Utah Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Consumer Loan Application - Personal Loan Agreement?

Are you in a location where you will require documentation for potentially business or personal purposes almost every day.

There are numerous authentic document templates accessible online, but finding forms you can rely on isn’t easy.

US Legal Forms offers a vast array of document templates, including the Utah Consumer Loan Application - Personal Loan Agreement, designed to meet state and federal requirements.

Utilize US Legal Forms, one of the most extensive collections of authentic forms, to save time and avoid errors.

The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Utah Consumer Loan Application - Personal Loan Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

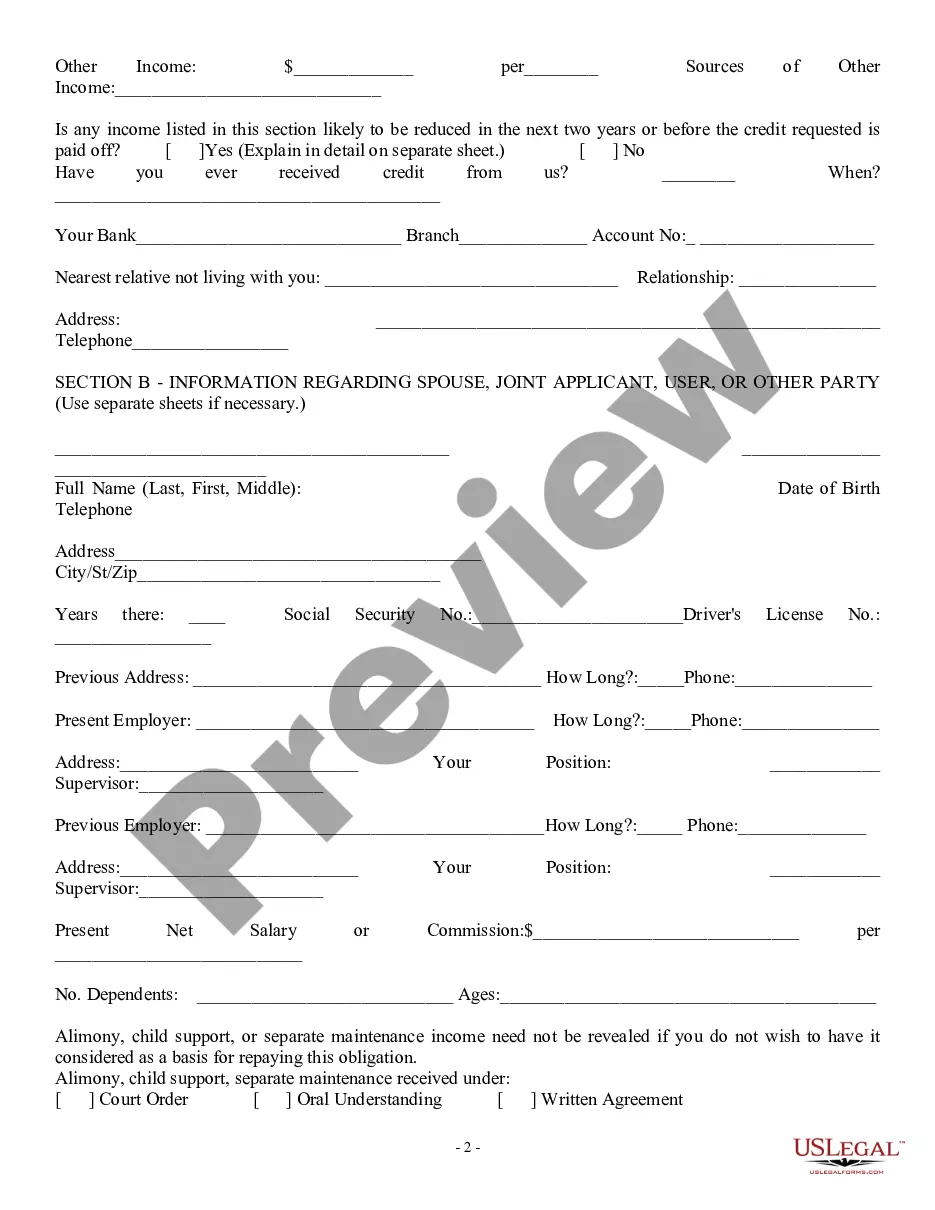

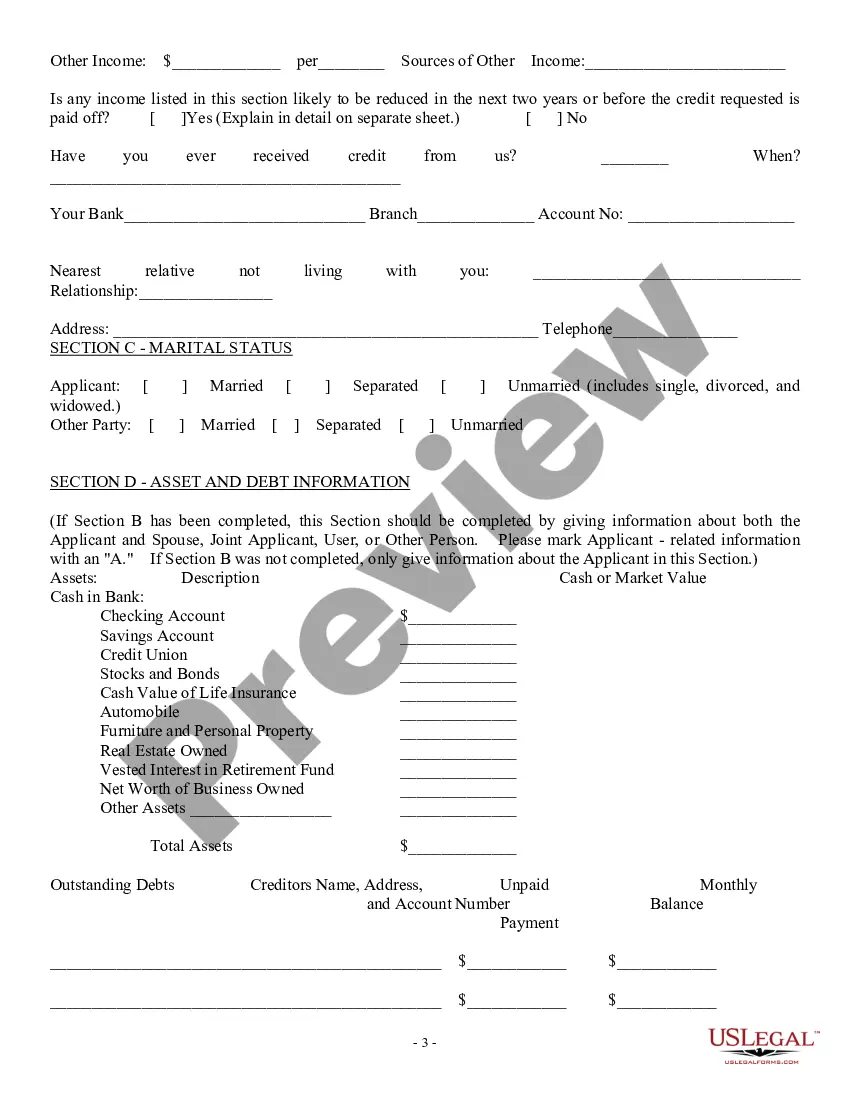

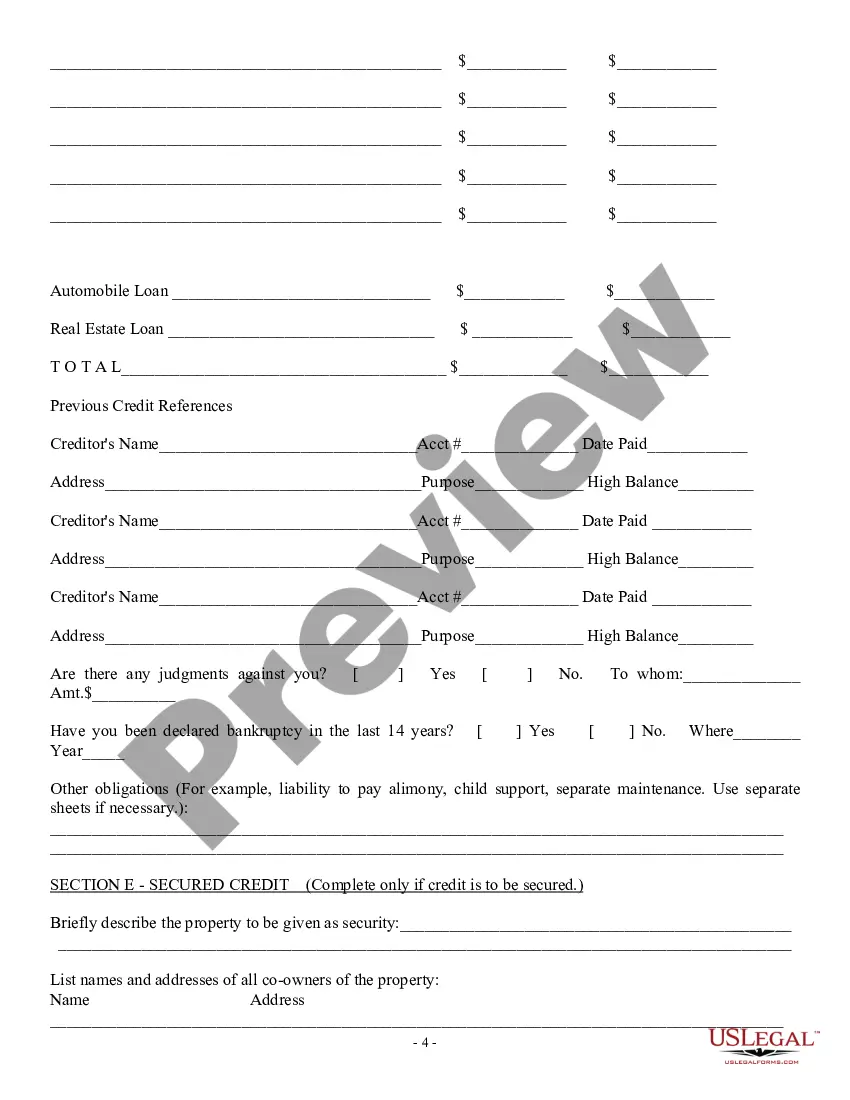

- Utilize the Review button to examine the document.

- Read the description to make certain that you have selected the correct form.

- If the document isn’t what you are looking for, use the Search field to find the form that meets your needs and requirements.

