LLC Operating Agreement for Husband and Wife

Description

Definition and meaning

An LLC Operating Agreement for Husband and Wife is a legal document that outlines the management structure, operational procedures, and ownership percentages of a limited liability company (LLC) formed by spouses. This agreement is essential for establishing clear terms regarding how the business operates and the responsibilities of each member. It serves as a foundational document that protects the interests of both parties and helps prevent potential disputes in the future.

Who should use this form

This operating agreement is recommended for any married couple planning to start a business together. It is particularly useful for couples who wish to formalize their partnership as a limited liability company, providing benefits such as liability protection and potential tax advantages. Additionally, this form is beneficial for couples who want to clarify their roles, responsibilities, and profit-sharing agreements from the outset.

Key components of the form

The LLC Operating Agreement for Husband and Wife typically includes several crucial components:

- Name of the LLC: The official name under which the business will operate.

- Management Structure: Guidance on how the management of the LLC will be executed, often specifying roles for each spouse.

- Ownership Percentages: Clear outline of the percentage of ownership held by each spouse.

- Profit and Loss Distribution: Details on how profits and losses will be shared between the spouses.

- Decision-Making Procedures: Processes for resolving disputes or making significant business decisions.

Benefits of using this form online

Utilizing an online template for the LLC Operating Agreement for Husband and Wife offers several advantages:

- Convenience: The ability to access and complete the form from anywhere at any time.

- Time-Saving: Online platforms often provide ready-to-use templates, reducing the time needed to draft an agreement from scratch.

- Cost-Effective: Online forms can be less expensive than hiring a lawyer for personalized paperwork.

- Guided Instructions: Many online services offer step-by-step guidance, helping users complete the form accurately.

Common mistakes to avoid when using this form

When completing the LLC Operating Agreement for Husband and Wife, it's crucial to be aware of common pitfalls, such as:

- Ignoring State-Specific Laws: Ensure compliance with your state's regulations regarding LLC agreements.

- Inadequate Detail: Providing vague descriptions regarding roles and responsibilities can lead to misunderstandings.

- Failure to Update: Not revising the agreement as your business or relationship changes can create problems down the line.

What documents you may need alongside this one

In addition to the LLC Operating Agreement, you may need to prepare and submit other documents, such as:

- Certificate of Formation: This document formally establishes the LLC with the state.

- Owner's Identification: Personal identification documents for each member may be required.

- Operating Licenses: Depending on your business type, local licenses may be necessary.

