This form is a Warranty Deed where the Grantor is a Trust and the Grantee is an individual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Utah Warranty Deed from a Trust to an Individual

Description

How to fill out Utah Warranty Deed From A Trust To An Individual?

Looking for a Utah Warranty Deed from a Trust to an Individual online can be stressful. All too often, you see files that you think are fine to use, but discover later they’re not. US Legal Forms offers over 85,000 state-specific legal and tax forms drafted by professional lawyers in accordance with state requirements. Have any document you’re searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll automatically be added to your My Forms section. If you don’t have an account, you have to sign up and choose a subscription plan first.

Follow the step-by-step recommendations listed below to download Utah Warranty Deed from a Trust to an Individual from the website:

- Read the document description and hit Preview (if available) to verify whether the form suits your expectations or not.

- If the form is not what you need, get others with the help of Search engine or the listed recommendations.

- If it’s appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- Right after getting it, you may fill it out, sign and print it.

Get access to 85,000 legal templates right from our US Legal Forms catalogue. In addition to professionally drafted templates, users will also be supported with step-by-step guidelines on how to find, download, and fill out forms.

Form popularity

FAQ

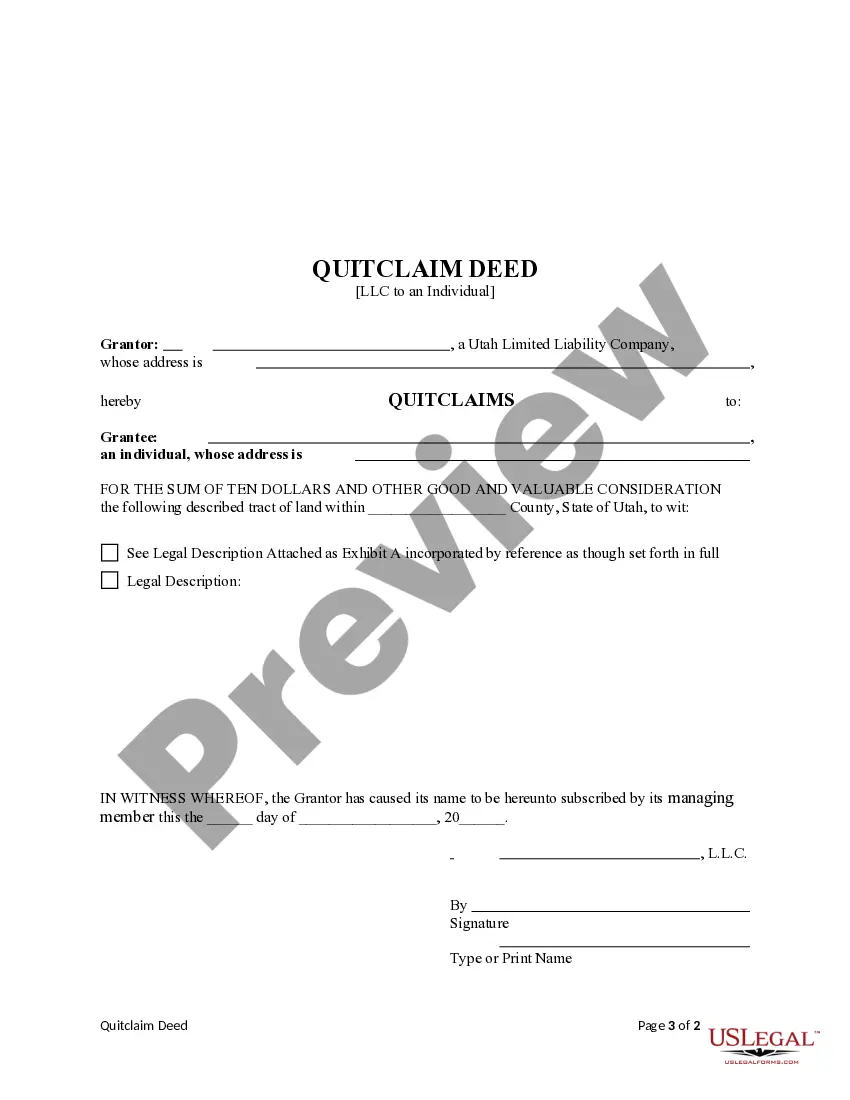

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

A trustee deed offers no such warranties about the title.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.