Cooperative Loan Recognition Agreement

Description

Key Concepts & Definitions

Cooperative Loan Recognition Agreement: An agreement that is critical in cooperative housing contexts, particularly in New York. It outlines terms under which a lending body recognizes the cooperative (coop) corporation's proprietary lease.

Recognition Agreement: Also known as an Aztech Recognition Agreement, it is specifically designed for transactions involving cooperative apartments where the recognition between the lender, borrower, and coop corporation is formally established.

Proprietary Lease: A form of lease agreement in cooperative housing that grants the tenant (who is also an owner of shares in the coop) the right to use a specific housing unit.

Share Loan: Often associated with cooperative apartments, this is a loan taken to purchase shares in a cooperative building which entail the right to occupy a specific unit.

Step-by-Step Guide to Processing a Cooperative Loan Recognition Agreement

- Identify the Parties: Ensure all involved parties, the coop corporation, borrower, and lender are correctly identified and agree to move forward.

- Review Borrower's Requirements: Confirm that the borrower meets all necessary financial criteria as stipulated by entities like Fannie Mae and the coop corporation.

- Document Preparation: The recognition agreement should be prepared, often involving legal counsel to ensure all ownership clauses and coop rules are properly integrated.

- Approval by Coop Corporation: The agreement must be approved by the coop board, who will verify the terms align with the corporation's guidelines regarding real estate transactions.

- Finalization and Signing: Upon approval, all parties sign the agreement, which then governs the relationship between the borrower and the coop corporation regarding the share loan and mortgage payments.

Risk Analysis of Cooperative Loan Recognition Agreements

- Financial Uncertainty: Changes in the borrower's financial status can impact the ability to meet mortgage payments, risking default.

- Real Estate Market Volatility: Fluctuations in the real estate market, particularly in volatile markets like New York, can affect property values and equity.

- Regulatory Changes: Amendments to housing laws and regulations by entities such as Fannie Mae might alter fundamental aspects of cooperative loans and recognition agreements, requiring adaptations.

- Coop Corporation Rules: Stringent coop corporation rules and unexpected changes in proprietary lease terms could significantly impact the agreement's efficacy and the borrowers continued occupancy.

FAQ

What is the significance of a recognition agreement in a cooperative loan? It ensures that all partiesthe lender, the borrower, and the coopare aligned, which secures the lender's interest in the borrower's proprietary lease and obligations.

How do Fannie Maes rules affect cooperative loans? Fannie Mae provides specific guidelines regarding the eligibility of borrowers and properties which must be adhered to, ensuring the stability and predictability of the lending process in cooperatives.

Can someone be denied a proprietary lease under a cooperative loan agreement? Yes, if a cooperative board finds that a prospective borrower doesnt meet the legal or financial standards, or the rules stipulated in the coop's bylaws, the lease and subsequent recognition agreement may not be approved.

How to fill out Cooperative Loan Recognition Agreement?

Use the most extensive legal library of forms. US Legal Forms is the perfect platform for finding updated Cooperative Loan Recognition Agreement templates. Our service provides a huge number of legal forms drafted by certified lawyers and sorted by state.

To obtain a sample from US Legal Forms, users only need to sign up for a free account first. If you’re already registered on our platform, log in and choose the document you are looking for and buy it. After purchasing templates, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the steps below:

