Articles of Association of Unincorporated Charitable Association

Definition and Meaning

The Articles of Association of Unincorporated Charitable Association serve as a foundational document that outlines the purpose, governance, and operational guidelines of a charitable organization that operates without incorporation. This document is crucial for establishing the organization's legitimacy and guiding its activities.

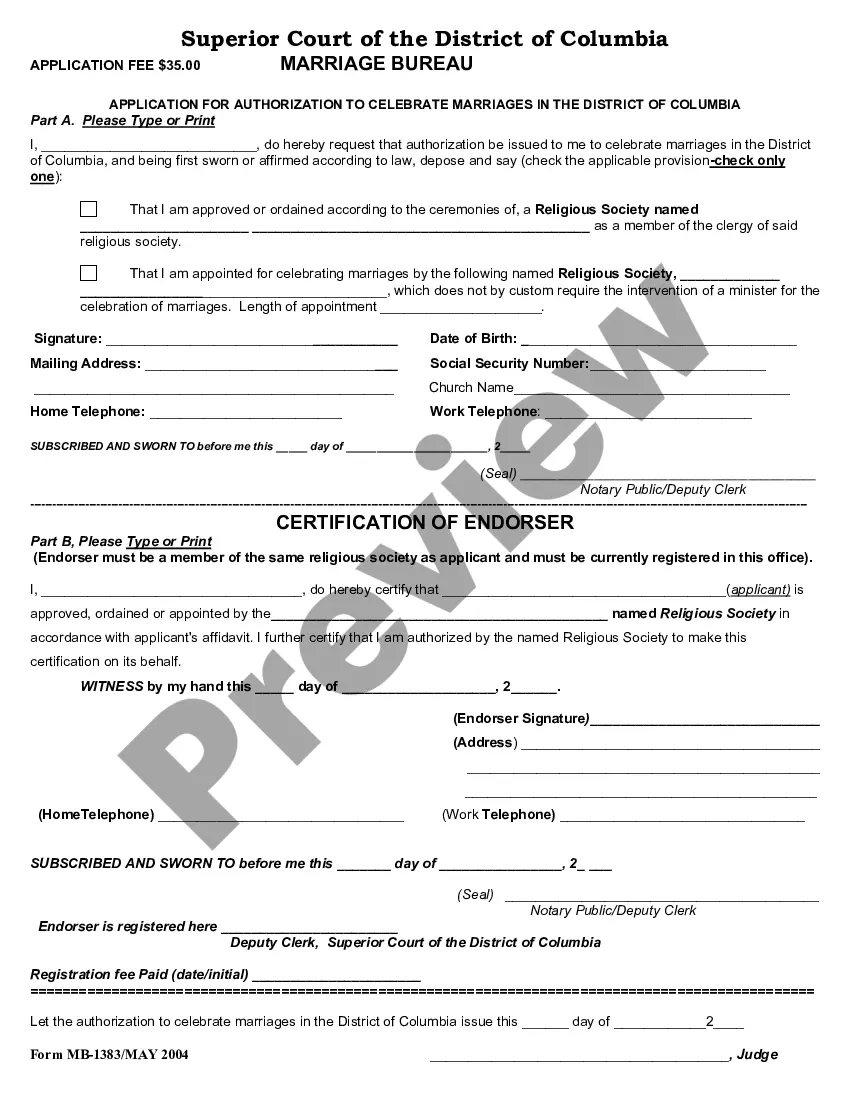

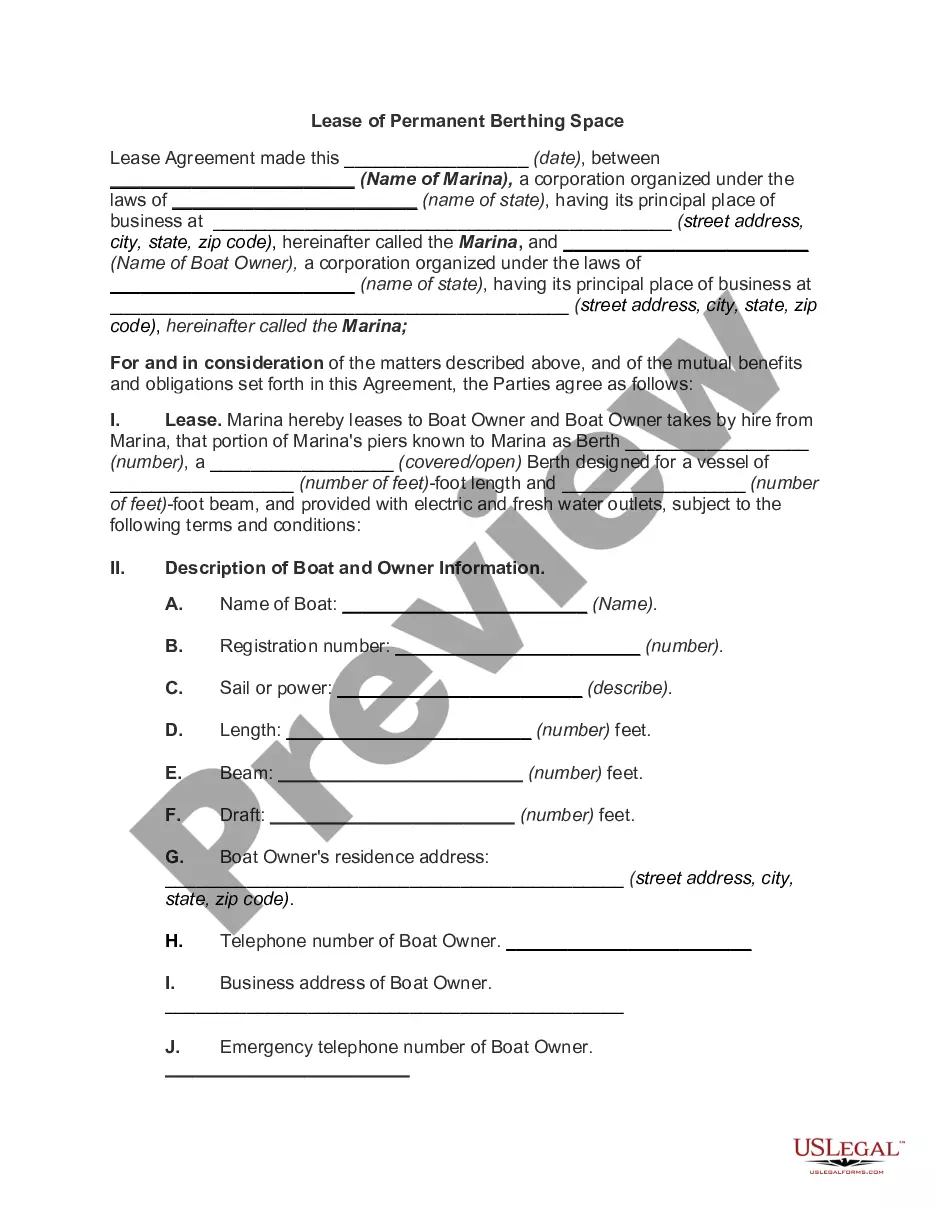

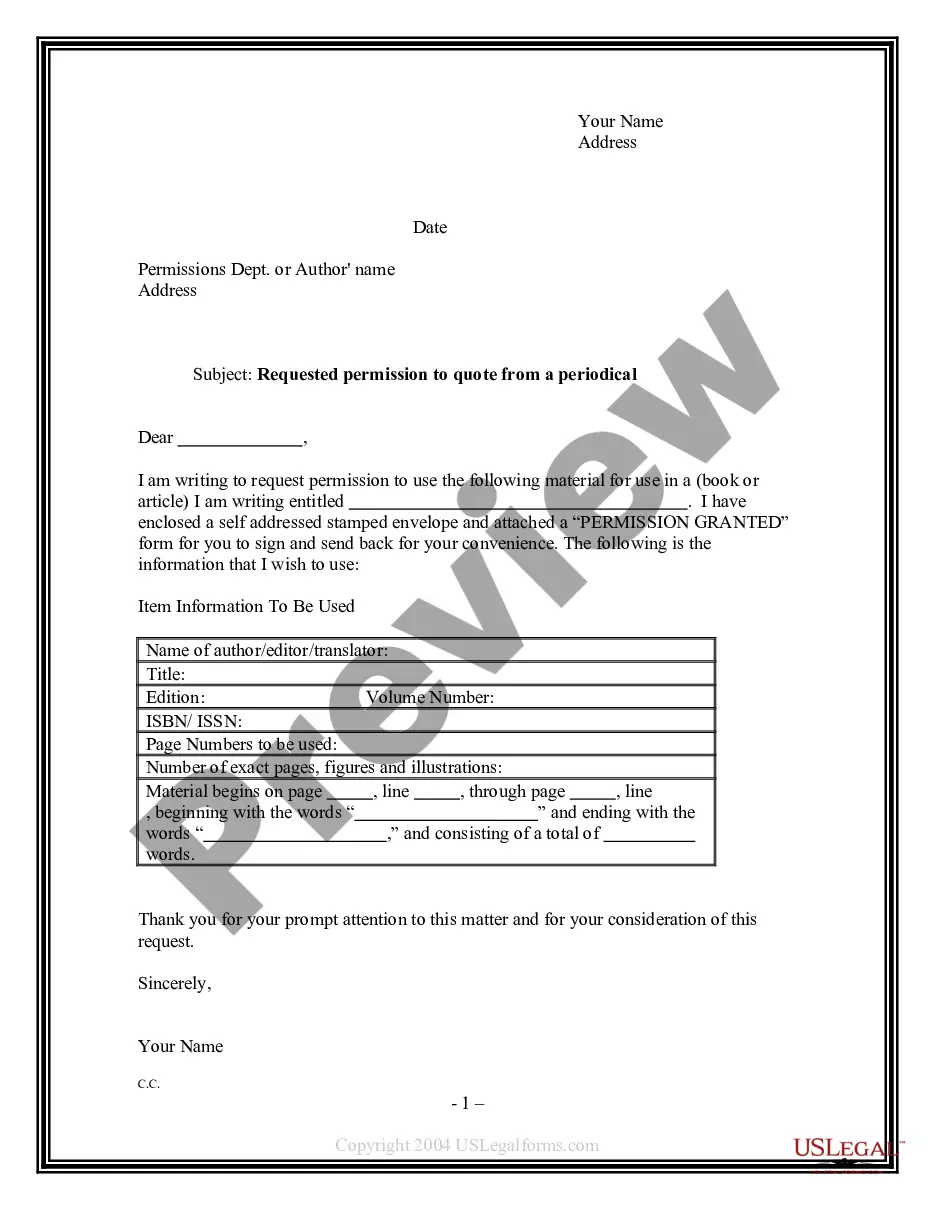

How to Complete a Form

Completing the Articles of Association requires careful attention to detail. Here’s a step-by-step process:

- Begin by clearly stating the name of the association.

- Specify the primary charitable purposes of the organization.

- List the property and money that the association possesses at the time of forming.

- Provide the names and addresses of initial trustees.

- Outline the voting process and membership eligibility.

- Include amendments procedure to allow future adjustments to the articles.

Ensure that each section is filled out completely to avoid issues with legal compliance.

