Utah Officers Bonus in form of Stock Issuance - Resolution Form

Description

How to fill out Officers Bonus In Form Of Stock Issuance - Resolution Form?

If you wish to obtain, download, or print certified document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search tool to find the documents you require.

Various templates for business and individual purposes are organized by categories and states, or keywords. Use US Legal Forms to acquire the Utah Officers Bonus in the form of Stock Issuance - Resolution Form in just a few clicks.

Every legal document template you acquire is yours permanently. You will have access to each form you obtained in your account.

Click on the My documents section and select a form to print or download again. Complete and download, and print the Utah Officers Bonus in the form of Stock Issuance - Resolution Form with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to retrieve the Utah Officers Bonus in the form of Stock Issuance - Resolution Form.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

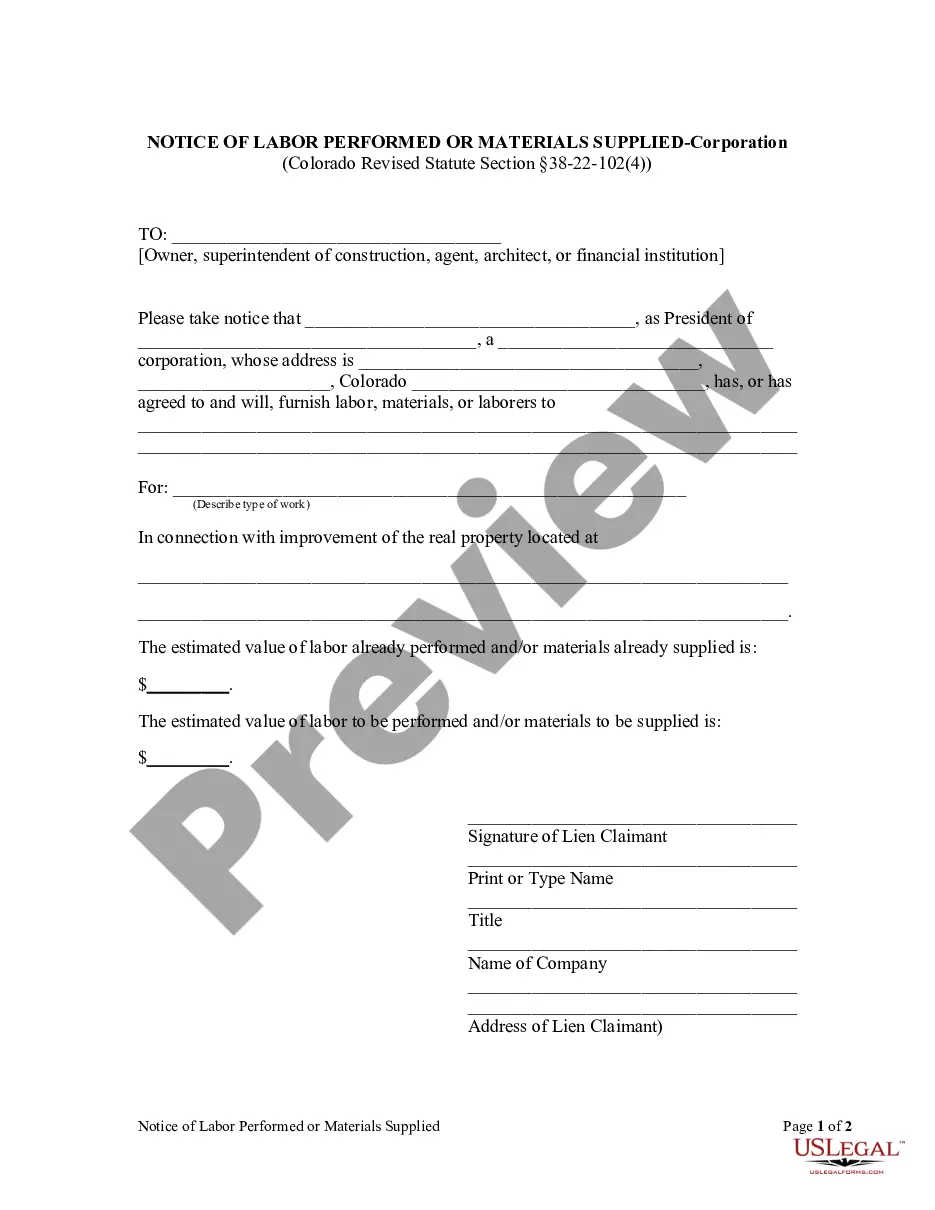

- Step 2. Utilize the Review option to examine the form's content. Don't forget to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Proceed with the purchase. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Utah Officers Bonus in the form of Stock Issuance - Resolution Form.

Form popularity

FAQ

Yes, a resolution is generally required to issue shares within a corporation. This requirement ensures that all share issuances are conducted according to company policy and state law. The Utah Officers Bonus in form of Stock Issuance - Resolution Form provides a structured way to obtain this resolution, ensuring compliance and safeguarding shareholder interests.

A corporate resolution for a stock transfer is a formal document that records the approval of transferring ownership of shares within a corporation. This resolution ensures that all transfers are properly authorized and documented. If connected to the Utah Officers Bonus in form of Stock Issuance - Resolution Form, it helps maintain clarity and legality in share allocation.

A board or shareholder resolution is a formal agreement made either by the board of directors or shareholders to take specific actions concerning company affairs. This can involve financial decisions, changes in policies, or share distributions, including the Utah Officers Bonus in form of Stock Issuance - Resolution Form. Both parties must document these resolutions to ensure accountability.

A board resolution for share issuance is an official statement recorded by the board that dictates how shares are distributed. This resolution conveys the board’s intent to strengthen the company’s equity or incentivize employees. Incorporating the Utah Officers Bonus in form of Stock Issuance - Resolution Form streamlines this process, making it clear and legally binding.

The board resolution for the issue of shares details the decision made by the board regarding how many shares will be issued and to whom. This document includes the rationale for the share issuance and any conditions that may apply. When this is related to a Utah Officers Bonus in form of Stock Issuance - Resolution Form, it emphasizes transparency in corporate governance.

A director's resolution to issue shares is a specific directive from the board that authorizes the issuance of shares to selected individuals or groups. This resolution outlines the terms and conditions of the share issuance. Utilizing the Utah Officers Bonus in form of Stock Issuance - Resolution Form, directors can efficiently manage this process, ensuring compliance with state regulations.

A board resolution is a formal document that records decisions made by a company's board of directors. It serves as legal evidence of the actions agreed upon in a board meeting. For instance, if your board decides to issue shares as part of the Utah Officers Bonus in form of Stock Issuance - Resolution Form, this decision is documented in the resolution.

A corporate resolution for share transfer is a document that formally authorizes the transfer of shares from one party to another within a corporation. It includes details such as the number of shares and the recipient’s information. Using the Utah Officers Bonus in form of Stock Issuance - Resolution Form can provide a structured template to document this transfer effectively, reducing potential legal complications.

To initiate a shareholder resolution, you typically need to draft the resolution and present it to the board during a meeting. The shareholders must then vote on the proposed resolution for it to pass. Incorporating the Utah Officers Bonus in form of Stock Issuance - Resolution Form can help in formulating and documenting the resolution, ensuring clarity and compliance.

A corporate resolution is an official document that records decisions made by a corporation's board of directors or shareholders. This document serves as a legal record of actions taken and can include various corporate activities, such as approving stock issuance. By using the Utah Officers Bonus in form of Stock Issuance - Resolution Form, companies can simplify the resolution process and maintain proper documentation.