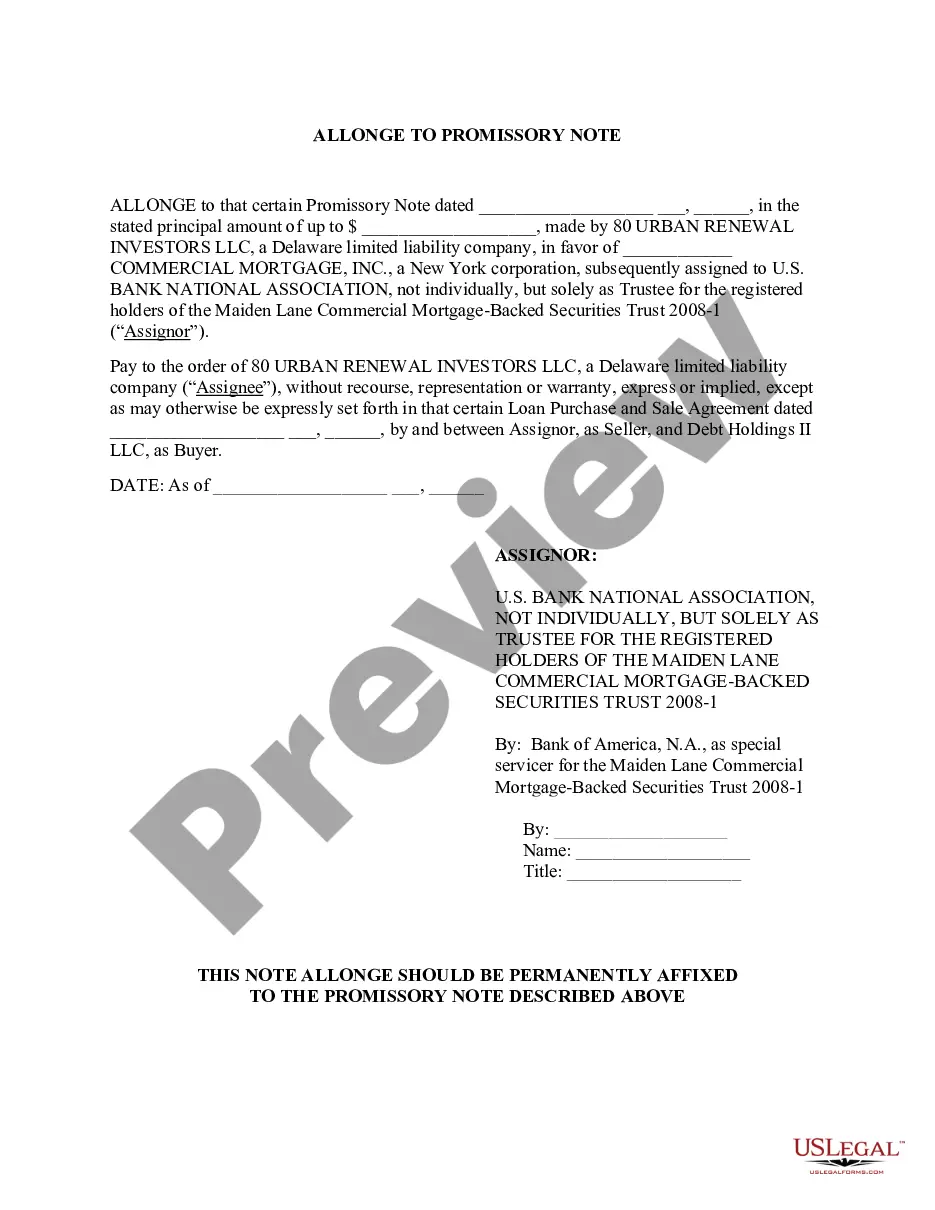

Allonge to Promissory Note

Description

An allonge to promissory note is different from an assignment. An assignment in this context is what gives a party the legal designation and right to move forward with legal action on a property, whereas an allonge is an endorsement that allows you to collect on the promissory note.