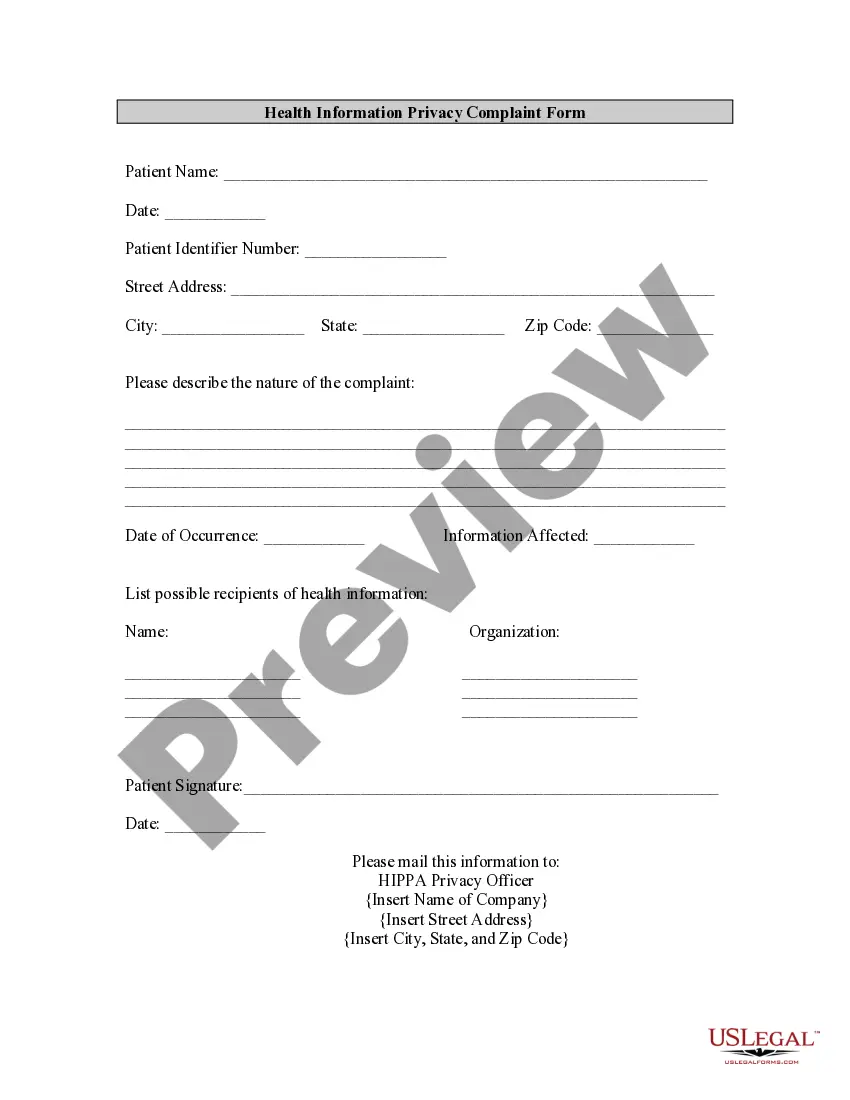

Key Components of the Form

The Articles of Association typically include several key sections:

- Name: The organization's official name.

- Purposes: The specific goals and objectives of the association.

- Membership: Criteria for who can become a member.

- Trustees: Information about the governing body.

- Amendments: Process for making changes to the Articles.

Understanding these components is essential for those involved in the establishment of the association.

