Convertible Note Agreement

Description

How to fill out Convertible Note Agreement?

Aren't you sick and tired of choosing from numerous samples each time you need to create a Convertible Note Agreement? US Legal Forms eliminates the wasted time an incredible number of American citizens spend searching the internet for appropriate tax and legal forms. Our skilled group of lawyers is constantly modernizing the state-specific Samples collection, to ensure that it always provides the right documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have an active subscription need to complete easy steps before having the ability to download their Convertible Note Agreement:

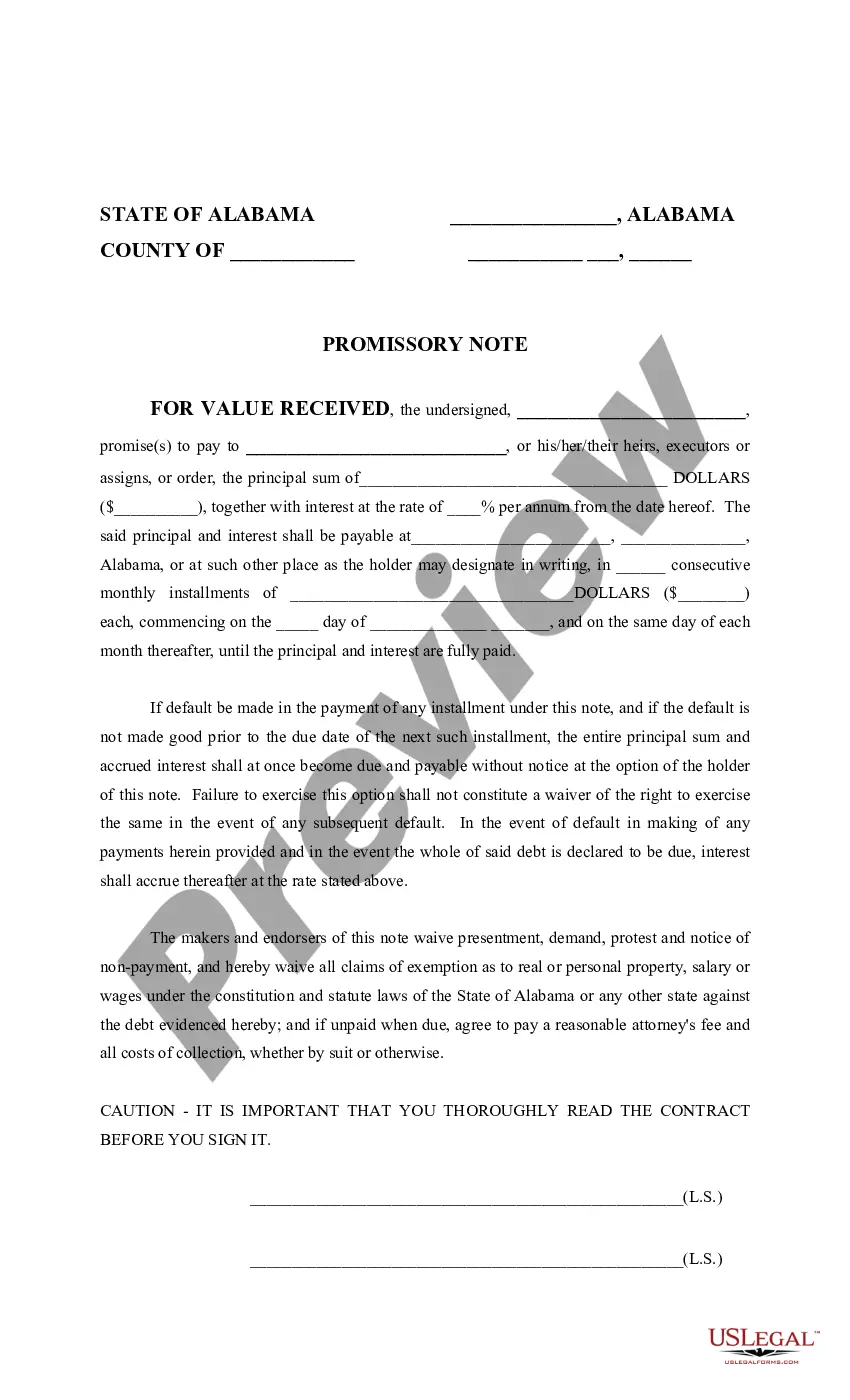

- Utilize the Preview function and look at the form description (if available) to make sure that it is the correct document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate sample for the state and situation.

- Use the Search field at the top of the site if you need to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your file in a required format to finish, print, and sign the document.

When you have followed the step-by-step guidelines above, you'll always have the ability to log in and download whatever file you require for whatever state you require it in. With US Legal Forms, finishing Convertible Note Agreement templates or other legal files is not difficult. Get going now, and don't forget to look at the examples with accredited lawyers!

Form popularity

FAQ

A convertible note is short-term debt that converts into equity. In the context of a seed financing, the debt typically automatically converts into shares of preferred stock upon the closing of a Series A round of financing.

Generally, convertible notes convert into shares (the Conversion Shares) at a qualified equity financing round (this term should be defined in the note and usually means a preferred financing round of a minimum size) at the lower of two different prices per share: (1) the price per share using the conversion cap (

The maturity date is a deadline for a preferred round, and only during a preferred round can a convertible note convert into equity. Let's say there was a maturity date of 2 years from the date of investment. If the company hasn't had a preferred round within 2 years, the investor could demand their money back.

No while convertible debt is outstanding, then Yes after it converts to equity. No repayment until sale of company. Repayment on fixed schedule. Repayment on maturity, or converted to equity and no repayment until sale of company.

The amount you're raising on the convertible note (say $500k), the conversion discount of the note (say 20%), the pre-money valuation cap of the note (say $4m), the percentage of your company which the VCs will take in your Series A (say 30%),

A convertible note cap sets the maximum valuation at which the investment made via the convertible note can convert into equity. Investors in the convertible note typically get converted at the lesser of the valuation of the next qualified priced round and the cap.

What happens to a convertible note if a company is acquired or merges with another company?Most convertible notes call for the note to be converted to common shares in the company at a pre-set price just before the acquisition/merger, often at the same price as the cap of the note.

A convertible note is a debt instrument that is convertible into shares of the issuer or another entity. They offer investors the downside protection of a debt instrument and the upside potential of an equity investment, but in return typically offer lower interest rates than straight debt instruments.