Utah Dividend Policy - Resolution Form - Corporate Resolutions

Description

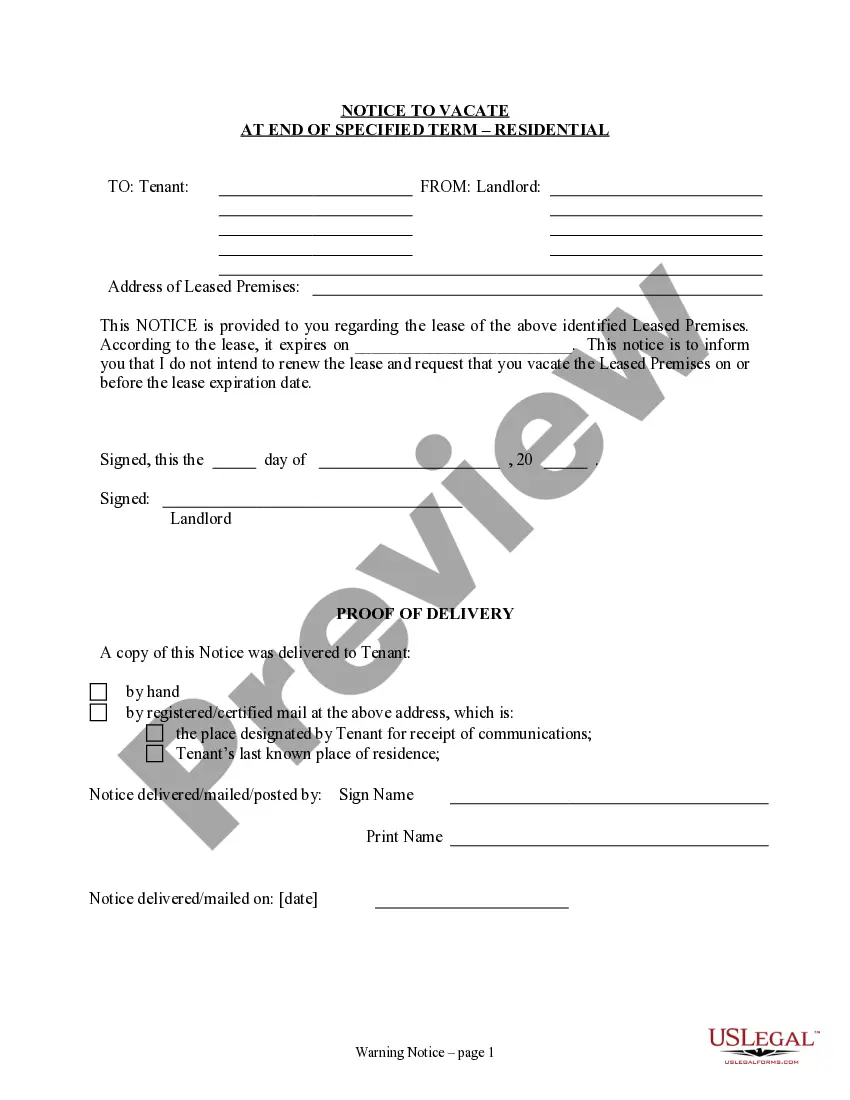

How to fill out Dividend Policy - Resolution Form - Corporate Resolutions?

US Legal Forms - among the largest collections of legal documents in the USA - offers a variety of legal document templates that you can download or print.

By using the website, you can locate thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Utah Dividend Policy - Resolution Form - Corporate Resolutions in just a few minutes.

If you have a monthly subscription, Log In and download the Utah Dividend Policy - Resolution Form - Corporate Resolutions from the US Legal Forms library. The Download button will appear on every form you view. Access all previously saved forms from the My documents tab of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form onto your device. Edit. Fill out, modify, print, and sign the saved Utah Dividend Policy - Resolution Form - Corporate Resolutions. Each template you add to your account does not expire and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Utah Dividend Policy - Resolution Form - Corporate Resolutions with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have chosen the correct form for your locality/county.

- Click the Preview button to review the form's details.

- Read the form description to confirm you have selected the correct form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking on the Buy now button.

- Then, select the pricing plan you prefer and provide your information to register for the account.

Form popularity

FAQ

A resolution of authorization is a formal document that gives approval for certain actions or decisions within a company. This act of authorization is vital for delegating responsibilities and clarifying who can act on behalf of the organization. By using the Utah Dividend Policy - Resolution Form - Corporate Resolutions, you can efficiently create resolutions that authorize individuals effectively and securely.

A signed corporate resolution is a document that reflects the consensus of a corporation’s board or members regarding a specific decision. It serves as an official record that can be referenced in legal and business matters, thus enhancing transparency. Utilizing the Utah Dividend Policy - Resolution Form - Corporate Resolutions, you can ensure that your corporate resolutions are properly documented and signed.

A corporate ratification resolution is a formal process whereby a company affirms past decisions made by its officers or directors. This resolution is significant in maintaining corporate integrity, as it provides a legal backing for actions that were taken without prior authorization. In the context of the Utah Dividend Policy - Resolution Form - Corporate Resolutions, this can help protect a corporation and validate previous activities.

A director's resolution for signing authority grants specific powers to directors to execute documents and make decisions. This resolution is crucial for corporate governance, ensuring that decisions are made by specific, authorized individuals. With the Utah Dividend Policy - Resolution Form - Corporate Resolutions, directors can easily formalize their authority in a clear, compliant manner.

A corporate resolution for authorized signers formally designates individuals within a corporation who have the authority to act on its behalf. This document protects the corporation by preventing unauthorized actions that could lead to legal issues. By implementing the Utah Dividend Policy - Resolution Form - Corporate Resolutions, businesses can maintain clarity and structure in their operations.

The LLC resolution for signing authority outlines who can execute documents on behalf of the company. This resolution is essential for establishing clear lines of authority, especially when entering contracts or managing funds. By utilizing the Utah Dividend Policy - Resolution Form - Corporate Resolutions, you ensure your LLC operates smoothly and complies with internal and external requirements.

You document a resolution by creating a formal record that captures the complete details of the decision. This includes the date, involved parties, and context of the resolution. Storing this documentation in a secure location and maintaining clear organization is crucial, especially when aligned with the Utah Dividend Policy - Resolution Form - Corporate Resolutions.

To document a resolution, create a written record that includes the resolution title, the facts supporting it, and the decisions made. Ensure all relevant parties sign the document to validate it. Recording this in the corporate minutes and referencing the Utah Dividend Policy - Resolution Form - Corporate Resolutions can help maintain organization and legality.

A corporate resolution for signature authority designates which individuals have the power to sign contracts and documents on behalf of the corporation. This type of resolution helps streamline decision-making processes and clarifies authority within the company. Utilizing tools like the Utah Dividend Policy - Resolution Form - Corporate Resolutions can assist in formalizing this structure.

A resolution statement should begin with a clear declaration of the intent behind the resolution. Follow this with the rationale, highlighting any relevant facts or considerations that support the decision. It is beneficial to frame the statement with respect to established guidelines, such as those found in the Utah Dividend Policy - Resolution Form - Corporate Resolutions.