Utah Increase Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Increase Dividend - Resolution Form - Corporate Resolutions?

Locating the appropriate legal document template can be a challenge. Obviously, there are numerous templates available online, but how can you locate the legal form you require? Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Utah Increase Dividend - Resolution Form - Corporate Resolutions, which can be utilized for both business and personal purposes. All forms are verified by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to acquire the Utah Increase Dividend - Resolution Form - Corporate Resolutions. Use your account to review the legal documents you have previously purchased. Visit the My documents section of your account to obtain another copy of the document you need.

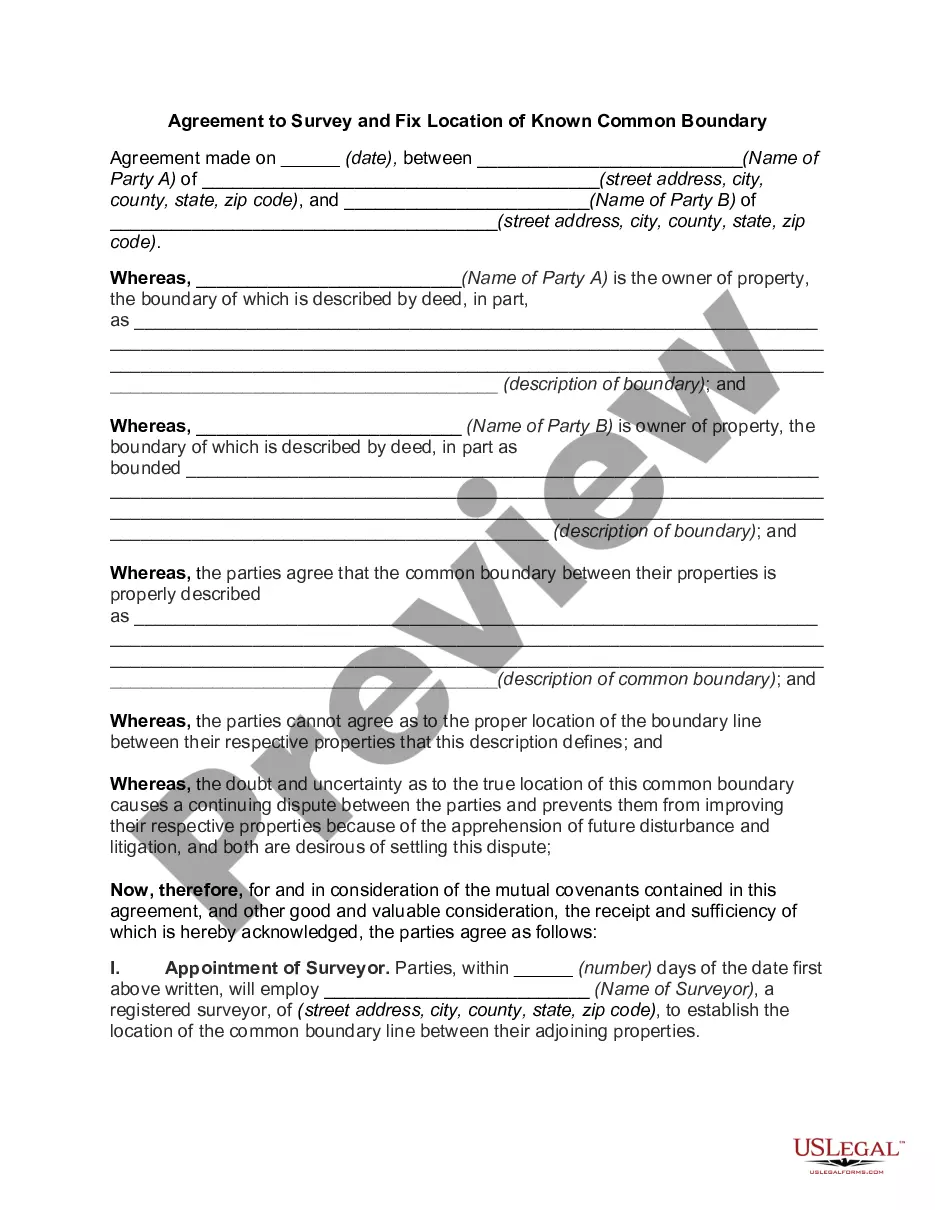

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure you have selected the correct form for your area/region. You can preview the form using the Review button and read the form description to confirm it meets your needs. If the form does not meet your requirements, utilize the Search field to find the suitable form.

US Legal Forms is the largest collection of legal documents available, offering a wide variety of document templates. Take advantage of the service to access professionally prepared paperwork that adheres to state standards.

- Once you are confident that the form is appropriate, click the Get now button to download the form.

- Choose the pricing plan you desire and fill in the necessary details.

- Create your account and complete your purchase using your PayPal account or credit card.

- Select the document format and save the legal document template to your device.

