Definition and meaning

A Contract for Deed, also known as a land contract or installment sale agreement, is a legal document used to outline the terms and conditions of the sale of real estate, wherein the seller retains the property's title until the buyer completes all payment obligations. This arrangement can benefit both buyers and sellers, providing an alternative to traditional mortgage financing.

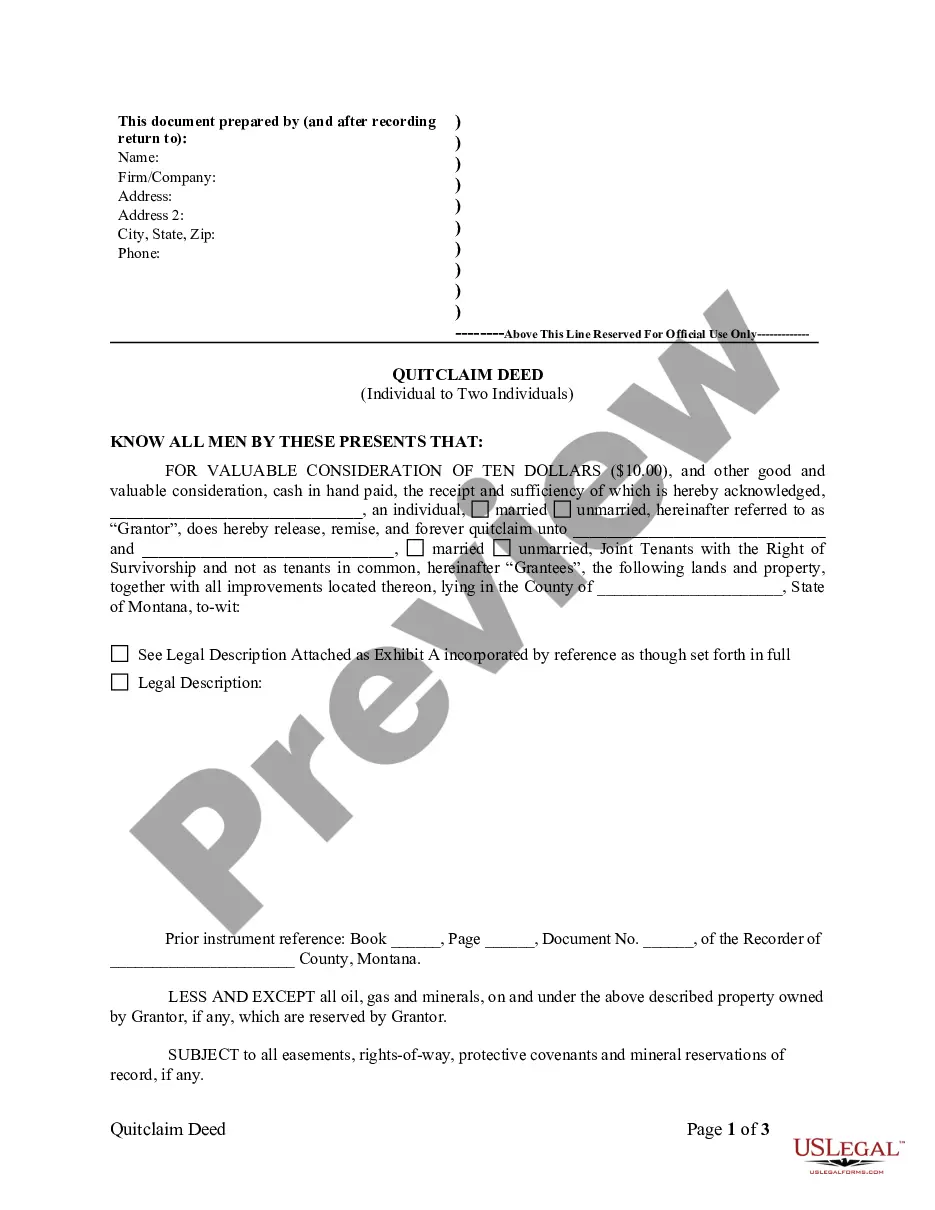

How to complete a form

Completing a Contract for Deed involves several steps:

- Fill in the names of the sellers and purchasers.

- Clearly describe the property being sold, including its legal description.

- Specify the purchase price and payment terms, including any down payment required.

- Outline responsibilities for taxes, insurance, and maintenance.

- Include provisions for default and remedies available to sellers.

It is advisable to review the filled form with a legal professional to ensure compliance with state laws.

Key components of the form

A comprehensive Contract for Deed should include the following essential components:

- Sellers and Purchasers: Names and addresses of all parties involved.

- Property Description: A detailed legal description of the property being sold.

- Purchase Price: Total cost and payment schedule, including down payment and monthly installments.

- Default Terms: Precise terms and procedures applicable in case of payment defaults.

- Signatures: To validate the agreement, both parties must sign.

Common mistakes to avoid when using this form

When using a Contract for Deed, consider the following common pitfalls:

- Incomplete Information: Ensure all essential details such as names, property description, and payment terms are included.

- Neglecting State Laws: Different states impose varied requirements for legal contracts. Reviewing state-specific guidelines is crucial.

- Failure to Specify Default Terms: Clearly outline the consequences of default to avoid disputes.

- Not Consulting Legal Help: A contract has significant legal implications; seeking legal advice can prevent future disputes.

What documents you may need alongside this one

When completing a Contract for Deed, you may also need to prepare:

- Property Deed: The current deed that demonstrates ownership by the seller.

- Title Report: Documentation confirming ownership and any liens or encumbrances on the property.

- Insurance Policies: Proof of insurance coverage for the property being sold.

Gathering these documents in advance can expedite the process and ensure a smoother transaction.

Who should use this form

A Contract for Deed is ideal for:

- Buyers who may have difficulty securing traditional financing through banks.

- Sellers looking for a quicker sale and a steady stream of income.

- Parties wanting to avoid the complexities of the traditional closing process.

This form serves as a viable solution for individuals seeking alternative real estate transactions.

Aren't you tired of choosing from hundreds of templates every time you want to create a Contract for Deed? US Legal Forms eliminates the wasted time millions of Americans spend surfing around the internet for perfect tax and legal forms. Our expert crew of attorneys is constantly upgrading the state-specific Forms catalogue, so it always has the right files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have a subscription should complete quick and easy actions before having the capability to download their Contract for Deed:

- Utilize the Preview function and look at the form description (if available) to make certain that it’s the appropriate document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the right template for your state and situation.

- Utilize the Search field at the top of the page if you want to look for another document.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your sample in a needed format to complete, print, and sign the document.

Once you’ve followed the step-by-step guidelines above, you'll always have the ability to log in and download whatever file you want for whatever state you require it in. With US Legal Forms, finishing Contract for Deed templates or any other legal files is not hard. Begin now, and don't forget to double-check your examples with accredited attorneys!