Generally, a license in respect of real property (since it is a mere personal privilege), cannot be assigned or transferred by the licensee. A license does not pass with the title to the property, but is only binding between the parties, expiring upon the death of either party. This form is an example of such.

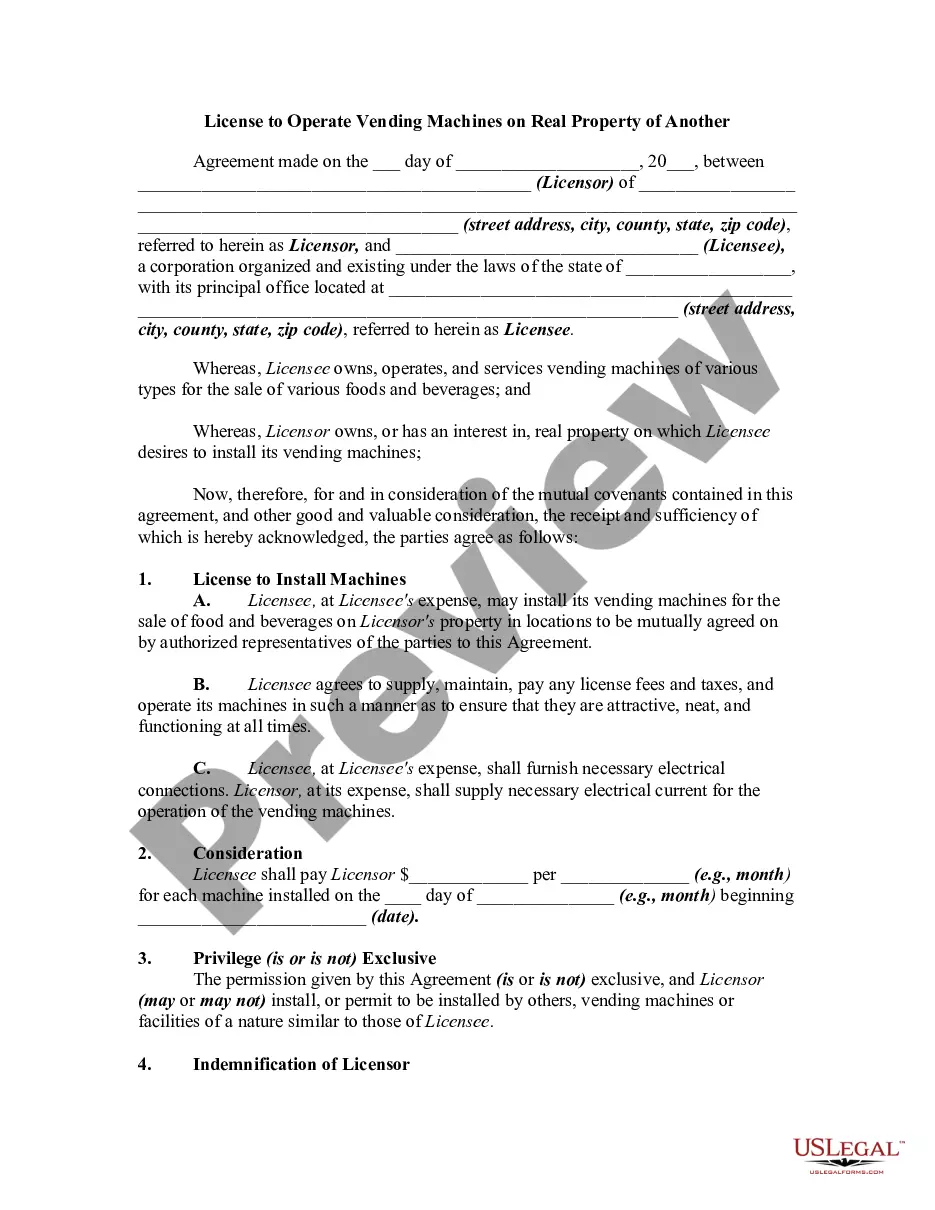

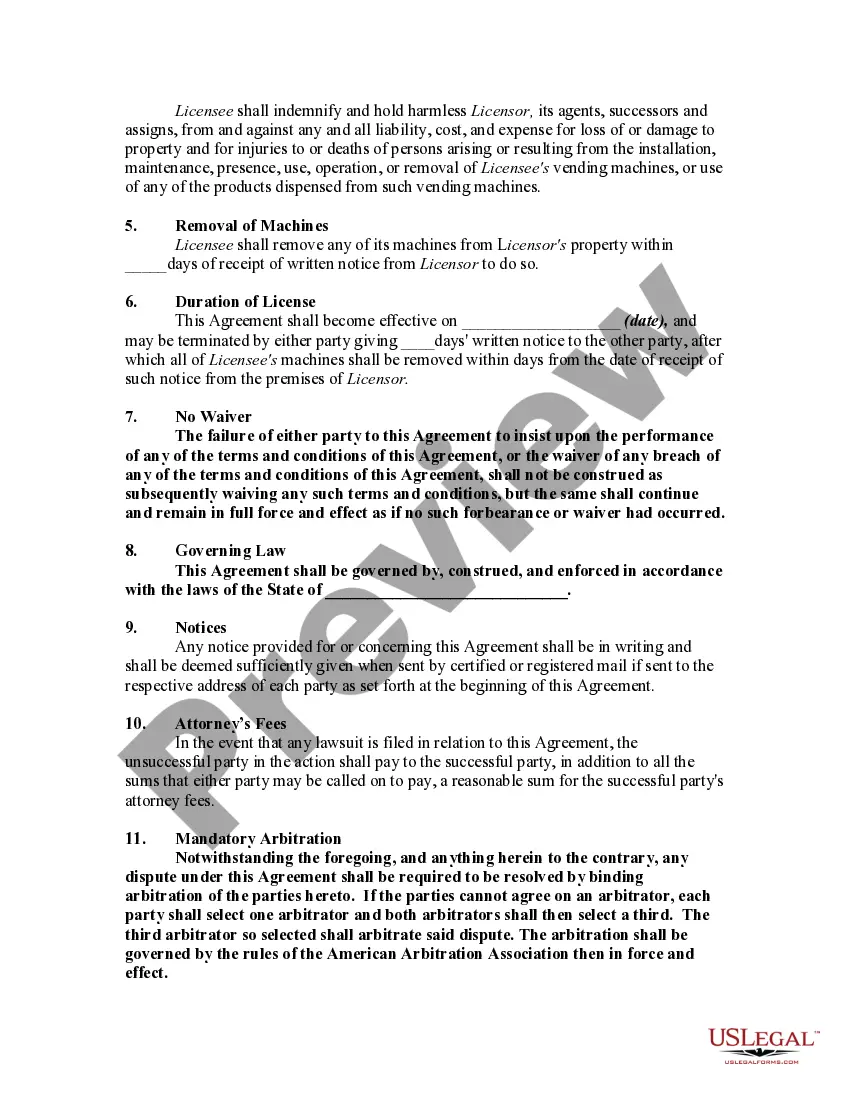

Utah License to Operate Vending Machines on Real Property of Another

Description

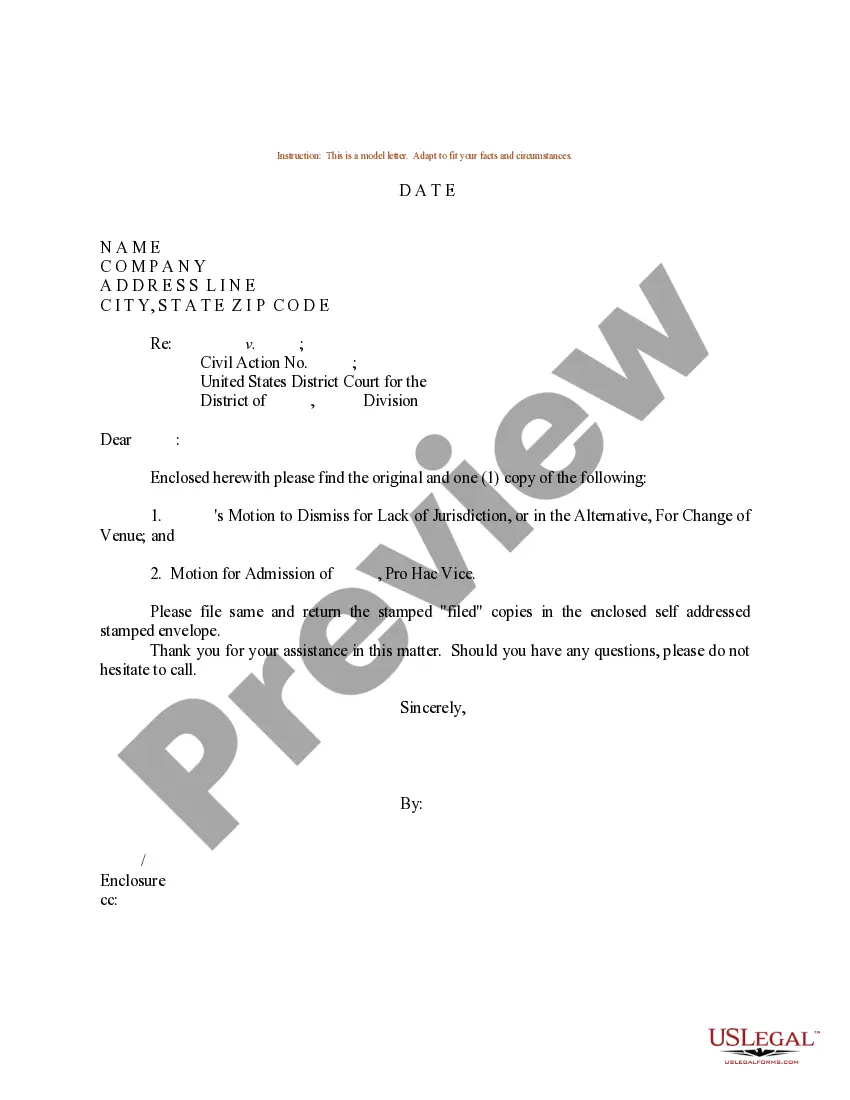

How to fill out License To Operate Vending Machines On Real Property Of Another?

Selecting the appropriate legal document template can be quite challenging. Clearly, there are numerous templates accessible online, but how can you obtain the legal form you need.

Utilize the US Legal Forms website. The platform offers a wide selection of templates, such as the Utah License to Operate Vending Machines on Real Property of Another, that can be utilized for both business and personal purposes.

All the forms are reviewed by professionals and comply with federal and state regulations.

If the form does not fit your needs, use the Search feature to find the correct form. Once you are certain that the form meets your requirements, click the Purchase now button to acquire the form. Choose your preferred pricing plan and provide the required information. Create your account and complete the payment using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Utah License to Operate Vending Machines on Real Property of Another. US Legal Forms serves as the largest repository of legal forms where you can find various document templates. Take advantage of the service to download professionally created documents that comply with state requirements.

- If you are already registered, Log In to your account and click on the Download button to obtain the Utah License to Operate Vending Machines on Real Property of Another.

- Use your account to browse the legal forms you have previously ordered.

