Private Annuity Agreement

Description

Definition and meaning

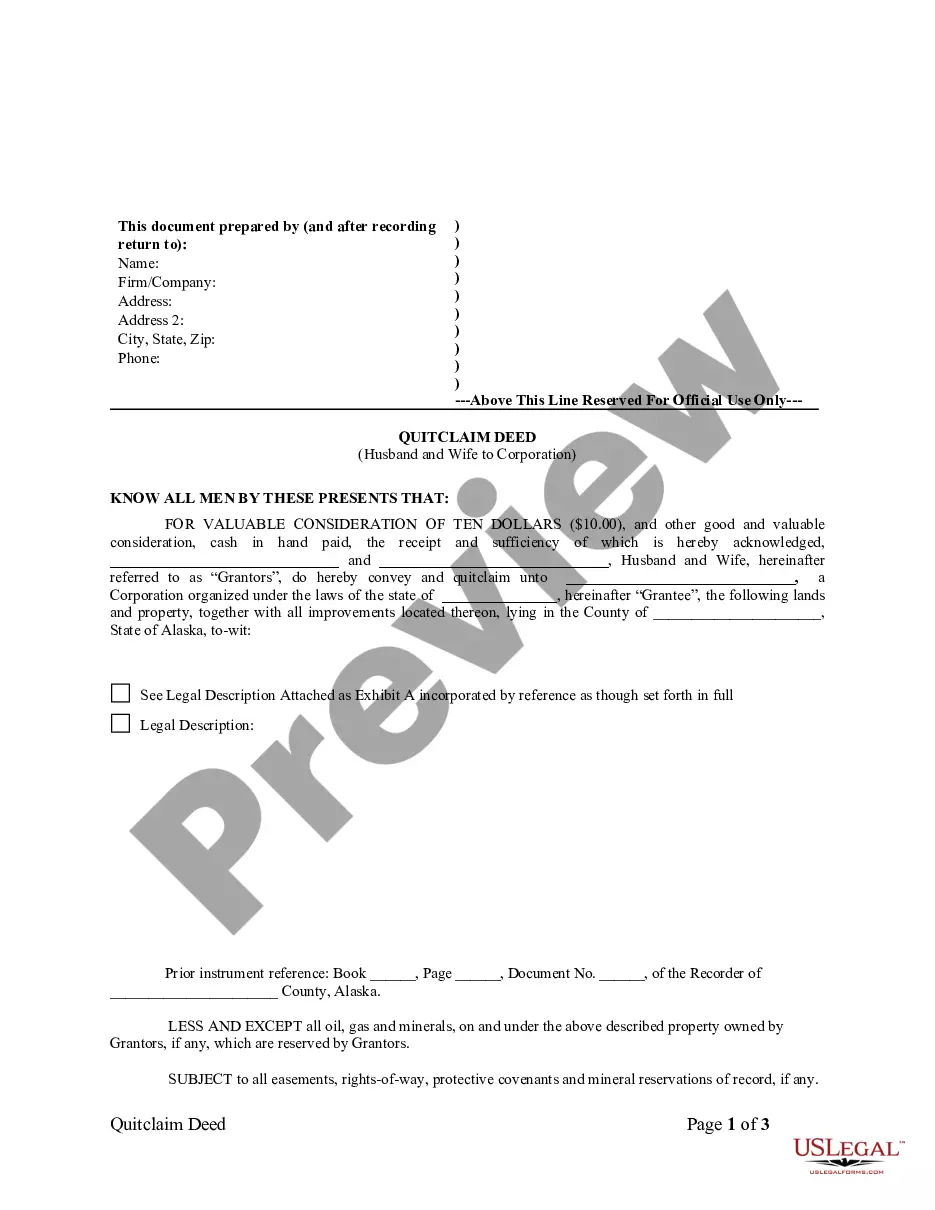

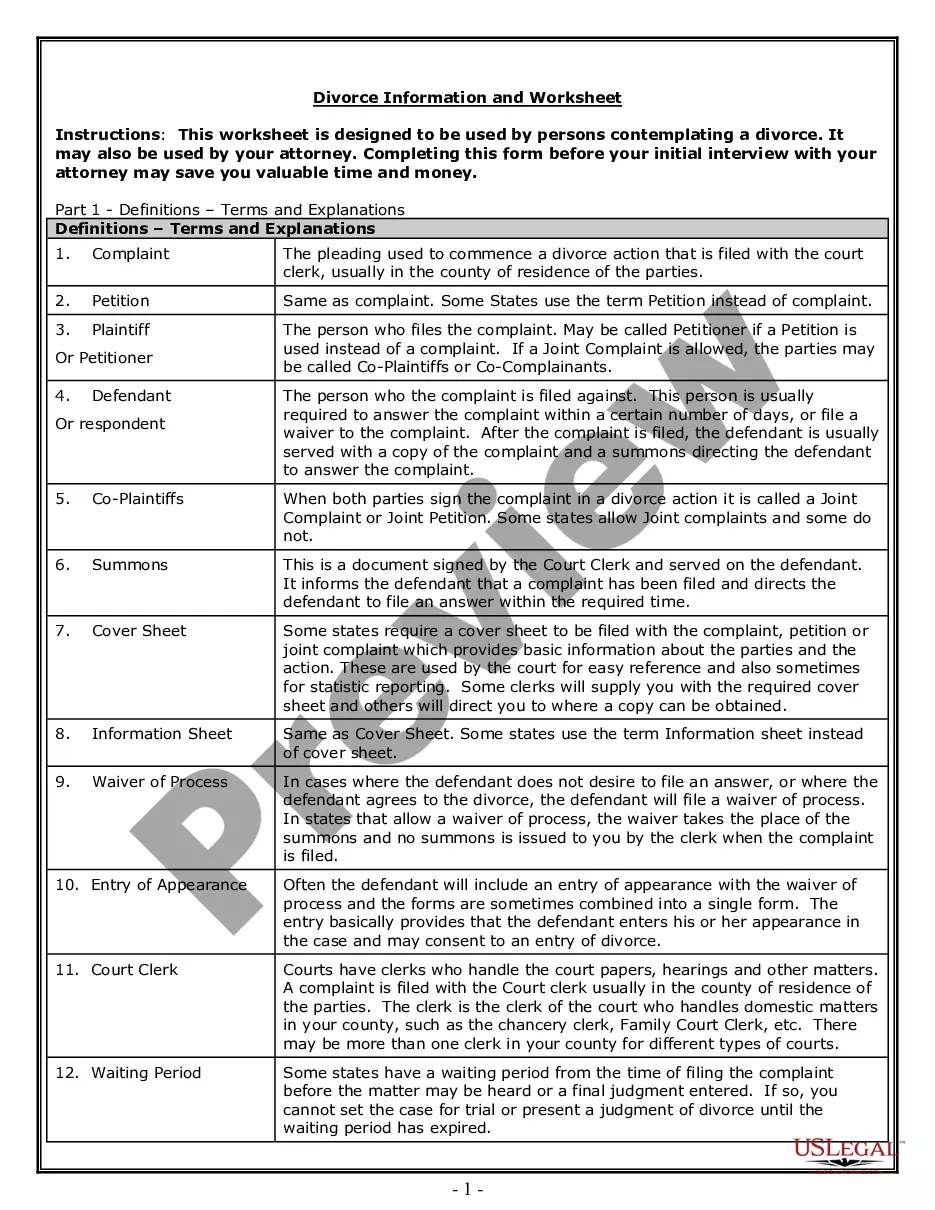

A Private Annuity Agreement is a financial contract between two parties, typically involving a property transfer in exchange for a series of fixed payments over the lifetime of one party, known as the Transferor. This agreement allows the Transferor to receive a stable income while relinquishing ownership of the property. It is essential for both parties to understand the implications of such an agreement, including tax considerations and the responsibilities involved.

How to complete the form

Completing a Private Annuity Agreement involves several key steps:

- Gather information: Collect all relevant details about the property being transferred, including its fair market value.

- Identify the parties: Clearly define the Transferor and Transferee, including their full names and addresses.

- Draft the agreement: Fill in the terms of the agreement, including payment amounts, schedule, and any special provisions.

- Review: Ensure all details are accurate and complete, reflecting mutual understanding.

- Sign and notarize: Both parties must sign the agreement, and it should be notarized to ensure enforceability.