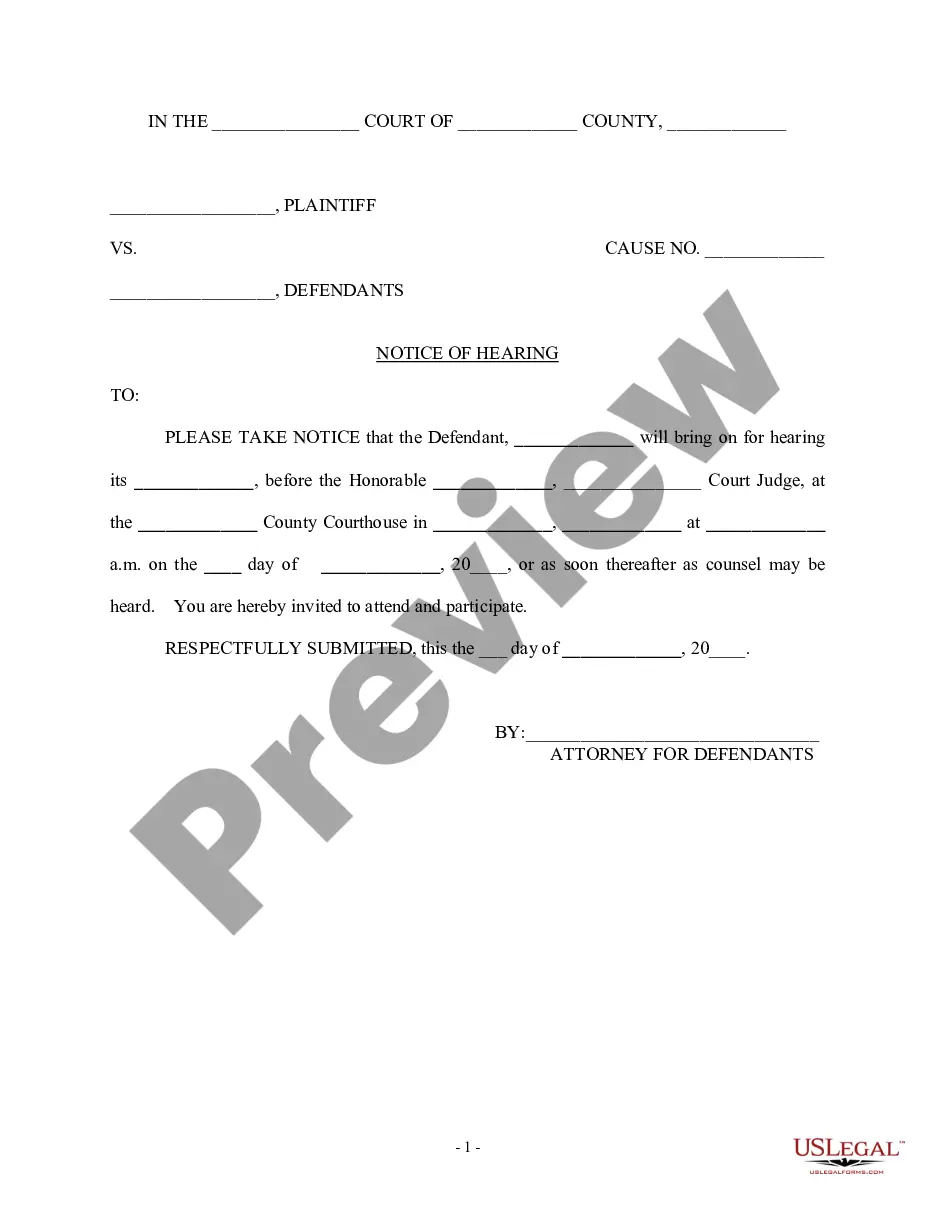

Who Should Use This Form

This form is designed for individuals and groups intending to establish an unincorporated charitable association. It is suited for:

- Non-profit organizations focused on charitable, educational, or religious purposes.

- Community groups seeking to formalize their operations.

- Individuals who wish to create a charitable structure for gathering donations and funding.

Utilizing this form helps ensure compliance with relevant legal guidelines and enables effective organization.