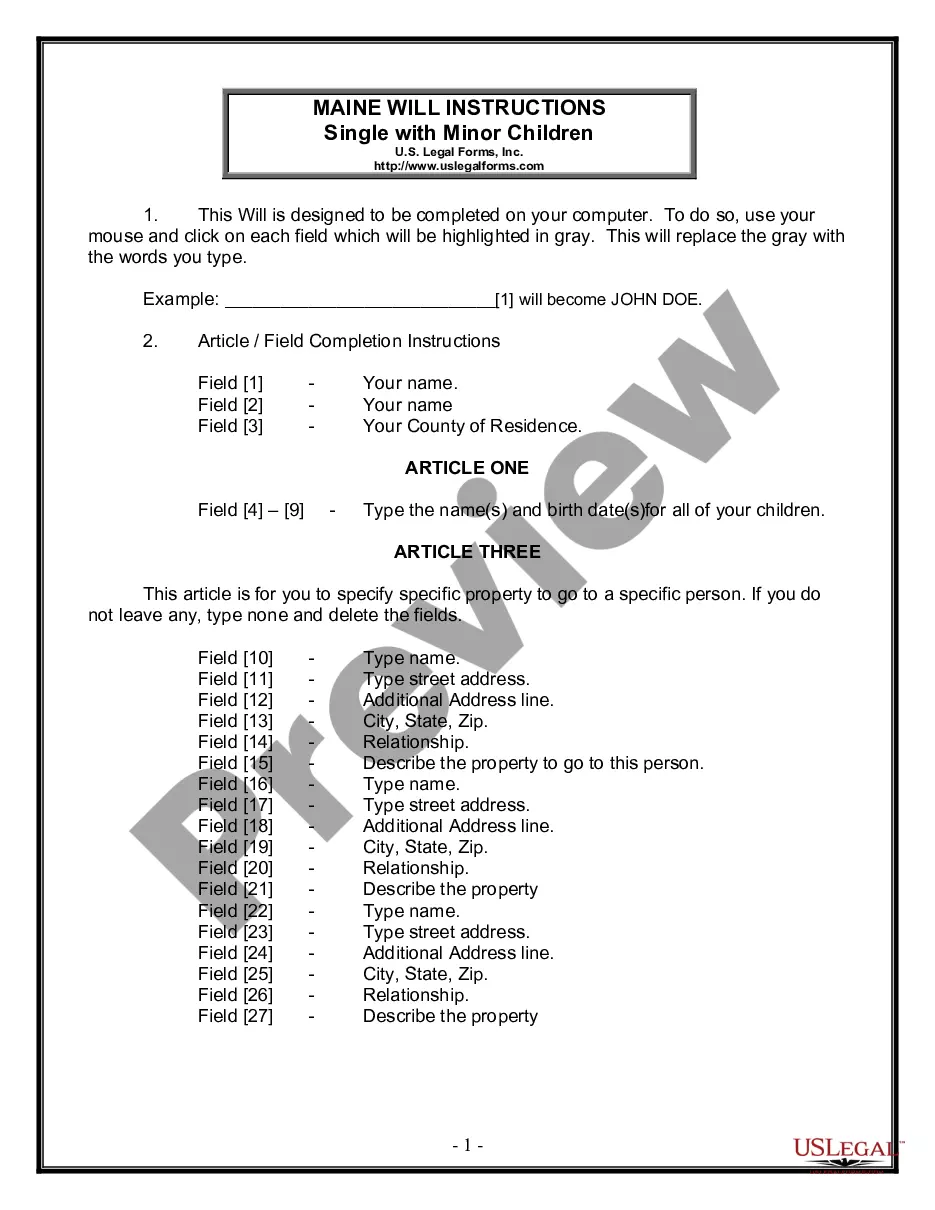

How to fill out LLC Operating Agreement For Husband And Wife?

Use US Legal Forms to get a printable LLC Operating Agreement for Husband and Wife. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most extensive Forms library online and offers affordable and accurate samples for consumers and lawyers, and SMBs. The documents are grouped into state-based categories and some of them might be previewed prior to being downloaded.

To download templates, users need to have a subscription and to log in to their account. Hit Download next to any form you need and find it in My Forms.

For individuals who don’t have a subscription, follow the tips below to quickly find and download LLC Operating Agreement for Husband and Wife:

- Check out to make sure you have the correct form with regards to the state it is needed in.

- Review the form by reading the description and using the Preview feature.

- Press Buy Now if it’s the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Use the Search engine if you need to find another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including LLC Operating Agreement for Husband and Wife. More than three million users have already utilized our service successfully. Select your subscription plan and have high-quality forms in just a few clicks.

Form popularity

FAQ

If both spouses take part in the business and are the only members of an LLC, and a joint tax return is personally filed, a qualified joint venture can be elected instead of a partnership. This election treats each spouse as a sole proprietor instead of a partnership.

All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case. An operating agreement is similar to the by-laws that guide a corporation's board of directors and a partnership agreement, which is used by partnerships.

Every member of the LLC and the manager or managers (if there are any) need to sign the operating agreement. Each signatory should sign a separate signature page.

If you share a business with your husband or wife, you should have a written agreement to protect your interests.The benefits of a husband/wife LLC are that you can file as a disregarded entity. No need to file a separate partnership return.

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

When a spouse frequently works in an LLC, one of the best ways to avoid personal liability is to make the spouse a member.After the addition of a member, a limited liability company must amend the operating agreement to reflect the changes to the members' interests in voting, profits, and losses.

Partnerships must file income taxes on Form 1065. But a husband-wife partnership may be eligible to be considered as a qualified joint venture and to file using Schedule C, under certain circumstances. Note that in this case, each owner must file a separate Schedule C, dividing up all of the income and expenses.

If an LLC is owned by a husband and wife in a non-community property state the LLC should file as a partnership. However, in community property states you can have your multi-member (husband and wife owners) and that LLC can get treated as a SMLLC for tax purposes.