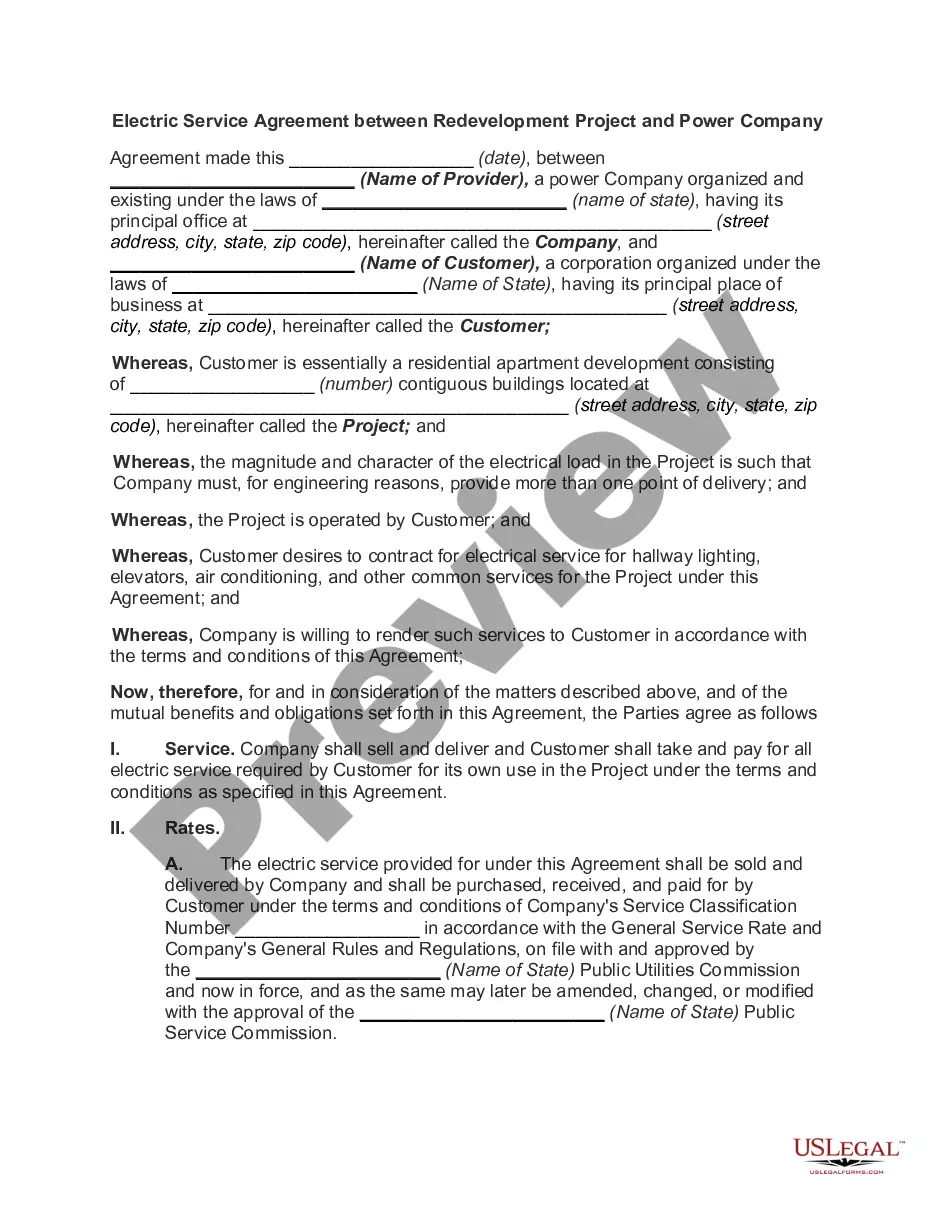

Under the Fair Credit Reporting Act, whenever credit or insurance for personal, family, or household purposes, or employment involving a consumer is denied, or the charge for such credit or insurance is increased, either wholly or partly because of information contained in a consumer report from a consumer reporting agency, the user of the consumer report must:

notify the consumer of the adverse action,

identify the consumer reporting agency making the report, and

notify the consumer of the consumer's right to obtain a free copy of a consumer report on the consumer from the consumer reporting agency and to dispute with the reporting agency the accuracy or completeness of any information in the consumer report furnished by the agency.

