Utah Assignment of Deed of Trust

Description

How to fill out Assignment Of Deed Of Trust?

If you have to complete, obtain, or printing authorized file themes, use US Legal Forms, the most important collection of authorized varieties, that can be found on-line. Make use of the site`s simple and easy handy lookup to get the documents you require. Various themes for enterprise and individual uses are categorized by categories and says, or keywords. Use US Legal Forms to get the Utah Assignment of Deed of Trust within a few click throughs.

If you are already a US Legal Forms customer, log in in your account and then click the Down load key to have the Utah Assignment of Deed of Trust. You can also accessibility varieties you in the past saved from the My Forms tab of your own account.

Should you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have chosen the shape for the correct metropolis/country.

- Step 2. Utilize the Review choice to look through the form`s content. Do not forget to see the description.

- Step 3. If you are unhappy together with the type, use the Research industry towards the top of the monitor to find other variations in the authorized type web template.

- Step 4. Upon having discovered the shape you require, select the Acquire now key. Pick the rates strategy you like and include your credentials to register for an account.

- Step 5. Process the transaction. You should use your Мisa or Ьastercard or PayPal account to complete the transaction.

- Step 6. Pick the structure in the authorized type and obtain it on your own product.

- Step 7. Full, modify and printing or signal the Utah Assignment of Deed of Trust.

Every single authorized file web template you buy is your own property for a long time. You may have acces to every single type you saved inside your acccount. Select the My Forms portion and choose a type to printing or obtain again.

Compete and obtain, and printing the Utah Assignment of Deed of Trust with US Legal Forms. There are thousands of professional and condition-certain varieties you may use for the enterprise or individual requirements.

Form popularity

FAQ

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

Release of security interest. "Revolving credit line" means an agreement between the borrower and a secured lender who agrees to loan the borrower money on a continuing basis so long as the outstanding principal amount owed by the borrower does not exceed a specified amount.

How much does a Trust cost in Utah? In Utah, the cost of setting up a basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts may cost even more.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

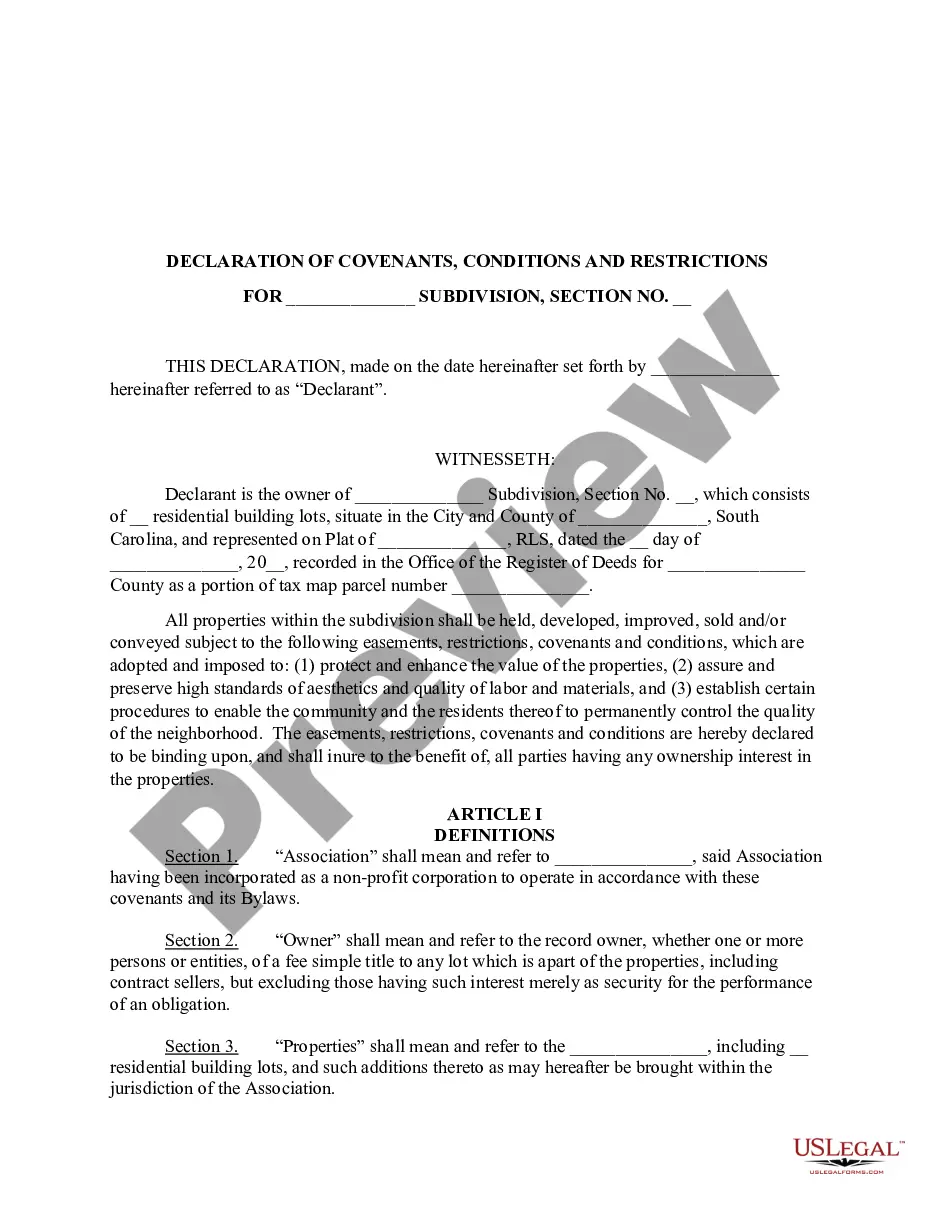

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

Utah is known as a Trust Deed and Promissory Note state. There are references to a foreclosure being allowed under the law, typically in a Contract for Deed transaction but this is certainly not the standard.

Draft and sign a trust agreement. Sign a deed that transfers the home to the trust, making sure to include the name of the trustee, the trust name, and the trust date. Record the deed with the appropriate Utah county recorder's office and pay any associated fees.

The assets you cannot put into a trust include the following: Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles.