Utah Agreement to Assign Lease to Incorporators Forming Corporation

Description

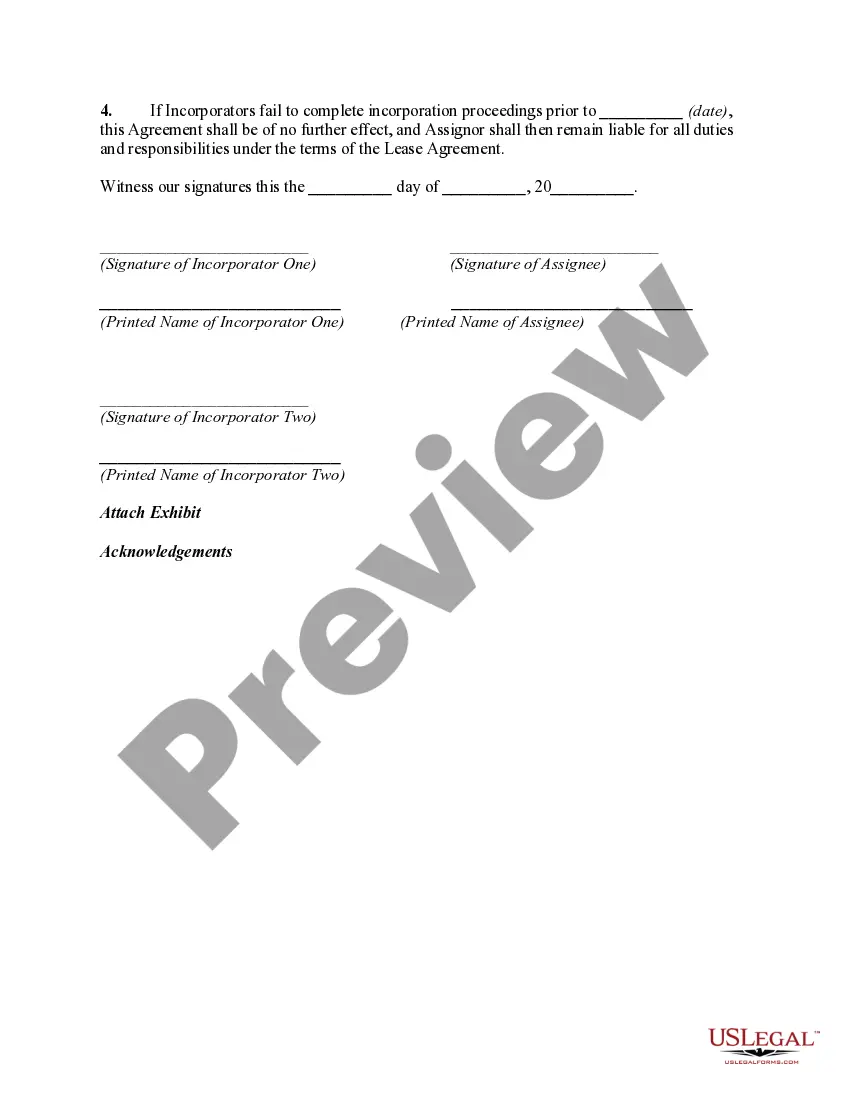

How to fill out Agreement To Assign Lease To Incorporators Forming Corporation?

You can spend hours online searching for the legal document format that meets the state and federal requirements you need.

US Legal Forms offers a vast collection of legal forms that have been reviewed by experts.

You can either download or print the Utah Agreement to Assign Lease to Incorporators Forming Corporation from their service.

First, ensure that you have selected the correct document format for the county/city of your choice. Review the form description to confirm that you have chosen the appropriate form. If available, use the Preview button to browse through the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, modify, print, or sign the Utah Agreement to Assign Lease to Incorporators Forming Corporation.

- Every legal document format you acquire belongs to you permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click on the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Switching to an S Corporation involves specific steps starting with confirming eligibility under IRS guidelines. You must then file IRS Form 2553, electing S Corporation status for your existing business entity. Analyze your business's lease arrangements and leverage a Utah Agreement to Assign Lease to Incorporators Forming Corporation to facilitate lease transfers if needed.

To change ownership of an LLC in Utah, start by updating your operating agreement to reflect the new ownership structure. Depending on your situation, you may need to notify the Utah Secretary of State of the changes. If your LLC also involves lease agreements, consider implementing a Utah Agreement to Assign Lease to Incorporators Forming Corporation to ensure a seamless transition.

Changing an LLC to an S Corporation in Utah requires numerous steps. First, consult your operating agreement and service options available through legal platforms like uslegalforms. After that, file the IRS Form 2553 and manage documentation concerning ownership and leases, possibly using a Utah Agreement to Assign Lease to Incorporators Forming Corporation.

To convert your LLC to an S Corporation in Utah, begin by reviewing your operating agreement for any provisions about the conversion process. Next, file Form 2553 with the IRS to elect S Corporation status. Ensure you document assets and liabilities, and utilize the Utah Agreement to Assign Lease to Incorporators Forming Corporation if lease ownership needs to be reassigned.

Setting up a corporation in Utah involves several steps. Start by choosing a unique business name, then file your Articles of Incorporation with the Utah Secretary of State. Don't forget to create bylaws and obtain any necessary licenses. Lastly, consider utilizing a Utah Agreement to Assign Lease to Incorporators Forming Corporation to handle lease transitions appropriately.

To file for an S Corporation in Utah, you must first establish a corporation by submitting Articles of Incorporation to the Utah Secretary of State. Once your corporation is formed, you can file Form 2553 with the IRS to elect S Corporation status. Additionally, ensure you have a Utah Agreement to Assign Lease to Incorporators Forming Corporation if you plan to transfer lease agreements to the new business entity.

In Canada, the business judgment rule is similar to that in the United States, protecting directors from liability when making decisions for the corporation. It requires directors to act honestly, prudently, and in good faith, aligning their actions with the corporation’s best interests. Knowledge of this rule can assist Canadian corporations in strengthening their governance frameworks, which can be beneficial alongside agreements like the Utah Agreement to Assign Lease to Incorporators Forming Corporation.

To obtain a certificate of existence in Utah, you must contact the Department of Commerce, Division of Corporations. You can apply online or by mail, providing the necessary business information. This certificate is essential for verifying your business's legal status, especially when forming a corporation with the help of a Utah Agreement to Assign Lease to Incorporators Forming Corporation.

The purpose of the business judgment rule is to provide corporate directors with the freedom to make decisions without the fear of being second-guessed or held liable. It encourages directors to take calculated risks that can lead to corporate growth. By acting in accordance with this rule, a corporation can maintain its focus on long-term success, often aided by tools like the Utah Agreement to Assign Lease to Incorporators Forming Corporation.

The business judgment rule is a legal principle that protects corporate directors from liability when making decisions in good faith. This principle assumes that directors act in the best interest of the corporation, relying on their knowledge and expertise. Understanding this rule can help businesses avoid legal disputes, especially when utilizing a Utah Agreement to Assign Lease to Incorporators Forming Corporation.