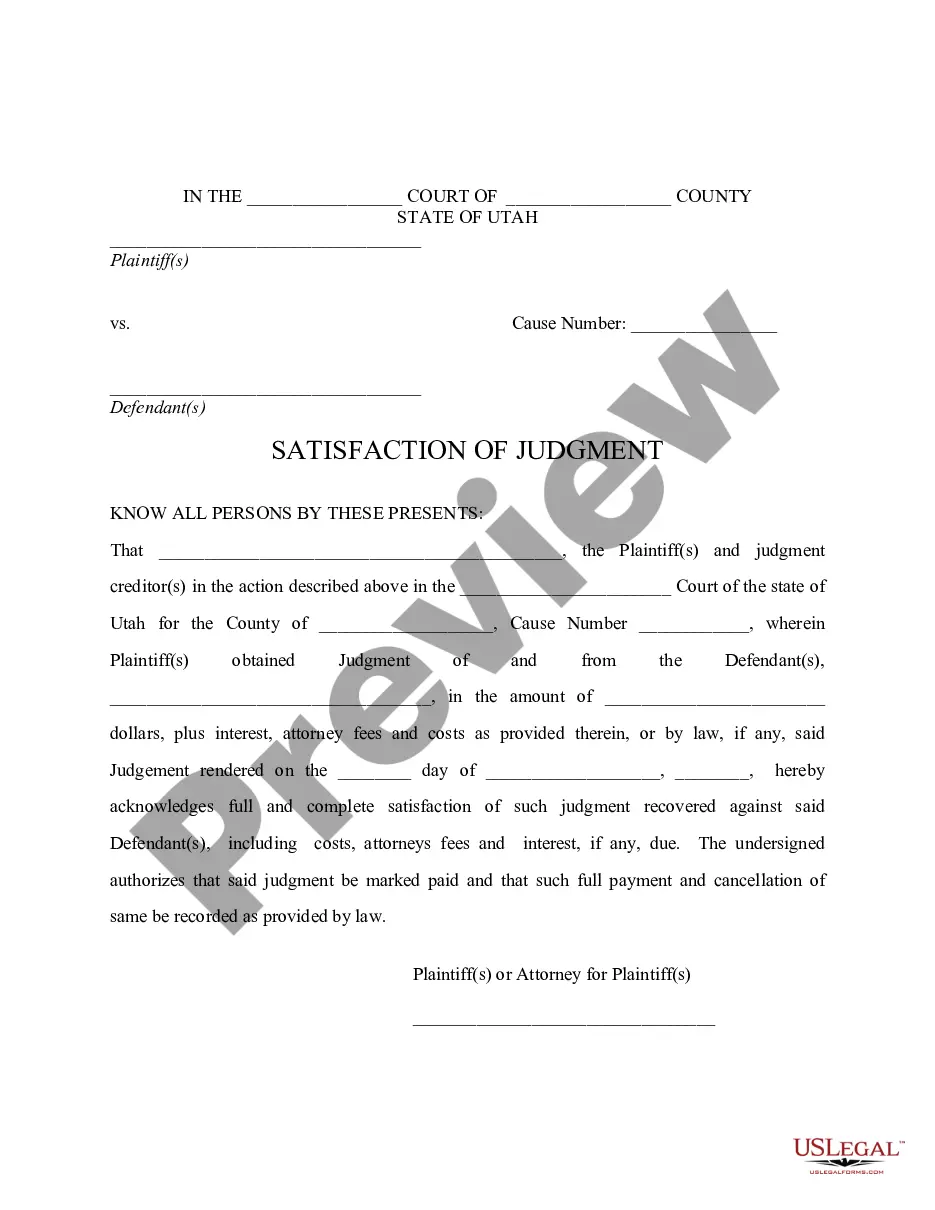

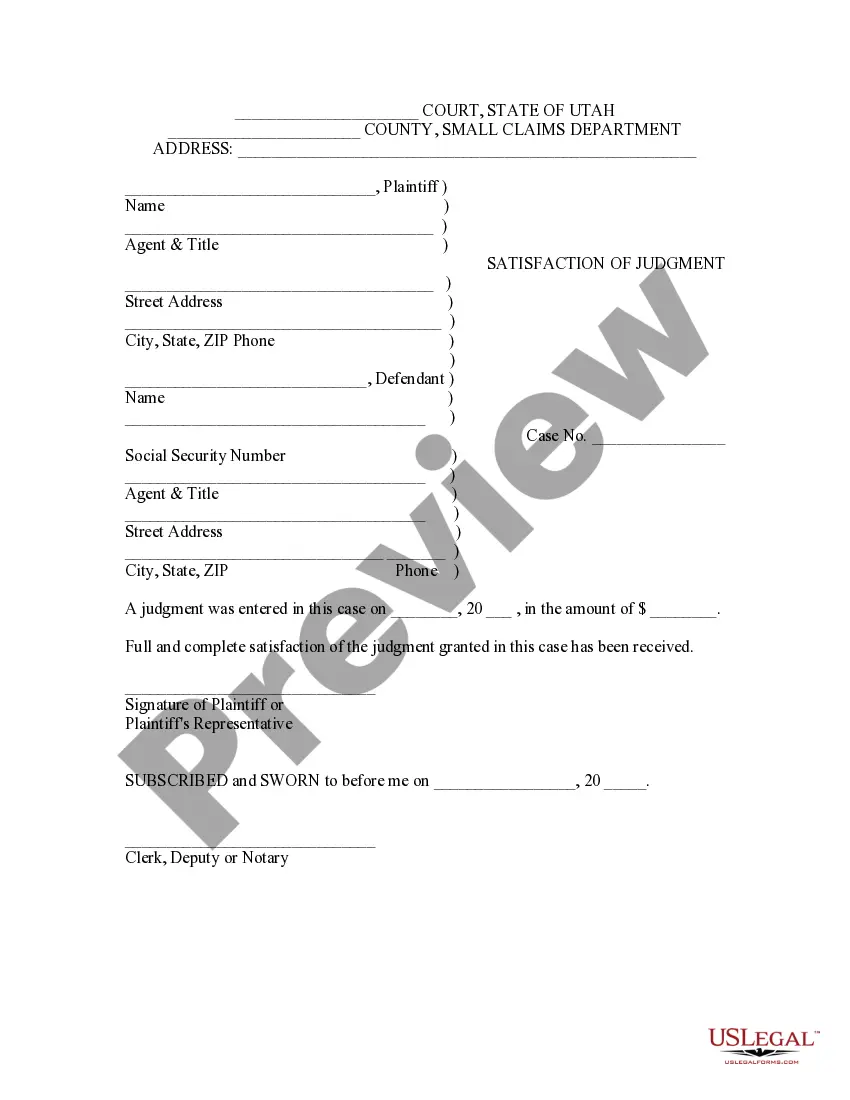

This is a satisfaction of judgment which indicates that a judgment has been paid in full, including all fees, costs and interest. It acknowledges full and complete satisfaction of the judgment and directs that the judgment be marked as paid in full.

Utah Satisfaction of Judgment

Description

How to fill out Utah Satisfaction Of Judgment?

Looking for a Utah Satisfaction of Judgment on the internet can be stressful. All too often, you find files that you just believe are ok to use, but find out later on they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional attorneys in accordance with state requirements. Have any form you’re searching for within minutes, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It will instantly be included to your My Forms section. In case you do not have an account, you need to sign-up and pick a subscription plan first.

Follow the step-by-step recommendations below to download Utah Satisfaction of Judgment from the website:

- Read the form description and press Preview (if available) to verify whether the template suits your expectations or not.

- If the form is not what you need, find others with the help of Search field or the provided recommendations.

- If it is right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via card or PayPal and download the document in a preferable format.

- After getting it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal templates right from our US Legal Forms library. Besides professionally drafted samples, users are also supported with step-by-step guidelines on how to find, download, and complete templates.

