Employment Verification Letter for Independent Contractor

Definition and meaning

An Employment Verification Letter for Independent Contractor serves as a formal document that confirms an independent contractor’s engagement with a company. This letter typically includes details about the contractor's role, the duration of their work, and the nature of the services provided. Such letters are essential for verifying employment status for purposes such as securing loans, leasing agreements, or even immigration applications.

How to complete a form

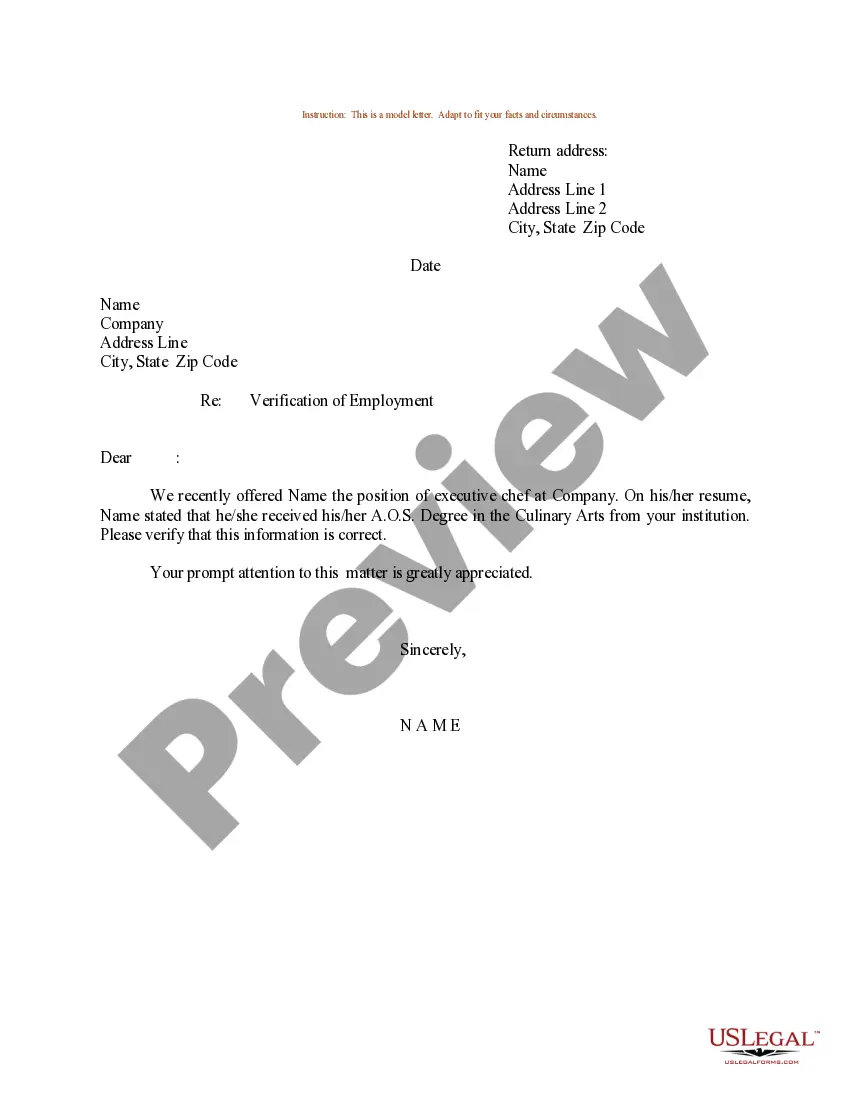

To complete an Employment Verification Letter for Independent Contractor, follow these steps:

- Begin with the sender's contact information, including name and address.

- Include the date of completion.

- Address the letter to the appropriate recipient, including their name, title, and company details.

- Write a clear subject line indicating the purpose of the letter.

- Detail the contractor’s identity, including their full name and the position they hold.

- Describe the nature of the services provided and the time period of engagement.

- Close the letter with a professional sign-off and include the sender’s name and title.

Who should use this form

This form is primarily used by businesses and organizations that hire independent contractors. It is particularly useful for human resources departments, project managers, or administrators who need to confirm the employment status of a contractor for various verification purposes, including banks or other institutions requiring proof of employment.

Key components of the form

An effective Employment Verification Letter for Independent Contractor includes the following key components:

- Sender Information: The name and contact details of the individual writing the letter.

- Recipient Information: Details of the person or organization receiving the letter.

- Date: The date when the letter is written.

- Contractor’s Information: Full name of the contractor and their specific role.

- Verification Statement: A clear assertion confirming the contractor’s employment and the specifics of their work.

Common mistakes to avoid when using this form

When drafting an Employment Verification Letter for Independent Contractor, avoid these common errors:

- Failing to include accurate contact information for both the sender and recipient.

- Not specifying the contractor's role or details about their work.

- Omitting the date, which is critical for establishing the letter's timing.

- Using vague language that might lead to misunderstandings.

- Neglecting to proofread for spelling or grammatical errors, as professionalism is key in such communications.

What documents you may need alongside this one

When preparing an Employment Verification Letter for Independent Contractor, consider having the following documents ready:

- Contract or agreement outlining the terms of the engagement.

- Invoices submitted by the contractor for services rendered.

- Previous correspondence or communication regarding the contractor's role.

- Any relevant identification documents, such as a driver’s license or business license, if applicable.

Form popularity

FAQ

Do employers need to complete employment verification checks for independent contractors? No.However, it is important to note that businesses and individuals may not hire independent contractors if they are aware that the independent contractor is not authorized to work in the United States.

Wage and Tax Statement for Self Employed (1099). These forms prove your wages and taxes as a self employed individual. Profit and Loss Statement or Ledger Documentation. Bank Statements.

In general, we would not recommended that you ask to see their work authorization unless you have a company policy or practice in place in which you verify work authorization for all independent contractors.

Proof of employment letter Also known as an employment verification letter, this is an official document written by an employer, typically on company letterhead.Employee salary information. Employee's hire date. Employee's job title and responsibilities.

So, can you write a proof of income letter for self employment on your own behalf? The answer is yes. Write an income verification letter and use the following accepted documentation to prove your income: IRS Form 1099 Miscellaneous Income used by freelancers to record any job that paid $600 or more.

Write the company's information. Include a statement verifying that the employee does indeed work at this place of employment, as well as the date he or she began working. Sign the document. Current Employee. Past Employee. Best Practices.

The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Verification letters for independent contractors must, at the very least, specify dates of work, rate of pay, and hours/project fees that have been contracted.

Step 2 Include a self-declaration statement. In your letter include the name of your company, if self-employed, or the company you worked for. Step 3 Include specific dates of employment. Step 4 Include a detailed list of tasks performed during this period of time.

Lying during employment verification is particularly risky because you're often risking your reputation with several organizations, including the party requesting verification and your current or former employer.