Definition and meaning

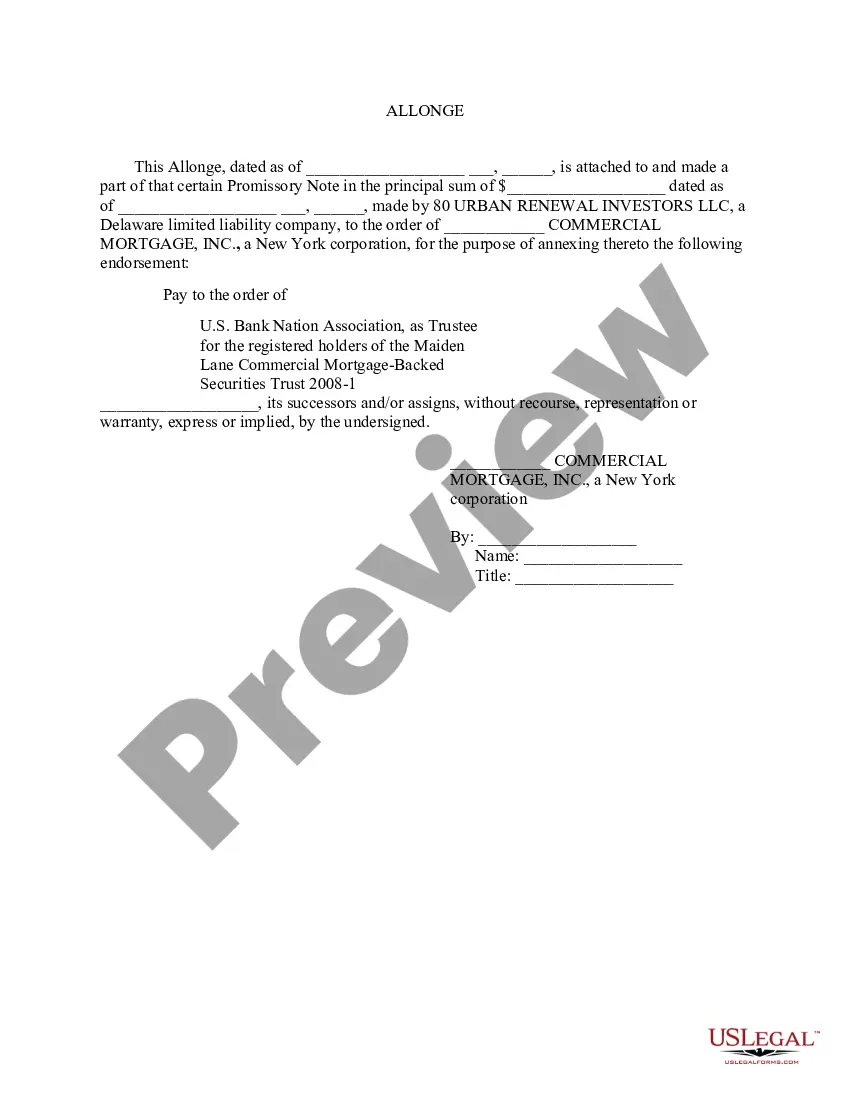

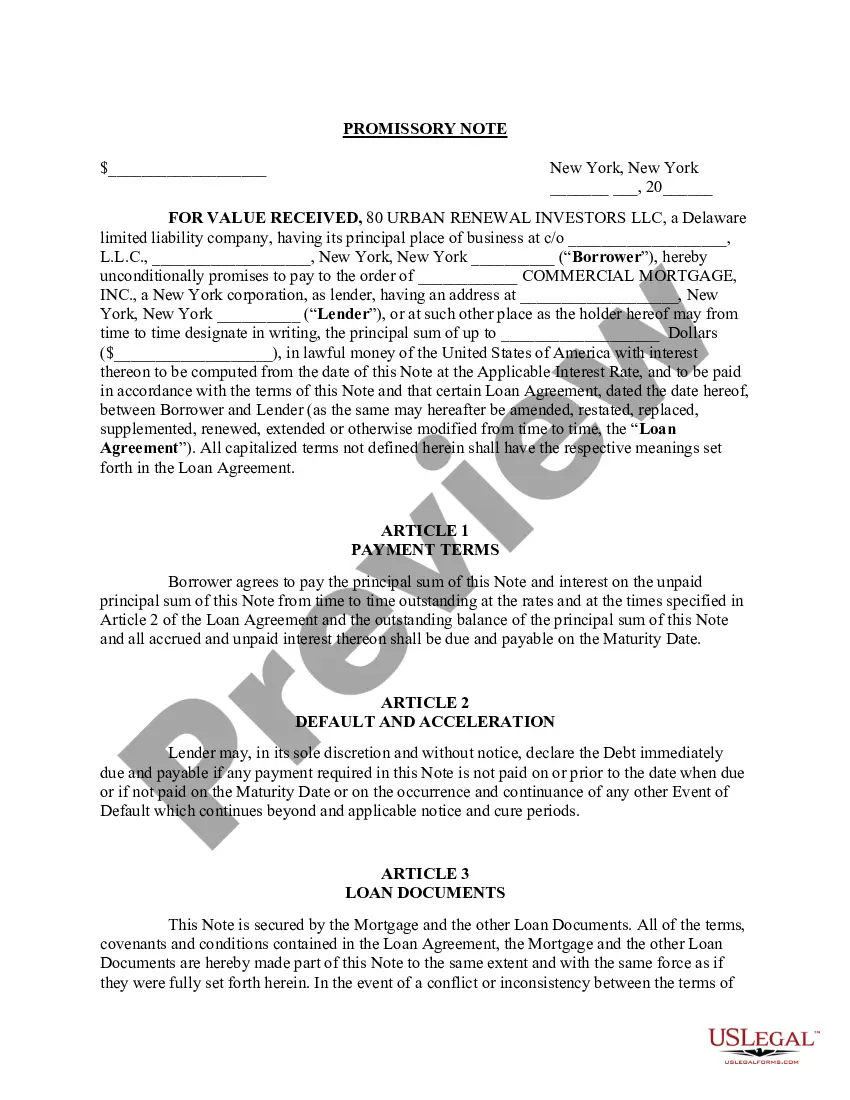

An Allonge to Promissory Note is an attachment that serves as a method to add or modify endorsements or assignments to an existing promissory note. This document is crucial in situations where the original note cannot be amended directly, allowing for seamless legal recognition of changes related to payments or transfer of obligation. Essentially, the Allonge operates as a physical extension of the note, ensuring legal compliance while maintaining clarity in financial transactions.

How to complete a form

When filling out an Allonge to Promissory Note, follow these steps:

- Begin with the date section, indicating the effective date of the allonge.

- Specify the original promissory note details, including the date it was created and the amount involved.

- Identify the parties involved, including the Assignor and Assignee, along with their respective roles.

- Clearly state the terms of the assignment or endorsement detailed in the form.

- Ensure all parties sign and date the document, completing the transaction.

It is advisable to review the completed form for accuracy before finalizing any signatures.

Who should use this form

This form is primarily used by individuals or entities involved in financial transactions where a promissory note needs modification. Typical users include:

- Borrowers who need to make changes to payment terms or assignments.

- Lenders who are transferring their rights under the promissory note.

- Attorneys representing clients in business or personal financial matters.

- Financial institutions managing securities that involve promissory notes.

Ensuring these parties understand the use of this form is key to protecting their legal rights.

Key components of the form

