This form for use in litigation against an insurance company for bad faith breach of contract. Adapt this model form to fit your needs and specific law. Not recommended for use by non-attorney.

Utah Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand

Description

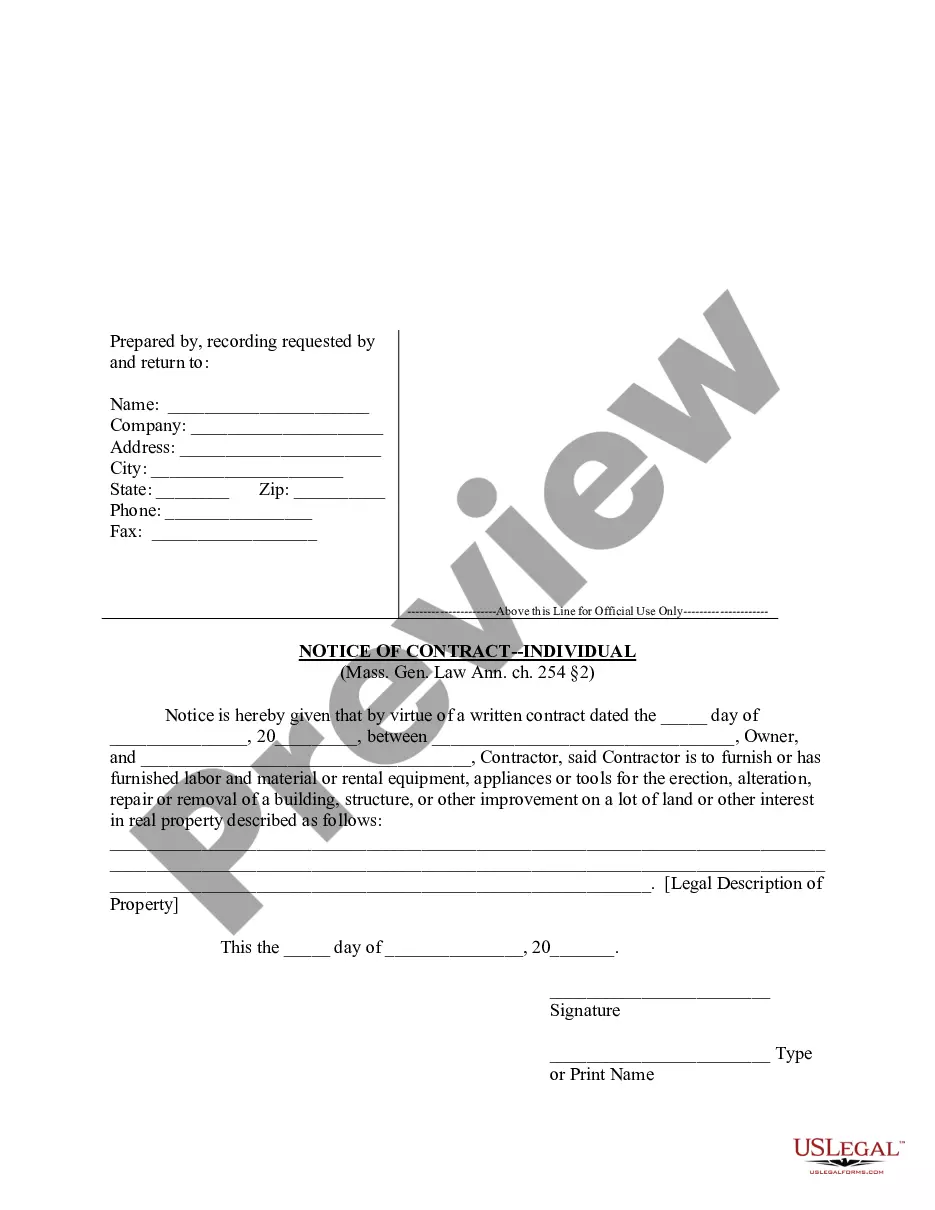

How to fill out Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand?

Selecting the ideal legal document template can be quite challenging. It goes without saying that there are numerous formats accessible online, but how do you find the specific legal type you require? Utilize the US Legal Forms website. The platform offers thousands of templates, including the Utah Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand, which can be utilized for both business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are already a member, Log In to your account and click the Acquire button to locate the Utah Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand. Use your account to view the legal documents you have previously obtained. Visit the My documents section of your account and obtain another copy of the documents you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your region. You can review the document using the Review button and read the form description to confirm it is the right one for you. If the form does not meet your requirements, utilize the Search area to find the appropriate one. Once you are certain the document is correct, click the Get now button to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, edit, print, and sign the obtained Utah Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand.

Utilize US Legal Forms for all your legal document needs and ensure that you have access to high-quality, compliant templates.

- US Legal Forms is the largest repository of legal templates.

- You can find many document formats.

- Utilize the service to download properly designed documents.

- Ensure compliance with state requirements.

- Access a variety of legal forms easily.

- Get the legal papers you need without hassle.

Form popularity

FAQ

To prove insurance bad faith, you need to demonstrate that the insurer acted unreasonably in handling your claim. This involves showing that the insurer failed to pay benefits owed under your policy, despite having no valid reason for doing so. Gathering documentation, including correspondence and claims records, can support your case. If you face difficulties, consider filing a Utah Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand, which can help you seek the compensation you deserve.

An insurer can be liable for bad faith in various ways, including failing to investigate a claim adequately, denying a valid claim without justification, or delaying payment unreasonably. Each of these actions can demonstrate a lack of fair dealing with the policyholder. If you encounter such issues, it may lead to a Utah Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

In Utah, insurance companies are governed by the Utah Department of Insurance, which oversees the regulation of insurance practices to protect consumers. This department ensures that companies comply with state laws and provide fair treatment to policyholders. Understanding this governance can be beneficial when addressing a Utah Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

To prove an insurance company acted in bad faith, you must demonstrate that the insurer failed to honor its contractual obligations and did not conduct a reasonable investigation of your claim. Collect documentation, such as communications and claim files, to support your case. This evidence is vital if you decide to pursue a Utah Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

A DOI complaint refers to a formal grievance filed with the Department of Insurance. This process allows consumers to report issues regarding unfair practices, claim denials, or failures to pay benefits. Filing a DOI complaint is essential for addressing situations where you might consider a Utah Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

The insurance company with the most complaints can vary from year to year, but typically, larger companies may receive more complaints simply due to their size. You can check the National Association of Insurance Commissioners (NAIC) database for the latest statistics on insurance complaints. Understanding complaint trends can help you make informed decisions when facing a Utah Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

Filing a complaint against an insurance company in Utah involves gathering your policy information and documentation related to your claim. You can then submit a complaint through the Utah Department of Insurance's online portal or by sending a written complaint. This creates a formal record, which is important when dealing with situations like a Utah Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

To file a complaint with the Utah Department of Insurance, visit their official website and locate the complaint form. Complete the form with accurate details about your situation, including the name of the insurer and specifics about your claim. Once completed, submit the form online or mail it to the Department. This process is crucial for addressing issues related to a Utah Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.