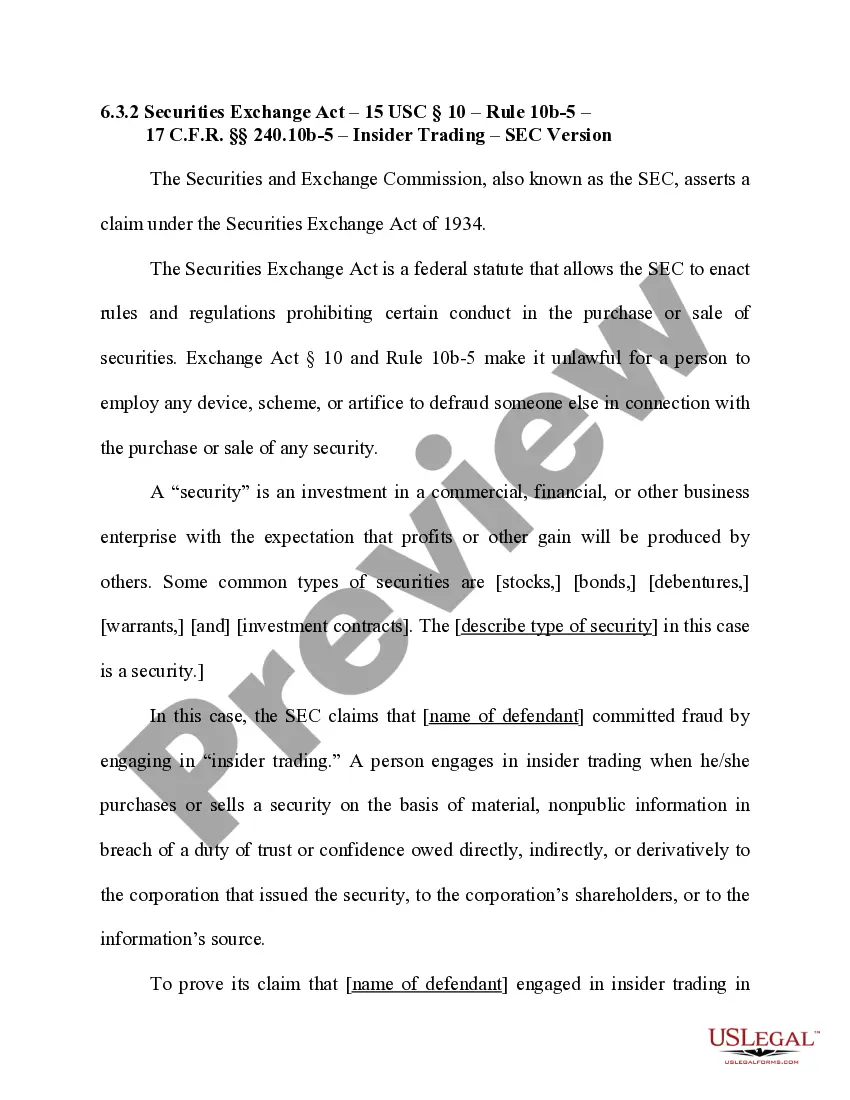

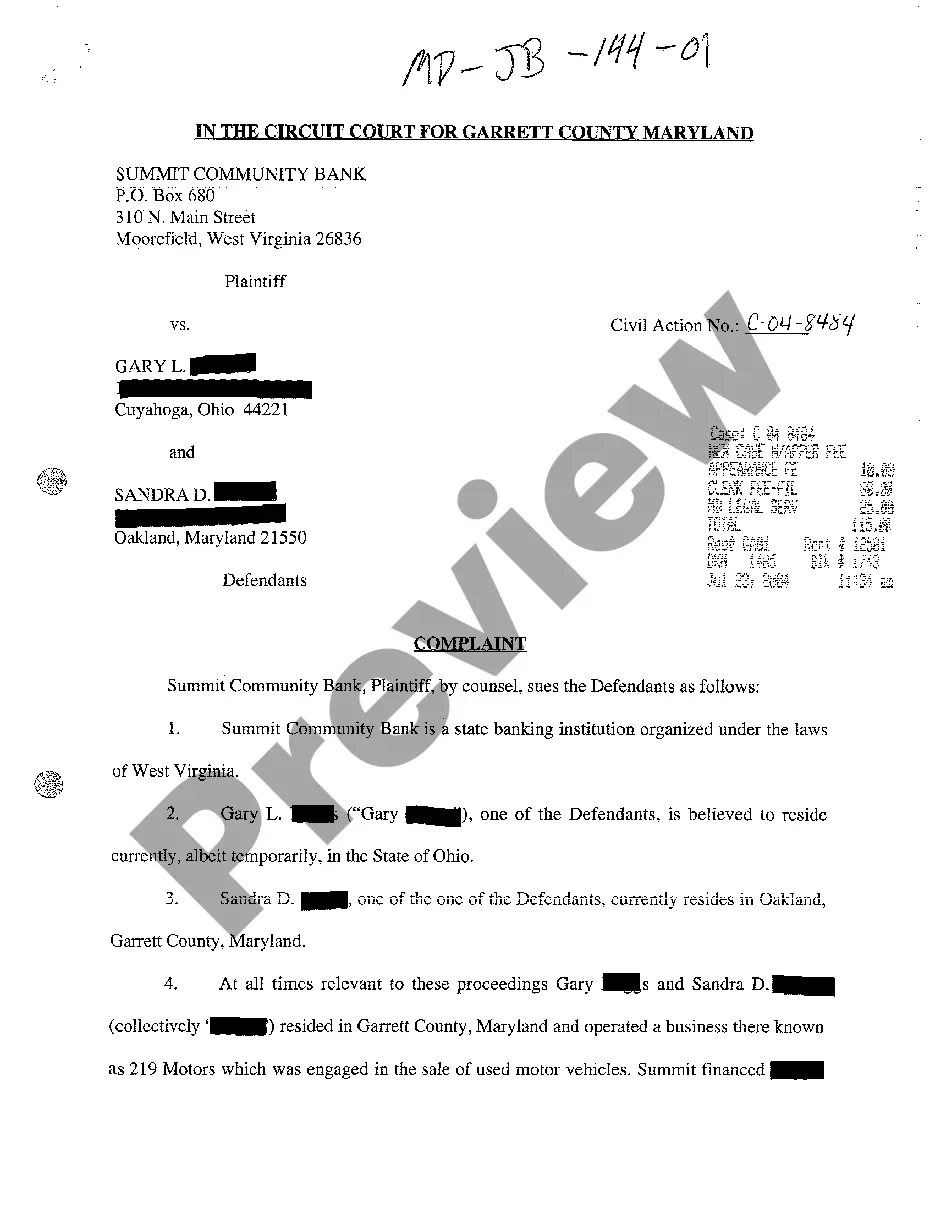

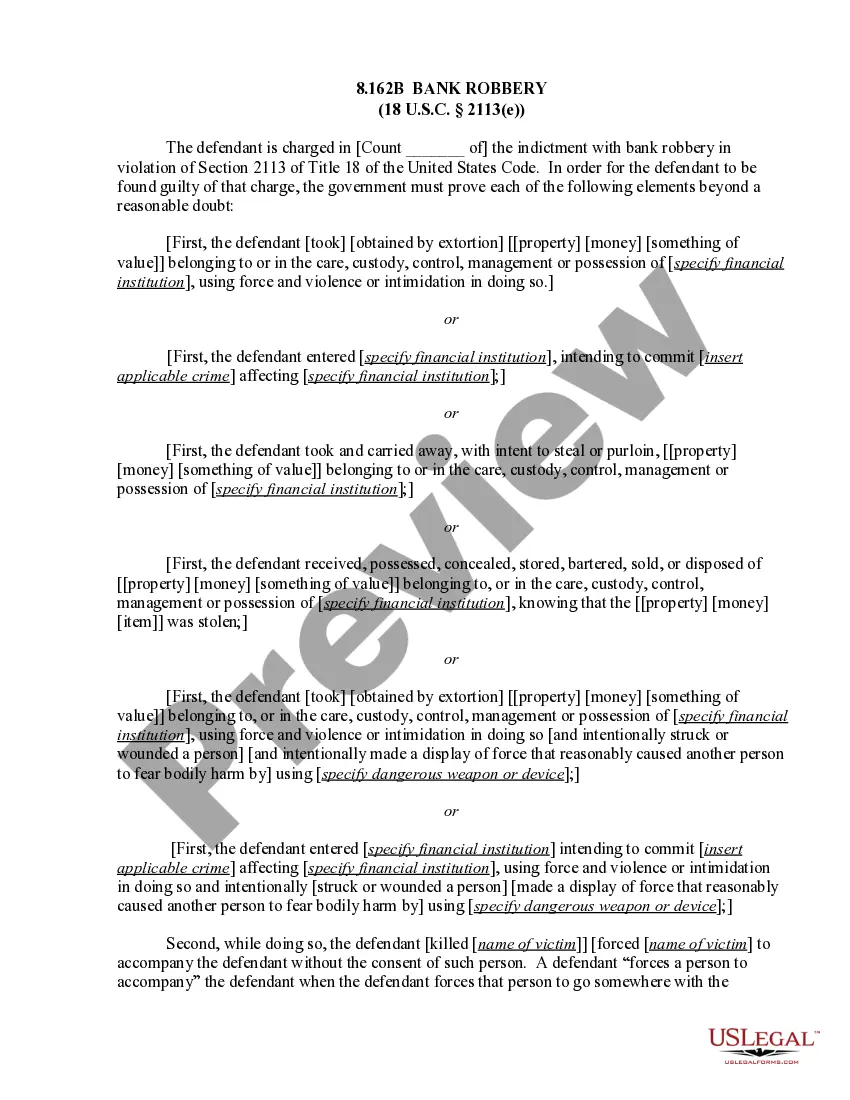

Legal Use and Context

The Articles of Association are legally binding and set forth the framework within which the unincorporated charitable association will operate. Adherence to these articles is essential for maintaining the association’s tax-exempt status under 26 U.S.C.A. § 501(c)(3). Each provision within the document relates directly to the legal expectations set forth by the state and federal regulations for charitable organizations.

Benefits of Using This Form Online

Using this form online provides several advantages:

- Convenience: Access the form anytime, anywhere.

- Time-efficient: Download and complete the form quickly.

- Accuracy: Reduce the likelihood of errors with clear instructions provided.

- Cost-effective: Often lower fees associated with online forms compared to traditional methods.

These benefits make using the online version of the Articles of Association a practical choice for many users.

Form popularity

FAQ

