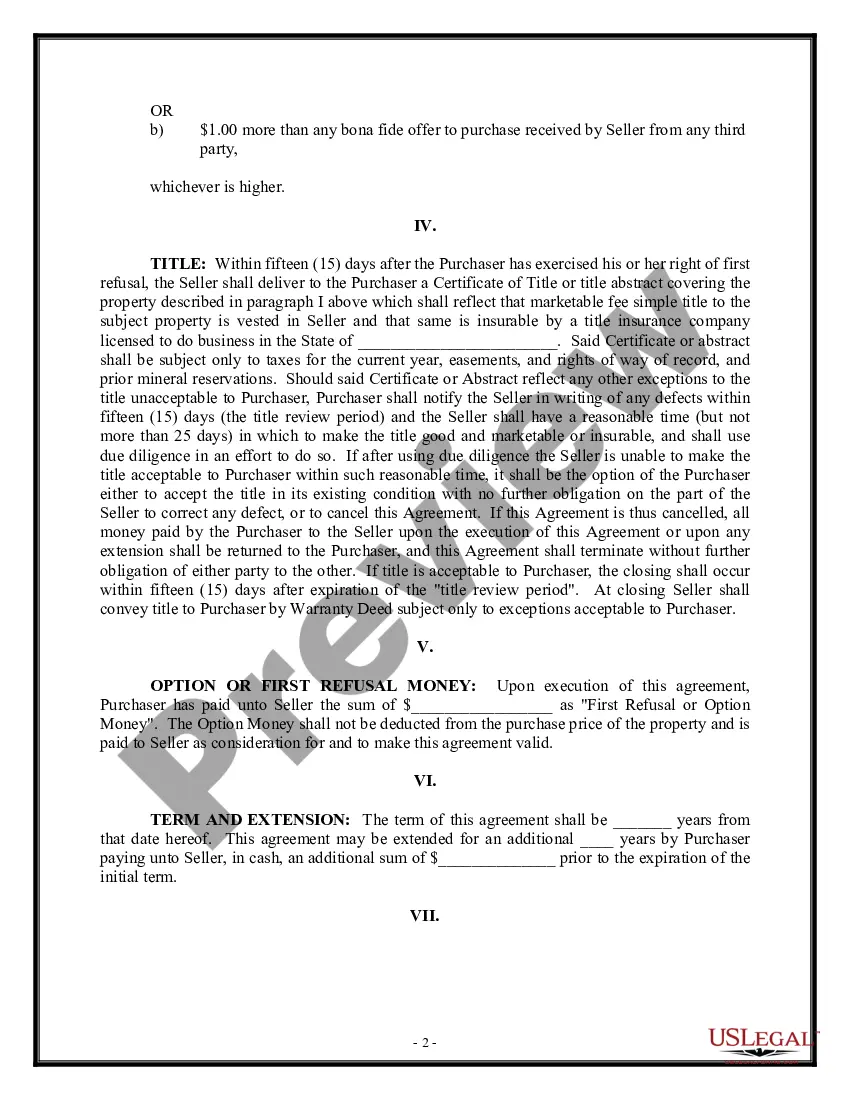

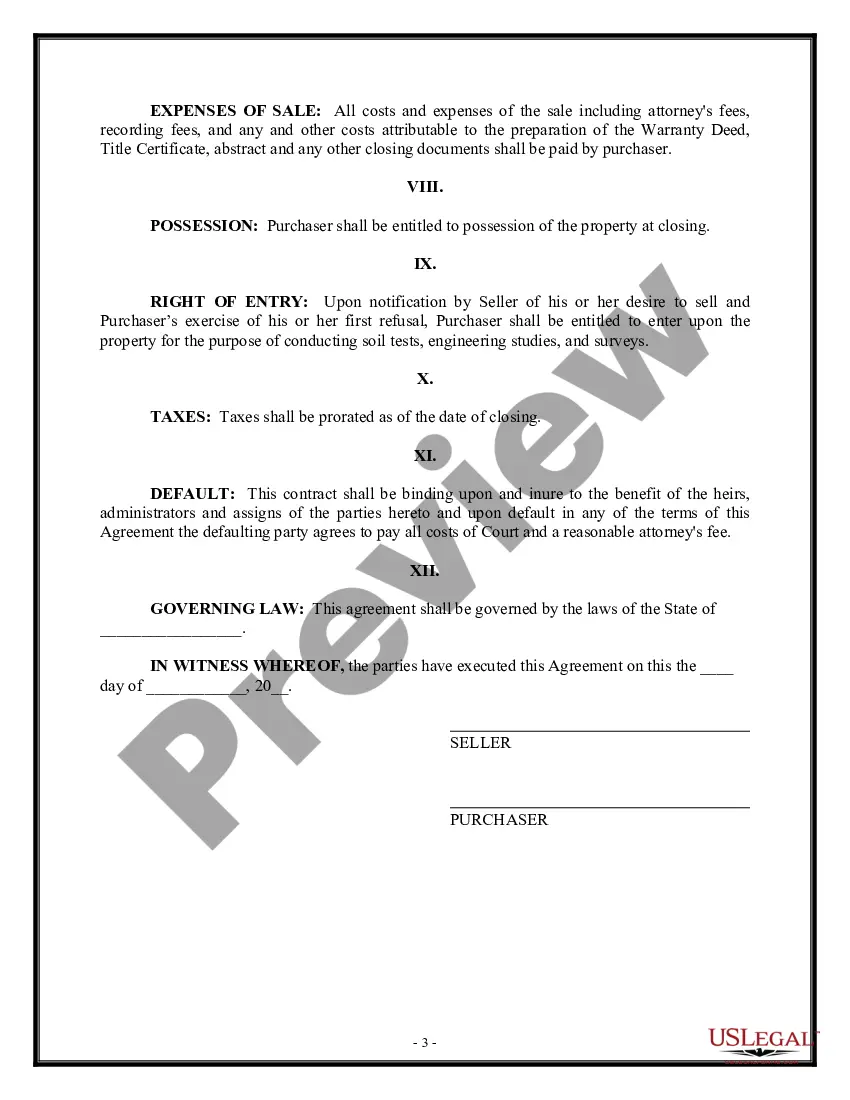

Utah Right of First Refusal to Purchase Real Estate

Description

How to fill out Right Of First Refusal To Purchase Real Estate?

Are you presently in a position where you need documents for either business or personal purposes regularly.

There are numerous legal document templates available online, but locating trustworthy ones can be difficult.

US Legal Forms offers thousands of form templates, such as the Utah Right of First Refusal to Purchase Real Estate, which are crafted to meet state and federal requirements.

When you locate the correct form, click on Get now.

Select the pricing plan you want, fill in the necessary details to create your account, and purchase the order using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you will be able to download the Utah Right of First Refusal to Purchase Real Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

