Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Self-Employed Independent Contractor Payment Schedule?

Among countless free and paid samples that you find on the internet, you can't be certain about their accuracy and reliability. For example, who created them or if they are skilled enough to deal with what you need them to. Always keep relaxed and use US Legal Forms! Discover Self-Employed Independent Contractor Payment Schedule samples developed by professional attorneys and prevent the high-priced and time-consuming process of looking for an lawyer or attorney and after that having to pay them to write a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you’re searching for. You'll also be able to access all your earlier downloaded examples in the My Forms menu.

If you’re making use of our platform for the first time, follow the instructions listed below to get your Self-Employed Independent Contractor Payment Schedule fast:

- Make certain that the document you see applies in the state where you live.

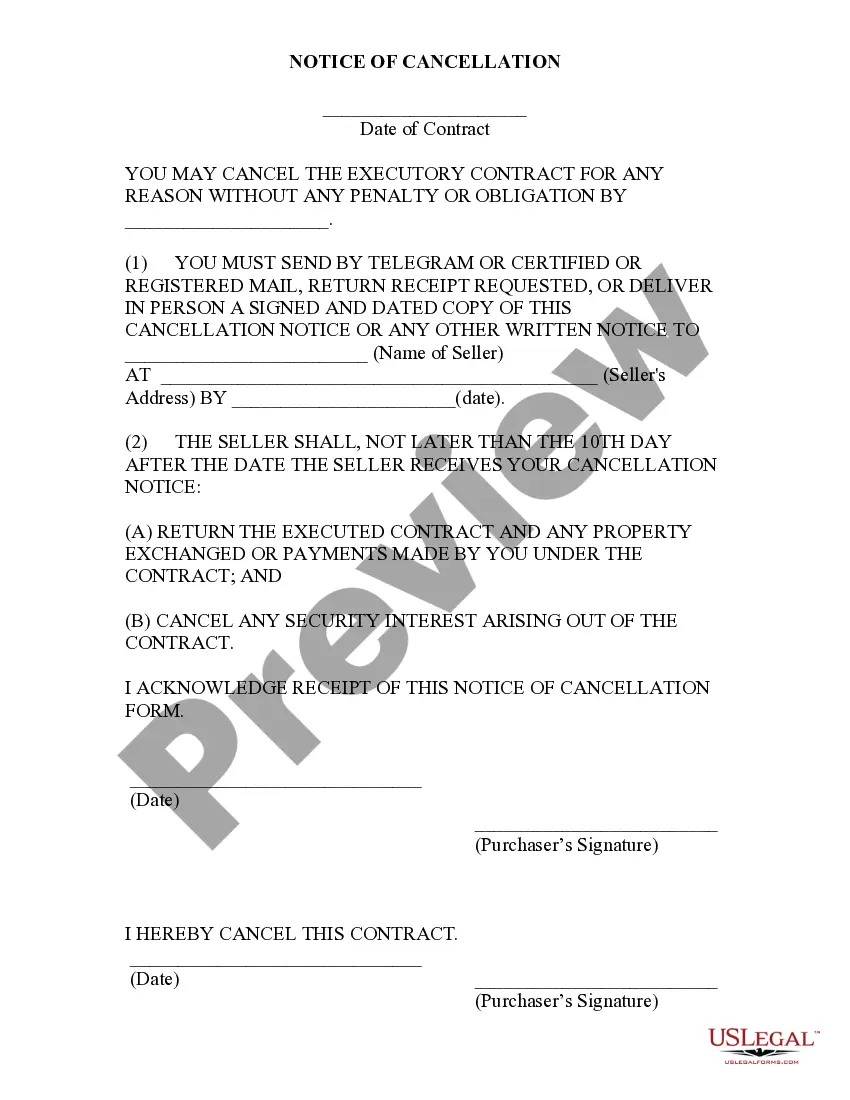

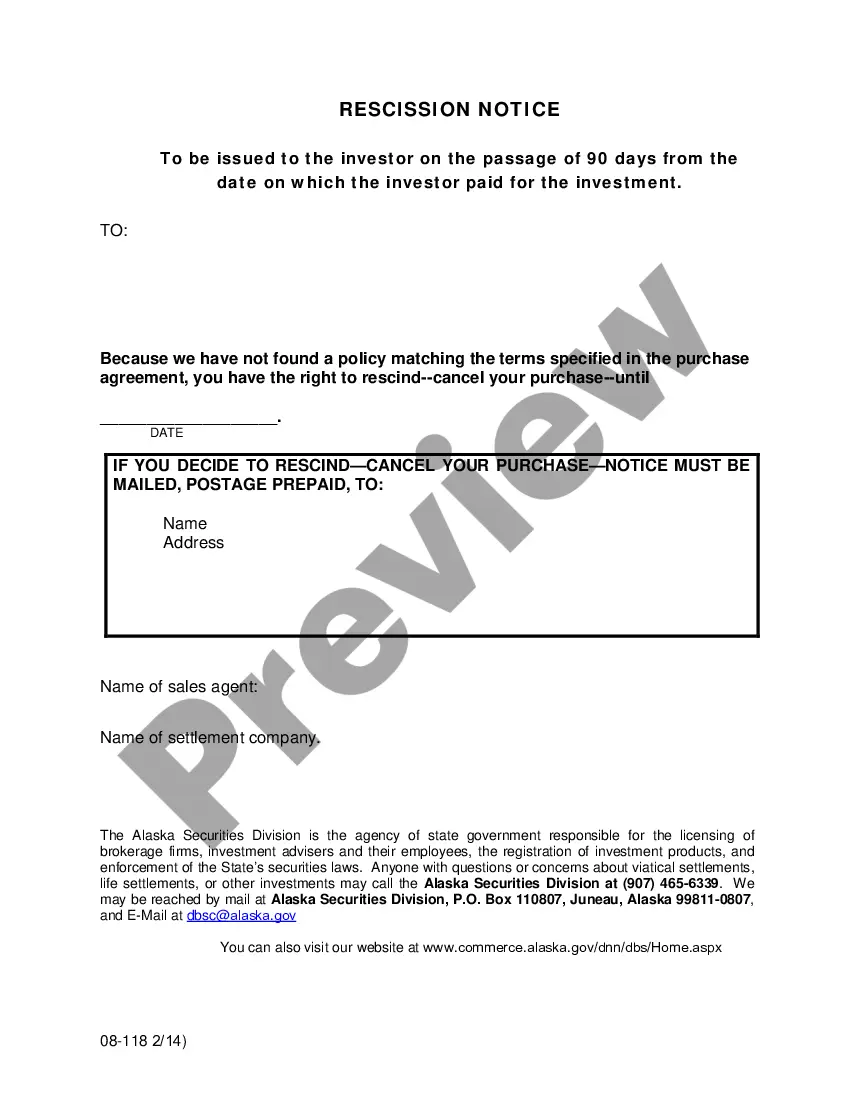

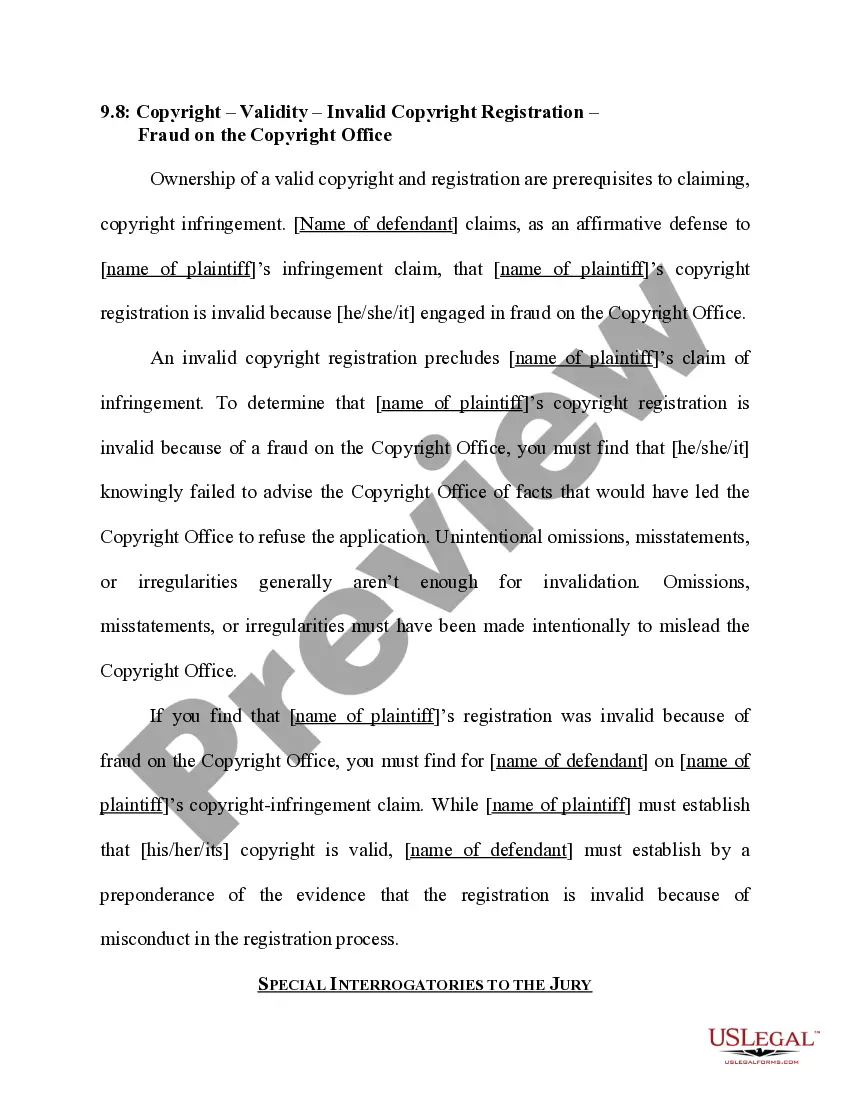

