Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Definition and meaning

The Request for Loan Modification RMA Under Home Affordable Modification Program (HAMP) is a formal document used by homeowners seeking to modify the terms of their existing mortgage loans. This program was established to assist individuals struggling with mortgage payments due to financial hardships, allowing them to request more manageable loan terms.

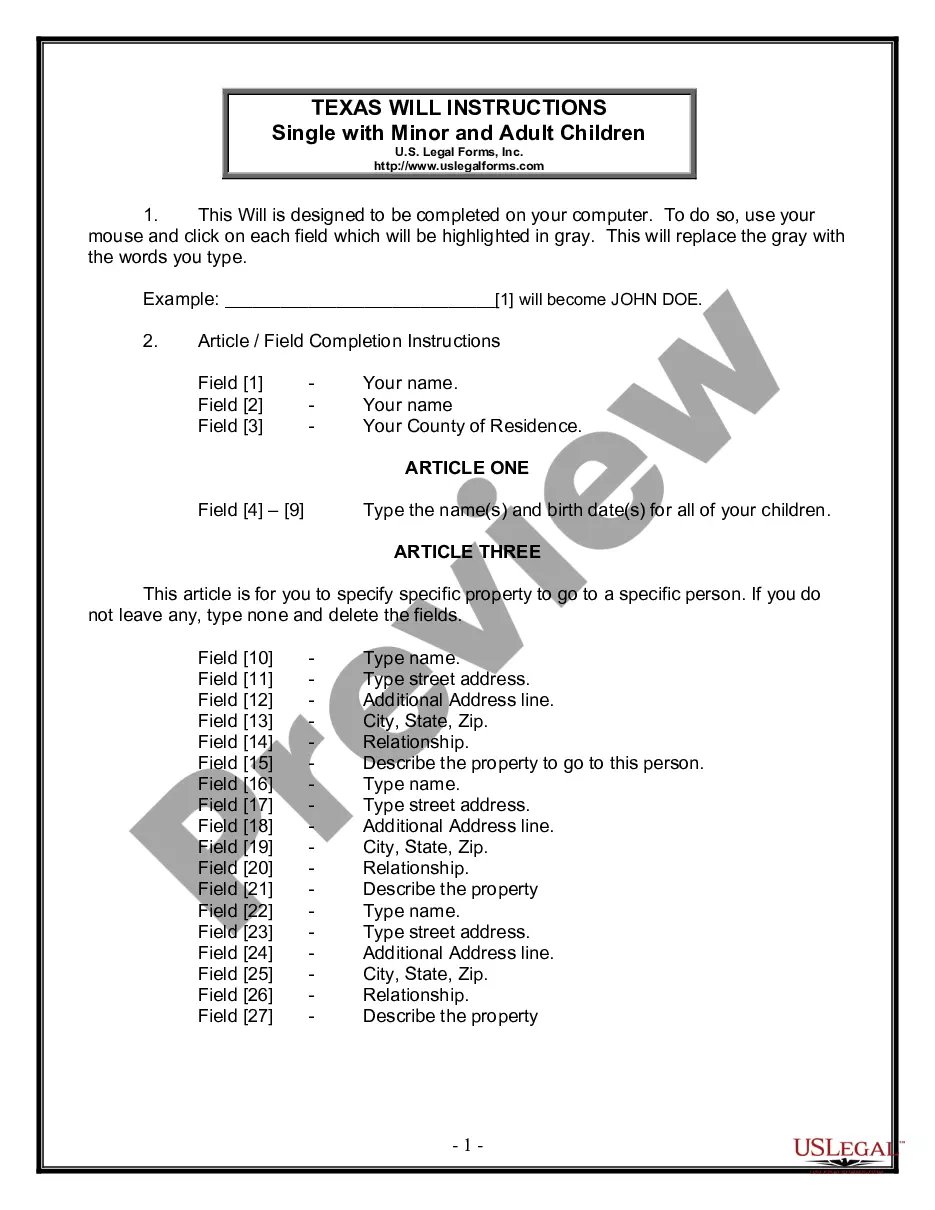

How to complete a form

Filling out the Request for Loan Modification form involves the following steps:

- Gather all necessary personal financial information.

- Provide the loan identification number and details of the property.

- List your household income and monthly expenses accurately.

- Complete the hardship affidavit section by describing your financial difficulties.

- Sign and date the form at the end to confirm the truthfulness of the provided information.

Who should use this form

This form is designed for homeowners who are experiencing financial difficulties and wish to lower their monthly mortgage payments. It is particularly suitable for individuals who have experienced job loss, reduced income, or other financial hardships that hinder their ability to maintain their current payment schedule.

Key components of the form

The Request for Loan Modification form comprises several essential sections:

- Borrower Information: Information about the borrower and co-borrower, including names, contact details, and social security numbers.

- Property Details: Information regarding the property, including its status and occupancy type.

- Financial Information: A detailed account of the borrower's income, expenses, and any other debts.

- Hardship Affidavit: A declaration of the reasons for seeking modification, detailing financial challenges faced.

Common mistakes to avoid when using this form

When filling out the Request for Loan Modification, consider the following common pitfalls:

- Failing to provide complete and accurate information.

- Omitting required supporting documents, which may delay the processing.

- Not signing the form, leading to automatic rejection.

- Missing deadlines for submission, which could jeopardize your eligibility.

Form popularity

FAQ

Homeowners go through the process of a loan modification to stay afloat in times that their mortgage payments are becoming too difficult to maintain. It is possible to refinance the loan again in the future, but do not expect it to come without challenges.

All modifications be in writing. All parties involved sign the modification. In appropriate cases, the modification should be recorded. The title company and attorneys be involved early in the process to properly structure the modification to protect the lender's interest at the lowest cost.

A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one.Loan term changes: If you're having trouble making your monthly payments, your lender may modify your loan and extend your term.

An income and expenses financial worksheet. tax returns (often, two years' worth) recent pay stubs or a profit and loss statement. proof of any other income (including alimony, child support, Social Security, disability, etc.) recent bank statements, and.

HAMP borrowers can also refinance if there is a clear benefit. "A borrower who has applied for or received a loan modification is eligible to refinance under DU Refi Plus" (this is Fannie's name for the HARP program).The terms of the modified loan (trial or permanent) must be used for this comparison.

HAMP is designed specifically to help homeowners impacted by financial hardship. With HAMP, the loan is modified to make the monthly mortgage payment no more than 31% of the Borrower's Gross (pre-tax) Monthly Income. If eligible, the modification permanently changes the original terms of the mortgage.

The loan modification underwriter will analyze and review the particular circumstances which justify a loan modification. The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay.

A loan modification can result in an initial drop in your credit score, but at the same time, it's going to have a far less negative impact than a foreclosure, bankruptcy or a string of late payments.If it shows up as not fulfilling the original terms of your loan, that can have a negative effect on your credit.

HAMP's goal is to offer homeowners who are at risk of foreclosure reduced monthly mortgage payments that are affordable and sustainable over the long-term.HAMP was designed to help families who are struggling to remain in their homes and show: Documented financial hardship.