Utah Certificate of Trust for Mortgage

Description

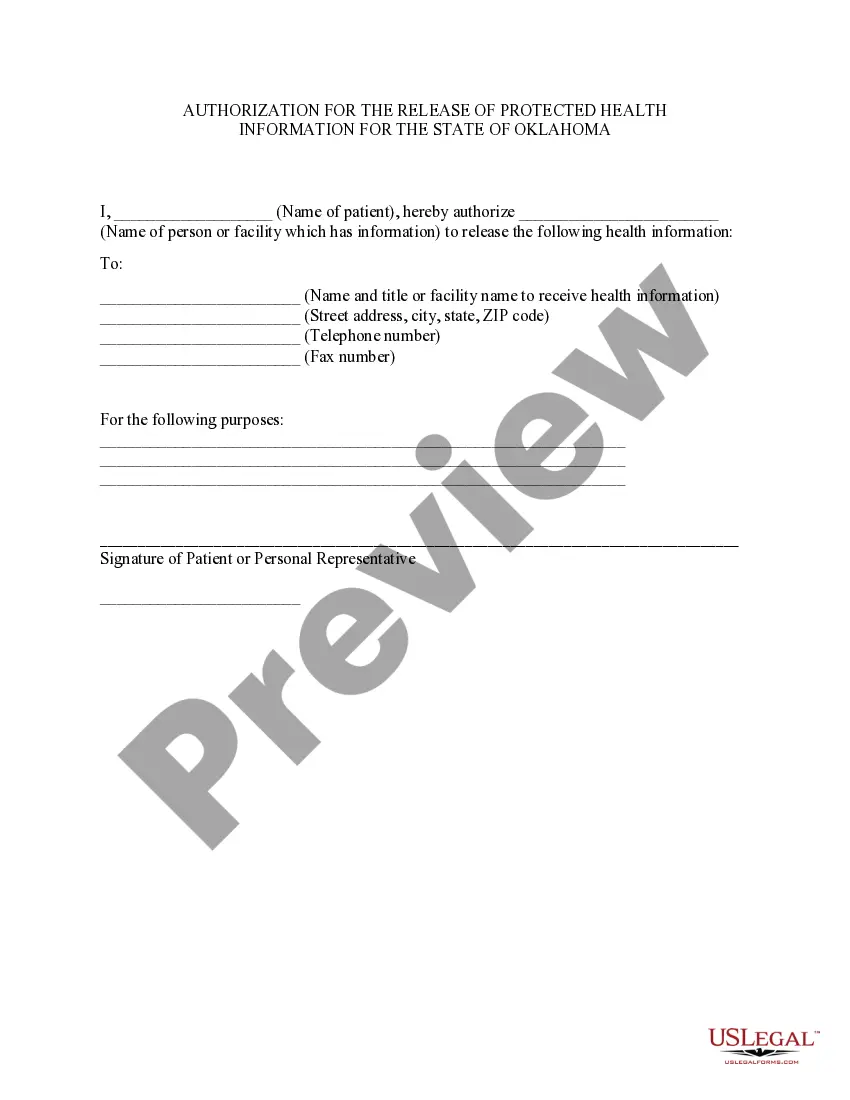

How to fill out Certificate Of Trust For Mortgage?

Choosing the best lawful papers design can be a battle. Naturally, there are a variety of themes accessible on the Internet, but how would you get the lawful kind you want? Utilize the US Legal Forms site. The service delivers a huge number of themes, for example the Utah Certificate of Trust for Mortgage, that can be used for organization and private requirements. All of the forms are examined by experts and satisfy federal and state specifications.

If you are currently registered, log in in your accounts and click the Down load option to get the Utah Certificate of Trust for Mortgage. Make use of your accounts to check from the lawful forms you have purchased formerly. Proceed to the My Forms tab of your accounts and have yet another duplicate in the papers you want.

If you are a fresh end user of US Legal Forms, listed below are basic guidelines for you to stick to:

- First, be sure you have selected the correct kind for the town/area. You may look through the shape while using Preview option and browse the shape description to make certain it is the best for you.

- When the kind does not satisfy your needs, make use of the Seach field to get the correct kind.

- When you are sure that the shape would work, click the Acquire now option to get the kind.

- Select the costs plan you would like and enter the essential information. Design your accounts and buy the transaction using your PayPal accounts or charge card.

- Opt for the file file format and down load the lawful papers design in your system.

- Comprehensive, modify and produce and sign the acquired Utah Certificate of Trust for Mortgage.

US Legal Forms is definitely the greatest catalogue of lawful forms for which you can find various papers themes. Utilize the service to down load skillfully-produced files that stick to express specifications.

Form popularity

FAQ

The certification of trust in Utah is codified at Utah Code 75-7-1013 as part of the Utah Uniform Trust Code. Trustees execute this document, which contains certified statements relating to a trust and the trustee's authority to act on the trust's behalf.

How much does a Trust cost in Utah? In Utah, the cost of setting up a basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts may cost even more.

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateSouth DakotaYYTennesseeYTexasYUtahY47 more rows

(1) A trust is created only if: (a) the settlor has capacity to create a trust, which standard of capacity shall be the same as for a person to create a will; (b) the settlor indicates an intention to create the trust or a statute, judgment, or decree authorizes the creation of a trust; (c) the trust has a definite ...

While you are alive, the assets are owned in the name of the trust, but you have total control over them. You live in your house and use your assets as you normally would without restriction. After your death, all the assets are already in the trust and the successor trustee steps in and continues managing them.

Draft and sign a trust agreement. Sign a deed that transfers the home to the trust, making sure to include the name of the trustee, the trust name, and the trust date. Record the deed with the appropriate Utah county recorder's office and pay any associated fees.

A Trust Certification gives a Trustee the ability to provide anyone who needs it (think: financial institutions or other third parties) important information about the Trust - like the date it was formed, the legal/formal name of the Trust, who the Trustee is (or Trustees are) and other information institutions may ...

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.