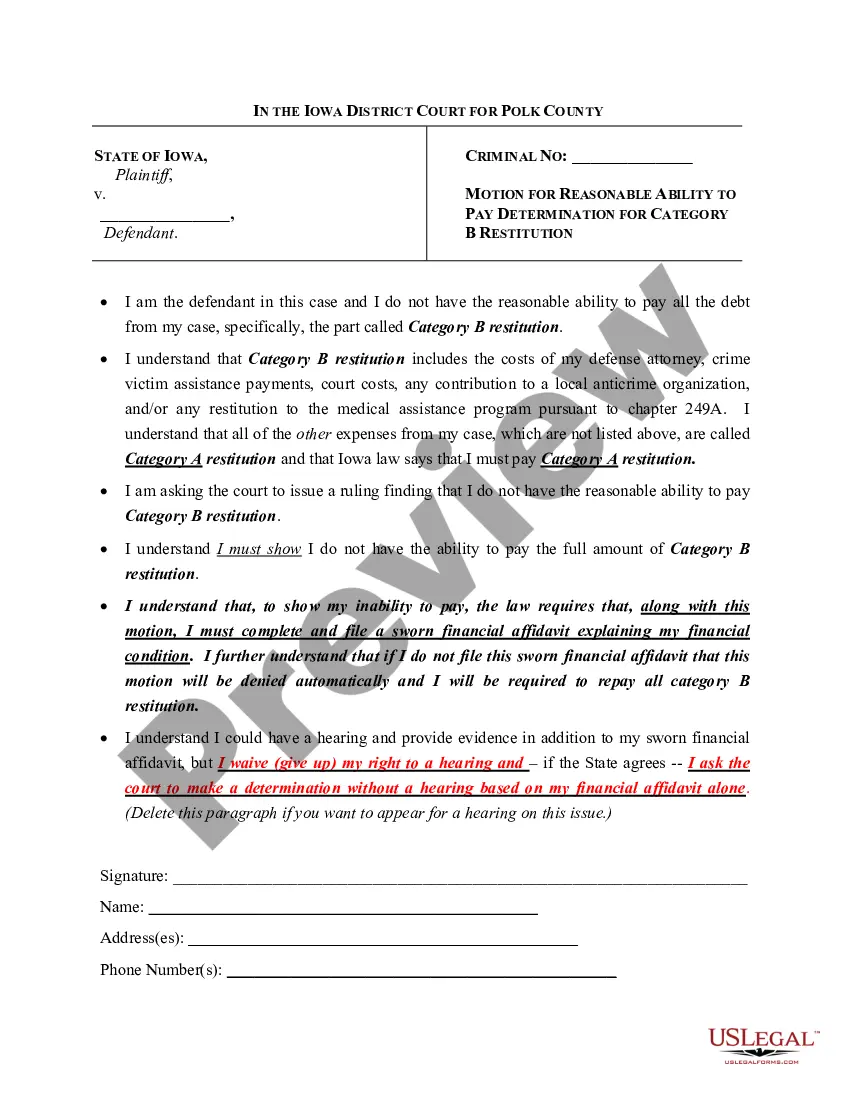

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the purchasing process or find another sample using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

As soon as you’ve signed up and bought your subscription, you can utilize your Self-Employed Independent Contractor Payment Schedule as many times as you need or for as long as it continues to be valid where you live. Change it with your preferred editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Is a 1099 the Same as a Schedule C? A form 1099 is not the same as a Schedule C form.It will then file the 1099 with the government, and provide you a copy too so that you can do your personal income tax return using the figure provided.

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.You may need to make estimated tax payments.

1099 employees are self-employed independent contractors. They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax return.The employer withholds income taxes from the employee's paycheck and has a significant degree of control over the employee's work.

An owner must pay a direct contractor within 30 days of the contractor's request for payment.

Schedule C is the tax form filed by most sole proprietors. As you can tell from its title, "Profit or Loss From Business," it´s used to report both income and losses. Many times, Schedule C filers are self-employed taxpayers who are just getting their businesses started.

When you first engage with a 1099 worker, you'll also need to consider some additional payment agreements, such as: How often is payment due? Upon receipt of the invoice, net 15 and net 30 days are the most common payment terms.

A 1099 job is a job that is performed by a self-employed contractor or business owner as opposed to an employee hired by a business or self-employed contractor. The 1099 form is the Internal Revenue Service form you fill out for the person doing the work. It denotes how much money was paid for the service.

Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. And If You Have a Business Loss.

When you earn money by performing work, that income is usually subject to social security and Medicare taxes.When you receive a 1099-MISC with income in Box 7 that is for nonemployee compensation, the IRS requires that this income be reported on a Schedule C.