Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

Definition and meaning

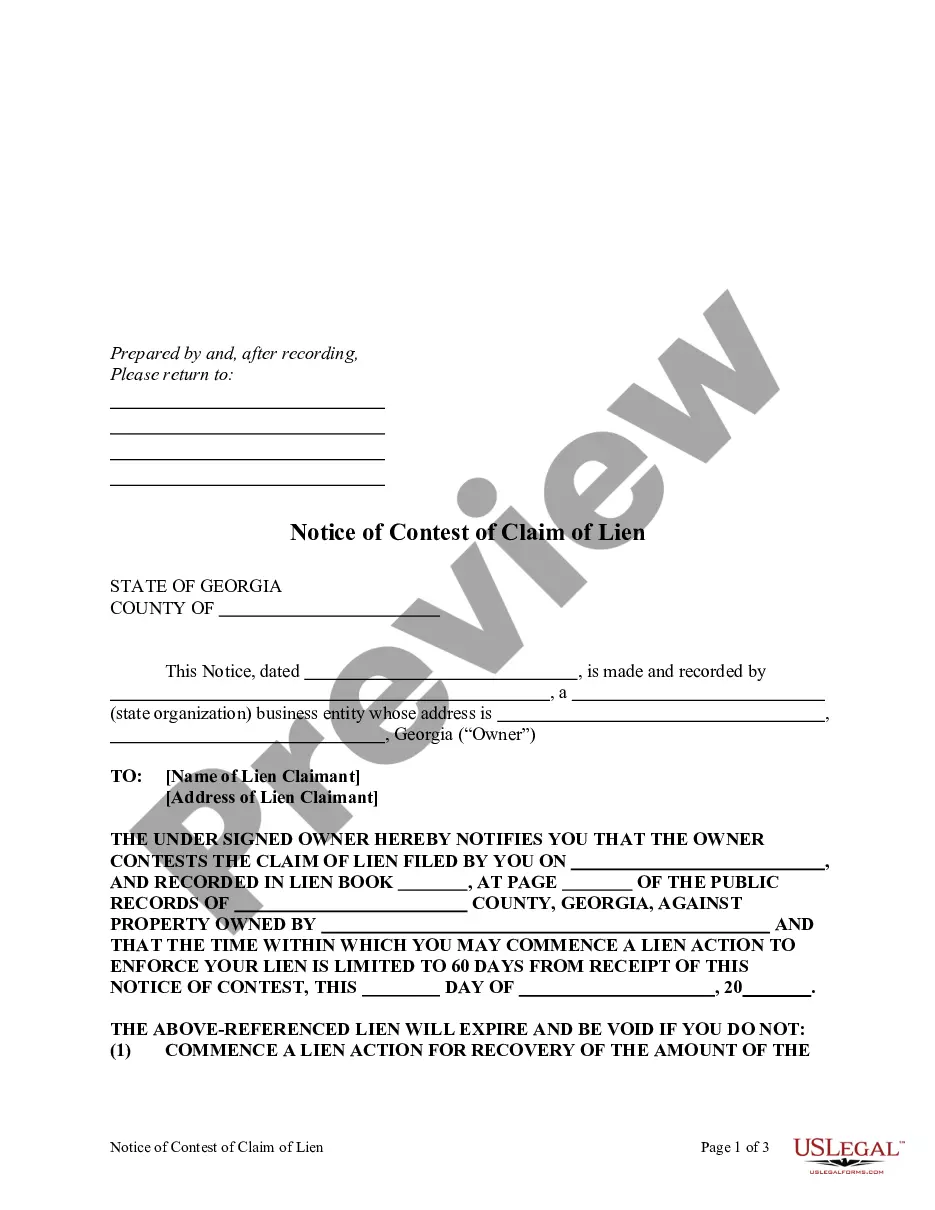

A Promissory Note in Connection with a Sale and Purchase of a Mobile Home is a written agreement in which one party—typically the buyer—promises to pay a specific sum of money to another party—the seller—for a mobile home. This document outlines the terms of the loan, including the principal amount, interest rate, payment schedule, and any additional conditions pertaining to the sale.

How to complete the form

To complete the Promissory Note, follow these steps:

- Enter the amount of the note in dollars.

- Specify the city and state where the note is executed.

- Provide the date of execution.

- Input the name of the buyer and seller.

- Indicate the interest rate and monthly installment amounts.

- Set the dates for payment due, including the first installment date and the final payment date.

Once all fields are completed, ensure that both parties sign and date the document.

Who should use this form

This form is beneficial for individuals or entities involved in the sale of a mobile home where part of the purchase price is financed through a promissory note. It is primarily intended for:

- Buyers who need a structured payment plan for purchasing a mobile home.

- Sellers who wish to formalize the loan arrangement with written documentation.

Key components of the form

The Promissory Note contains several essential components:

- Principal Amount: The total amount financed by the buyer.

- Interest Rate: The percentage rate at which interest will accrue on the unpaid balance.

- Payment Schedule: Detailed information regarding the number and amount of monthly installments.

- Place of Payment: The address where payments should be made.

- Default Conditions: Terms outlining the implications of failing to make payments.

Common mistakes to avoid when using this form

Users should be cautious of the following errors when filling out a Promissory Note:

- Failing to specify the interest rate clearly, which can lead to confusion about payment expectations.

- Not accurately stating the payment amounts or schedule, which can result in missed payments.

- Leaving out signatures or dates, rendering the document incomplete.

- Neglecting to include a clause about prepayments or late fees.

What to expect during notarization or witnessing

If a Promissory Note requires notarization, the following steps are generally involved:

- The parties will meet with a licensed notary public who will verify their identities.

- Both parties will sign the document in the presence of the notary.

- The notary will then apply their seal and signature to confirm the execution of the agreement.