Form popularity

FAQ

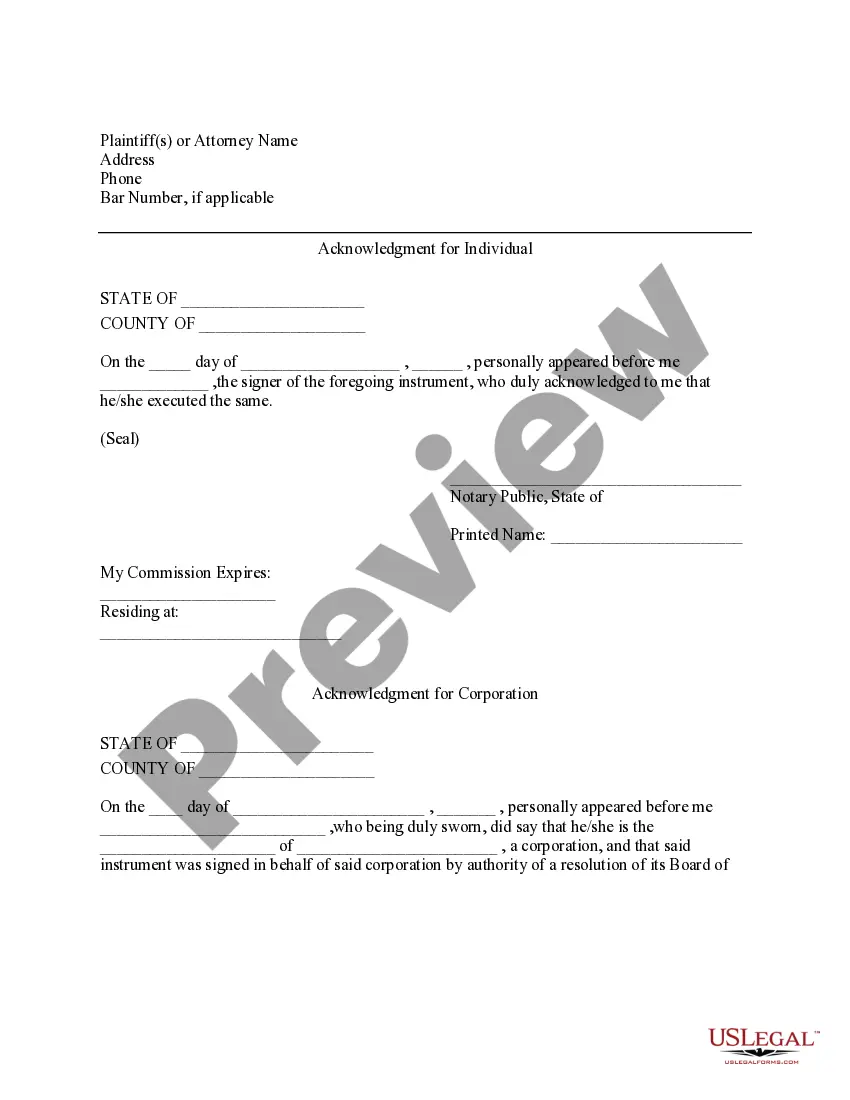

You will need one original, notarized copy for the judgment debtor. If you recorded an abstract of judgment to place a lien against the debtor's real property, you will need an original, notarized copy of your Acknowledgment of Satisfaction of Judgment (EJ-100) for each county where you placed a lien.

While a vacated judgment is typically the best-case scenario, the unfortunate truth is most legitimate judgments satisfied or not aren't going away anytime soon. In fact, judgments will generally remain on your credit report for seven years from the judgment date (the day the judgment was filed) before expiring.

Judgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans.You should pay legitimate judgments and dispute inaccurate judgments to ensure these do not affect your finances unduly.

Once a judgment is paid, whether in installments or a lump sum, a judgment creditor (the person who won the case) must acknowledge that the judgment has been paid by filing a Satisfaction of Judgment form with the court clerk.

