Utah Triple Net Lease

Description

How to fill out Triple Net Lease?

If you require extensive, obtain, or printing legitimate document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's user-friendly and efficient search to obtain the documentation you need.

A wide array of templates for commercial and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have found the form you need, select the Buy now button. Choose your desired pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to derive the Utah Triple Net Lease with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to receive the Utah Triple Net Lease.

- You can also access forms you have previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have chosen the form for the appropriate city/state.

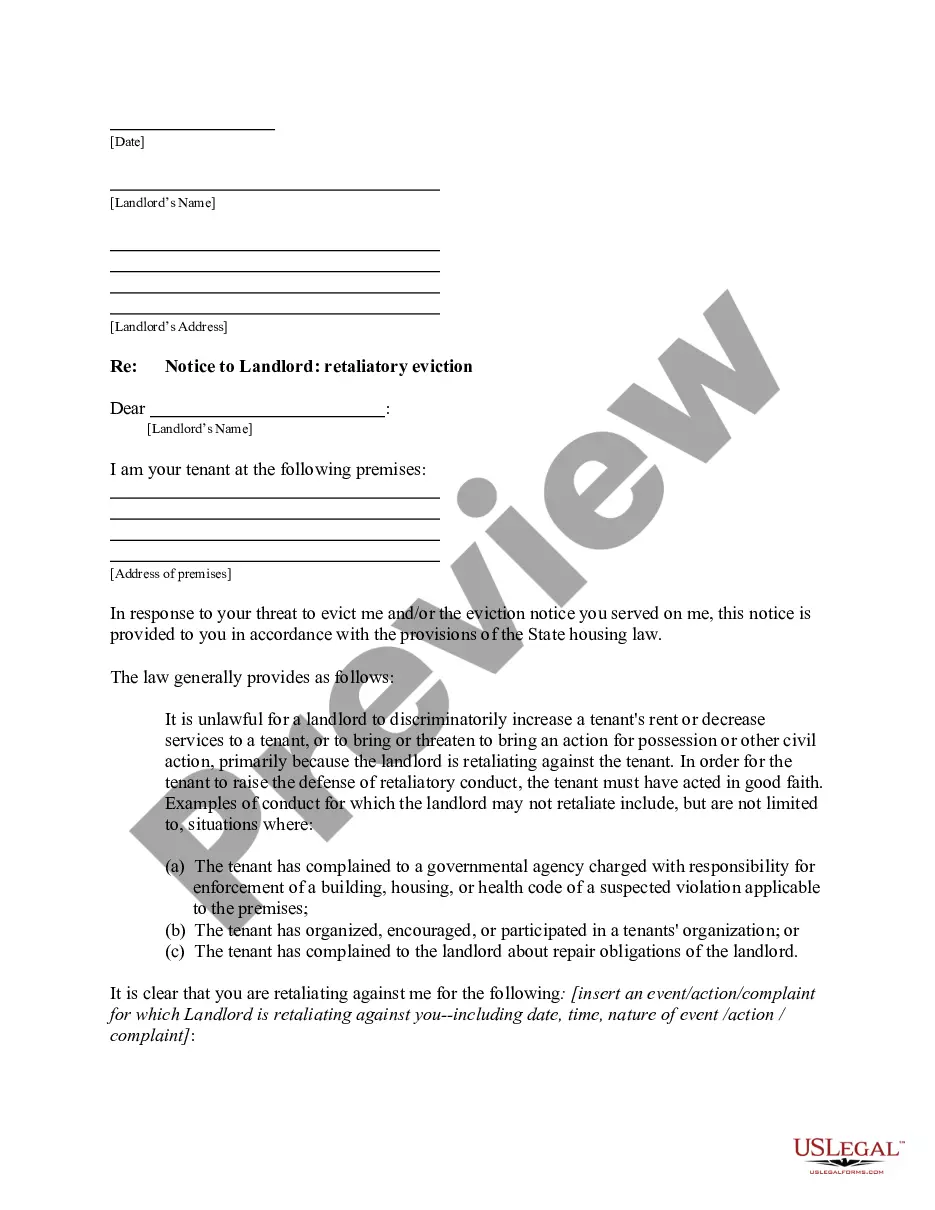

- Step 2. Use the Review method to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search area at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

An absolute NNN lease is a type of lease agreement where the tenant assumes all responsibilities, including structural repairs alongside operational expenses. This means landlords have minimal obligations, providing them with peace of mind regarding their investment. Absolute NNN leases are sought after in the Utah Triple Net Lease market for their stability and low management requirements.

Calculating a triple net lease involves determining the base rent along with property-related expenses. Landlords typically estimate annual costs for taxes, insurance, and maintenance, which they add to the rent amount. When analyzing a Utah Triple Net Lease, it’s crucial for investors to assess these expenses accurately to ensure they achieve their desired return on investment.

NNN stands for 'triple net lease,' which is a leasing arrangement where the tenant is responsible for three major expenses: property taxes, insurance, and maintenance. This arrangement provides a straightforward income stream for landlords, offering reassurance and protection in their investment. In Utah Triple Net Leases, this model is becoming increasingly popular among commercial property investors.

The primary difference between NN and NNN leases lies in the allocation of expenses. In a NN lease, the tenant is responsible for property taxes and insurance but not maintenance costs. Conversely, a NNN lease requires the tenant to manage all expenses, making the Utah Triple Net Lease more favorable for landlords who seek stability and low-risk investment.

The best triple net lease tenants typically include well-established companies with financial stability, such as major retailers or national chains. These tenants provide reliable income for landlords and often have a strong track record of fulfilling lease obligations. For landlords considering a Utah Triple Net Lease, partnering with reputable tenants reduces the risks associated with vacancy and default.

Net absolute refers to a specific type of lease agreement where tenants are responsible for paying all property-related expenses. This includes property taxes, insurance, and maintenance costs. In the context of a Utah Triple Net Lease, tenants enjoy security and predictability in managing property expenses, while landlords benefit from a simplified income stream.

The triple net format is a lease structure where tenants are responsible for paying all property expenses, ensuring that landlords receive a stable, net income. In a Utah Triple Net Lease, these expenses generally include property taxes, insurance, and maintenance costs. This format benefits landlords by minimizing their financial responsibilities while providing tenants with clearer ownership expectations. Utilizing resources like uslegalforms can help you to better understand and navigate this lease structure.

The most common residential lease type is the standard one-year lease, which protects both landlords and tenants in Utah. While it may not be a Utah Triple Net Lease, it delivers essential terms and conditions for housing arrangements. This lease provides stability for tenants and ensures landlords have occupancy for a specified duration. Understanding lease types helps tenants choose what best fits their needs.

Breaking a lease in Utah typically requires a clear understanding of your lease agreement and applicable laws. If you are looking to initiate a Utah Triple Net Lease, be aware that the lease terms often have specific conditions regarding early termination. You may need to negotiate with your landlord or provide a valid reason, such as a legal issue or the unit becoming uninhabitable. Legal assistance, like that from uslegalforms, can guide you through this process effectively.

Commercial properties, such as retail buildings, office spaces, and industrial warehouses, often utilize a Utah Triple Net Lease. This type of lease structure places most of the ongoing costs, including taxes, insurance, and maintenance, on the tenant. Landlords prefer triple net leases for their predictability and steady income. As a result, tenants seeking to manage their operational expenses find this approach particularly beneficial.