A private placement memorandum (PPM) is a document providing information about a proposed private placement of securities, where a company sells securities to select investors, rather than releasing them to the public. This document is sent to proposed investors so they can review the information and make a decision about whether they want to invest. Firms draft private placement memoranda in consultation with their attorneys to ensure accuracy and completeness Private placement of securities usually involves the sale of stocks, bonds, and other securities to institutional investors who are willing to buy large blocks of securities. The private placement allows a company to raise capital for activities without needing to formulate an initial public offering and it is highly discreet in nature, as members of the public are generally not aware of the sale of securities until after it is complete. In addition, private placements conducted within specific limits do not need to be registered with the Securities and Exchange Commission.

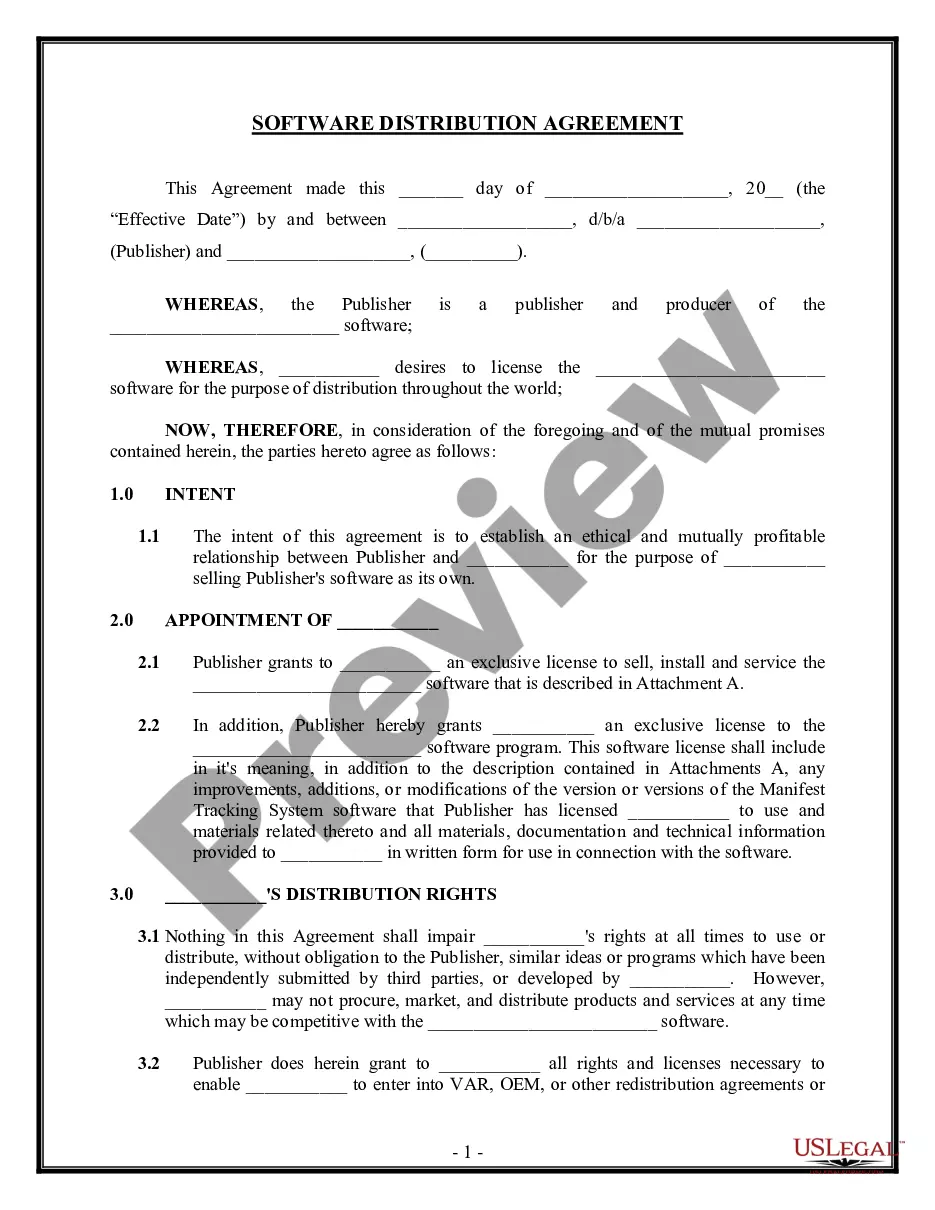

Sample Private Placement Memorandum

Description

Definition and meaning

A Sample Private Placement Memorandum (PPM) is a legal document provided to potential investors when a company is seeking to raise capital through private investment. It outlines the details of the investment offering, including the risks and benefits associated with the investment. The PPM serves as both a marketing tool and a legal safeguard for the issuing company by ensuring that all necessary information is disclosed to investors.

