Utah Trust Agreement - Revocable - Multiple Trustees and Beneficiaries

Description

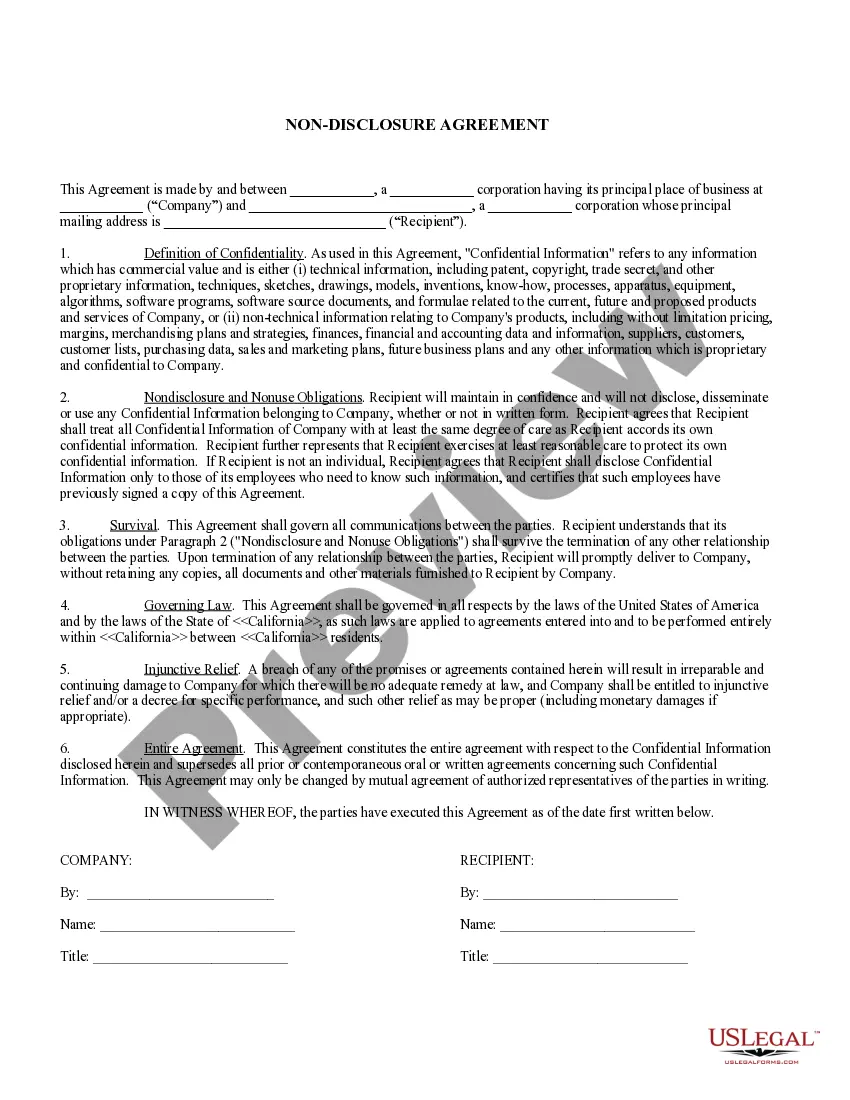

How to fill out Trust Agreement - Revocable - Multiple Trustees And Beneficiaries?

You might spend hours online looking for the correct legal document template that meets the requirements of your state and federal regulations.

US Legal Forms offers thousands of legal forms that can be reviewed by professionals.

You can effortlessly obtain or create the Utah Trust Agreement - Revocable - Multiple Trustees and Beneficiaries with my assistance.

First, ensure that you have selected the correct document template for your chosen area/city. Review the document description to verify that you have chosen the right form. If available, use the Review button to browse through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you are able to complete, modify, produce, or sign the Utah Trust Agreement - Revocable - Multiple Trustees and Beneficiaries.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and press the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Yes, two people can share the same trust under a Utah Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. This arrangement is common for couples or partners who want to jointly manage their assets and designate beneficiaries. Collaborating in this way can simplify the distribution of assets and ensure both parties are aligned in their estate planning.

The main difference lies in control and flexibility. A revocable trust allows the trustor to modify or dissolve the trust at any time, while an irrevocable trust typically cannot be changed once established. This distinction is significant when considering a Utah Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, as it provides more control over your assets.

Yes, a person can create multiple Revocable Living Trusts under a Utah Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. Each trust can serve a different purpose, such as managing distinct assets or benefiting different beneficiaries. It's important to consult with a legal advisor to ensure proper setup and compliance with state laws.

While trusts offer many advantages, they can also have downsides. The initial setup can require significant time and financial resources, especially for a Utah Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. Moreover, misunderstandings about the trust's terms can lead to disputes among beneficiaries. Therefore, ensuring everyone involved understands the details can prevent long-term issues and promote harmony.

A family trust can present challenges, particularly if family dynamics are strained. Conflicts can arise among family members regarding decisions made by the trustees. In addition, setting up a Utah Trust Agreement - Revocable - Multiple Trustees and Beneficiaries may be costly and time-consuming. To navigate these hurdles, it's beneficial to communicate openly with family members and seek professional advice to tailor the trust to your family's needs.

Having multiple trustees can provide a system of checks and balances that enhances transparency and accountability. In a Utah Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, multiple trustees can pool their skills and perspectives, ensuring better decision-making. This arrangement can also reduce the burden on a single trustee, allowing for more thorough management of the trust. It’s a strategy that fosters collaboration and trust among the parties involved.

One of the biggest mistakes parents make is failing to clearly define the roles and responsibilities of trustees and beneficiaries. Clarity is essential for any trust fund, including a Utah Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. This can lead to misunderstandings and disputes down the line. Additionally, not reviewing the trust regularly to align with life changes can also pose significant issues.

Trust funds can pose several risks, especially if not managed properly. Mismanagement can lead to conflicts among beneficiaries, depletion of the trust’s assets, or even legal challenges. It’s crucial to understand the rules governing a Utah Trust Agreement - Revocable - Multiple Trustees and Beneficiaries to mitigate these dangers. Proper communication and professional guidance are key to maintaining the integrity of your trust.

Yes, you can certainly add more beneficiaries to your trust. With a Utah Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, the flexibility to include additional beneficiaries exists. Keep in mind that all amendments must be properly documented to ensure clarity and legality. Always consult with a professional to ensure your trust remains compliant with current laws.

The rules for trusts in Utah are primarily governed by the Utah Trust Code. A trust must have a legitimate purpose, defined beneficiaries, and clearly stated terms in the trust agreement. Additionally, trustees must act in the best interests of the beneficiaries while adhering to state laws. Creating a solid Utah Trust Agreement - Revocable - Multiple Trustees and Beneficiaries is vital to ensure compliance with these regulations and protect the interests of all parties involved.