Utah Personal Monthly Budget Worksheet

Description

How to fill out Personal Monthly Budget Worksheet?

If you require to complete, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Take advantage of the site’s simple and user-friendly search to locate the documents you need.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you want, click on the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to locate the Utah Personal Monthly Budget Worksheet within a few clicks.

- If you are already a US Legal Forms member, Log In to your account and then click the Download button to get the Utah Personal Monthly Budget Worksheet.

- You can also find documents you previously downloaded in the My documents section of your account.

- If using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the form for the correct city/state.

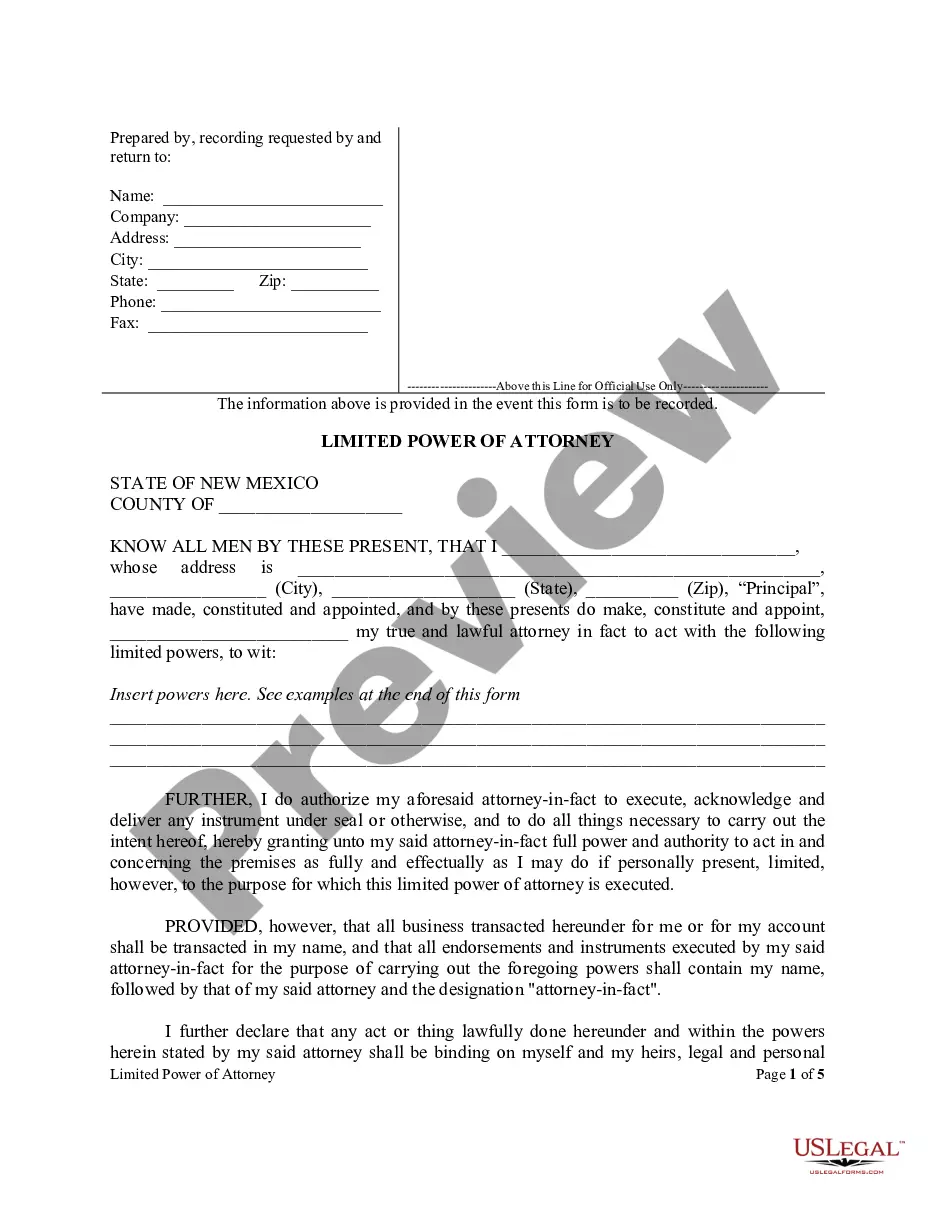

- Step 2. Use the Preview feature to review the form’s information. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The 50/30/20 rule of budgeting worksheet is a tool that helps you apply this budgeting principle efficiently. It allows you to input your income and expenses, and see how they align with the 50%, 30%, and 20% allocations. This is an essential feature of the Utah Personal Monthly Budget Worksheet, assisting you in visualizing your financial habits.

Your monthly spending should depend on your overall financial situation and goals. A good practice is to keep your needs under 50% of your monthly income, while reserving 30% for wants and at least 20% for savings or debt repayment. Using a Utah Personal Monthly Budget Worksheet can help you monitor your expenses and adjust as necessary.

The 70-10-10-10 budget rule divides your income into distinct categories. You spend 70% on living expenses, while 10% goes to savings, 10% to debt repayment, and the final 10% towards charity or investments. This rule can also be effectively incorporated into your Utah Personal Monthly Budget Worksheet to help maintain a balanced financial approach.

A good monthly personal budget varies per individual but generally meets the 50/30/20 rule guidelines. It needs to reflect your income and account for essential expenses, discretionary spending, and savings goals. Creating a customized Utah Personal Monthly Budget Worksheet can help you define what's good for your unique situation.

The 50/30/20 rule budget helps you categorize your spending and ensures you have enough for essential expenses. By following this budget, you can simplify your financial tracking, making it easier to plan your future expenses and savings. Incorporating this method into your Utah Personal Monthly Budget Worksheet can enhance your overall financial management.

The 50/30/20 rule is a straightforward guideline to manage your finances effectively. It suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment. By adhering to this rule, you can create a balanced Utah Personal Monthly Budget Worksheet that promotes financial health and stability.

To calculate your monthly budget, first add up all your sources of income to find your total earnings. Then, sum up your expenses by categorizing them into fixed and variable costs. Using a Utah Personal Monthly Budget Worksheet will simplify this calculation and help you see the balance between income and expenses clearly. Adjust your budget to ensure you spend less than you earn, prioritizing savings and essentials.

To write a monthly budget example, start with a sample income amount and then list potential expenses below it. An effective Utah Personal Monthly Budget Worksheet can serve as your template to ensure you include categories like utilities, groceries, and transportation costs. Be realistic in estimating your expenses to create a practical budget. Refresh your example monthly to accommodate changing financial situations.

Filling out a monthly budget sheet begins with recording your total income at the top. Next, categorize your expenses into fixed costs, like rent or mortgage, and variable costs, such as food and entertainment. By using a Utah Personal Monthly Budget Worksheet, you will find it easier to track your spending habits throughout the month. Don’t forget to leave space for savings and unexpected expenses.

A budget sheet should clearly outline your income, fixed expenses, and variable expenses. You can design your Utah Personal Monthly Budget Worksheet to include categories like housing, groceries, and transportation. This layout will help you see at a glance where you are overspending and where you can cut back. Make sure it also includes sections for savings and debt repayment to promote financial health.