Utah Reduce Capital - Resolution Form - Corporate Resolutions

Description

How to fill out Reduce Capital - Resolution Form - Corporate Resolutions?

You might spend hours online trying to locate the authentic document template that meets the federal and state requirements you desire.

US Legal Forms offers a vast array of authentic forms that have been examined by specialists.

You can obtain or create the Utah Reduce Capital - Resolution Form - Corporate Resolutions using our service.

If available, use the Preview button to view the document template as well. For another version of the form, utilize the Search field to find the template that fits your needs and requirements.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- Afterward, you can complete, modify, create, or sign the Utah Reduce Capital - Resolution Form - Corporate Resolutions.

- Every legal document template you purchase is yours to keep permanently.

- To acquire another copy of a purchased form, navigate to the My documents tab and click on the designated button.

- If you are using the US Legal Forms site for the first time, follow the simple steps below.

- First, ensure you have selected the correct document template for your county/city of choice.

- Read the form description to confirm you've chosen the appropriate form.

Form popularity

FAQ

The LLC equivalent of a corporate resolution is often referred to as an operating agreement or a member resolution. This document outlines key decisions and actions taken by the LLC members. It serves a similar purpose in terms of documenting consensus and authority within the company. For ease of use, consider the Utah Reduce Capital - Resolution Form - Corporate Resolutions, which can help streamline this process.

A corporate resolution for signing authority designates specific members or managers who can legally sign documents on behalf of the LLC. This resolution is vital for establishing trust and authority in business transactions. Ensure that all members are informed and consent to the signing authority. The Utah Reduce Capital - Resolution Form - Corporate Resolutions provides a clear framework for creating this type of resolution.

Generally, the members or managers of an LLC can write a corporate resolution. They must have the authority to make decisions on behalf of the LLC. It's important to follow proper procedures in documenting the resolution for legal validity. For assistance in creating these documents, the Utah Reduce Capital - Resolution Form - Corporate Resolutions is an excellent resource.