Key components of the form

The Sample Private Placement Memorandum typically includes several key components that provide essential information. These components include:

- Company Overview: A summary of the company's history, business model, and services offered.

- Offering Details: Information about the number of shares being offered, price per share, and overall investment terms.

- Risks: A detailed list of potential risks involved in the investment, making it clear to investors what they may face.

- Use of Proceeds: An explanation of how the funds raised will be utilized by the company, including marketing, operations, or expansion efforts.

Who should use this form

The Sample Private Placement Memorandum is primarily suited for companies looking to raise capital through private investors. This may include:

- Startups seeking initial funding for development.

- Established businesses looking to expand operations.

- Companies in need of funding for special projects or acquisitions.

Investors interested in private placements should also review this document to make informed decisions regarding potential investments.

Legal use and context

The Sample Private Placement Memorandum must comply with securities regulations as governed by the Securities and Exchange Commission (SEC) and state securities laws. The PPM is issued under exemptions from registration requirements, allowing companies to solicit investments without undergoing the full registration process. It also protects the company by disclosing material information, thereby reducing liability for misrepresentation.

Common mistakes to avoid when using this form

When preparing a Private Placement Memorandum, it is crucial to avoid several common pitfalls:

- Insufficient Information: Failing to provide complete details about the offering and associated risks.

- Overly Technical Language: Using jargon that might confuse potential investors instead of clear, simple language.

- Neglecting Regulatory Compliance: Not adhering to the necessary legal requirements can lead to serious legal repercussions.

- Inadequate Risk Disclosure: Not fully disclosing all potential risks associated with the investment may lead to investor distrust.

How to fill out Sample Private Placement Memorandum?

Make use of the most complete legal library of forms. US Legal Forms is the best platform for getting updated Sample Private Placement Memorandum templates. Our service offers a large number of legal forms drafted by certified lawyers and grouped by state.

To obtain a sample from US Legal Forms, users just need to sign up for an account first. If you’re already registered on our service, log in and select the document you are looking for and purchase it. Right after buying templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines below:

- Find out if the Form name you have found is state-specific and suits your needs.

- When the template has a Preview option, utilize it to check the sample.

- In case the template does not suit you, utilize the search bar to find a better one.

- Hit Buy Now if the sample meets your expections.

- Choose a pricing plan.

- Create your account.

- Pay with the help of PayPal or with yourr debit/credit card.

- Select a document format and download the template.

- After it’s downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and fill out the Form name. Join thousands of delighted clients who’re already using US Legal Forms!

Form popularity

FAQ

A Private Placement Memorandum (PPM), also known as a private offering document and confidential offering memorandum, is a securities disclosure document used in a private offering of securities by a private placement issuer or an investment fund (collectively, the Issuer).

A private placement memorandum (PPM) is a legal document provided to prospective investors when selling stock or another security in a business.The PPM describes the company selling the securities, the terms of the offering, and the risks of the investment, amongst other things.

A PPM provides the offering structure, the share structure of the company, SEC disclosures about the shares being purchased, company information, information on company operations, risks involved with the investment, management information, use of proceeds, information on certain transactions that could affect the

The firms will likely charge at least $35,000 to draft a PPM. Keep in mind that only one or two attorneys would be working on your documents, despite the size of the firm, and these lawyers may not even be specialists in private placements, but rather have a more general corporate securities background.

In practice, most broker-dealer firms will require a PPM in order to have the offering approved for retail to their investor clients.As a result, in general, most small and emerging companies do not need to use a PPM to raise capital from investors.

They are Required by Law. They Can Act as Insurance. It Can Act as Protection against Security Fraud Claims. It Can Act as a Sales Document. Mention the Introduction. Provide Brief Summary for Offering Terms. Highlight the Risk Factors.