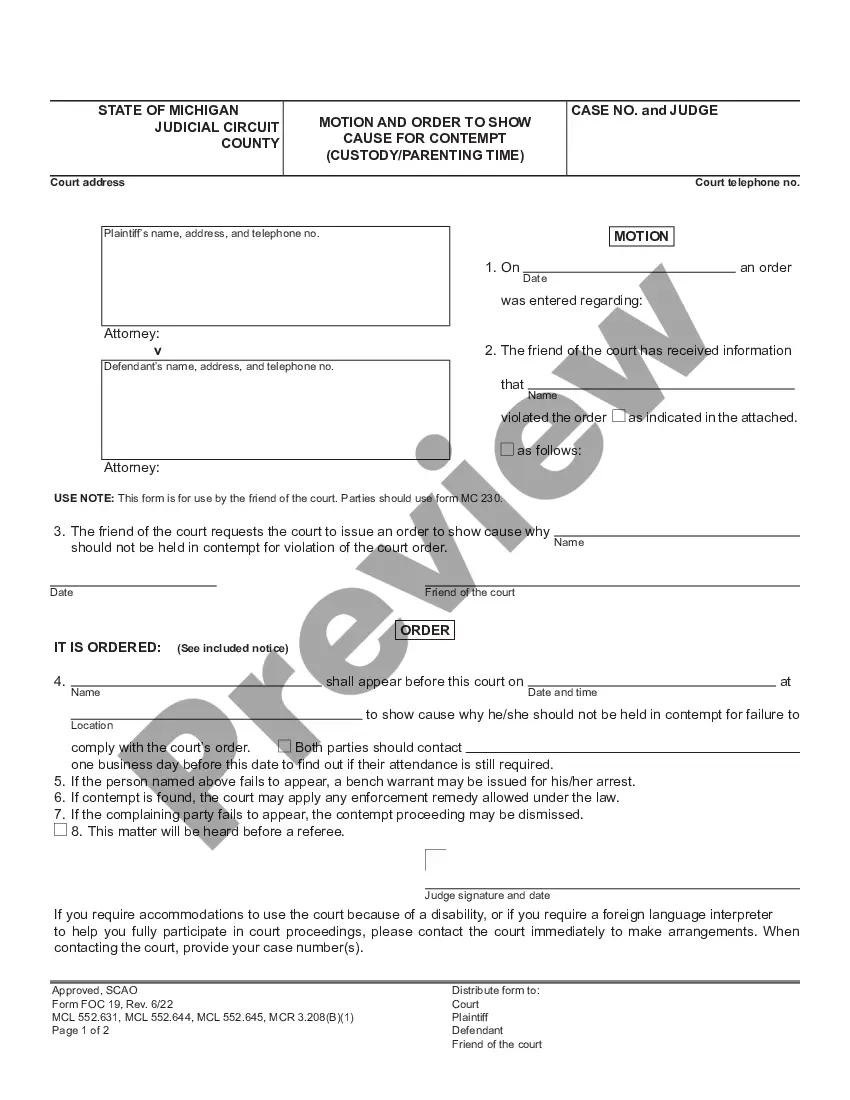

- Use the Preview option to examine the document.

- Review the information to confirm that you have chosen the right form.

- If the form does not meet your needs, utilize the Search box to find the document that fulfills your requirements.

Form popularity

FAQ

Because the ROFR is a contractual right, the penalties for violating the terms are based on contract law. If not given the right to refuse, the harmed party may sue for money damages or specific damages, but typically not both. Specific performance means the party is ordered to perform under the contract.

People often talk about giving or getting a Right of First Refusal ("ROFR") in real estate transactions. But what is a ROFR? A simple definition might be: If the owner of the property decides to sell the property, then the person holding the ROFR gets the opportunity to buy the property on the same terms first.

Right of first refusal (ROFR), also known as first right of refusal, is a contractual right to enter into a business transaction with a person or company before anyone else can. If the party with this right declines to enter into a transaction, the obligor is free to entertain other offers.

In negotiating the ROFR, the holder needs to consider how much time it will need to evaluate an offer, taking into account its internal processes, particularly if it is a large company that may require multiple internal parties to review and approve the exercise of the offer.

The right of first refusal applies to sales as well as rentals. And with any sale or rental, the board has the opportunity to exercise its right of first refusal or to waive that right.

Making a right of first refusal to acquire an interest in land protects the holders of such rights in cases where the owner of the land breached their contractual promise and did not give the right holder the first opportunity to purchase but agreed to sell the land to a third party.

Once that is done the ROFR holder has the option of purchasing the property instead or waiving their ROFR and allowing another sale to go through. To get to closing, a title company has to have a signed Waiver of Right of First Refusal document in the file before funding can occur.

The right of first refusal is usually triggered when a third party offers to buy or lease the property owner's asset. Before the property owner accepts this offer, the property holder (the person with the right of first refusal) must be allowed to buy or lease the asset under the same terms offered by the third party.

Right of first refusal usually has a time limit placed on it, and when the time is up, any potential buyers can make an offer on the property. Quite often, a right of first refusal will last anywhere from 24-72 hours from the time another party presents an acceptable offer.