Moving Services Contract - Self-Employed

Description

Definition and meaning

A Moving Services Contract for Self-Employed individuals is a legal document that outlines the terms between an employer and a mover. This agreement specifies the services to be provided by the mover, compensation rates, and the conditions under which the work will be performed. It is essential for ensuring that both parties understand their rights and obligations during the moving process.

Key components of the form

The Moving Services Contract includes several critical components:

- Work to be performed: Details about the specific moving services the mover will provide.

- Completion date: The agreed-upon date by which the moving services must be completed.

- Compensation: Information on how much the mover will be paid and the payment schedule.

- Independent contractor status: Acknowledgment that the mover is not an employee but an independent contractor.

- Insurance requirements: Any necessary insurance coverage the mover must obtain.

- Termination clause: Conditions under which either party may terminate the agreement.

Who should use this form

This form is designed for individuals or businesses engaging the services of a self-employed mover. It is applicable for:

- Homeowners planning to hire movers for residential relocation.

- Businesses needing to transport office equipment and furniture.

- Anyone requiring moving services for special events or temporary relocations.

Using this form helps ensure clarity and legal protection for both the employer and the mover.

Common mistakes to avoid when using this form

When filling out the Moving Services Contract, pay attention to the following common pitfalls:

- Inadequate service description: Failing to clearly define the services the mover will provide can lead to disputes.

- Ambiguous payment terms: Not specifying the payment schedule may cause confusion about compensation.

- Ignoring insurance requirements: Skipping insurance clauses may expose one party to unnecessary risks.

- Neglecting to include termination clauses: Failing to define how either party can terminate the contract can lead to complications.

Legal use and context

The Moving Services Contract is a legally binding agreement that serves to protect both parties involved in a moving arrangement. It is essential to complete the form accurately to avoid any legal disputes. The contract should be governed by the laws of the jurisdiction in which the moving services are performed. Consulting a legal professional can help clarify any state-specific regulations that may apply.

What to expect during notarization or witnessing

While notarization may not be required for all Moving Services Contracts, having the agreement notarized can enhance its legal validity. Here's what to expect:

- The parties involved will need to appear in front of a notary public.

- All parties should bring identification to verify their identities.

- The notary will review the document, ensure it is complete, and witness the signing.

- Once signed, the notary will affix their seal and provide a signed certificate of acknowledgment.

Having the document witnessed can provide additional assurance that the terms were agreed upon freely and voluntarily.

How to fill out Moving Services Contract - Self-Employed?

Among lots of free and paid samples that you find on the internet, you can't be sure about their reliability. For example, who made them or if they’re qualified enough to take care of what you need those to. Keep calm and make use of US Legal Forms! Discover Moving Services Contract - Self-Employed samples created by professional attorneys and get away from the high-priced and time-consuming procedure of looking for an lawyer and then having to pay them to write a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you’re searching for. You'll also be able to access your earlier acquired samples in the My Forms menu.

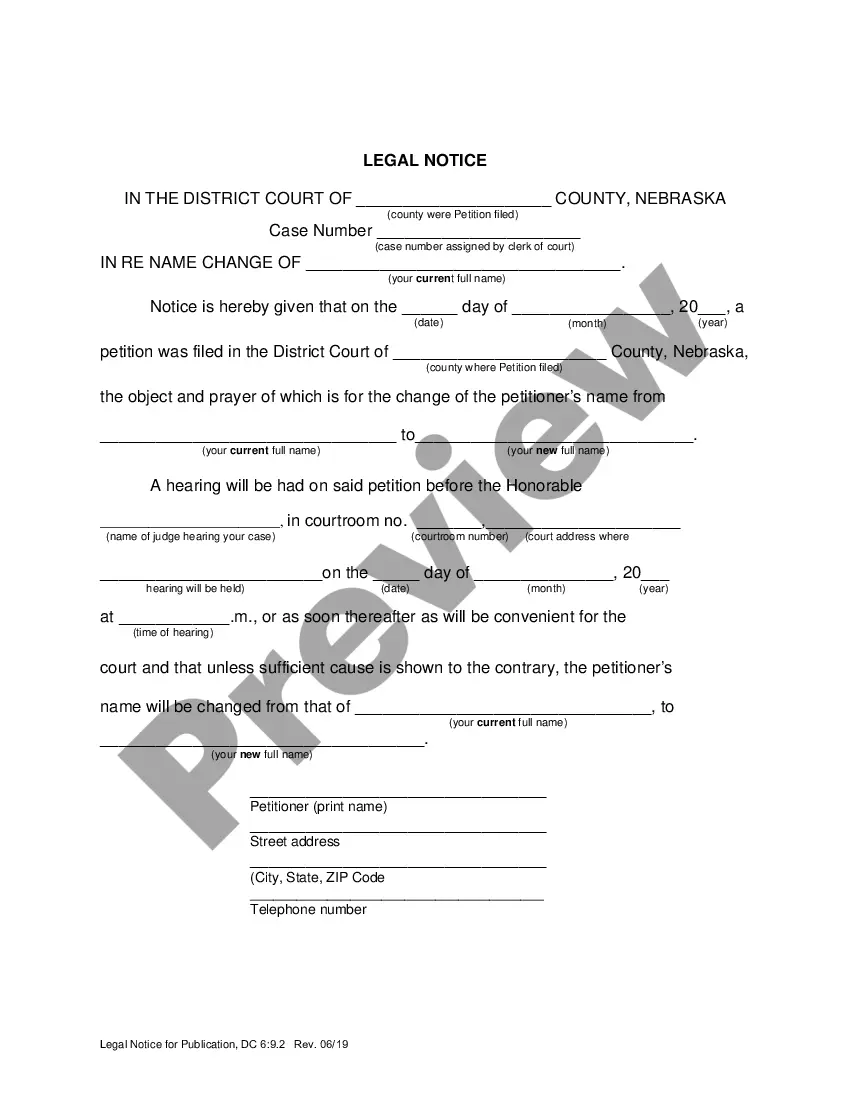

If you’re utilizing our website for the first time, follow the instructions listed below to get your Moving Services Contract - Self-Employed with ease:

- Ensure that the file you discover is valid in your state.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another sample utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

When you have signed up and paid for your subscription, you may use your Moving Services Contract - Self-Employed as many times as you need or for as long as it remains valid in your state. Change it with your preferred offline or online editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

An attorney or accountant who has his or her own office, advertises in the yellow pages of the phone book under Attorneys or Accountants, bills clients by the hour, is engaged by the job or paid an annual retainer, and can hire a substitute to do the work is an example of an independent contractor.

By the hour. For local moves within 50 miles, you can expect to pay movers by the hour. If you have two people handling the move, average moving costs should be between $80 and $100 per hour. You can expect to pay more per hour for a larger crew, but you'll likely finish faster, so costs tend to even out.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.

Unlike contractors and subcontractors who are brought in by a client to work on a specific project, self-employed people work for their own clients and are their own bosses. In general, the self-employed have a little more freedom than contractors when it comes to setting their schedules.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed.However, your earnings as an employee may be subject to FICA (Social Security tax and Medicare) and income tax withholding.

As an independent contractor that is paying their own expenses and being paid a percentage of the move, they may make more money on some jobs and less on others (profit/loss). An employee does not have this risk, they are paid the same amount no matter what.

In the last year alone, the following well-recognized companies have been involved in independent contractor misclassification lawsuits: FedEx, Macy's, the NFL, Sleepy's, Penthouse, Lowe's, Jani-King, DirecTV, BMW and SuperShuttle.