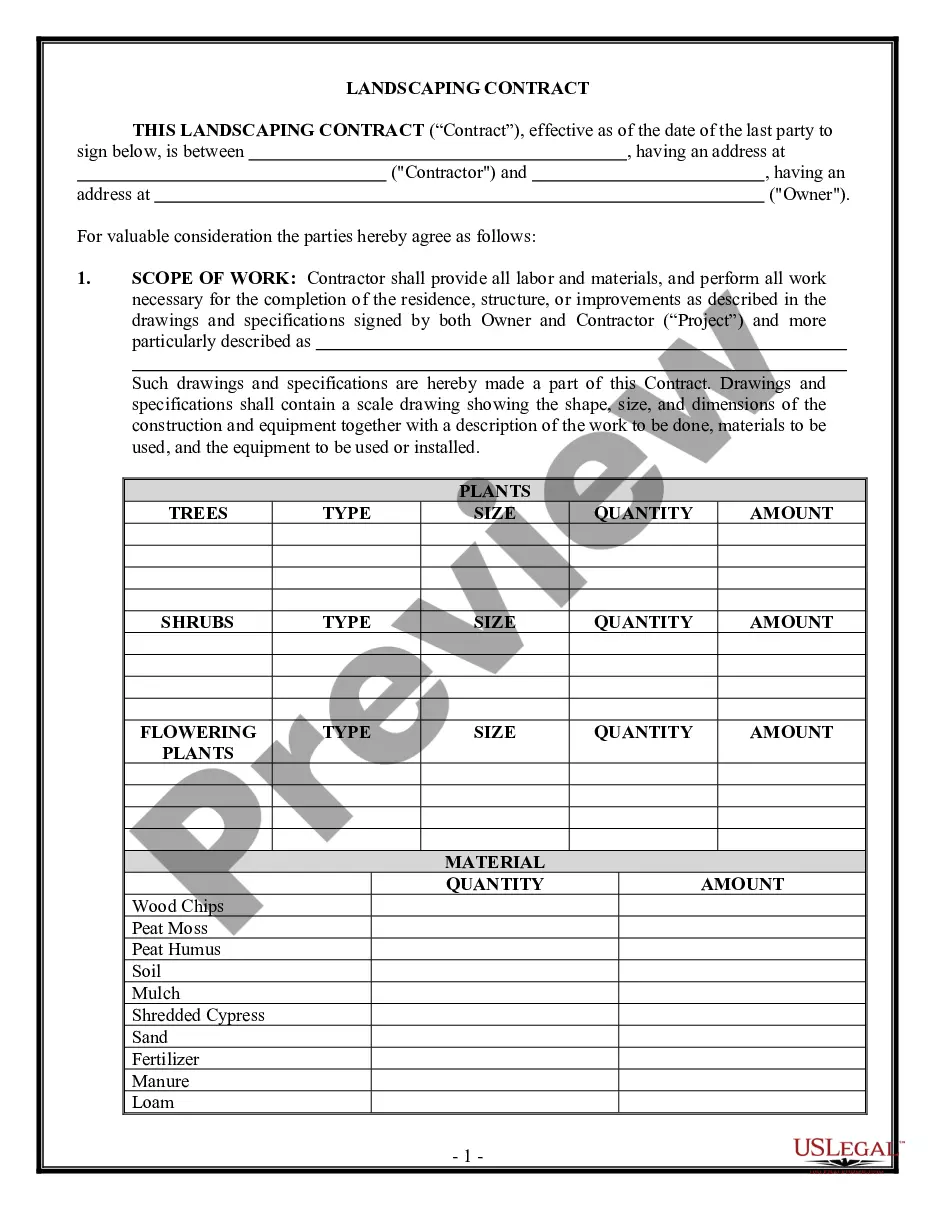

A written resolution for capital reduction is a formal document that indicates the LLC's decision to reduce its capital. This document outlines the terms and conditions under which the reduction occurs, including the reasons and implications for the members. It is crucial for compliance with state laws. Consider using the Utah Reduce Capital - Resolution Form - Corporate Resolutions for a structured approach to drafting this resolution.

Writing a resolution for an LLC requires you to clearly define the action the resolution is addressing. Include the date, the reasons for the resolution, and the voting outcomes. It's essential to ensure that all members who participated sign the document. To streamline this, you can use the Utah Reduce Capital - Resolution Form - Corporate Resolutions for clarity and compliance.

To fill out a corporate resolution form, first ensure you have all necessary details, including the names of the LLC members and the exact resolution. Carefully complete each section, noting any resolutions regarding authority, approvals, or capital changes. Finally, have all involved parties sign the form to validate it. The Utah Reduce Capital - Resolution Form - Corporate Resolutions has a user-friendly design that assists you throughout this process.

Filling out a resolution form involves detailing the specific action your LLC plans to take. Start with the title, followed by the date, and a statement of the resolution itself. Be sure to list the signatures of all members who voted on the resolution. Utilizing the Utah Reduce Capital - Resolution Form - Corporate Resolutions simplifies this task as it provides structured fields to ensure accuracy.

To write a corporate resolution for your LLC, begin by clearly stating the purpose of the resolution. Include the date, the names of the members, and the specific decision that needs approval. Remember to outline the voting results and who is authorized to sign the resolution. Using the Utah Reduce Capital - Resolution Form - Corporate Resolutions can guide you through this process with ease.

The corporate return form for Utah is TC-20. This form is essential for corporations to report their income and calculate taxes. When preparing your TC-20, remember that the Utah Reduce Capital - Resolution Form - Corporate Resolutions may play a significant role in your financial reporting and tax strategy.

The business judgement rule in Utah offers protection to corporate directors and officers when making decisions on behalf of the company. This rule assumes that decisions made are done in good faith and with reasonable care. If you are dealing with corporate resolutions in Utah, understanding the implications of the business judgement rule can enhance your ability to make sound decisions using the Utah Reduce Capital - Resolution Form - Corporate Resolutions.