Who should use this form

A Private Annuity Agreement is suitable for individuals looking to transfer assets while ensuring a steady income stream during their retirement. It is particularly beneficial for:

- Retirees who want to liquidate property without immediately incurring tax liabilities.

- Individuals seeking to provide financial support to family members while retaining income from their assets.

- Those who wish to manage their estate planning more effectively by securing fixed payments.

Key components of the form

The essential components of a Private Annuity Agreement include:

- Identification of parties: Names and addresses of both the Transferor and Transferee.

- Description of the property: Detailed description of the property being transferred, often referenced in an attached schedule.

- Payment terms: Details regarding the annual payment amount, payment dates, and conditions related to payment obligations.

- Responsibilities: Outline of the obligations of both parties regarding maintenance of the property, if applicable.

- Governing law: Specification of the state laws that govern the agreement.

Common mistakes to avoid when using this form

To ensure the legality and efficiency of a Private Annuity Agreement, avoid the following common mistakes:

- Incomplete information: Not providing all necessary details regarding the parties and property can lead to disputes.

- Ambiguous terms: Failing to clearly define payment terms and responsibilities may result in misunderstandings.

- Not seeking legal advice: Attempting to draft or execute the agreement without professional guidance can expose both parties to legal risks.

- Neglecting notarization: Forgetting to have the agreement notarized can render it unenforceable.