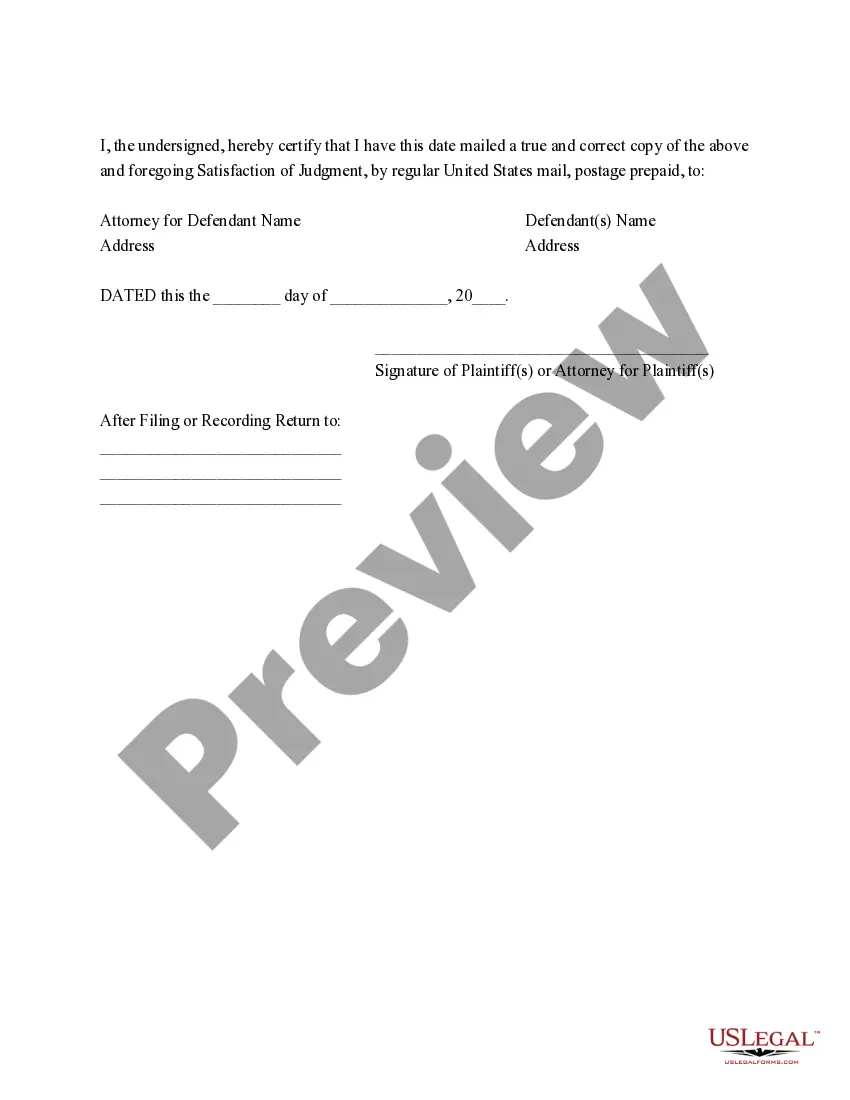

A Satisfaction of Judgment is a document signed by one party acknowledge receipt of the payment. The Satisfaction of Judgment is then filed with the court. This is beneficial to the paying party for multiple reasons. One, the court is put on notice that the debt has been satisfied.

There are a few ways you can satisfy or avoid a lien altogether. The firstand most obviousoption is to repay the debt. If you pay off your obligation, the creditor will remove the lien. This is done by filing a release through the same place the lien was recordedthe county or state.

A Satisfaction of Judgment is a document signed by one party acknowledge receipt of the payment. The Satisfaction of Judgment is then filed with the court. This is beneficial to the paying party for multiple reasons. One, the court is put on notice that the debt has been satisfied.

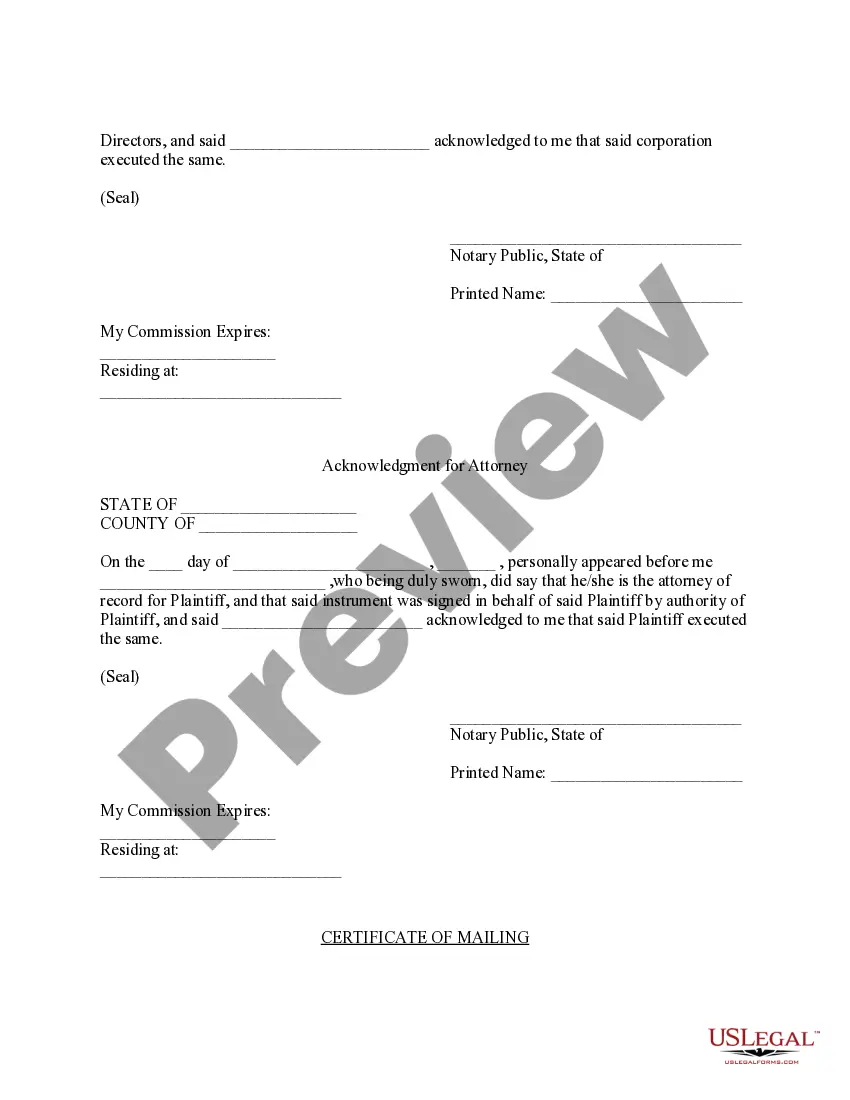

Satisfaction by Levy A judgment creditor's obligation to give or file an acknowledgement of satisfaction arises only when the judgment creditor received the full amount required to satisfy the judgment from the levying officer.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

A document signed by the party who is owed money under a court judgment (called the judgment creditor) stating that the full amount due on the judgment has been paid.