A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Utah Guaranty or Guarantee of Payment of Rent

Description

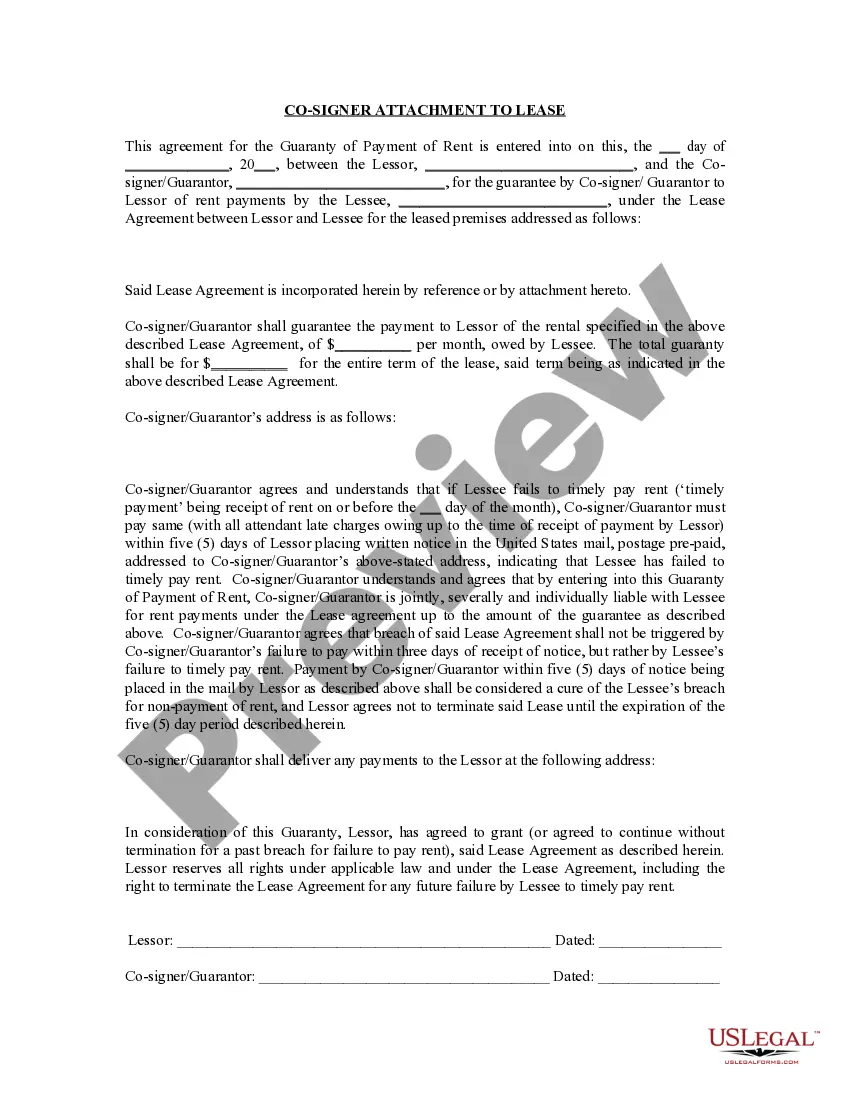

How to fill out Utah Guaranty Or Guarantee Of Payment Of Rent?

Looking for a Utah Guaranty or Guarantee of Payment of Rent on the internet might be stressful. All too often, you see documents that you just think are ok to use, but discover later on they are not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional lawyers in accordance with state requirements. Get any form you’re looking for quickly, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll instantly be included to your My Forms section. In case you don’t have an account, you have to sign up and choose a subscription plan first.

Follow the step-by-step recommendations listed below to download Utah Guaranty or Guarantee of Payment of Rent from our website:

- See the form description and hit Preview (if available) to check whether the form suits your requirements or not.

- If the form is not what you need, find others using the Search field or the listed recommendations.

- If it’s appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- After downloading it, you are able to fill it out, sign and print it.

Get access to 85,000 legal forms straight from our US Legal Forms catalogue. In addition to professionally drafted templates, users can also be supported with step-by-step guidelines regarding how to get, download, and fill out forms.

Form popularity

FAQ

Another form of limited guarantee is sometimes referred to as a floating guarantee, which means that you are personally responsible for a certain sum of money or a certain number of months rent after a default. For example, your liability might be capped at one year's rent.

Being a guarantor involves helping someone else get credit, such as a loan or mortgage. Acting as a guarantor, you guarantee someone else's loan or mortgage by promising to repay the debt if they can't afford to.

