Request for Verification of Deposit

Description

Definition and meaning

A Request for Verification of Deposit is a formal document used to confirm the balance and authenticity of a bank account. It is typically requested by lenders or financial institutions as part of the loan application process. This verification helps lenders assess a borrower's financial stability and ability to repay the loan.

How to complete a form

Completing the Request for Verification of Deposit form requires attention to detail. First, provide your personal details, including your name, address, and loan or escrow number. Next, specify the lending institution and the type of account you are verifying. Ensure that the financial institution accurately fills in the current balance and account statements. Review all sections to confirm accuracy before submission.

Who should use this form

This form is essential for individuals applying for loans, such as mortgage or personal loans. Anyone who needs to validate their financial status to a lender should complete this request, including homeowners, renters, and business owners seeking financing.

Key components of the form

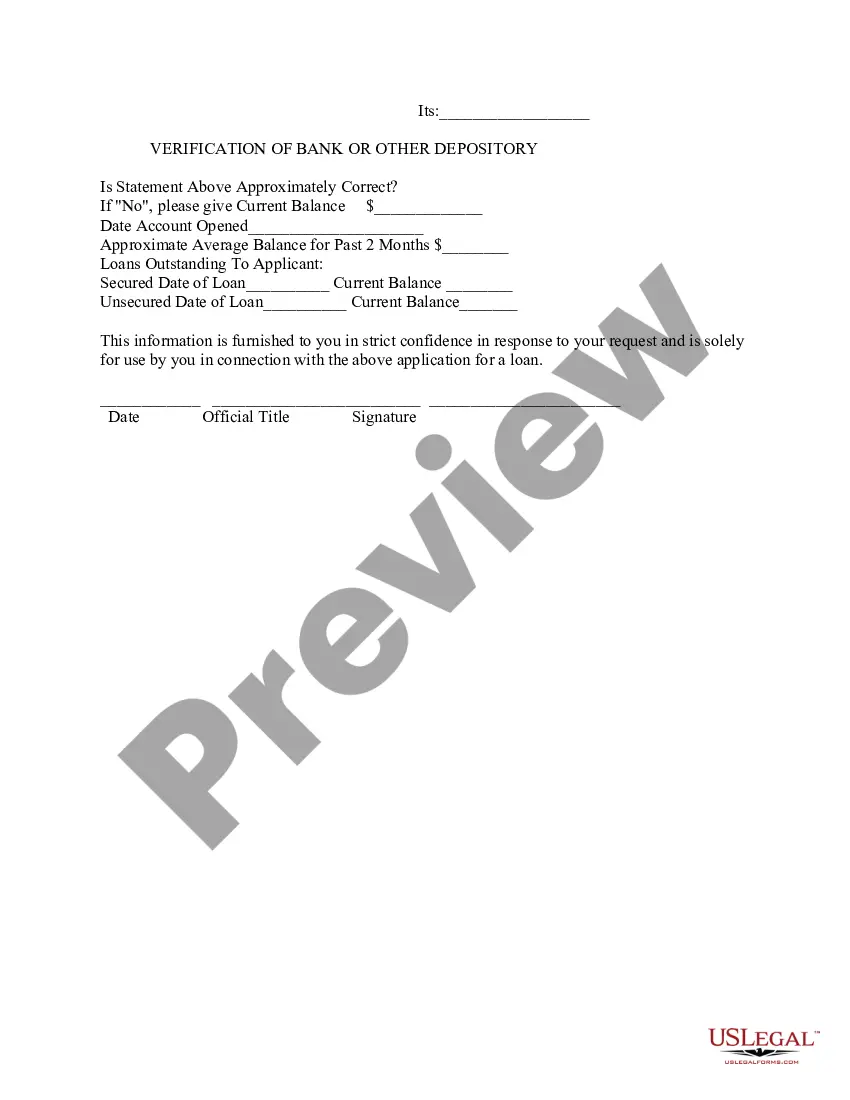

The Request for Verification of Deposit consists of several critical components:

- Applicant Information: Personal details of the borrower.

- Lending Institution: Name and details of the financial institution.

- Account Details: Type of account, current balance, and statements from the bank.

- Signature: Required for verification by a bank representative.

Common mistakes to avoid when using this form

When completing the Request for Verification of Deposit, be cautious of the following common mistakes:

- Inaccurate account information leading to delays.

- Failing to include all required personal and account details.

- Not obtaining the proper signature from the bank.

- Submitting the form without reviewing for completeness.

How to fill out Request For Verification Of Deposit?

Coping with official paperwork requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Request for Verification of Deposit template from our library, you can be sure it complies with federal and state regulations.

Working with our service is easy and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your Request for Verification of Deposit within minutes:

- Remember to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for another formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Request for Verification of Deposit in the format you prefer. If it’s your first time with our website, click Buy now to proceed.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the Request for Verification of Deposit you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

Bank account verification can take as little as a few seconds and as many as 10 days, depending on the method used. Open banking verification and credit checks each involve electronic checks against accounts in real time.

A verification of deposit typically includes information such as current balance, average balance for the previous six months and the date the account was opened.

U.S. Bank processes the Verification of Deposit (VOD) you need within three business days.

A verification of deposit is a document through which a mortgage lender obtains proof from a borrower's banking institution of his or her balances. Upon a lender's request, a banking institution will fulfill this inquiry by providing current data as well as two months' worth of the borrower's average bank balances.

Verification. Request. Purpose: To verify an applicant's/resident's checking, savings, or other accounts. Note: This form must be mailed or faxed to the financial institution.

This is called the micro-deposit verification process. This process can take up to three (3) business days to complete.

Mortgage companies looking to obtain balance information to determine customer eligibility for a loan should use our Verfiication of Deposit (VOD) for mortgage companies service.