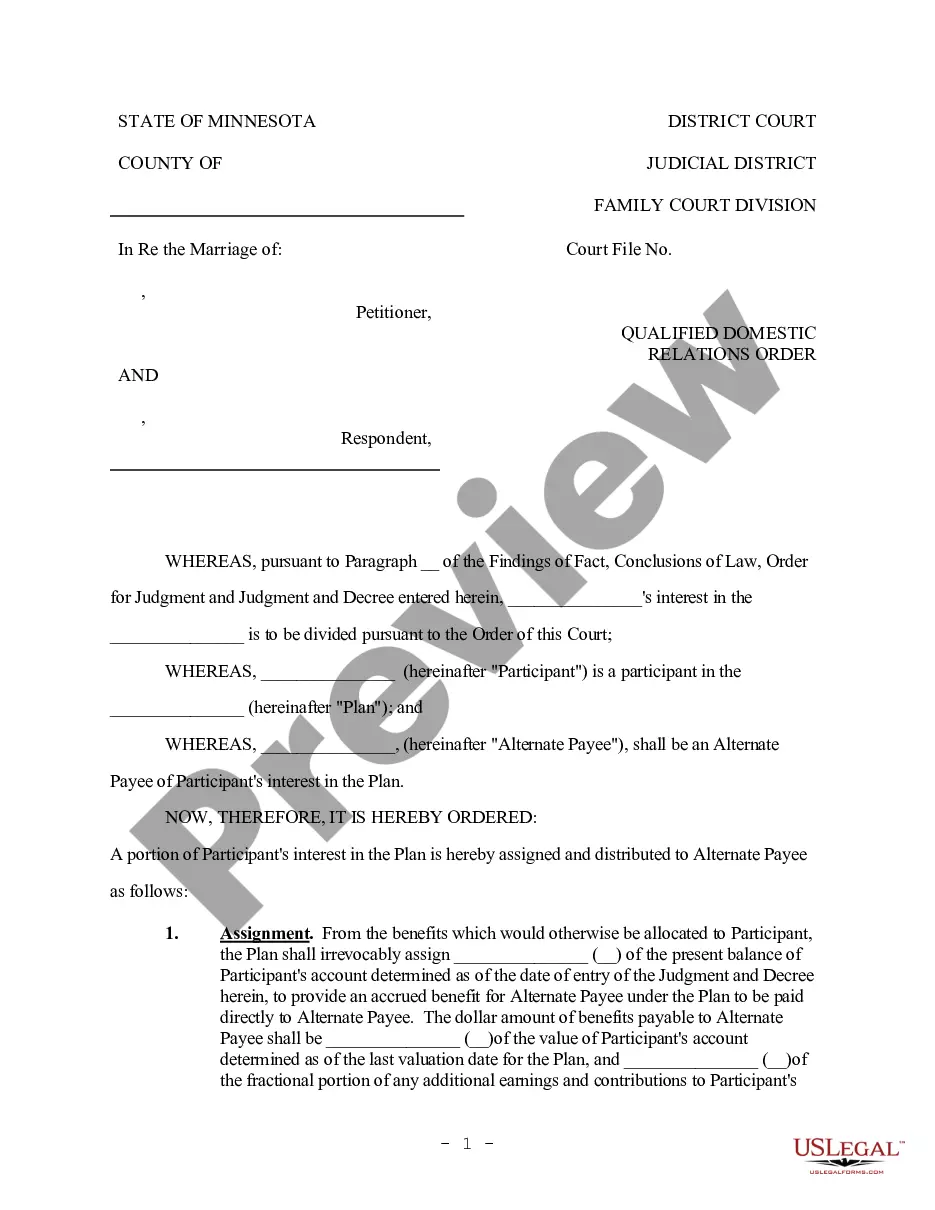

Form 2 Notice of Appeal from Tax Court is a document used to inform the Tax Court of an appeal from a decision made in their court. It is typically filed by the appellant (the person making the appeal) or their representative. It must include the tax court's case number, the name and address of the appellant, the date the decision was made, any additional information the appellant wishes to provide, and the signature of the appellant or their representative. There are two types of Form 2 Notice of Appeal from Tax Court; one for appeals from decisions of the Tax Court of Canada (TCC), and one for appeals from decisions of the Tax Court of New Brunswick (CNB).

Form 2 Notice of appeal from Tax Court

Description

How to fill out Form 2 Notice Of Appeal From Tax Court?

If you’re looking for a way to appropriately prepare the Form 2 Notice of appeal from Tax Court without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every individual and business scenario. Every piece of paperwork you find on our online service is drafted in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Follow these simple guidelines on how to acquire the ready-to-use Form 2 Notice of appeal from Tax Court:

- Make sure the document you see on the page corresponds with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the dropdown to locate an alternative template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your Form 2 Notice of appeal from Tax Court and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it rapidly or print it out to prepare your paper copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

You will get as fair and impartial a hearing in tax court as you would in any other federal court. After you file your petition, it will be at least six months until you are called for trial. While most small cases (see immediately below) are decided within one year, regular cases take much longer.

You can fill out a petition on the Tax Court website and print it, print out the petition form and fill it out, or fill in the petition form contained in the informational packet available from the Court. You may also file a petition online.

Congress created the Tax Court as an independent judicial authority for taxpayers disputing certain IRS determinations. The Tax Court's authority to resolve these disputes is called its jurisdiction. Generally, a taxpayer may file a petition in the Tax Court in response to certain IRS determinations.

What happens after I file my petition? If you filed a paper petition, you will receive a notice of receipt of petition from the Tax Court by mail acknowledging the filing of the petition. That document will tell you the docket number of your case.

A Tax Court Opinion can be cited as legal authority, and the decision can be appealed.

Taxpayers who sue the IRS in U.S. Tax Court can expect a very high probability of at least partial success. Approximately 85% of tax court cases reach a settlement before even going to trial.

While a petition to redetermine liability is one of the more common reasons you may petition the Tax Court, you can also petition for other issues such as a determination or failure to make a determination by the IRS in your innocent spouse relief case, or a disagreement with the results in your collection due process

After the trial, the Tax Court may require that the parties file post-trial briefs, and the Judge ultimately will issue an opinion in the case. It sometimes can take up to a year (or longer) to receive an opinion from the Court.