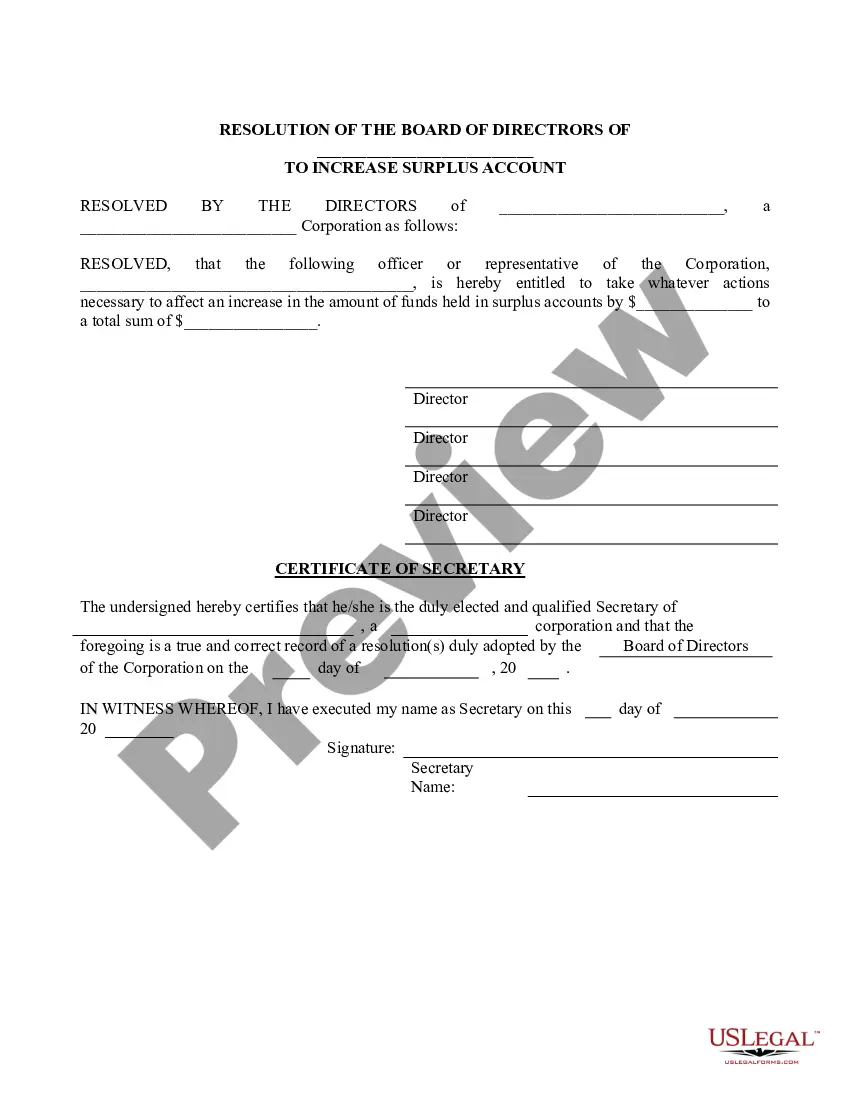

- Complete, modify, print, and sign the acquired Utah Increase Dividend - Resolution Form - Corporate Resolutions.

Form popularity

FAQ

To file for an S Corporation in Utah, you'll need to gather essential documents like your Articles of Incorporation and an IRS Form 2553. Additionally, ensure you have a detailed operating agreement and any necessary corporate resolutions at hand. Using the Utah Increase Dividend - Resolution Form - Corporate Resolutions can help you maintain compliance while efficiently managing key business decisions.

To file an S Corporation in Utah, begin by completing the appropriate forms to elect S Corporation status with the IRS. Then, make sure to file your Articles of Incorporation at the state level. Keep your documents organized; the Utah Increase Dividend - Resolution Form - Corporate Resolutions can assist in maintaining clarity as your business grows.

Writing a corporate resolution involves clearly stating the decision being made, identifying the company, and capturing the date. Include signatures from the necessary officers to confirm agreement. Utilize tools like the Utah Increase Dividend - Resolution Form - Corporate Resolutions to streamline this process, ensuring your documentation is complete and legally compliant.

To set up a corporation in Utah, you need to file the Articles of Incorporation with the state. This process can usually be completed online through the Utah Department of Commerce. Once established, consider drafting a Utah Increase Dividend - Resolution Form - Corporate Resolutions to formalize major decisions and enhance business structure.

Utah does impose taxes on S Corporations, but they are generally at a lower rate than C Corporations. Specifically, S Corps in Utah must fill out a corporate tax return but may not face the same burden as a traditional company. Always consult the latest guidelines to stay compliant while enjoying the benefits of the Utah Increase Dividend - Resolution Form - Corporate Resolutions.

The minimum income for an S Corporation in Utah isn't strictly defined, but generally, it is advisable to have a reasonable income to cover operational costs. An S Corp is pass-through taxation, which means the income is reported on your personal tax returns. Ensure you keep accurate records of your finances, especially when preparing the Utah Increase Dividend - Resolution Form - Corporate Resolutions.

Yes, a corporation is considered an artificial being or a legal entity distinct from its owners. This means that the corporation can own property, incur liabilities, and enter contracts independently. Understanding this concept is vital, especially when dealing with matters like the Utah Increase Dividend - Resolution Form - Corporate Resolutions, as it emphasizes the corporation's separate legal status in the context of financial decisions and responsibilities.

Yes, you can serve as your own registered agent for your LLC in Utah, provided you have a physical address in the state and are available during regular business hours. Acting as your own agent can save you costs associated with hiring a service. Just remember, you will need to maintain accurate records, including resolutions like the Utah Increase Dividend - Resolution Form - Corporate Resolutions, especially if you handle dividend distributions.

Incorporating in Utah provides numerous benefits, such as a favorable tax environment, business-friendly laws, and a growing economy. Utah offers strong protections for corporate entities, allowing flexibility in management and operations. Moreover, leveraging the Utah Increase Dividend - Resolution Form - Corporate Resolutions can help you effectively manage corporate finances and support dividend distribution, enhancing your corporate governance.

To start an AC Corporation in Utah, you need to file the necessary incorporation documents with the state, such as Articles of Incorporation. Choose an appropriate business name, appoint directors, and create bylaws to manage your corporation. Once established, consider utilizing the Utah Increase Dividend - Resolution Form - Corporate Resolutions to distribute dividends efficiently and ensure compliance with state regulations.