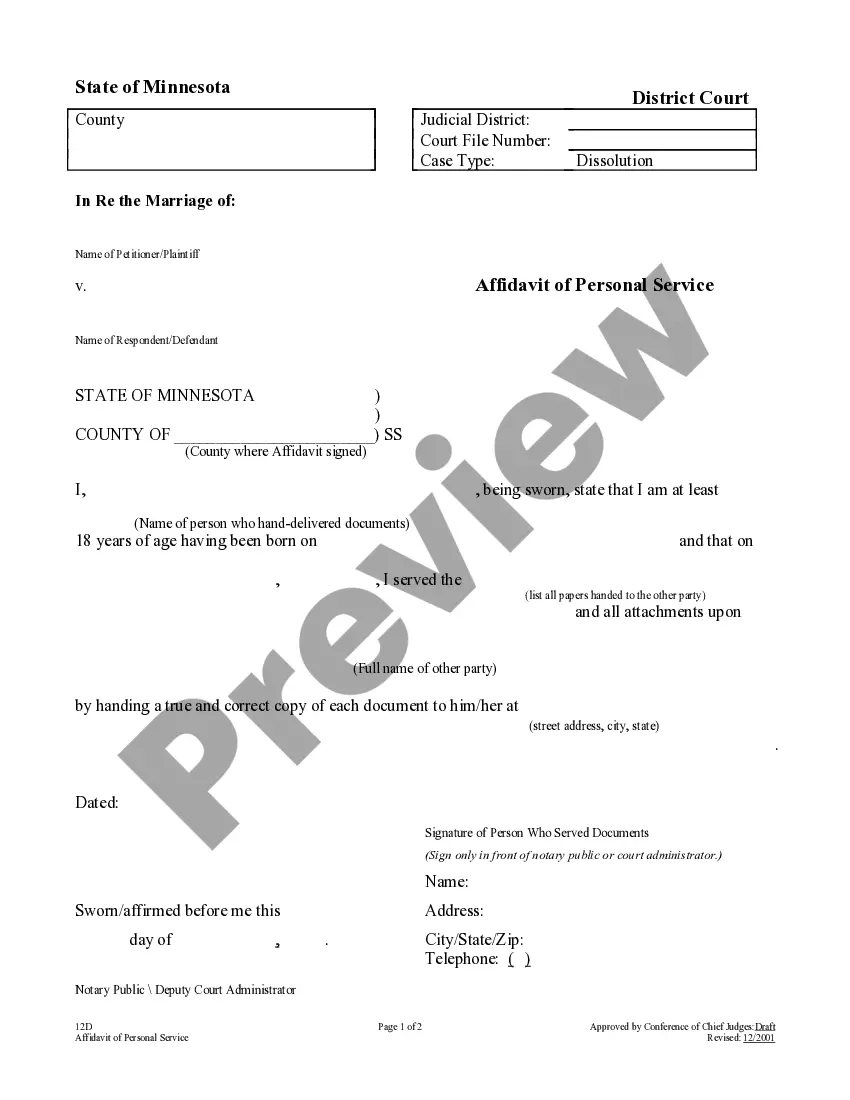

This form is an Authority to Release. The county clerk is authorized and requested to release from a deed of trust a parcel of land to the executor of the estate. The form must be signed in the presence of a notary public.

Utah Authority to Release of Deed of Trust

Description

How to fill out Authority To Release Of Deed Of Trust?

If you have to total, acquire, or print out legitimate document web templates, use US Legal Forms, the biggest assortment of legitimate varieties, which can be found on the web. Make use of the site`s easy and handy research to obtain the papers you want. Different web templates for company and person purposes are categorized by types and suggests, or keywords. Use US Legal Forms to obtain the Utah Authority to Release of Deed of Trust with a couple of clicks.

When you are presently a US Legal Forms customer, log in in your account and click on the Down load option to have the Utah Authority to Release of Deed of Trust. You may also accessibility varieties you in the past delivered electronically from the My Forms tab of your respective account.

If you are using US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape for your appropriate town/region.

- Step 2. Take advantage of the Preview solution to look through the form`s content material. Don`t forget about to see the information.

- Step 3. When you are unhappy using the kind, utilize the Look for industry on top of the screen to discover other types of the legitimate kind format.

- Step 4. After you have discovered the shape you want, go through the Get now option. Choose the costs plan you prefer and include your references to sign up on an account.

- Step 5. Procedure the deal. You may use your credit card or PayPal account to finish the deal.

- Step 6. Select the structure of the legitimate kind and acquire it on your own gadget.

- Step 7. Comprehensive, modify and print out or signal the Utah Authority to Release of Deed of Trust.

Each legitimate document format you purchase is your own eternally. You possess acces to each kind you delivered electronically inside your acccount. Select the My Forms portion and decide on a kind to print out or acquire yet again.

Be competitive and acquire, and print out the Utah Authority to Release of Deed of Trust with US Legal Forms. There are many expert and express-certain varieties you can use to your company or person requires.

Form popularity

FAQ

Deed of Trust has how many parties and who are they? 3 Parties - Lender (beneficiary), Borrower (Trustor), Trustee (bank officer that is appointed.

Form of quitclaim deed -- Effect. A quitclaim deed when executed as required by law shall have the effect of a conveyance of all right, title, interest, and estate of the grantor in and to the premises therein described and all rights, privileges, and appurtenances thereunto belonging, at the date of the conveyance."

Utah is known as a Trust Deed and Promissory Note state. There are references to a foreclosure being allowed under the law, typically in a Contract for Deed transaction but this is certainly not the standard.

Transactions involving deeds of trust are normally structured, at least in theory, so that the lender/beneficiary gives the borrower/trustor the money to buy the property; the borrower/trustor tenders the money to the seller; the seller executes a grant deed giving the property to the borrower/trustor; and the borrower ...

A deed of trust (also known as a trust deed) is a document sometimes used in financed real estate transactions, generally instead of a mortgage.

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

In a deed of trust, a trustor is the borrower and the trustee is a third party that holds the property's title. The trustee is entrusted with the title and the right to sell the property if the trustor defaults on the loan.

Release of security interest. "Revolving credit line" means an agreement between the borrower and a secured lender who agrees to loan the borrower money on a continuing basis so long as the outstanding principal amount owed by the borrower does not exceed a specified amount.