Witnessing may require similar steps, depending on state laws and the preferences of the involved parties.

Key takeaways

When using a Promissory Note in Connection with a Sale and Purchase of a Mobile Home, it’s crucial to:

- Clearly understand the terms laid out in the document.

- Complete all sections accurately to avoid disputes later.

- Ensure proper execution to validate the agreement legally.

This form provides a structured way to facilitate financing a mobile home purchase, fostering a clear understanding between buyer and seller.

How to fill out Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

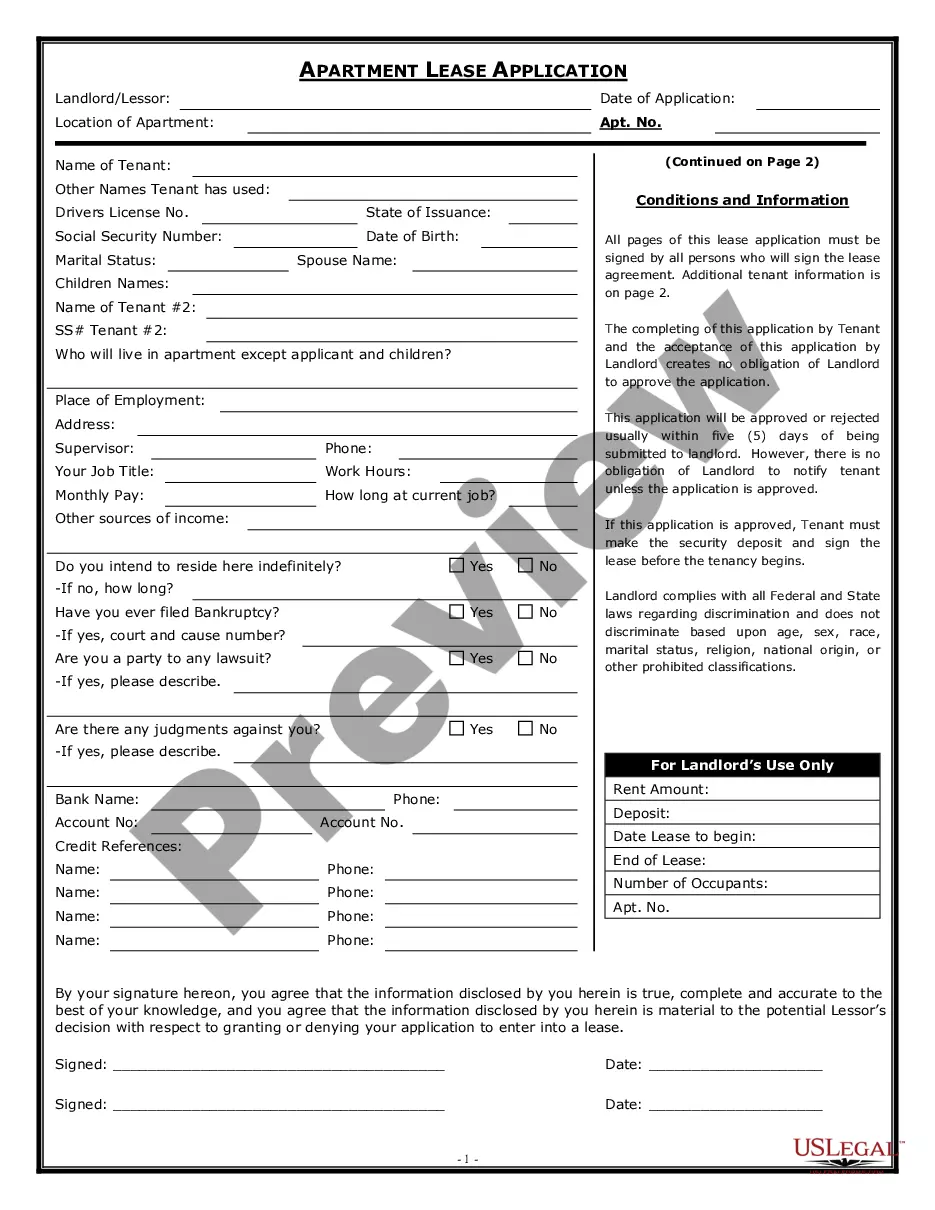

Aren't you sick and tired of choosing from hundreds of samples every time you need to create a Promissory Note in Connection with a Sale and Purchase of a Mobile Home? US Legal Forms eliminates the lost time millions of American people spend exploring the internet for perfect tax and legal forms. Our expert team of lawyers is constantly updating the state-specific Forms library, so that it always provides the right files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have a subscription should complete simple actions before having the ability to download their Promissory Note in Connection with a Sale and Purchase of a Mobile Home:

- Make use of the Preview function and look at the form description (if available) to make sure that it is the right document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the proper example to your state and situation.

- Use the Search field at the top of the web page if you need to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your template in a required format to finish, print, and sign the document.

When you have followed the step-by-step instructions above, you'll always have the ability to log in and download whatever file you want for whatever state you require it in. With US Legal Forms, finishing Promissory Note in Connection with a Sale and Purchase of a Mobile Home templates or any other legal files is simple. Get started now, and don't forget to look at the samples with accredited attorneys!

Form popularity

FAQ

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

A buyer wanted to use a promissory note for consideration on the purchase of a property. Can he do this? Yes, this is acceptable as long as the seller agrees.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Date. The promissory note should include the date it was created at the top of the page. Amount. Loan terms. Interest rate. Collateral. Lender and borrower information. Signatures.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Promissory notes are one of the simplest ways to obtain financing for your company. They are often basic documents with few formalities.As such, a promissory note must contain the usual standard requirements for a contract, including consideration, meeting of the minds and capacity.