Utah Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance

Description

How to fill out Buy Sell Or Stock Purchase Agreement Covering Common Stock In Closely Held Corporation With Option To Fund Purchase Through Life Insurance?

Are you currently in the location where you require documents for potentially business or personal purposes every single day.

There are numerous legal document templates accessible online, but finding reliable ones isn't straightforward.

US Legal Forms offers a vast array of form templates, such as the Utah Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance, designed to meet state and federal specifications.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Utah Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance at any time, if needed. Just select the required form to download or print the document template.

- If you are already familiar with the US Legal Forms site and have your account, simply Log In.

- From there, you can download the Utah Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Obtain the form you need and confirm it is for the correct city/county.

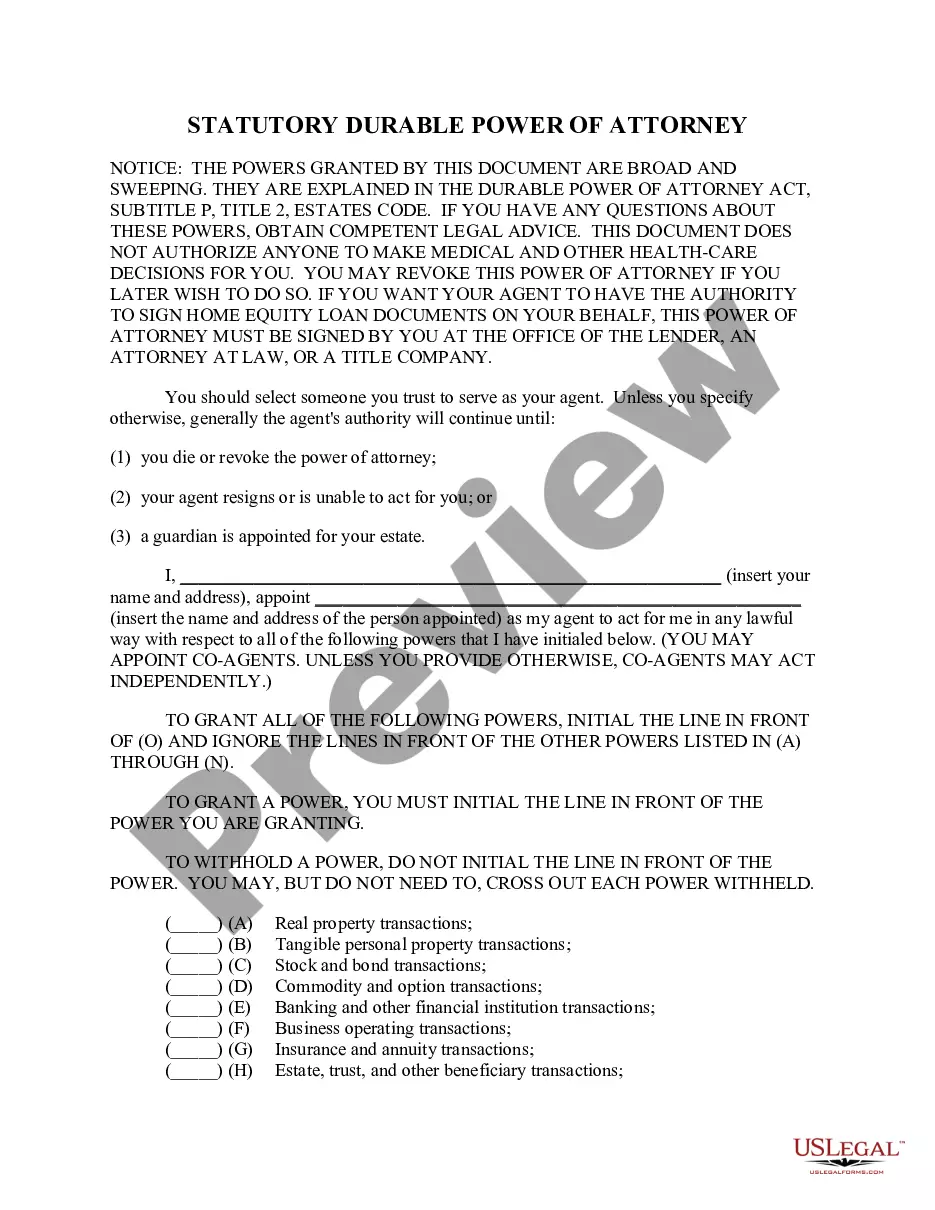

- Use the Review button to examine the document.

- Check the description to ensure you have selected the appropriate form.

- If the form isn’t what you’re looking for, utilize the Search field to find the document that meets your needs and requirements.

- Once you find the right form, click on Get now.

- Select the pricing plan you prefer, enter the necessary information to set up your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

A good buy-sell agreement can offer business owners peace of mind and help them to avoid future conflict and retain control of their companies. Once in place, agreements should be reviewed on a regular basis or especially when there is a major change in the business or an anticipated change in ownership.

Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership. The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.

Buy-sell agreements can be structured under various forms, including 1) entity redemption, 2) cross purchase, 3) cross endorsement, 4) wait-and-see and 5) a one-way agreement.

There are four common buyout structures:Traditional cross purchase plan. Each owner who is left in the business agrees to purchase the co-owner's shares if that individual dies or leaves the business.Entity redemption plan.One-way buy sell plan.Wait-and-see buy sell plan.

A stock purchase agreement is an agreement that two parties sign when shares of a company are being bought or sold. These agreements are often used by small corporations who sell stock. Either the company or shareholders in the organization can sell stock to buyers.

Common Stock Agreement means an agreement between the Company and a Grantee evidencing the terms and conditions of an individual Common Stock grant. The Stock Grant agreement is subject to the terms and conditions of the Plan.

The two most common types of buy-sell agreements are entity-purchase and cross-purchase agreements.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

Establish a market for the corporation's stock that might otherwise be difficult to sell; Ensure that the ownership of the business remains with individuals selected by the owners or remains closely held; Provide liquidity to the estate of a deceased shareholder to pay estate taxes and costs; and.