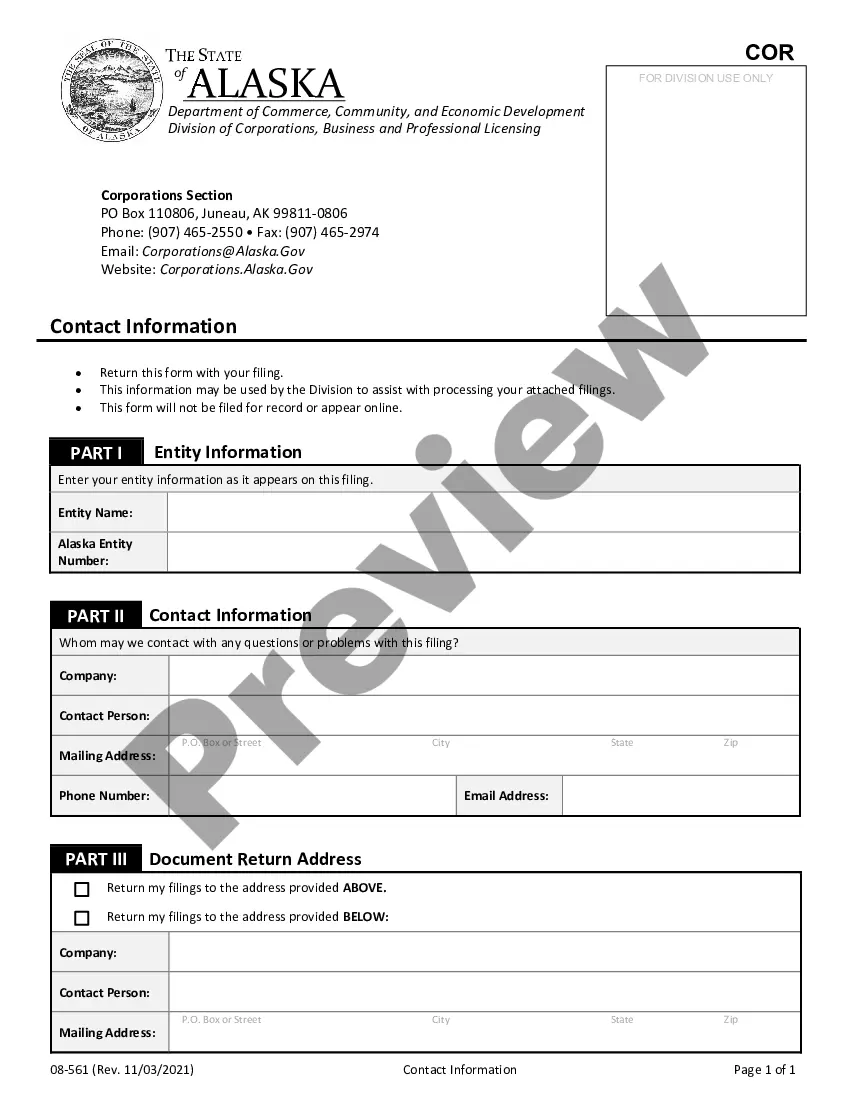

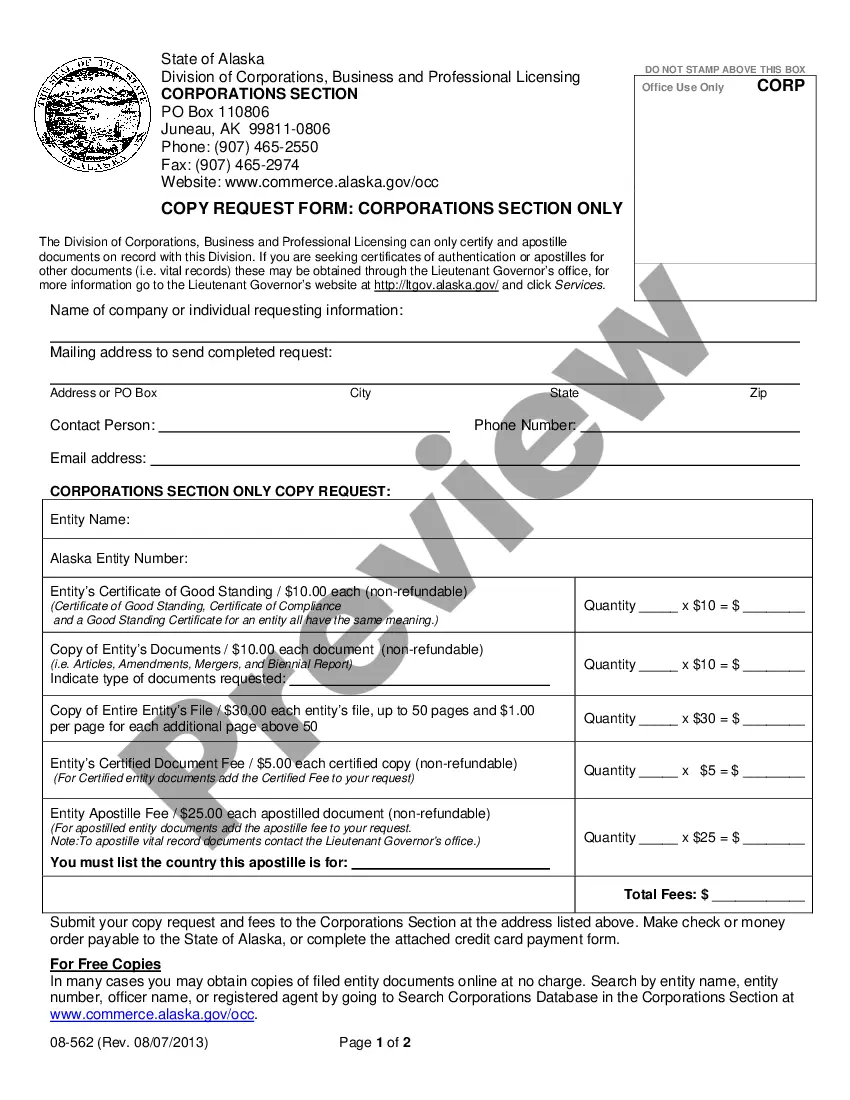

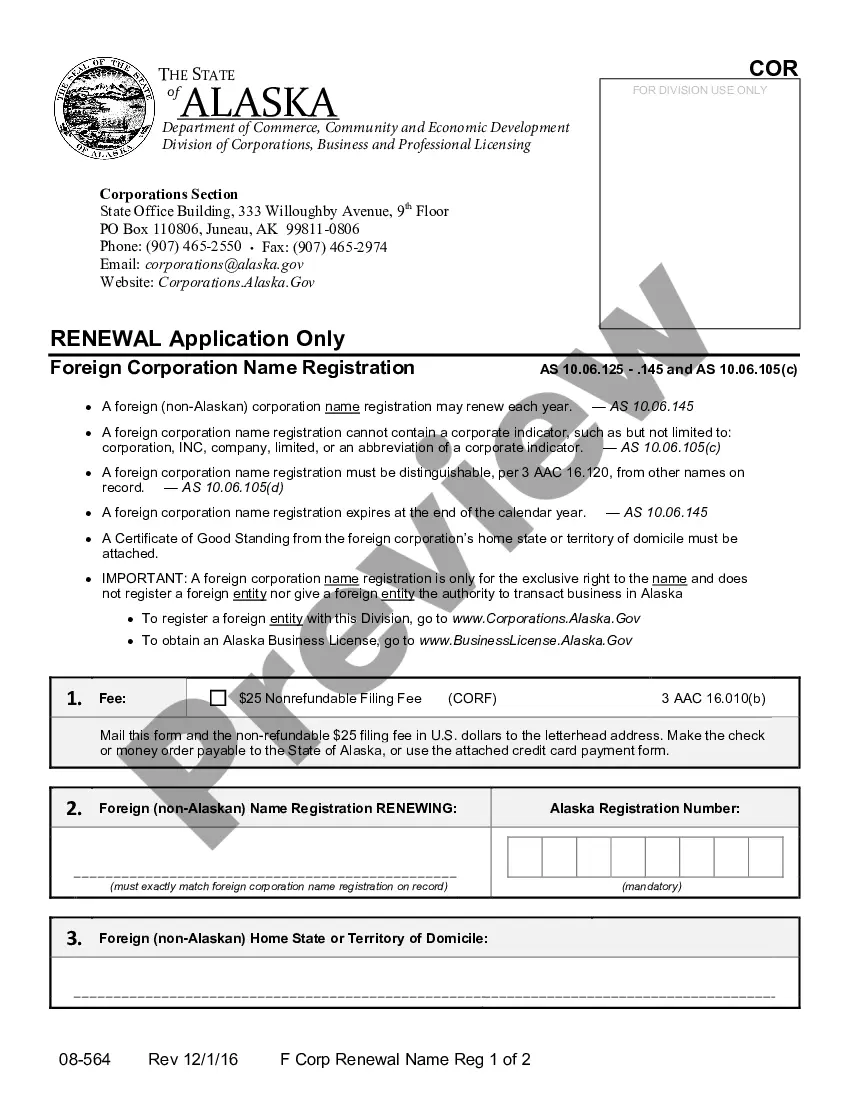

What documents you may need alongside this one

When executing a Private Annuity Agreement, it may be necessary to provide or prepare additional documents, such as:

- Property title: Documentation that verifies the Transferor's ownership of the property.

- Fair market value assessment: An appraisal or valuation of the property to support the agreed-upon prices.

- Power of attorney: If applicable, this document allows a designated individual to act on behalf of the Transferor.

- Tax information: Records showing any tax obligations related to the property transfer or annuity payments.

How to fill out Private Annuity Agreement?

Aren't you tired of choosing from countless templates each time you want to create a Private Annuity Agreement? US Legal Forms eliminates the lost time numerous American citizens spend searching the internet for perfect tax and legal forms. Our expert group of attorneys is constantly changing the state-specific Samples catalogue, to ensure that it always has the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have a subscription should complete quick and easy steps before being able to get access to their Private Annuity Agreement:

- Make use of the Preview function and look at the form description (if available) to be sure that it is the correct document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the proper template to your state and situation.

- Utilize the Search field on top of the webpage if you want to look for another document.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your template in a convenient format to finish, create a hard copy, and sign the document.

After you have followed the step-by-step instructions above, you'll always have the capacity to log in and download whatever file you will need for whatever state you need it in. With US Legal Forms, finishing Private Annuity Agreement templates or any other legal documents is easy. Get going now, and don't forget to double-check your examples with certified attorneys!

Form popularity

FAQ

The simple answer is YES. You can write your own contracts. There is no requirement that they must be written by a lawyer. There is no requirement that they have to be a certain form or font.

Contact information for both parties. Location/state whose laws apply to the agreement. Terms and conditions of the business relationship. Terms of payment. Start date of the agreement. End date of the agreement.

A written agreement is only legally binding when you have finalised all of the essential terms of the agreement.You should consider whether your written agreement contains all of the details necessary to fulfil the promises made by parties. If it does, your written agreement may be legally binding.

For a contract to be valid, it must have four key elements: agreement, capacity, consideration, and intention.