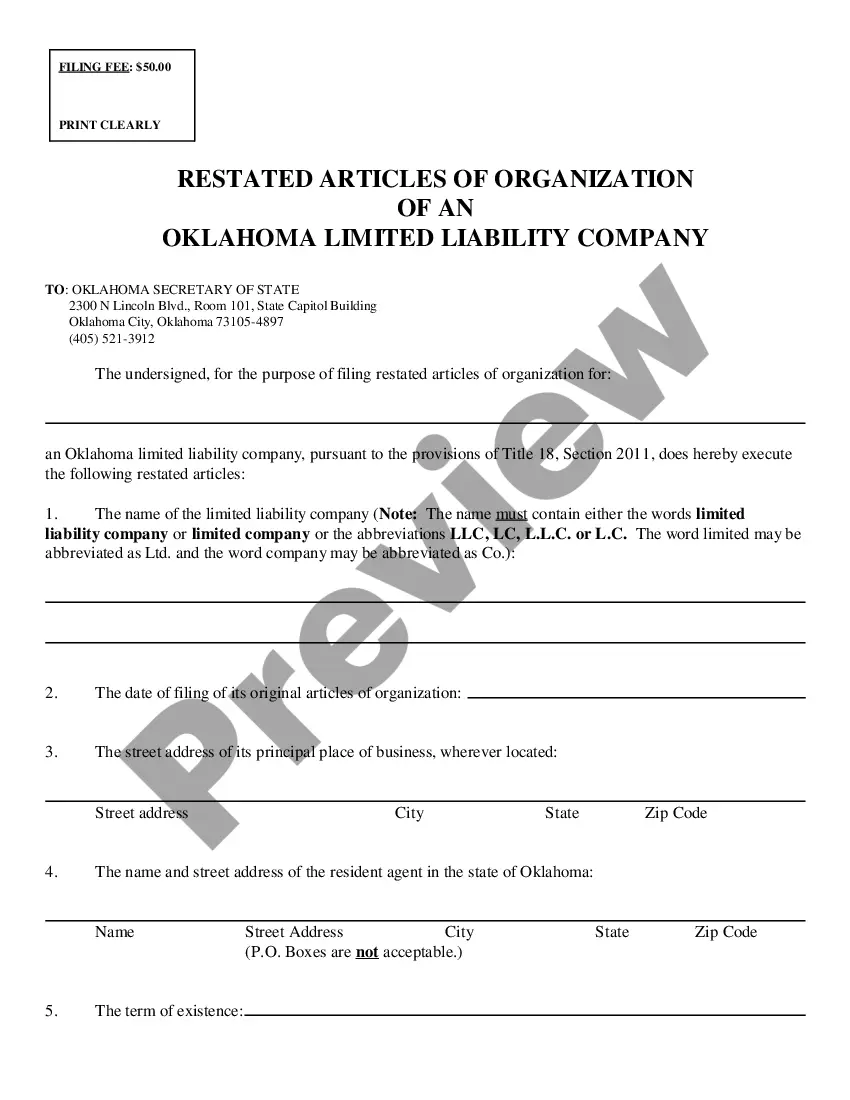

- Check if the Form name you’ve found is state-specific and suits your requirements.

- When the form has a Preview option, use it to check the sample.

- If the sample does not suit you, utilize the search bar to find a better one.

- Hit Buy Now if the template corresponds to your requirements.

- Choose a pricing plan.

- Create your account.

- Pay with the help of PayPal or with the credit/visa or mastercard.

- Choose a document format and download the template.

- After it’s downloaded, print it and fill it out.

Save your time and effort using our platform to find, download, and fill out the Form name. Join a huge number of happy clients who’re already using US Legal Forms!

Form popularity

FAQ

An Aztec form is an agreement between three parties: the bank, the co-op and the shareholder. It confirms consent by the co-op corporation to the lender extending a loan to the shareholder in exchange for a lien on the shareholder's lease and shares as security.

Recognition Agreement means, an agreement among a Co-op Corporation, a lender and a Mortgagor with respect to a Co-op Loan whereby such parties (i) acknowledge that such lender may make, or intends to make, such Co-op Loan, and (ii) make certain agreements with respect to such Co-op Loan.

Recognition Agreement means, an agreement among a Co-op Corporation, a lender and a Mortgagor with respect to a Co-op Loan whereby such parties (i) acknowledge that such lender may make, or intends to make, such Co-op Loan, and (ii) make certain agreements with respect to such Co-op Loan.

An Aztech remains a contract between those three parties. It states the bank will have a first lien on the buyer's shares as collateral for the mortgage. The name comes from the Aztech Document Systems company, which dates from 1973.

An Aztec form is an agreement between three parties: the bank, the co-op and the shareholder. It confirms consent by the co-op corporation to the lender extending a loan to the shareholder in exchange for a lien on the shareholder's lease and shares as security.

Closing is usually scheduled within two weeks of the time you receive co-op board approval or the condo issues its waiver of right of first refusal, assuming you've received a commitment letter and your bank is ready to close.

Closing on a house takes 30 to 45 days from when your loan begins processing. And an hour or so on the day you sign the final paperwork.

An Aztech remains a contract between those three parties. It states the bank will have a first lien on the buyer's shares as collateral for the mortgage. The name comes from the Aztech Document Systems company, which dates from 1973.