Business owners are often required to give a personal guarantee to get a business loan or to lease commercial space for their business. Most business advisors say you should keep business and personal financial matters separate, and the loan is for the business, not for the individual.

Rolling guaranty: this can be a 12 month, 24 month or some other number of months, rolling guaranty. It means that the total exposure is the number of months regardless of how many months are remaining in the lease (unless the remaining months are less than the rolling months.

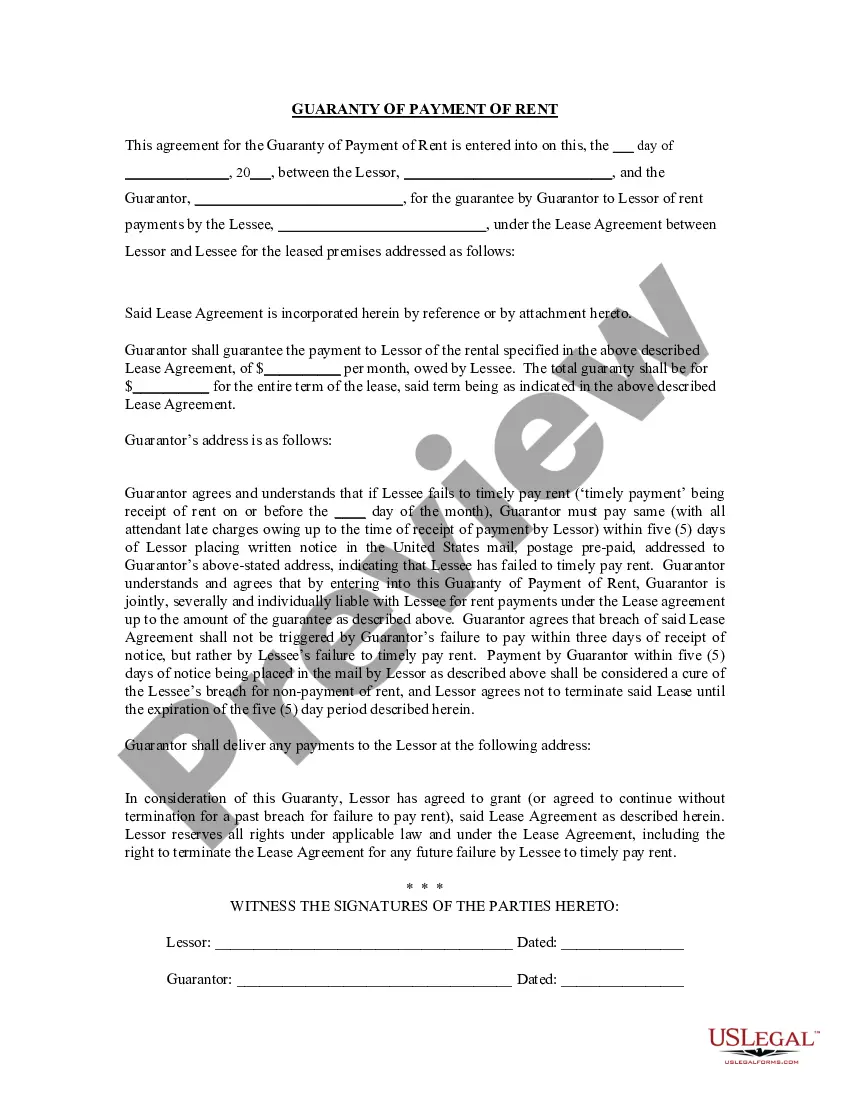

A guaranty of lease is a covenant by the guarantor to be responsible for the obligations of the tenant.In these examples, a selective landlord would not enter into the lease without the tenant offering a creditworthy guarantor.

A guaranty of lease is a covenant by the guarantor to be responsible for the obligations of the tenant.In these examples, a selective landlord would not enter into the lease without the tenant offering a creditworthy guarantor.

It's very common for a guarantee to last as long as the tenancy lasts. So, if the tenant remains in the property for four years, you will continue to be responsible for any arrears or damages during that entire period. Most tenancies will run for a fixed term and will then continue on a month-by-month basis.

A lease guaranty is a separate contract under which a third party guarantor agrees to meet the obligations of the Tenant to the Landlord.If the Tenant fails to pay rent, the Landlord can recover the arrears from the guarantor, usually before seeking damages from Tenant.

Landlords often require a personal or corporate lease guarantee, a separate document executed simultaneously with the lease, which makes the guarantor liable for the tenant's defaults.Landlords want an unconditional and unlimited guarantee, holding the guarantor liable for all of the tenant's defaults.