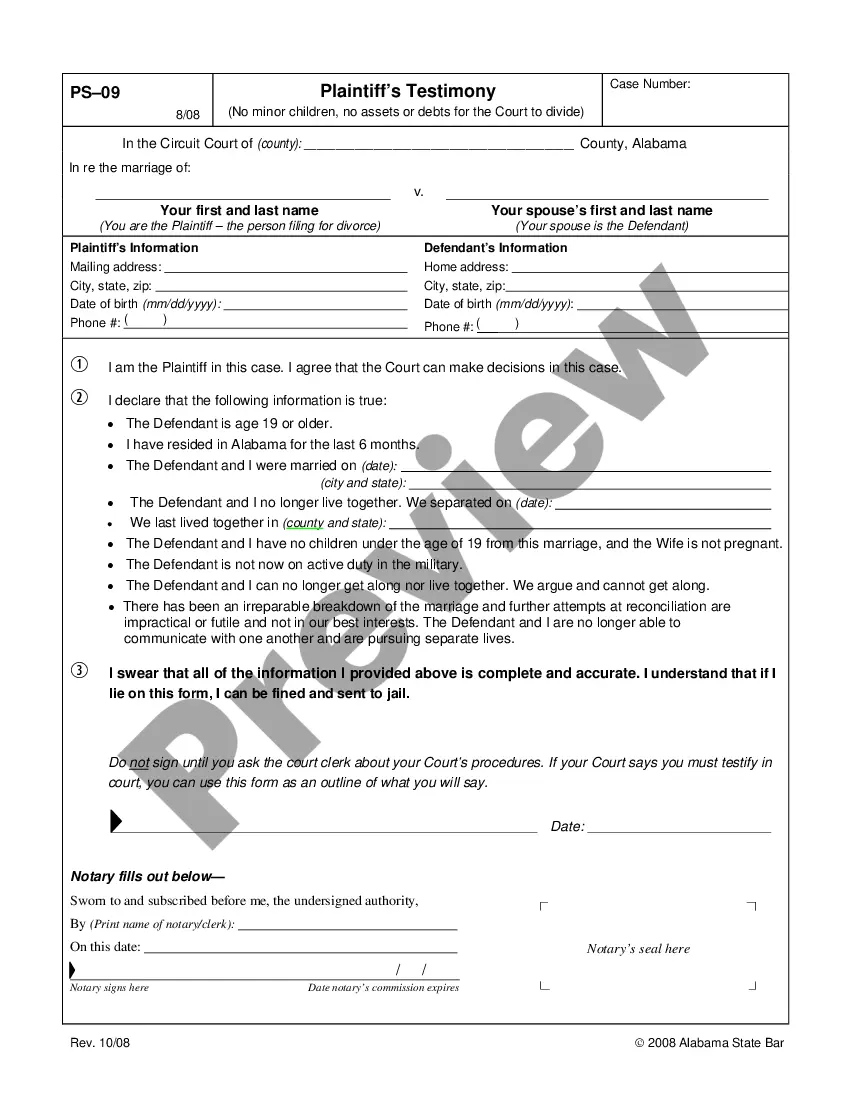

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Utah Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of All Of Expected Interest In Estate In Order To Pay Indebtedness?

You may invest time on the Internet trying to find the authorized record design that meets the federal and state demands you will need. US Legal Forms provides a large number of authorized kinds that are examined by professionals. It is possible to obtain or produce the Utah Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness from our assistance.

If you have a US Legal Forms bank account, you may log in and then click the Down load key. After that, you may complete, revise, produce, or sign the Utah Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. Every authorized record design you purchase is yours for a long time. To have yet another version of the obtained develop, check out the My Forms tab and then click the related key.

If you work with the US Legal Forms internet site initially, keep to the easy instructions beneath:

- First, make certain you have chosen the best record design for your area/metropolis of your liking. Read the develop outline to ensure you have selected the right develop. If offered, use the Review key to look from the record design also.

- If you would like find yet another version in the develop, use the Search discipline to discover the design that meets your needs and demands.

- After you have found the design you need, click Purchase now to move forward.

- Choose the costs strategy you need, type in your references, and sign up for your account on US Legal Forms.

- Complete the deal. You may use your bank card or PayPal bank account to pay for the authorized develop.

- Choose the formatting in the record and obtain it in your system.

- Make alterations in your record if necessary. You may complete, revise and sign and produce Utah Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness.

Down load and produce a large number of record themes using the US Legal Forms Internet site, that offers the largest selection of authorized kinds. Use skilled and state-specific themes to tackle your small business or personal requires.

Form popularity

FAQ

If you receive an inheritance that you do not need or want, or if you receive an inheritance that you would prefer someone else receive, you can make an ?assignment.? An assignment occurs when you transfer all or part of your inheritance to someone else.

The Utah Probate Code states that "formal testacy or appointment proceedings ... may [not] be commenced more than three years after the decedent's death.? Utah Code § 75?3?107.

Every contract for the leasing for a longer period than one year, or for the sale, of any lands, or any interest in lands, shall be void unless the contract, or some note or memorandum thereof, is in writing subscribed by the party by whom the lease or sale is to be made, or by his lawful agent thereunto authorized in ...

Evidence of death or status. A certified or authenticated copy of any record or report of a governmental agency, domestic or foreign, that an individual is missing, detained, dead, or alive is prima facie evidence of the status and of the dates, circumstances, and places disclosed by the record or report.

In Utah, the requirement that the trustee keep beneficiaries informed generally applies only to ?qualified beneficiaries.? A qualified beneficiary is any beneficiary who is a current or permissible distributee of trust income or principal, or any beneficiary who would be a distributee if the trust terminated at the ...

A key provision, Utah Code § 25-6-502(3), stipulates that if an irrevocable trust's creator is also its beneficiary, a creditor can't claim an interest in assets under the trust's name or force distributions, given certain conditions are met.

Abuse of psychotoxic chemical solvents. the person offers, sells, or provides a psychotoxic chemical solvent to another person, knowing that other person or a third party intends to possess or use that psychotoxic chemical solvent in violation of Subsection (1)(a).

Title 75 Chapter 7 Part 1 Section 107 Governing law. 75-7-107. Governing law. "Foreign trust" means a trust that is created in another state or country and valid in the state or country in which the trust is created.