- When you find the appropriate document, click Get now.

- Select the pricing plan you desire, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

- Choose a suitable file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Utah Consumer Loan Application - Personal Loan Agreement at any time if needed. Just click on the desired form to download or print the document template.

Form popularity

FAQ

The biggest difference between a consumer loan and a personal loan is that consumer loans can include revolving credit. Personal loans are nonrevolving financial lending products that provide borrowers with a lump sum of money and payment schedule for repaying the loan.

What is a credit contract? A consumer credit contract is a formal written agreement to borrow money, or pay something off over time, for personal use. You pay interest and fees for the use of the bank or finance company's money. One or more of your assets might secure the loan.

A personal loan is one of the most popular types of unsecured loans that offer instant liquidity. However, since a personal loan is an unsecured mode of finance, the interest rates are higher than secured loans.

Consumer credit refers to the ability of a consumer to access a loan. The most common form of credit used by consumers is a credit card account issued by a financial institution. Merchants may also provide direct financing for products which they sell. Banks may directly finance purchases through loans and mortgages.

A personal loan (also known as a consumer loan) describes any situation in which an individual borrows money for personal need, including making investments in a company. All personal loans have three common elements: Evidence of the debt (promissory note)

A consumer loan is a loan given to consumers to finance specific types of expenditures. In other words, a consumer loan is any type of loan made to a consumer by a creditor. The loan can be secured (backed by the assets of the borrower) or unsecured (not backed by the assets of the borrower).

Personal loans are typically unsecured, meaning they are not backed by collateral. Personal loans typically include an origination fee and may have other fees as well.

Consumer credit, or consumer debt, is personal debt taken on to purchase goods and services. Although any type of personal loan could be labeled consumer credit, the term is more often used to describe unsecured debt of smaller amounts.