If you have to complete, down load, or printing authorized file layouts, use US Legal Forms, the largest selection of authorized types, which can be found on the Internet. Make use of the site`s simple and handy lookup to obtain the papers you require. Different layouts for company and individual uses are categorized by classes and claims, or keywords. Use US Legal Forms to obtain the Utah Release of Claims against Estate by Creditor within a few clicks.

Should you be currently a US Legal Forms consumer, log in in your accounts and then click the Down load switch to have the Utah Release of Claims against Estate by Creditor. Also you can accessibility types you formerly delivered electronically in the My Forms tab of the accounts.

Should you use US Legal Forms the very first time, follow the instructions beneath:

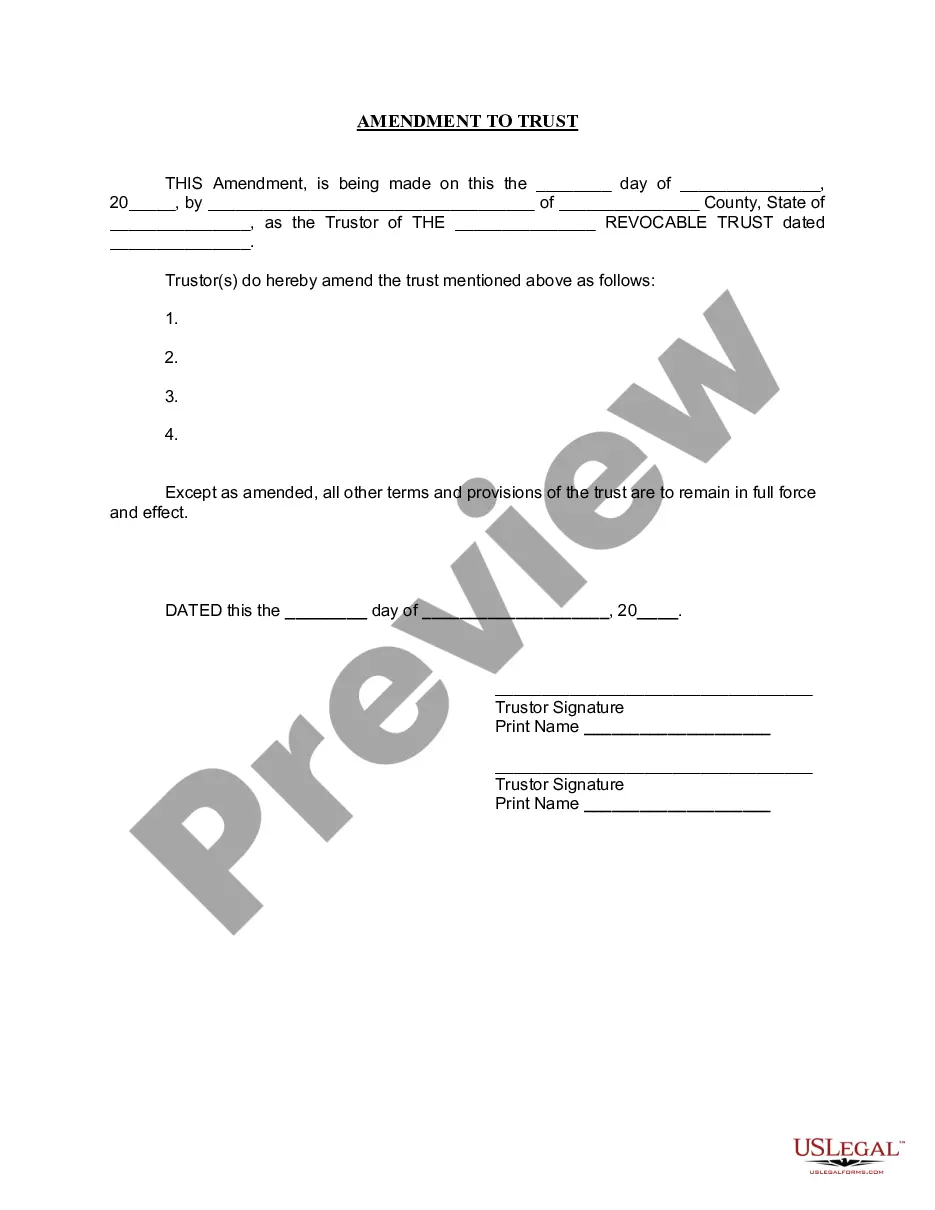

- Step 1. Make sure you have selected the form for your appropriate metropolis/nation.

- Step 2. Make use of the Preview option to check out the form`s content. Do not neglect to read the description.

- Step 3. Should you be unsatisfied together with the form, utilize the Search area on top of the screen to discover other versions in the authorized form design.

- Step 4. Upon having found the form you require, select the Get now switch. Choose the costs program you like and include your qualifications to register to have an accounts.

- Step 5. Approach the transaction. You can utilize your credit card or PayPal accounts to finish the transaction.

- Step 6. Find the format in the authorized form and down load it on the product.

- Step 7. Comprehensive, change and printing or indication the Utah Release of Claims against Estate by Creditor.

Each authorized file design you get is the one you have permanently. You might have acces to each form you delivered electronically within your acccount. Go through the My Forms segment and choose a form to printing or down load again.

Compete and down load, and printing the Utah Release of Claims against Estate by Creditor with US Legal Forms. There are many skilled and state-particular types you can utilize for the company or individual needs.