- Go to the My documents section of your account and retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are some straightforward steps to follow.

- First, ensure you have selected the correct form for your city/state.

- You can review the form using the Review button and read the form description to ensure it is suitable for you.

Form popularity

FAQ

Utah Code 53 13 104 provides guidance on the enforcement of vending machine regulations. This code outlines the penalties for non-compliance, which can include fines or license suspensions. Familiarizing yourself with this code is vital to maintaining your Utah License to Operate Vending Machines on Real Property of Another and ensuring your business remains compliant.

Utah Code 59 12 102 addresses the tax implications associated with vending machine operations. It is important for operators to understand how to handle sales tax obligations to comply with state laws. Proper knowledge of this code will help you effectively manage finances and maintain your licensing for the Utah License to Operate Vending Machines on Real Property of Another.

Utah Code 53 10 102 focuses on the licensing and operational standards for placing vending machines on someone else's property. This code provides clarity on receiving permission from property owners, which is a crucial aspect of securing a Utah License to Operate Vending Machines on Real Property of Another. Knowing this code helps you avoid legal troubles and ensures a smooth vending operation.

Utah Code 53 14 101 establishes the requirements for obtaining a Utah License to Operate Vending Machines on Real Property of Another. This code outlines the necessary procedures, including application submission, background checks, and compliance with local regulations. It is essential for operators to understand these requirements to ensure they are legally compliant and prepared for inspections.

Utah sales tax is primarily based on destination, meaning it is applied where the buyer takes possession of the item. This principle is crucial for understanding how your vending machine transactions will be taxed. Keep in mind, having a Utah License to Operate Vending Machines on Real Property of Another is vital for staying compliant with these tax regulations.