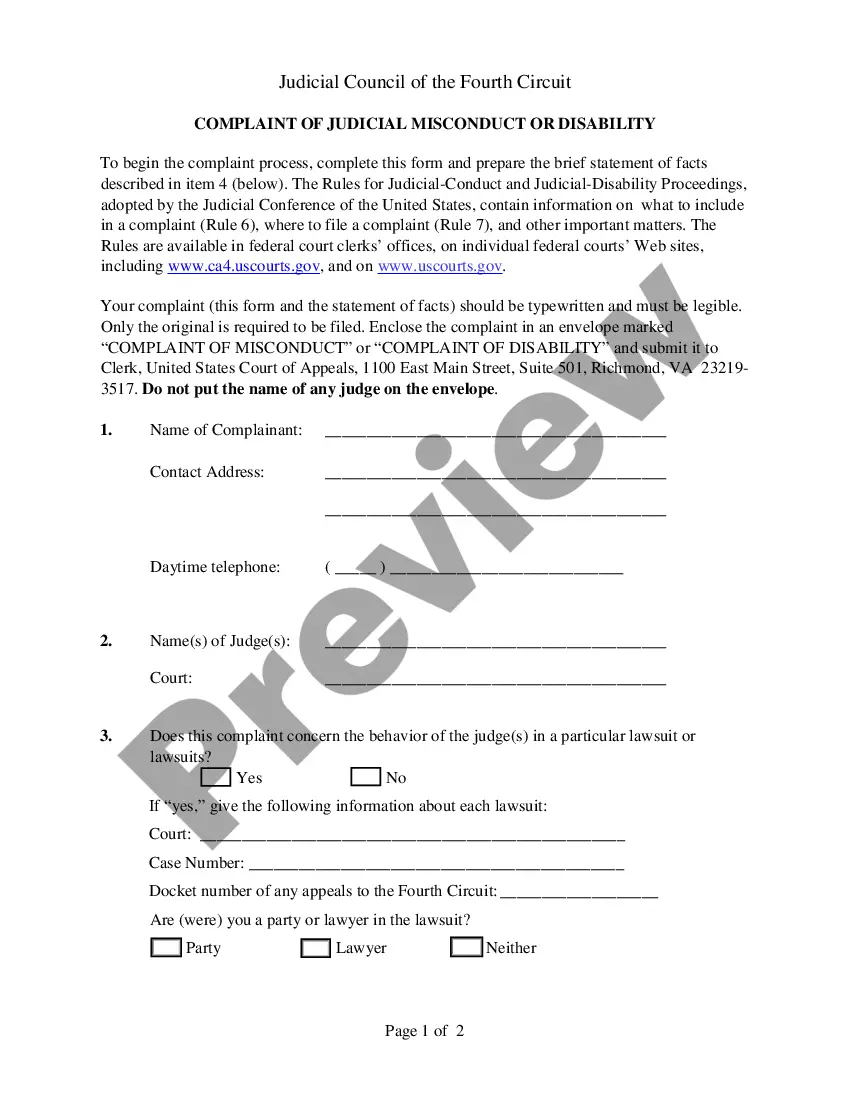

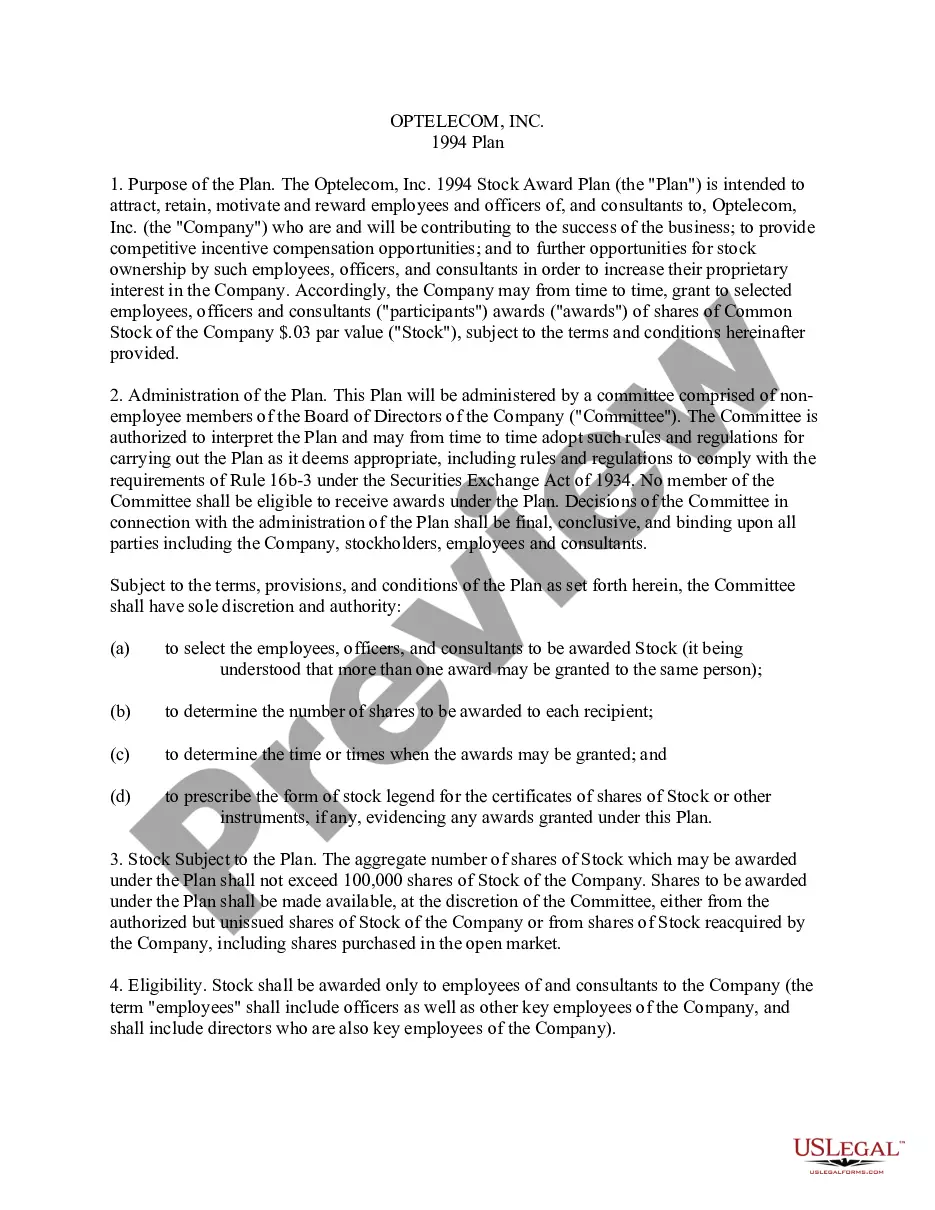

Utah Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency

Description

How to fill out Notice Of Increase In Charge For Credit Or Insurance Based On Information Received From Consumer Reporting Agency?

You are able to commit hours on the web looking for the legal record template that fits the federal and state needs you want. US Legal Forms offers thousands of legal types which can be reviewed by pros. You can actually obtain or printing the Utah Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency from my support.

If you have a US Legal Forms bank account, you can log in and then click the Download key. Afterward, you can total, edit, printing, or signal the Utah Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency. Each legal record template you acquire is yours forever. To acquire one more backup of any obtained type, go to the My Forms tab and then click the related key.

If you work with the US Legal Forms internet site the very first time, adhere to the simple guidelines under:

- First, be sure that you have chosen the correct record template for the state/metropolis of your choosing. Look at the type information to ensure you have picked the right type. If accessible, use the Preview key to appear throughout the record template too.

- If you would like locate one more version of the type, use the Look for area to discover the template that suits you and needs.

- Upon having discovered the template you would like, just click Buy now to continue.

- Choose the prices program you would like, type your accreditations, and register for a free account on US Legal Forms.

- Full the financial transaction. You can utilize your credit card or PayPal bank account to fund the legal type.

- Choose the format of the record and obtain it for your device.

- Make adjustments for your record if needed. You are able to total, edit and signal and printing Utah Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency.

Download and printing thousands of record layouts while using US Legal Forms website, that provides the most important variety of legal types. Use expert and status-particular layouts to deal with your small business or individual needs.

Form popularity

FAQ

A credit report or another type of consumer report to deny your application for credit, insurance, or employment ? or to take another adverse action against you ? must tell you, and must give you the name, address, and phone number of the agency that provided the information.

A consumer report is any written, oral or other communication of any information by a Consumer Reporting Agency bearing on a consumer's credit worthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living.

If you receive an Adverse Action Notice, it doesn't necessarily mean you also receive a hard credit inquiry. The notice may simply mean that the lender was unable to provide a personalized offer to you. The notice itself is not reflected on your credit report and doesn't impact your credit score.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

Understanding the Basics: What Does FCRA Require? The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

If you deny a consumer credit based on information in a consumer report, you must provide an ?adverse action? notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a ?risk-based pricing? notice.

The Fair Credit Reporting Act (FCRA) is designed to protect the privacy of consumer report information ? sometimes informally called ?credit reports? ? and to guarantee that information supplied by consumer reporting agencies (CRAs) is as accurate as possible.