When dealing with an Allonge to Promissory Note, several key components must be included to ensure its validity:

- Date: The effective date of the allonge must be specified.

- Details of the original promissory note: This includes the note's date, principal amount, and involved parties.

- Signatures: All necessary parties must sign the allonge to establish agreement.

- Assignment terms: Clear wording indicating the transfer or endorsement of rights.

These components are essential to uphold the integrity and enforceability of the allonge in any legal context.

Common mistakes to avoid when using this form

Users should be cautious to avoid the following common mistakes when completing the Allonge to Promissory Note:

- Failing to date the allonge properly, which may lead to confusion about the effective date.

- Neglecting to include accurate details of the original promissory note.

- Not ensuring that all parties involved sign the document, which invalidates the changes.

- Overlooking state-specific requirements that may affect the form's validity.

By being aware of these pitfalls, users can enhance the reliability of the allonge and its legal standing.

What documents you may need alongside this one

In conjunction with the Allonge to Promissory Note, it is advisable to have certain documents readily available to facilitate a smooth transaction:

- The original promissory note that the allonge modifies.

- Any prior amendments or modifications related to the promissory note.

- Proof of ownership or assignment agreements that may correlate with the transfer of rights.

- Legal documents related to the transaction, such as loan agreements or mortgage documents.

Having these documents on hand can aid in resolving any disputes that may arise and help maintain accurate records.