Utah does accept out of state resale certificates, but only if they meet specific requirements. Generally, you must provide valid documentation showing that you are reselling the items purchased. If you are using vending machines and considering obtaining a Utah License to Operate Vending Machines on Real Property of Another, be sure to check how this certificate affects your operations.

Yes, Utah requires a seller's permit for businesses engaging in retail sales, including those operating vending machines. This permit ensures compliance with sales tax laws and registration for tax collection. If you have a Utah License to Operate Vending Machines on Real Property of Another, acquiring a seller's permit will be a part of your business setup.

59-12-104 refers to a section of the Utah Code that outlines specific sales tax exemptions. This includes provisions for certain transactions that may be tax-exempt. For businesses looking to sell products, like those operated with a Utah License to Operate Vending Machines on Real Property of Another, understanding these exemptions can help you minimize costs.

To avoid car sales tax in Utah, consider purchasing a vehicle from a private seller, as sales tax may not apply in that situation. Additionally, look for exemptions related to specific circumstances, such as transfers between family members. Remember, if you also intend to sell items via vending machines, a Utah License to Operate Vending Machines on Real Property of Another can help you navigate tax implications effectively.

The difference between origin and destination lies in how sales tax is applied. Origin-based taxation uses the seller's location, while destination-based taxation considers where the buyer resides. For those seeking a Utah License to Operate Vending Machines on Real Property of Another, understanding this difference can significantly affect your tax responsibilities.