An unincorporated association can be a charity, but it does not have to be.An unincorporated association is not incorporated, so it cannot enter into contracts or own property in its own right. To set up an unincorporated association, all you need to do is write and agree a constitution in your group.

In order to form a nonprofit corporation, you must file articles of incorporation (sometimes called a "certificate of incorporation" or "charter document" or "articles of organization") with the state and pay a filing fee.

To set up an unincorporated association, all you need to do is write and agree a constitution in your group. If you do not plan to become a charity, your constitution should lay out whatever aims you want for your group.

Broadly, articles of incorporation should include the company's name, type of corporate structure, and number and type of authorized shares. Bylaws work in conjunction with the articles of incorporation to form the legal backbone of the business.

Nonprofit incorporation usually involves these steps: Choose a business name that is legally available in your state and file for an EIN (Employment Identification Number) Prepare and file your articles of incorporation with your state's corporate filing office, and pay a filing fee.

Legal Name of the Organization (Not taken by other companies in your State) Address of the Organization (Should be in the Incorporating State) Incorporator of the Nonprofit Organization.

The name of your corporation. your corporation's principal place of business. the name and address of your corporation's registered agent. a statement of the corporation's purpose. the corporation's duration. information about the number of shares and classes of stock the corporation is authorized to issue.

An unincorporated association serving in a volunteer capacity for the public good is considered an unincorporated nonprofit association. These organizations do not have to pay taxes or file a tax return if they have no more than $5,000 in revenues.

Whenever two or more people decide to work together to accomplish a common purpose, they've formed an unincorporated association. If that purpose is to generate a profit, then the unincorporated association they've formed is a partnership or a joint venture.